The Commission to Whole Life Insurance Agents is a critical aspect of the insurance industry, representing the compensation structure for agents specializing in whole life insurance policies. This commission system is designed to incentivize agents to provide comprehensive and tailored financial solutions to their clients. It involves a structured payment plan based on the number of policies sold, the value of the policies, or a combination of both. Understanding this commission structure is essential for both insurance agents and their clients, as it directly impacts the quality of service and the overall cost of insurance policies.

What You'll Learn

- Definition: Commission-based agents earn a percentage of premiums for selling whole life insurance

- Compensation Structure: They receive a commission for each policy sold, plus potential bonuses

- Commission Rates: Rates vary, typically 0.5% to 2% of the policy's annual premium

- Commission Payouts: Payouts are made periodically, often monthly or annually

- Commission vs. Salary: Some agents earn a combination of commission and a fixed salary

Definition: Commission-based agents earn a percentage of premiums for selling whole life insurance

Commission-based agents play a crucial role in the insurance industry, particularly in the sale of whole life insurance policies. These agents are incentivized through a performance-based compensation structure, where their earnings are directly tied to the success of their sales. When an individual purchases a whole life insurance policy, a portion of the premium paid goes towards the agent who facilitated the sale. This commission is a percentage of the total premium, and it serves as a reward for the agent's efforts and expertise in guiding the client through the insurance buying process.

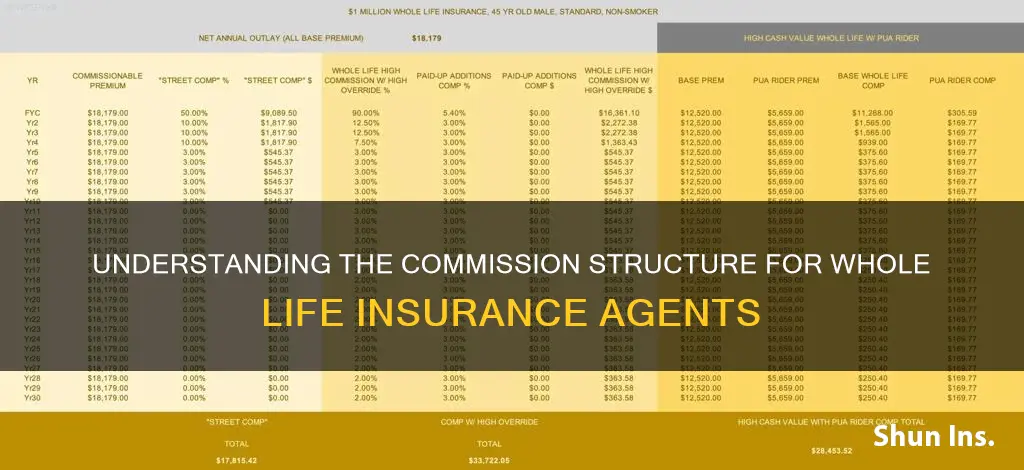

The commission structure for whole life insurance agents is designed to motivate them to provide exceptional service and build long-term relationships with their clients. As an agent, your primary goal is to help clients understand the complexities of whole life insurance and make informed decisions. In return for your expertise, you earn a commission, which can vary depending on the insurance company, the policy type, and the agent's performance. Typically, the commission rate is a percentage of the annual premium, and it can range from a few percent to a more substantial figure, especially for high-value policies.

For instance, if a client purchases a whole life insurance policy with an annual premium of $10,000, and the agent's commission rate is 5%, the agent would earn $500 per year as a commission. This commission is not a one-time payment but rather a recurring income as long as the policy remains active. Over time, this can accumulate to a significant amount, especially for agents who successfully guide multiple clients through the insurance buying process.

Commission-based agents have a vested interest in ensuring client satisfaction and policy longevity. They strive to provide comprehensive advice, helping clients choose the right coverage and ensuring they understand the policy's benefits and potential long-term value. This approach not only benefits the clients but also contributes to the agent's professional reputation and future business prospects.

In summary, commission-based agents in the whole life insurance industry earn a percentage of the premiums collected for each policy they sell. This compensation model encourages agents to provide valuable expertise, build strong client relationships, and contribute to the overall success of the insurance company. Understanding this commission structure is essential for both agents and clients to ensure a transparent and mutually beneficial insurance experience.

Preparing for a Life Insurance Interview: What to Expect

You may want to see also

Compensation Structure: They receive a commission for each policy sold, plus potential bonuses

The compensation structure for whole life insurance agents is primarily based on commissions, which can vary depending on the company and the specific role of the agent. These commissions are typically a percentage of the total policy premium collected from the policyholder. When an agent sells a whole life insurance policy, they earn a commission on the initial premium payment, and this commission can be a significant portion of their overall earnings. The rate of commission can range from 1% to 5% or even higher, depending on the insurance company's policies and the agent's experience and performance.

In addition to the commission, whole life insurance agents may also be eligible for various bonuses and incentives. These bonuses can be structured in different ways and are often designed to motivate agents to achieve sales targets and provide exceptional customer service. Common types of bonuses include:

- Sales Bonuses: These are additional payments made to agents who consistently meet or exceed sales targets. The bonus amount can be a fixed percentage of the total sales or a tiered system where higher sales volumes result in higher bonus percentages.

- Longevity Bonuses: Some companies offer bonuses to agents who have been with the company for a certain period, rewarding their loyalty and continued performance.

- Leadership Bonuses: For experienced agents who mentor and train new recruits, there might be additional bonuses to recognize their leadership and contribution to the team's success.

- Performance-based Bonuses: These bonuses are tied to specific performance metrics, such as customer satisfaction scores, policy retention rates, or the number of policies sold in a given period.

The compensation structure for whole life insurance agents is performance-driven, encouraging them to provide excellent service and consistently deliver results. It also allows agents to build a substantial income over time, as their earnings can grow exponentially with each new policy sold. However, it's important to note that the success of an agent in this field also depends on their ability to build a strong client base, maintain relationships, and provide ongoing support to policyholders.

Understanding the compensation structure is crucial for agents to manage their expectations and plan their career paths effectively. It also helps them make informed decisions about the products they offer and the strategies they employ to attract and retain clients. By combining a solid commission structure with potential bonuses, whole life insurance agents can create a rewarding and sustainable career in the insurance industry.

Understanding Bank-Owned Life Insurance: An Intangible Asset?

You may want to see also

Commission Rates: Rates vary, typically 0.5% to 2% of the policy's annual premium

When it comes to whole life insurance, agents play a crucial role in helping individuals secure long-term financial protection. One of the primary ways they earn an income is through commissions, which are a percentage of the annual premium paid by the policyholder. Understanding these commission rates is essential for both agents and policyholders to grasp the financial dynamics of the insurance industry.

Commission rates for whole life insurance agents can vary significantly, typically ranging from 0.5% to 2% of the policy's annual premium. This range provides a broad perspective on the potential earnings for agents, which can be influenced by various factors. The higher end of this spectrum, 2%, is often associated with more complex policies or those with additional riders or benefits. These policies may require agents to demonstrate a deeper understanding of the product and its features, thus justifying a higher commission rate.

The 0.5% end of the spectrum represents a more standard commission structure. Policies in this range often have straightforward terms and may be more commonly sold by agents. It's important to note that these rates are not set in stone and can be influenced by the insurance company's policies, the agent's experience, and the specific market conditions.

Agents should be transparent about these commission rates with their clients. This transparency ensures that policyholders understand how their premiums contribute to the agent's income and the overall cost of the insurance. It also fosters trust and allows clients to make informed decisions about their insurance choices.

In summary, commission rates for whole life insurance agents are a critical aspect of the insurance business, offering a clear incentive for agents to provide valuable services. The range of 0.5% to 2% reflects the diversity of policies and the expertise required by agents, ultimately shaping the financial relationship between agents, insurance companies, and policyholders.

Life Insurance: Maximizing Your Money, Securing Your Future

You may want to see also

Commission Payouts: Payouts are made periodically, often monthly or annually

Commission payouts are a critical aspect of the compensation structure for whole life insurance agents, and understanding how these payouts work is essential for agents and their clients alike. When an insurance agent sells a whole life insurance policy, they typically earn a commission, which is a percentage of the policy's premium. This commission is not a one-time payment; instead, it is paid out over time, often in a structured and periodic manner.

The frequency of these payouts can vary, but it is common for commissions to be paid on a monthly or annual basis. Monthly payouts are attractive to agents as they provide a steady income stream, ensuring a consistent cash flow. This is particularly beneficial for agents who are just starting their careers or those who prefer a more regular financial reward for their efforts. On the other hand, annual payouts are more suitable for agents with a larger client base and higher sales volume, as they receive a substantial sum at the end of each year, which can be a significant financial boost.

Periodicity of payouts is an important consideration for agents, as it directly impacts their financial planning and stability. For instance, monthly payouts allow agents to budget more effectively and plan for short-term expenses, while annual payouts can be reinvested into the business or saved for long-term goals. It's worth noting that the specific payout schedule may vary depending on the insurance company and the agent's agreement. Some companies might offer both monthly and annual payout options, providing agents with flexibility in their compensation structure.

In addition to the frequency, the amount of the commission payout is also crucial. Agents should be aware of the commission structure for the policies they are selling, including the initial commission and any subsequent commissions that may be earned over the policy's lifetime. Understanding the total commission potential can help agents set realistic financial goals and attract clients who align with their sales strategy.

Overall, commission payouts play a significant role in the financial success of whole life insurance agents. By offering periodic payments, insurance companies provide agents with a stable income, allowing them to focus on building their business and providing excellent customer service. Agents should carefully review the payout terms and conditions to ensure they are satisfied with the compensation structure and can effectively manage their finances accordingly.

Heart Disease: Life Insurance Impact and Considerations

You may want to see also

Commission vs. Salary: Some agents earn a combination of commission and a fixed salary

Many whole life insurance agents operate on a commission-based structure, where their earnings are directly tied to the sales they make. This model is common in the insurance industry and can be highly lucrative for top performers. However, it also means that agents' income can vary significantly from month to month, depending on their sales performance. For those who excel and consistently bring in new policies, this can be a rewarding system.

In contrast, some agents are offered a combination of commission and a fixed salary. This hybrid approach provides a more stable income, ensuring a regular pay check each month. It can be particularly appealing to agents who prefer a more consistent and predictable income, especially those who are just starting their careers or have family commitments. With a fixed salary, agents can focus on building their client base and developing their skills without the added pressure of solely relying on commission.

The decision to work on a commission-only, commission-plus-salary, or salary-only basis often depends on an agent's experience, goals, and personal circumstances. Newer agents might start with a commission-only model to motivate them to sell more policies and build their reputation. As they gain experience and establish a strong client base, they may transition to a hybrid model, allowing them to maintain a steady income while still earning performance-based incentives.

For those who prefer a more secure financial foundation, a salary-based role can be attractive. This structure ensures a regular income, which can be beneficial for agents who want to focus on long-term career development and building a stable client portfolio. However, it's important to note that with a salary, there might be less potential for high earnings, especially for those who don't meet certain sales targets.

In summary, the choice between commission and salary, or a combination of both, is a strategic decision for whole life insurance agents. It requires a thorough understanding of one's goals, the insurance market, and personal financial needs. Some agents thrive in a commission-only environment, while others prefer the security of a fixed salary. Ultimately, the right approach will vary depending on individual circumstances and the specific demands of the insurance agency or company.

Life Insurance: Can You Still Get Covered?

You may want to see also

Frequently asked questions

Commission to Whole Life Insurance Agents refers to the compensation structure for insurance agents who specialize in selling whole life insurance policies. This commission is typically a percentage of the premium paid by the policyholder for the insurance coverage. The rate can vary depending on the insurance company, the agent's experience, and the specific policy sold.

When an insurance agent sells a whole life insurance policy, they earn a commission based on the initial premium payment made by the customer. This commission is usually a combination of a first-year commission and subsequent year commissions. The first-year commission is typically higher and covers the agent's initial efforts in acquiring the policy. Subsequent year commissions are generally lower and are paid annually as long as the policy remains in force.

Yes, commission structures can vary. Some insurance companies may offer a flat commission rate, while others use a sliding scale where the commission percentage increases with higher policy values or longer policy terms. Additionally, some agents might receive additional incentives or bonuses based on their performance, sales volume, or the number of policies they maintain over time.

To ensure a fair commission, agents should carefully review the commission structure with their insurance company or employer. They should understand the terms and conditions, including any caps or limits on commission earnings. Building a strong client relationship, providing excellent service, and maintaining a high level of professionalism can also help agents secure higher commissions and build a successful career in whole life insurance sales.