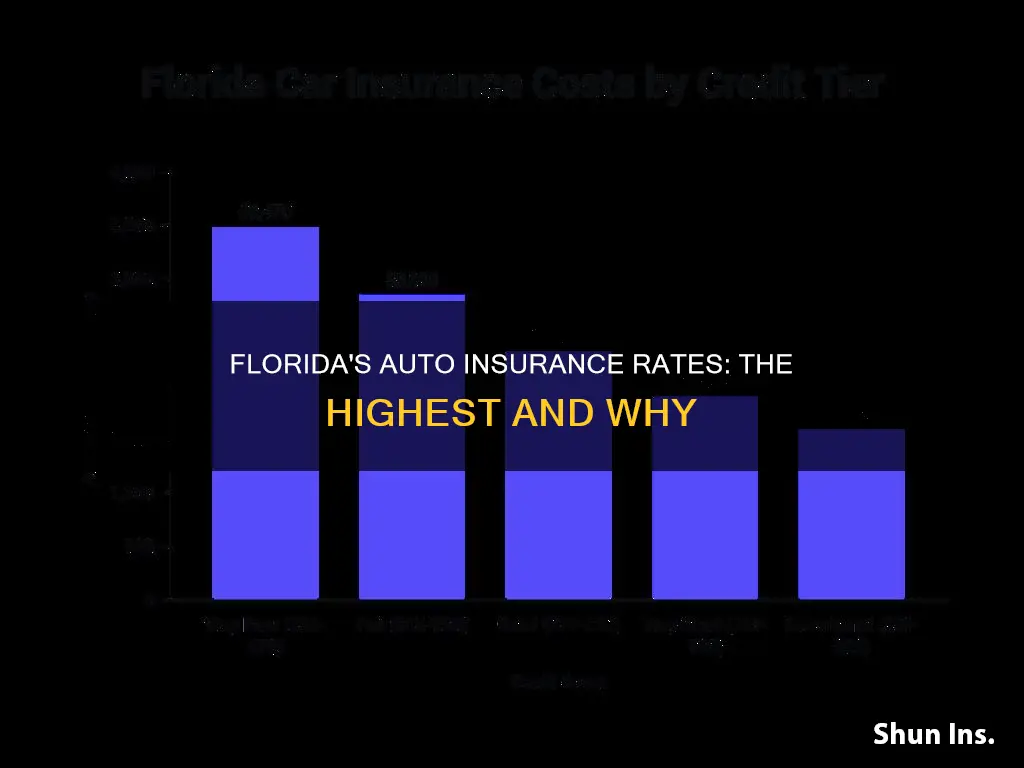

Florida is one of the most expensive states for car insurance, with drivers paying an average of $3,451 per year for full coverage and $1,055 per year for minimum coverage. This is due to several factors, including the state's high number of uninsured motorists, frequent severe weather events, and high rates of litigation and fraud.

To find the best auto insurance in Florida, it is important to consider factors such as cost, coverage options, customer satisfaction, and financial strength. Based on these criteria, here are the top five car insurance companies in Florida:

1. Geico: Geico offers some of the cheapest rates in Florida, especially for minimum coverage policies. They also have a highly-rated mobile app and a full-service website, making it convenient for customers to manage their policies online.

2. State Farm: State Farm has the cheapest average rates for full coverage in Florida and offers numerous discounts, including a Steer Clear program for young drivers. They also received the highest official customer satisfaction score from J.D. Power in the state.

3. Progressive: Progressive provides several digital tools, such as the Name Your Price tool, which makes it easy for customers to find the best coverage options within their budget. They also offer the Snapshot telematics program, which allows customers to save on premiums based on their driving habits.

4. Allstate: Allstate ranked highly in J.D. Power's customer satisfaction studies and offers a telematics program called Drivewise, which can help lower premiums. They also have a Deductible Rewards program that reduces your collision deductible for each year of safe driving.

5. Travelers: Travelers offers a broad range of coverage options and discounts. They received a high score for ease of use, with a user-friendly website and a simple claims filing process.

| Characteristics | Values |

|---|---|

| Cheapest Car Insurance in Florida | Geico |

| Best Car Insurance in Florida | Travelers |

| Best Car Insurance for Poor Credit in Florida | Geico |

| Best Car Insurance for DUI in Florida | State Farm |

| Best Car Insurance for Customer Satisfaction in Florida | Progressive |

What You'll Learn

- Florida has some of the highest car insurance rates in the country

- This is due to high rates of extreme weather, uninsured motorists, bad accidents and more

- Geico, Travelers, State Farm and Progressive are some of the cheaper car insurance providers in Florida

- Florida is a no-fault state for car insurance

- Florida's minimum car insurance requirements are

Florida has some of the highest car insurance rates in the country

There are multiple factors that contribute to Florida's high insurance rates. Firstly, the state is susceptible to severe weather events such as tropical storms, hurricanes, and tornadoes due to its geographic location. Secondly, Florida has a high population of uninsured drivers, with 15.9% of drivers estimated to be driving without insurance in 2022. This means that insured drivers often have to pay more. Additionally, the state has a high number of uninsured motorists, crash-related lawsuits, and bad accidents, which drive up insurance rates. Furthermore, car repair costs in Florida are rising, and the state has seen an increase in car thefts, with Kia and Hyundai vehicles being particularly at risk. All of these factors contribute to making Florida's car insurance rates among the highest in the country.

Texassure: Legit Vehicle Insurance Verification

You may want to see also

This is due to high rates of extreme weather, uninsured motorists, bad accidents and more

Florida has some of the highest auto insurance rates in the country. The average cost of a full-coverage policy in Florida is $2,917 per year, which is 44% higher than the national average. This is due to high rates of extreme weather, uninsured motorists, bad accidents, and more.

Florida is susceptible to hurricanes, tornadoes, and flooding, which can cause significant damage to vehicles and drive up insurance costs. The state also has a high number of uninsured motorists, with an estimated 15.9% of drivers not having insurance. This means that in the event of an accident, the insured driver may have to bear the full cost of repairs and medical expenses.

In addition, Florida has a high rate of severe car accidents, which can result in costly claims for insurance companies. The state also has a problem with insurance fraud, with staged accidents and fraudulent medical bills contributing to higher premiums.

The combination of these factors has made Florida a challenging market for insurers, with some companies even pulling out of the state. As a result, Florida drivers may have to pay more for car insurance than drivers in other states.

Auto Insurance: Business Accounting's Financial Shield

You may want to see also

Geico, Travelers, State Farm and Progressive are some of the cheaper car insurance providers in Florida

Florida drivers pay some of the highest auto insurance rates in the country. This is due to a variety of factors, including a high number of uninsured motorists, frequent extreme weather, and an increase in crash-related lawsuits.

According to MarketWatch, the top five cheapest car insurance companies in Florida are Geico, Travelers, State Farm, Farmers, and Nationwide. Geico offers the cheapest rates for many Floridians, with average rates starting as low as $49 per month for minimum-coverage plans and $158 for full coverage. However, the lowest rate for you will depend on your unique driver profile.

NerdWallet's analysis also names Geico, Travelers, State Farm, and Progressive as some of the best car insurance companies in Florida. Geico is highlighted for its nationwide availability and a wide range of discounts, while Travelers is recognised for its broad range of coverage options and discounts. State Farm is praised for its generous coverage, discounts for good driving habits, and high customer satisfaction ratings.

Overall, Geico, Travelers, State Farm, and Progressive are good options for drivers in Florida looking for cheaper car insurance providers.

Safe Auto Insurance: Is It Worth the Cost?

You may want to see also

Florida is a no-fault state for car insurance

Florida's no-fault insurance system ensures that certain costs incurred as a result of an accident are covered, regardless of who is at fault. This means that drivers won't need to exchange insurance information or file claims through each other's policies. However, this also means that all drivers bear additional costs, regardless of who caused the accident.

Florida's insurance requirements include a minimum of $10,000 in PIP and $10,000 in property damage liability (PDL) coverage. PDL coverage pays for damage to another person's vehicle or property. PIP coverage pays for 80% of medical treatment bills and 60% of lost wages up to the policy limit, as well as death benefits up to $5,000.

Florida's no-fault insurance also covers members of the policyholder's household and vehicle passengers who don't own a vehicle. PIP also protects drivers as passengers and pedestrians.

While Florida is a no-fault state, there are exceptions to the no-fault insurance system. Florida has a "serious injury threshold", which means that the type and severity of injuries determine if and when drivers can step outside the no-fault system and file a liability claim. In cases of permanent injury or significant and permanent scarring/disfigurement, a non-economic claim or personal injury lawsuit can be filed.

How Historic Tags Affect Auto Insurance Rates

You may want to see also

Florida's minimum car insurance requirements are

Florida's minimum car insurance requirements are among the most minimal in the country. Before registering a car in Florida, drivers need a minimum of $10,000 in both personal injury protection (PIP) and property damage liability (PDL) coverage. This means that, in the event of a car accident, the insurance company may pay up to $10,000 for property damage and $10,000 for medical expenses.

Florida is a "no-fault" state, meaning that each driver's insurance covers injuries or medical expenses for them and their passengers, regardless of who is at fault. However, Florida's minimum coverage limits are fairly low and drivers may find themselves with higher out-of-pocket expenses following a serious accident. As such, it is recommended that drivers purchase coverage beyond the legal requirement, including optional collision and comprehensive coverage, as well as uninsured and underinsured motorist coverage.

Florida drivers pay some of the highest auto insurance rates in the country, with the average cost of a full-coverage policy being $3,451 per year, and minimum coverage costing an average of $1,055 per year. These figures are significantly higher than the national averages of $2,348 and $639, respectively.

Some of the cheapest car insurance providers in Florida include Geico, State Farm, and Travelers, all of which offer rates below the national average.

NerdWallet's Auto Insurance Calculator: Accurate and Reliable?

You may want to see also

Frequently asked questions

The average cost of car insurance in Florida is $3,451 per year for a full coverage policy and $1,055 per year for a minimum coverage policy.

Florida is a no-fault state, meaning that regardless of who is responsible for an accident, each person involved is responsible for filing a claim with their own insurer to cover their initial medical expenses. The at-fault driver is responsible for property damage. Florida's state minimum car insurance laws require personal injury protection (PIP) and property damage coverage.

The best car insurance companies in Florida are Geico, State Farm, Progressive, Allstate, and Travelers.

To get cheaper car insurance in Florida, you can:

- Compare quotes from different companies

- Seek out discounts

- Maintain a clean driving record

- Choose a higher deductible

- Review your coverage

- Improve your credit score