The minimum age to purchase car insurance is typically 18 years old, as this is the age of majority in most states. However, age restrictions for buying car insurance vary by state, and in some states, such as Mississippi, Alabama and Nebraska, the age of majority is higher. In most cases, a person must be the age of majority in their state to buy a car insurance policy. That said, if you are a minor, you may still be able to purchase car insurance if you have a guardian or parent who co-signs the policy with you.

| Characteristics | Values |

|---|---|

| Minimum age to purchase car insurance | 18 years old |

| Age of majority | 18 in most states, 19 in Alabama and Nebraska, 21 in Mississippi |

| Age restrictions | Depend on each state's insurance laws and insurance company's policy |

| Emancipated minors | Can buy, register and insure cars |

| Insurance for minors | Require a parent or guardian to co-sign the insurance policy |

What You'll Learn

Age restrictions vary by state

The minimum age to purchase car insurance is typically 18 years old, as this is the age of majority in most states. However, age restrictions for buying car insurance depend on each state's insurance laws and insurance companies' policies about minors signing contracts. In some states, the age of majority is higher than 18, such as in Alabama and Nebraska, where it is 19, and in Mississippi, where it is 21.

While the minimum age to purchase car insurance is typically 18, many states allow drivers to get car insurance at a younger age if they have a valid driver's license and are under the supervision of an adult who already has auto insurance coverage. In these cases, a parent or guardian will usually need to sign the insurance contract with the minor.

In most states, a 17-year-old can obtain their own car insurance policy separate from their parent's, but they will need an adult co-signer on the policy until they reach the age of majority in their state. This is because minors are typically not legally allowed to sign contracts, and a car insurance policy is a legally binding contract. An adult co-signer assumes financial responsibility for the policy and can make changes or cancel it if needed.

Emancipated minors, or adolescents who are legally freed from parental control and can prove financial independence, can generally buy, register, and insure their vehicles in their own names, regardless of their age. However, they will likely pay higher insurance costs than if they had remained on their parent or guardian's policy.

The cost of car insurance for young drivers can be high due to the increased risk of accidents and lack of driving experience. As a result, it may be more affordable for young drivers to be added to an adult's policy, such as a parent or relative's, rather than purchasing their own insurance.

U.S. Auto Association Insurance: Tire Slashing Incidents and Coverage

You may want to see also

Minors can get insurance if a guardian co-signs

Minors can get auto insurance if a guardian co-signs. This is because minors are typically not legally allowed to sign a contract, and a co-signer is needed because an insurance policy is a legally binding contract. A parent or guardian co-signing an insurance policy assumes financial responsibility and vouches for the minor. This is similar to co-signing a loan.

The age of majority, which is the age that a child becomes an adult and can consent to medical treatment, sign a contract, and vote, is typically 18 years old. However, this varies by state, with some states, like Alabama and Nebraska, setting the age of majority at 19, and Mississippi setting it at 21.

Therefore, a minor can get auto insurance if a guardian co-signs, but the guardian will be financially responsible if the adolescent cannot or will not pay. The co-signer can also make changes to the policy or cancel it if needed.

Does Drag Racing Void Your Auto Insurance?

You may want to see also

Emancipated minors can get insurance

In most states, you must be 18 or older to purchase a car insurance policy. This is because 18 is the age of majority in most states, and the age of majority is the age at which a person can legally enter into contracts. However, if you are an emancipated minor, you can purchase a policy before turning 18.

An emancipated minor is a minor who has been legally freed from their parents' or guardians' control and the parents are freed of the child's responsibility. In other words, an emancipated minor is a minor who is legally independent from their parents or guardians. This usually applies to adolescents who leave their parents' household by agreement or demand.

There are various ways that a minor can be emancipated, but the most common reasons are:

- Enlisting in the military (with parental consent)

- Getting married (with parental consent)

- A court order from a judge (no parental consent required)

- A parent formally or informally agreeing to give up some or all of their parental control

Once a minor has been emancipated, they can enter into contracts, meaning they can sign a purchase agreement for a car and an insurance policy.

It's important to note that the specifics of emancipation laws vary by state, so be sure to check the laws in your state. Additionally, the eligibility of an emancipated minor for insurance will be governed by the contract terms of each insurer, so it's a good idea to contact the insurer directly.

Texas Auto Insurance in Louisiana: What You Need to Know

You may want to see also

Insurance is cheaper on a parent's policy

The minimum age to purchase car insurance is typically 18 years old. However, this may vary depending on state laws and insurance company guidelines. In most states, you must be 18 or older to purchase a policy as it is the age of majority in most states. The age of majority is the age at which you can legally enter into contracts.

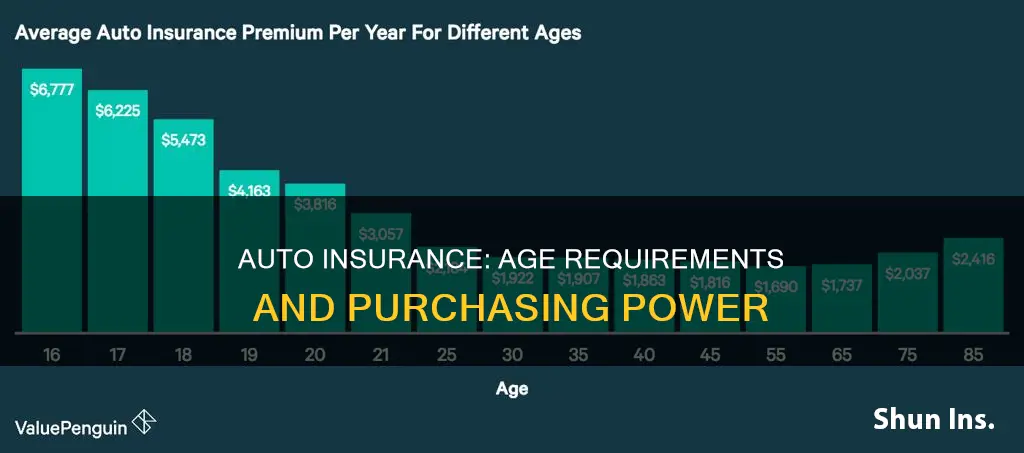

If you are younger than 18, you are considered a minor and will need a parent or guardian to sign or co-sign the car insurance policy with you. Even if you are old enough to get your own insurance policy, it is usually more cost-effective to stay on your parents' policy. This is because insurance providers view younger drivers as a higher risk due to their lack of driving experience. As a result, young drivers buying a policy independently are often charged much higher than average car insurance rates.

According to the Insurance Institute for Highway Safety, teens aged 16-19 are involved in the highest ratio of fatal accidents compared to all other age groups, despite accounting for the lowest number of drivers on the road. Therefore, insurance companies typically charge higher premiums to younger drivers to mitigate the potential costs associated with claims from this age group. By staying on your parents' policy, you can avoid these higher rates and save a significant amount of money.

In addition to the financial benefits, staying on your parents' policy can also help you establish a history with their insurance company. If you maintain continuous coverage and a good driving record, you may be able to receive discounted rates later on when you eventually purchase your own policy. It is important to note that there is no age limit for staying on your parents' policy, but you should consider purchasing your own insurance policy once you have achieved financial independence, moved out of your parents' home, own your own vehicle, or gotten married.

Storing an Unregistered, Uninsured Vehicle

You may want to see also

Insurance costs depend on driving history

The cost of auto insurance is determined by a range of factors, including age, gender, location, and vehicle type. However, one of the most significant factors is a person's driving history.

In general, the better your driving record, the lower your insurance premium will be. This is because insurance companies use your driving history to assess your risk level, i.e., how likely you are to file a car insurance claim. If you have a history of moving traffic violations, at-fault accidents, or a DUI/DWI conviction, you will likely pay more for car insurance and may even struggle to find an insurance company that will cover you. On the other hand, practicing safe driving habits and maintaining a clean driving record will help you secure better insurance rates.

The impact of your driving history on insurance costs also depends on the state you live in. Insurance companies typically look at a person's driving record from the past three to five years, but this timeframe can vary depending on your state. Additionally, the amount of time that accidents or tickets will remain on your record also differs by state, usually ranging from three to five years.

It's worth noting that some states, like California, Hawaii, Massachusetts, and Michigan, have banned the use of credit scores in setting insurance rates. This means that your credit history won't be considered when determining your car insurance premium in these states.

To lower your car insurance costs, it's recommended to shop around and compare quotes from different insurance providers, as rates can vary significantly between companies. You can also consider taking a defensive driving course, which may help reduce points on your driving record and lead to cheaper rates. Asking about discounts, such as good driver discounts or safe driver discounts, can also help reduce your insurance costs.

Does Your Auto Insurance Cover Other Drivers?

You may want to see also

Frequently asked questions

The minimum age to purchase car insurance is typically 18 years old. However, the minimum age varies by state, with some states requiring individuals to be 19 or 21 years old. Additionally, minors can obtain auto insurance with a parent or guardian's co-signature.

Yes, it is possible for minors under the age of 18 to obtain auto insurance with a parent or guardian's co-signature. In some states, individuals as young as 17 can obtain auto insurance with a co-signer.

While auto insurance for teens and young adults can be expensive, it may be more affordable to be added to another adult's policy, such as a parent or guardian. This can provide coverage for your vehicle at a lower cost.