If you use your personal vehicle for work, your employer may ask for proof of your auto insurance. This is to protect themselves from liability or financial responsibility if you are involved in an accident during work hours. You can provide proof of insurance by showing your policy ID card, declarations page, or digital proof via an app. If you are unsure about whether or not to provide this information, it is best to consult a legal professional.

| Characteristics | Values |

|---|---|

| When an employer might ask for proof of auto insurance | If you drive your personal vehicle for work |

| Purpose of asking for proof | To protect themselves from liability or financial responsibility if you are involved in a crash during work hours |

| Ways to provide proof | Physical proof (ID card, declarations page) or digital proof (app) |

| Whether an employer can ask for proof of auto insurance | Yes |

| Whether an employer can require proof of auto insurance | Maybe; lawyers argue this is close to subtle discrimination and may not always be enforceable |

| Why an employer would ask for proof of auto insurance | To ensure they won't be held responsible for losses you experience while performing your job duties |

| What an employer will want to confirm | That your insurance is up-to-date and meets your state's minimum standards |

| Whether you need liability coverage | If you're driving for work, you'll need at least some form of liability auto insurance |

| Whether you need full coverage | Not required, but may be beneficial if you drive a newer or more expensive car |

| Commercial auto insurance | Protects you if you drive your personal car for work; your employer's commercial plan may extend to your personal car when used for work purposes |

| Whether an employer can ask for a copy of your private car insurance document | Not if it's not in your contract |

What You'll Learn

- When to provide auto insurance to your employer?

- How to get a copy of your auto insurance?

- What to do if your employer asks for auto insurance when it's not in your contract?

- What to do if your employer asks for auto insurance when you don't drive for work?

- What to do if your employer asks for auto insurance when you do drive for work?

When to provide auto insurance to your employer

If you drive your personal vehicle for work, your employer will likely ask for proof of your auto insurance. This is because employers are subject to vicarious liability laws, meaning they can be held liable for any acts of negligence you commit while working.

Your employer will want to ensure that you have adequate insurance coverage in case of an accident. They may also want to confirm that your insurance is up-to-date and meets the state's minimum standards. This is especially important if you are using your personal vehicle for work purposes, as it reduces their share of financial responsibility in the event of an accident.

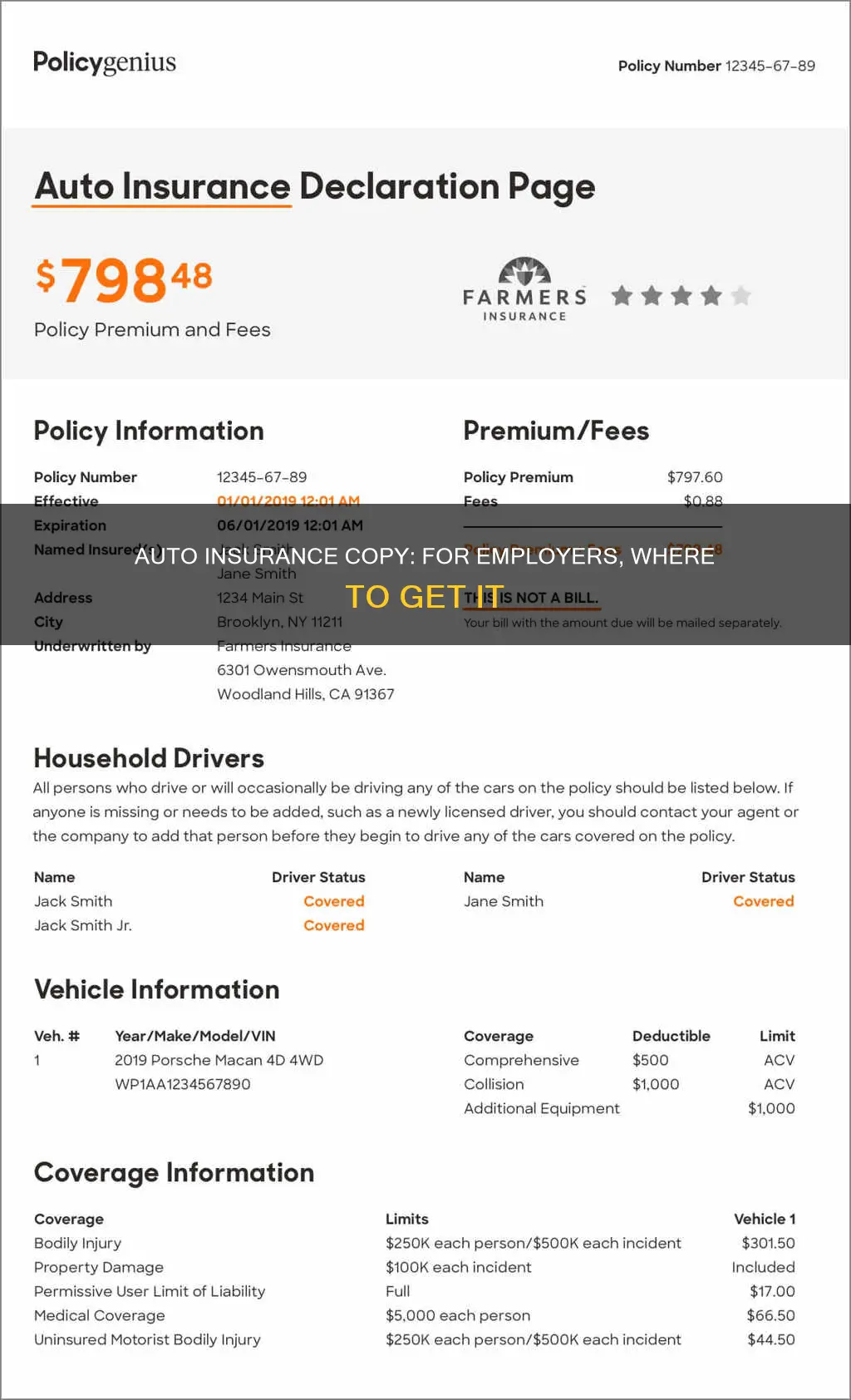

You can provide proof of insurance to your employer by showing them your policy ID card, declarations page, or by providing digital proof through a mobile app. It is recommended that you keep a copy of your insurance certificate with you at all times while driving, as some states require physical proof of insurance.

If you are unsure whether you are covered, you can contact your insurance company or check with your state's department of motor vehicles. It is also important to update your insurance information if there are any changes to your vehicle or policy to avoid a lapse in coverage.

Additionally, if you are driving a company-owned vehicle, your employer has likely already added you to a commercial insurance policy. However, if you are using your personal vehicle for work, it is essential to provide proof of your own insurance policy to your employer.

Double-Naming Auto Insurance: Is It Allowed?

You may want to see also

How to get a copy of your auto insurance

If you need a copy of your auto insurance, there are several ways to obtain one. The first step is to identify what type of proof you need. If you need a physical copy, you can request one from your insurance provider by calling them or visiting their office in person. You can also print a copy yourself if you have access to a printer. Alternatively, if a digital copy will suffice, you can usually download one from your insurance provider's website or mobile app.

When requesting a copy of your auto insurance, it is helpful to have certain information readily available. This includes your policy number, name, and any other relevant details that may be requested to verify your identity. It is also important to confirm that all the information on your insurance certificate is accurate and up to date.

In most states, drivers are required by law to carry physical proof of insurance, such as an insurance card or declarations page. This proof must be kept in your wallet or vehicle at all times when driving. Failure to provide proof of insurance when requested by law enforcement or in the event of an accident can result in serious penalties, including fines, license suspension, or even jail time in some states. Therefore, it is crucial to maintain a valid and up-to-date copy of your auto insurance at all times.

Additionally, if you use your personal vehicle for work-related activities, your employer may also request proof of your auto insurance. This is particularly common if your job involves frequent driving. Employers typically do this to protect themselves from liability in the event of a crash during work hours. By confirming that you have adequate insurance coverage, employers can reduce their financial risk and ensure compliance with vicarious liability laws.

Strategies for Independent Auto Insurance Sales Success

You may want to see also

What to do if your employer asks for auto insurance when it's not in your contract

If your employer asks for auto insurance when it's not in your contract, the first thing to do is remain calm and refrain from panicking. It's important to understand your rights and know what information your employer is legally allowed to request from you.

In most cases, employers can ask for proof of auto insurance, especially if you use your personal vehicle for work-related tasks, such as running errands or transporting items. They do this to protect themselves from liability and financial responsibility in case you are involved in an accident during work hours.

However, if providing auto insurance was not part of your initial employment agreement, you may want to review your contract and discuss the matter with your employer. It is advisable to approach this situation professionally and amicably, as requiring auto insurance may be a reasonable request on their part, given that you use your personal vehicle for work purposes.

- Review your employment contract: Go over the terms and conditions of your contract to understand the specific requirements and expectations set by your employer. Look for any clauses related to the use of personal vehicles for work or any mention of insurance requirements.

- Communicate with your employer: Schedule a meeting with your supervisor or HR department to discuss the matter. It is important to clarify their reasoning behind the request and express your concerns professionally.

- Provide alternative solutions: If you are uncomfortable providing a copy of your auto insurance policy, you can suggest alternative ways to meet their needs. For example, you can ask your insurance agent to provide a certificate of insurance, which confirms that you have the necessary coverage without disclosing detailed policy information.

- Understand your rights: Familiarize yourself with employment laws and regulations in your state or country. While employers can generally ask for proof of auto insurance, there may be specific restrictions or guidelines that apply to your situation.

- Seek legal advice: If you are still uncertain about your rights or feel that your employer is overstepping their boundaries, consider consulting an employment lawyer. They can provide you with specific advice based on your situation and help protect your rights.

Remember, it is essential to handle this situation professionally and collaboratively. Your employer is likely seeking to mitigate risks and ensure compliance with relevant laws. By communicating openly and working together, you can often find a solution that satisfies both parties.

Drive Safe in Georgia: No Auto Insurance, No Problem

You may want to see also

What to do if your employer asks for auto insurance when you don't drive for work

If your employer asks for proof of your auto insurance, it is likely because your job involves driving your personal vehicle for work. They may want to do this to protect themselves from liability or financial responsibility if you are involved in a crash during work hours.

If you are using your car for business purposes, your employer has a right to know whether you have insurance on your vehicle. However, rather than providing a copy of your policy, you can ask your insurance agent to provide you with a certificate of insurance.

If you don't drive for work, it is not clear why your employer would ask for proof of auto insurance. It may be worth asking your employer why they are making this request, and explaining that you don't use your personal vehicle for work.

- Contact your insurance provider: Reach out to your insurance company, either by phone or through their website.

- Provide necessary information: Be prepared to provide your policy number, name, and any other details requested by the insurance company to verify your identity.

- Request a copy of your certificate: Clearly state that you need a copy of your auto insurance certificate and specify the reason for your request.

- Delivery options: Ask about the available delivery options. Some insurance companies may email the certificate, while others may mail it to your address or offer a digital copy through their online portal.

- Confirm the details: Before receiving the certificate, ensure that all the information on it is accurate and up to date.

It is important to always carry proof of insurance in your vehicle, as some states may ask for physical proof if you are pulled over by the police or involved in an accident.

Auto Liability Insurance Coverage Explained for Texans

You may want to see also

What to do if your employer asks for auto insurance when you do drive for work

If your employer asks for proof of your auto insurance, it's likely because you're required to drive your personal vehicle for work. They'll want to ensure that you have adequate insurance coverage to protect themselves from liability in case you're involved in an accident during work hours. While it's not illegal for them to ask for this information, you have options for how to share it.

What to Provide to Your Employer

You can provide physical proof of insurance with an ID card or a declarations page from your insurance company. Alternatively, you can show digital proof through your insurance company's mobile app. If you're uncomfortable sharing these documents directly, you can ask your insurance agent to provide a certificate of insurance, which confirms that you have an active policy.

Review Your Insurance Coverage

It's important to review your insurance policy to ensure it meets your state's minimum standards and provides sufficient coverage for driving for work purposes. Most states require a minimum amount of liability coverage, and your employer will want to confirm that you have this in place. If you don't already have it, consider adding commercial coverage to your primary policy or purchasing a full-coverage plan to protect yourself and your vehicle.

Understand Your Employer's Concerns

Employers are primarily concerned with protecting themselves from financial liability and ensuring compliance with vicarious liability laws. In the event of an accident, they could be held responsible for paying any damages not covered by your insurance policy. Additionally, with a significant proportion of workplace fatalities resulting from traffic accidents, your employer has a vested interest in ensuring you have adequate insurance coverage.

Explore Alternate Forms of Protection

If you're concerned about sharing your personal insurance information, there may be other options. Inquire with your employer about their commercial auto insurance policy. Many such policies provide coverage for non-owned vehicles used for work purposes, so you may be able to be added as an insured driver under their plan.

In summary, if your employer asks for proof of auto insurance, it's likely because you're required to drive your personal vehicle for work. You have several options for providing proof of insurance while maintaining your privacy. Review your insurance coverage to ensure it meets the necessary standards, and consider alternate forms of protection if needed.

Divorce: Cheaper Auto Insurance?

You may want to see also

Frequently asked questions

Yes, if you are using your car for business purposes, your employer has a right to know whether you have insurance on your vehicle.

Proof of insurance is documentation — physical or electronic — that proves your insurance coverage is up-to-date and meets the state’s minimum requirements.

You can get a copy of your auto insurance card by contacting your insurer, visiting its digital services, seeing an in-person agent, or printing it out yourself.