Divorce can have a significant impact on your life, from finances to insurance. If you and your spouse shared a policy, you will need to update your auto insurance policy after the divorce. Changing your policy can affect your rates for better or worse, depending on your driving record and whether you are moving to a new state.

On average, a married driver pays $96 less per year for car insurance than a single, widowed, or divorced driver. Married couples are considered less risky to insure than single drivers, as they are seen as more financially stable and safer drivers. They are also assumed to share driving responsibilities, meaning less time behind the wheel for each person.

However, it's important to note that not all married couples' car insurance costs less. Factors like driving history can impact premiums. If one spouse has a good driving record and the other has a poor history, the one with the bad record can negatively affect both rates.

| Characteristics | Values |

|---|---|

| Average annual cost of car insurance for married drivers | $1381 |

| Average annual cost of car insurance for divorced drivers | $1467 |

| Average annual cost of car insurance for widowed drivers | $1431 |

| Average monthly cost of car insurance for married couples | $116 |

| Average annual cost of car insurance for a single driver | $1484 |

| Average annual cost of car insurance for a divorced driver | $1486 |

| Average annual cost of car insurance for a widowed driver | $1437 |

| Average discount for car insurance for married couples | 4% to 12% |

| States that do not allow marital status to be a determining factor for car insurance rates | Montana, Massachusetts, Hawaii, and Michigan |

What You'll Learn

- Insurance companies may charge higher premiums for divorced individuals

- Married couples are considered lower risk

- Divorced individuals may lose a multi-vehicle bundling discount

- Married couples are more likely to bundle insurance policies

- Divorced individuals may pay higher rates due to statistical correlation

Insurance companies may charge higher premiums for divorced individuals

Married couples are often offered cheaper rates by insurance companies because they are considered to be safer drivers and are less likely to get into accidents. This is based on statistics that show married drivers are involved in fewer accidents than unmarried people. Insurance companies also assume that married couples drive less often, as they share driving responsibilities, and that they have greater financial security due to pooled assets. These factors contribute to married couples being seen as less risky insurance clients.

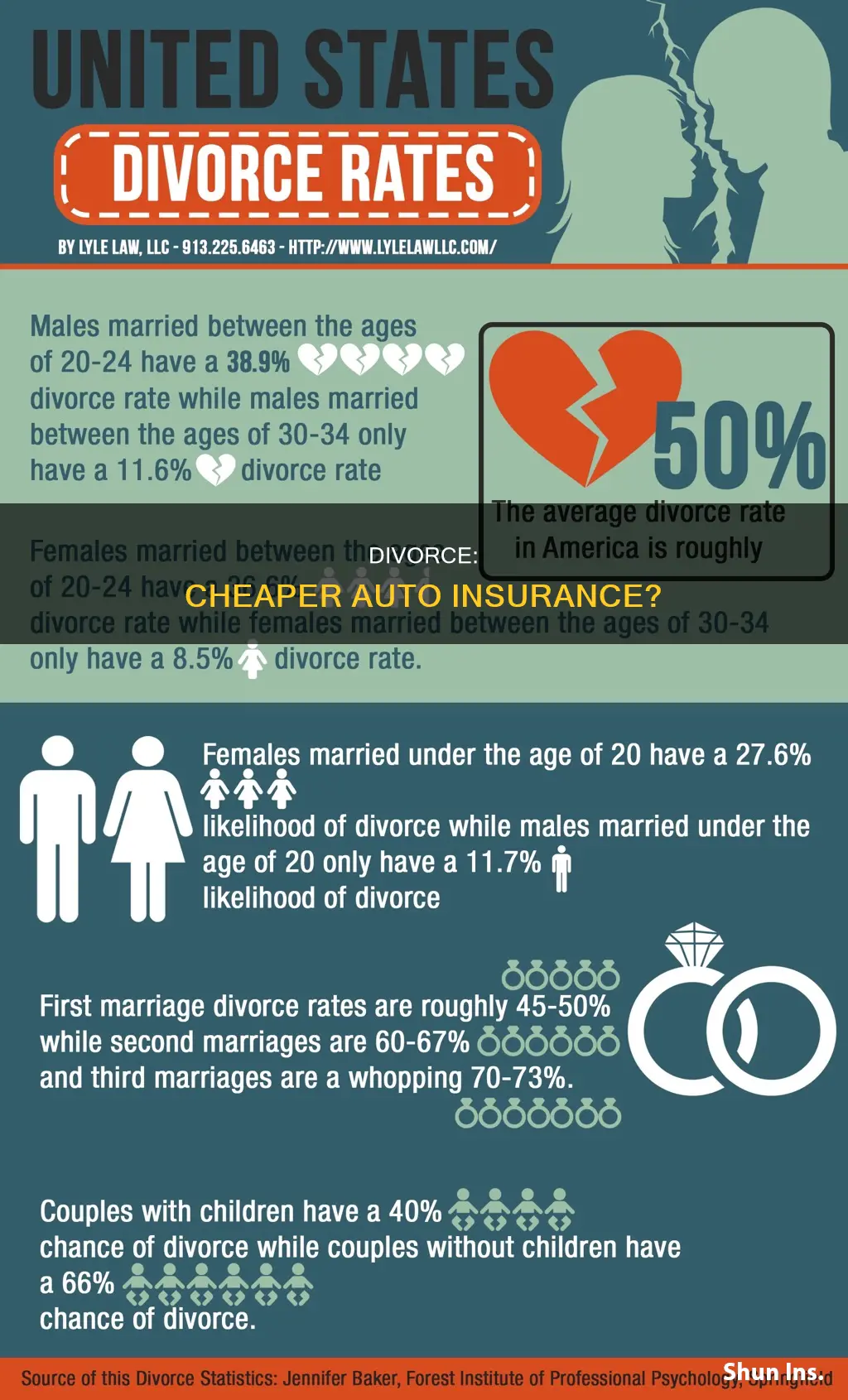

On the other hand, divorced drivers are typically viewed as more risky by insurance companies. They are considered to be less financially stable and are assumed to take more risks behind the wheel. Divorced drivers also tend to file more claims than married drivers, which results in higher premiums. According to a 2015 study by the Consumer Federation of America, premiums for divorced drivers were found to be almost always higher than those for married people with similar driving records.

It is important to note that not all insurance companies will charge higher premiums for divorced individuals. Additionally, there are ways for divorced individuals to lower their premiums, such as by bundling insurance policies or improving their driving record. Overall, while divorce may impact car insurance rates, there are factors other than marital status that insurance companies consider when determining premiums.

Michigan's Insured Vehicles: How Many?

You may want to see also

Married couples are considered lower risk

Another factor contributing to the lower risk assessment of married couples is their financial stability. Married couples are often viewed as having greater financial security, as they tend to pool their assets and may own a home or have children. This financial stability can influence their driving habits and insurance coverage choices. For example, married couples are more likely to bundle their insurance policies, including home, life, and car insurance, which can result in cost savings. They are also more likely to have multiple vehicles and qualify for multi-driver discounts on their auto insurance policies.

In addition, insurance companies assume that married couples share driving responsibilities, resulting in each person spending less time behind the wheel. This assumption further contributes to the perception of lower risk associated with married couples.

It is important to note that while marital status is a factor in determining auto insurance rates, it is not the sole determinant. Other factors, such as driving history, age, credit score, vehicle type, and location, also play a significant role in calculating insurance premiums. Additionally, the impact of marital status on insurance rates can vary depending on the specific insurance company and state regulations. Some states, like California, have passed laws prohibiting the use of marital status as a factor in auto insurance pricing.

Gap Healthcare Insurance: Filling Coverage Gaps

You may want to see also

Divorced individuals may lose a multi-vehicle bundling discount

Divorce can have a significant impact on auto insurance rates and policies. If you and your ex-spouse previously shared an auto insurance policy, you will need to make changes, such as switching to separate policies or keeping the same policy with updated information. One of the key considerations for divorced individuals is the potential loss of bundling discounts.

Multi-Vehicle Bundling Discounts

Divorced individuals may own multiple vehicles that were previously insured under the same policy. However, after the divorce, these vehicles will likely need to be insured separately, resulting in the loss of the multi-vehicle bundling discount. This discount is often offered by insurance companies when multiple vehicles are insured together, but with separate policies, this discount may no longer apply. This can lead to increased insurance costs for each individual.

Home and Auto Insurance Bundling Discounts

In addition to multi-vehicle discounts, divorced individuals may also lose bundling discounts for home and auto insurance. If one spouse moves out and rents a new place, they will need their own renters' insurance policy, losing the discount they previously received by bundling their home and auto insurance. Similarly, if the divorced individuals sell their shared home, the home insurance policy will need to be adjusted, resulting in the loss of the bundling discount with auto insurance.

Impact on Insurance Rates

The loss of bundling discounts can significantly impact insurance rates for divorced individuals. Without the discount, insurance premiums may increase, resulting in higher costs for each individual. It is important for divorced individuals to review their insurance policies and consider their options to mitigate these increased costs.

Adjusting Policies

To adjust their policies, divorced individuals may need to remove their ex-spouse from their existing policy or cancel the shared policy and obtain a new one. This process can be complicated, and it is recommended to consult with a divorce lawyer and insurance agent to ensure all necessary changes are made. Additionally, it is crucial to update address and contact information, especially if one spouse moves to a new location.

Shopping for New Policies

Divorced individuals may also consider shopping for new insurance policies that better suit their changed circumstances. Comparing rates and exploring different insurance providers can help identify more affordable options. Additionally, individuals can review their coverage and make adjustments, such as dropping collision and comprehensive coverage for older vehicles, to reduce overall insurance costs.

Auto Insurance: No-Fault Explained

You may want to see also

Married couples are more likely to bundle insurance policies

Combining insurance policies can qualify couples for significant discounts and lower rates. Insurance companies charge lower rates for married couples, and couples can also qualify for multi-vehicle discounts if they have multiple cars. Additionally, bundling insurance policies can offer benefits such as a single payment date and renewal date, and ensure that both spouses are covered when driving each other's vehicles.

Married couples who own a home together are also more likely to have home insurance and life insurance. Insurance companies may be able to convince these couples to purchase car insurance and bundle all their insurance policies, resulting in even bigger discounts. Married couples are also more likely to pool their assets, have a second home, and have children, all of which can impact their insurance rates.

While married couples typically combine their insurance policies, there are situations in which separate insurance policies may make sense. For example, if one spouse has a bad driving record, a low credit score, or a long commute, it may be more cost-effective for them to have a separate policy.

Uber's Commercial Auto Insurance Costs

You may want to see also

Divorced individuals may pay higher rates due to statistical correlation

Divorced individuals may pay higher insurance rates due to statistical correlation. According to a 2015 study by the Consumer Federation of America (CFA), premiums for single, divorced, and separated drivers were almost always higher than for married people with similar driving records. The Zebra reports that the average divorced driver in the US pays $1,486 per year for car insurance, $99 more than a married driver. This is because divorced drivers file more claims than married drivers, resulting in slightly higher premiums.

The increased rates for divorced individuals are not a punishment for their marital status but a reflection of historical data and statistical correlation. Insurance companies operate under the assumption that married couples are safer drivers, drive more carefully, and are less likely to be involved in accidents. They attribute this to greater financial security, shared driving responsibilities, and the likelihood of married couples owning a home and bundling insurance policies.

However, it's important to note that not all insurers will charge divorced drivers higher premiums. The impact of a divorce on car insurance rates can also depend on other factors, such as driving history, the number of insured vehicles, and the state of residence. Divorced individuals should review their policies, compare rates, and explore ways to lower their premiums.

While divorce can impact car insurance rates, it is essential to remember that insurance companies base their rates on various factors, including driving records, age, credit score, and vehicle type. Additionally, some states, such as Montana, Massachusetts, Hawaii, and Michigan, do not allow marital status to be a determining factor in car insurance rates.

Auto Insurance: What's Essential?

You may want to see also

Frequently asked questions

Divorce can impact your auto insurance rates. You should update your policy, and changes in driving records and moving to a new state can affect your rates.

Yes, it is important to notify your car insurance provider of any changes in car ownership or designated driver status. You will need to remove your ex-spouse to avoid future liability.

In some cases, divorce can lead to savings on car insurance as single drivers generally pay less than married drivers. However, there are other factors to consider, such as the driving history of your ex-spouse, whether you lose any multi-vehicle bundling discounts, and whether you are insuring one or two cars.