Slashed tires are a type of vandalism and can be covered by auto insurance in certain circumstances. USAA offers roadside assistance as an optional add-on to its auto insurance policy, which covers flat tires, towing, battery jumpstarts, and lockout services. While USAA roadside assistance does not cover the cost of the tire itself, it does provide services related to flat tires, such as towing the vehicle to a repair shop and changing to a spare tire. Therefore, USAA's roadside assistance can be beneficial in the event of slashed tires, providing services to get drivers back on the road safely.

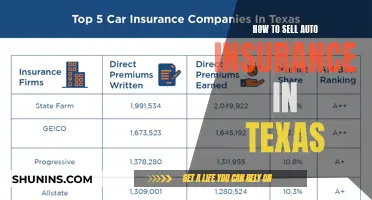

| Characteristics | Values |

|---|---|

| Does USAA cover slashed tires? | Yes, if the customer has comprehensive coverage. |

| What type of insurance covers slashed tires? | Comprehensive and collision insurance. |

| Does USAA cover flat tires? | Yes, if the customer has roadside assistance coverage. |

| How much does roadside assistance coverage cost? | $18-$24 per year. |

| What does roadside assistance cover? | Towing, battery jumpstarts, flat tire replacements, winching, lockout services, fuel delivery, and on-site labour. |

What You'll Learn

USAA covers slashed tires with comprehensive coverage

Slashed tires are a type of vandalism and are covered by USAA auto insurance if you have comprehensive coverage. Comprehensive coverage is an additional type of coverage that doesn't automatically come with most basic insurance policies. It covers damage to your vehicle due to uncontrollable situations, such as weather, animals, rioting, falling objects, and more. It also covers acts of vandalism, which include slashed tires.

USAA also offers roadside assistance as an optional policy add-on, which covers flat tire changes, towing, battery jump starts, gasoline delivery, and lockout services. This can be useful if you have a flat tire and need assistance changing it to a spare. However, it's important to note that USAA will not pay for the cost of the tire itself.

If you suspect that your tires have been slashed, it is recommended to file a police report and take pictures of the damages. Contact your insurance company to file a claim, and they will cover the cost of replacing the damaged tires, subject to any deductibles or limitations outlined in your policy.

Instant Auto Insurance: Same-Day Coverage

You may want to see also

Comprehensive coverage includes damage from vandalism

Slashed tires are a type of vandalism and are covered by comprehensive insurance. Comprehensive insurance is an additional type of coverage that doesn't automatically come with most basic insurance policies. It covers damage to your vehicle due to uncontrollable situations, such as weather, animals, rioting, falling objects, and more. It also typically covers damage caused by vandalism.

USAA offers comprehensive coverage as an optional add-on to its auto policies. If you have comprehensive coverage with USAA and your tires are slashed, they will cover the cost of replacing the damaged tires, subject to any deductibles or limitations outlined in your policy.

It's important to note that you need to have a spare tire for USAA to cover the cost of a tire change. Additionally, USAA roadside assistance is a separate add-on that can be useful in situations like flat tires, but it won't cover the cost of the tire itself.

Full Coverage Auto Insurance: Do I Need It?

You may want to see also

File a police report for slashed tires

If you discover that your car tires have been slashed, it is essential to take immediate action by following these steps:

Contact the Police

First, you should contact the police and file a report, regardless of whether you know the culprit or not. Filing a police report serves to document the crime, and it may also help apprehend the perpetrator if they are caught. The police may decide to investigate and gather evidence to charge the person responsible. This report is crucial for insurance purposes and can aid in your insurance claim. In most states, you can file a police report online, in person at a police station, or over the phone.

Document the Incident

After contacting the police, it is important to document the incident thoroughly by taking clear and detailed photographs of the slashed tires from multiple angles. These photos will serve as valuable evidence for insurance claims or legal proceedings. Make sure to note the date, time, and location of the incident, as well as any other relevant details you can recall. If there are any witnesses, obtain their contact information, and inform the authorities if any surveillance footage captured the incident.

Secure Your Vehicle

Once you have reported the incident and documented the damage, take steps to secure your vehicle to prevent further harm. Move your vehicle to a secure and well-lit location or a garage, if possible. If the damage is extensive and renders your vehicle unsafe to drive, consider having it towed to a reputable tire shop or dealership. Contact your insurance company and inform them about the incident to seek guidance on the next steps. Consider installing additional security measures, such as surveillance cameras or an alarm system, to deter future acts of vandalism.

Assess the Damage and Repair Options

Evaluate the condition of the tires by inspecting them for cuts, punctures, or sidewall slashes. Determine the severity of the damage and whether the tires can be repaired or need to be replaced. Consult a qualified tire specialist or mechanic to get expert advice on the best course of action. They will be able to assess the extent of the damage and recommend the appropriate solution.

Consider the Cost of Replacement

Consider the cost of repairing or replacing the tires. Depending on the severity of the damage, repairing the tires might not be feasible. In such cases, replacing the tires becomes necessary to ensure your safety on the road. Evaluate the cost of new tires, including installation fees, and whether it aligns with your budget. Check if there are any warranties or insurance coverage that can help offset the cost of replacement.

Preventive Measures for the Future

To reduce the risk of tire slashing incidents in the future, consider implementing preventive measures such as installing security features like alarm systems, wheel locks, and GPS tracking devices. Park your vehicle in well-lit areas or secure parking garages to deter potential vandals. Stay vigilant and aware of your surroundings, and report any suspicious individuals or activities to the authorities.

Aflac's Auto Insurance: Understanding Coverage for Rebuilt Title Cars

You may want to see also

USAA roadside assistance covers flat tires

To request roadside assistance, drivers can call 800-531-8555, which will connect them to Agero, USAA's roadside partner. They can also log in to their account online to request a breakdown service.

While USAA will cover the cost of changing a flat tire, it's important to note that they will not pay for the tire itself. Therefore, drivers will need to have a spare or pay out of pocket for a replacement.

In addition to flat tire changes, USAA roadside assistance also covers:

- Towing up to 50 miles

- Battery jump starts

- Gasoline delivery

- Lockout services

- Winching

ExamOne Results: Do Auto Insurers Get Them Automatically?

You may want to see also

USAA roadside assistance is an optional add-on

USAA will dispatch a professional to service your vehicle, such as a locksmith if you're locked out, or a tow truck if your vehicle is stuck. It takes up to 60 to 90 minutes for roadside assistance to arrive, depending on your location, the issue, and road conditions.

If you need to use your USAA roadside assistance, you can call 800-531-8555, submit an online claim, or submit a claim through the mobile app.

It's worth noting that there is a cap on the number of claims you can file within the policy period, and USAA roadside coverage will not be available if you are in a vehicle that is not listed in your auto policy. Additionally, while the labour to change a flat tire is covered, you will need to supply the spare tire yourself.

Permit Holders: Auto Insurance Options

You may want to see also

Frequently asked questions

USAA will cover slashed tires if you have comprehensive coverage. Collision and comprehensive coverage can be added to most basic insurance policies and cover acts of vandalism.

File a police report with your local authorities and take pictures of and write down important details about the damage.

Adding roadside assistance to your USAA auto policy will cost around $18 to $24 per year, depending on your policy and location.