Life insurance medical exams are a routine part of most insurance applications. They are used to determine an applicant's health and mortality risk, which in turn helps insurers decide on coverage eligibility and premium costs. The exam usually consists of two parts: a medical questionnaire and a physical examination. The entire process generally takes around 30 minutes and can be conducted at the applicant's home or workplace. While life insurance without a medical exam is available, it typically comes with lower death benefits and higher premiums.

| Characteristics | Values |

|---|---|

| Purpose | To assess the applicant's health and determine their insurability |

| Format | Two-part process: a questionnaire and a basic physical exam |

| Time | 15-45 minutes |

| Location | Home, office, or lab facility |

| Cost | Covered by the life insurance company |

| Preparation | Eating healthily, avoiding certain medications and alcohol, increasing water intake, and getting sufficient sleep |

What You'll Learn

How often do you need to retake the life insurance exam?

It is unclear how often you need to retake a life insurance exam. However, there are several factors that determine the type of policy, level of coverage, and cost. These include your age, overall health, family history, and lifestyle habits. Life insurance rates are based on these factors, which determine the amount of financial risk the life insurance company takes when it approves a policy.

Life insurance companies often require applicants to undergo a medical exam to assess their health and determine their insurable status. The exam typically consists of two parts: a questionnaire and a basic physical exam. The results of the medical exam will impact the cost of your life insurance policy. Applicants in good health usually qualify for lower premiums, while those with certain medical conditions may face higher rates or be deemed ineligible for certain types of policies.

It is important to note that there are also no-exam life insurance policies available, which are typically called "no-exam life insurance" or "simplified-issue life insurance." These policies offer a more convenient and streamlined application process but may have limited coverage amounts and higher premiums.

Medicare Life Insurance Scams: What You Need to Know

You may want to see also

What is tested in the life insurance exam?

A life insurance medical exam is a routine part of most insurance applications. It usually consists of two parts: a questionnaire and a physical exam. The examiner will often come to your home or office and perform a short physical examination that includes basic height and weight measurements, a check of your vital signs, including pulse and blood pressure, and taking blood and urine samples.

The Questionnaire

The policy underwriters (insurance company professionals who assess your risk) will consider both your medical and lifestyle information, so the questionnaire will likely cover the following:

- Family medical history

- Current and previous doctors’ contact information

- Details of current diagnoses

- Recent doctor visits

The Physical Exam

The physical exam will record your weight, height, body mass index (BMI), and vitals, including your pulse and blood pressure. Depending on your circumstances and the insurer's requirements, you may also have the following tests:

- Electrocardiogram (EKG)

- Treadmill stress test

- Cognitive ability test

The results of the medical exam will impact the cost of your life insurance policy. Applicants in good health typically qualify for lower premiums, while those with certain medical conditions may face higher rates or be ineligible for certain types of policies.

United Health's Life Insurance Offering: What You Need to Know

You may want to see also

How can you prepare for the life insurance exam?

Preparing for a life insurance exam is an important step in the application process. While you can't make significant changes to your health in a short time, there are some simple things you can do to ensure your body is in its best possible form. Here are some tips to help you prepare:

The Week Before the Exam:

- Eat Healthily: Focus on leafy greens and other vegetables, lean proteins, and "good fats" like avocado and olive oil. Limit high-cholesterol, fatty, salty, and sugary foods.

- Avoid Non-Essential Medications: Over-the-counter medications like antihistamines and decongestants can raise blood pressure and glucose levels, so avoid these unless essential.

- Avoid Alcohol: Alcohol can negatively impact liver enzymes and cause dehydration, which can affect blood and urine samples.

- Drink More Water: Aim for 64 ounces (8 glasses) of water per day. This will help flush out toxins and ensure you're well-hydrated for the blood draw.

- Get Plenty of Sleep: A well-rested body will have better vital signs, such as pulse and blood pressure.

12-24 Hours Before the Exam:

- Avoid Strenuous Exercise: Intense physical activity can negatively impact your blood pressure, cholesterol levels, and protein levels in your urine.

- Go to Bed Early: Aim for 8 hours of sleep to ensure you're well-rested.

- Fast: Avoid food and drink (except water) if you're required to fast.

- Drink a Glass of Water: This will help with hydration for the blood draw.

- Wear Lightweight Clothing: For your weigh-in, wear minimal clothing to get an accurate weight measurement, as weight can affect your rate class.

On the Day of the Exam:

- Schedule it Early: It's best to get the exam done early in the day, so you don't have to go without food or coffee for too long.

- Avoid Caffeine: Caffeine can affect your blood pressure, so skip the morning coffee.

- Avoid Tobacco: Nicotine raises your blood pressure.

- Avoid Poppy Seeds: Poppy seeds can lead to a false positive for opiates.

Additionally, make sure you have the necessary documents ready, including a photo ID, list of prescriptions, and contact information for doctors you've seen in the last 5 years.

Banner Life Insurance: Is It Worth the Hype?

You may want to see also

What happens after the life insurance exam?

After the life insurance medical exam, the results are sent to the insurance company's underwriting team. The underwriting process can take anywhere from a day to a few weeks, depending on the size of the policy and the complexity of the case. During this time, an underwriter will carefully examine your application, health information, and lifestyle to determine your insurance risk class.

Once the underwriting process is completed, you will be informed whether your application has been approved and the rate of your premium. If you have been working with an experienced agent and no unexpected health issues are discovered, you are unlikely to face premiums higher than what you expected. However, there may be instances where a person is approved for life insurance but not for the total amount applied for due to risk factors identified during the underwriting process.

In some cases, your insurer might request a follow-up exam if any of your lab tests yield unexpected results. While this may be frustrating, it is generally advisable to comply with the process to obtain your policy. The entire underwriting process, even with repeat medical exams, usually takes no longer than a couple of months.

Universal Life Insurance: Paid Up or Not?

You may want to see also

Can you get life insurance without an exam?

Yes, you can get life insurance without a physical medical exam. This is known as "no-medical-exam life insurance" or "no-exam life insurance" and is offered by some carriers.

No-exam life insurance is best suited for those with pre-existing health conditions, older adults who might not qualify for traditional policies, and people who need coverage quickly and don't have time for the application process required for traditional policies. It's also a good option for individuals with a fear of medical exams or needles.

There are three basic ways to get a no-exam policy:

- Simplified issue life insurance: These policies typically require a health questionnaire but not a physical exam. They generally have lower coverage limits (a maximum of $500,000 is typical), and premiums are more expensive compared to traditional policies.

- Guaranteed issue life insurance: You are virtually guaranteed to be approved regardless of any pre-existing conditions, and there are usually no health-related questions or exams. Many of these policies are "final expense policies", which cover funeral and other costs, and coverage limits are generally $50,000 or less. While monthly premiums may seem low, the price per $1,000 death benefit is almost always higher than other forms of coverage.

- Workplace (employer-sponsored) life insurance: Employer-sponsored life insurance often features cost-effective group rates and may not require a health exam unless you apply for coverage over a certain limit.

While no-exam life insurance can be a good option for some, it is important to note that it typically has lower death benefits and higher premiums than policies that include a medical exam. Additionally, the coverage amounts without a medical exam may be restricted, and the application process may still involve answering health-related questions.

Investments to Secure Your Future: Alternatives to Life Insurance

You may want to see also

Frequently asked questions

The frequency of life insurance exams is not specified, but they are typically required when applying for a new policy or changing an existing one.

A life insurance exam consists of two parts: a questionnaire about your medical history, lifestyle, and habits, followed by a physical exam, including measurements of vital signs and blood and urine samples.

It is recommended to eat healthily, avoid certain medications and strenuous exercise, stay hydrated, and get enough sleep before the exam.

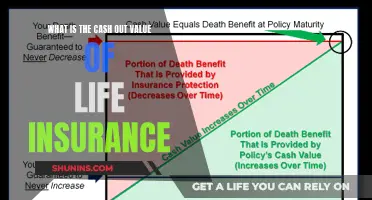

Medical exams help life insurance companies assess an applicant's health, determine their eligibility for coverage, and calculate the cost of premiums based on their life expectancy.