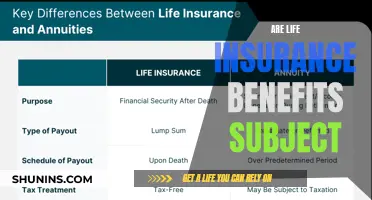

Life insurance is a financial tool that provides a safety net for loved ones in the event of a policyholder's death. It offers a tax-free death benefit, which means the proceeds paid out upon the insured individual's passing are generally not subject to income tax. However, the tax implications of life insurance can vary depending on the type of policy and the circumstances of its use. Understanding these tax considerations is essential for individuals and families to make informed decisions about their insurance coverage and financial planning.

What You'll Learn

- Tax Treatment of Premiums: Premiums paid for life insurance are generally tax-deductible, reducing taxable income

- Proceeds and Income Tax: Life insurance death proceeds are typically tax-free, but survivors may pay income tax on policy loans

- Capital Gains Tax: Life insurance policies can be subject to capital gains tax when sold or surrendered for a profit

- Estate Tax Implications: Life insurance proceeds can be exempt from estate tax, but proper planning is essential

- State-Specific Tax Laws: Tax rules vary by state, affecting the taxation of life insurance benefits and policy values

Tax Treatment of Premiums: Premiums paid for life insurance are generally tax-deductible, reducing taxable income

The tax treatment of life insurance premiums is an important consideration for individuals and families, as it can significantly impact their financial planning and overall tax liability. When it comes to life insurance, the premiums paid by policyholders can be a valuable tax deduction, offering a way to reduce taxable income and, consequently, the amount of tax owed.

In many countries, including the United States, life insurance premiums are generally tax-deductible. This means that the amount paid towards life insurance coverage can be subtracted from the individual's taxable income, which is a substantial benefit. By deducting these premiums, policyholders can effectively lower their taxable income, which is the total income earned before taxes are applied. This reduction in taxable income can lead to a lower tax bracket, resulting in a reduced tax rate and, ultimately, a lower tax bill.

For example, if a person pays $10,000 in life insurance premiums annually, they can claim this amount as a deduction on their tax return. This deduction directly reduces their taxable income, which may be calculated as $50,000 for the year. By subtracting the $10,000 premium, the taxable income drops to $40,000, potentially placing the individual in a lower tax bracket. This can be especially advantageous for high-income earners who may be in a higher tax bracket and can benefit from the tax savings.

It's important to note that there are specific rules and limitations regarding the tax treatment of life insurance premiums. Generally, the premiums must be paid for a qualifying life insurance policy, which typically includes term life insurance and permanent life insurance policies that meet certain criteria. Additionally, there may be income limits or other restrictions on who can claim these deductions, so it's essential to consult tax regulations or seek professional advice to ensure compliance with the law.

Understanding the tax implications of life insurance premiums is crucial for effective financial planning. By taking advantage of this tax-deductible benefit, individuals can optimize their tax strategy, potentially saving a significant amount of money over time. It is a valuable incentive for purchasing life insurance, as it provides both financial protection and tax advantages, making it an essential consideration for anyone looking to secure their family's financial future.

Understanding Family Unit Life Insurance: A Comprehensive Guide

You may want to see also

Proceeds and Income Tax: Life insurance death proceeds are typically tax-free, but survivors may pay income tax on policy loans

Life insurance is a financial tool that provides a safety net for individuals and their families, offering a lump sum payment (proceeds) upon the insured person's death. These proceeds are generally considered tax-free, which means they are not subject to income tax for the beneficiary. This tax-free status is a significant advantage of life insurance, ensuring that the entire benefit goes towards the intended purpose without being eroded by taxes.

However, there are certain scenarios where tax implications can arise. One such instance is when the insured individual takes out a loan against their life insurance policy. In this case, the loan amount is considered a taxable income for the policyholder. When the loan is repaid, the interest paid may also be taxable. This is because the loan is treated as a distribution from the policy, and any distribution can trigger tax consequences.

For beneficiaries, the tax treatment of life insurance proceeds can vary depending on the jurisdiction and the specific policy terms. In many countries, death proceeds from life insurance are generally exempt from income tax for the recipient. This is because the proceeds are often intended to provide financial support to the family or beneficiaries, and taxing them could reduce the overall benefit. However, there might be exceptions and specific rules that apply, especially in cases where the policy has been in force for a long period or has a complex structure.

It is important for individuals to understand the tax implications of their life insurance policies, especially when it comes to loans. Policyholders should be aware that taking a loan against their policy may result in taxable income, and they should consider the potential tax liabilities when making such decisions. Additionally, beneficiaries should be informed about the tax-free nature of death proceeds to ensure they receive the full benefit without unnecessary tax burdens.

In summary, life insurance death proceeds are generally tax-free for beneficiaries, providing a valuable financial safety net. However, policyholders should be cautious about taking loans against their policies, as it may lead to taxable income. Understanding these tax implications is crucial for making informed decisions regarding life insurance and ensuring that the intended beneficiaries receive the full value of the policy.

Understanding Spouse Riders: Life Insurance's Hidden Advantage

You may want to see also

Capital Gains Tax: Life insurance policies can be subject to capital gains tax when sold or surrendered for a profit

Life insurance policies can be a valuable asset, but they may also attract certain tax implications, particularly when it comes to capital gains tax. This is an important consideration for policyholders who are looking to sell or surrender their life insurance contracts. Understanding the tax treatment of these transactions is crucial to making informed financial decisions.

When an individual decides to sell or surrender a life insurance policy, they may realize a gain if the policy's cash surrender value exceeds the original investment. This gain is essentially the difference between the policy's surrender value and the total premiums paid. For instance, if a policyholder invested $10,000 in a life insurance policy and later surrendered it for $15,000, the gain would be $5,000. This scenario triggers capital gains tax, which is levied on the profit made from the sale or exchange of a capital asset.

The tax treatment of life insurance policies varies depending on the jurisdiction and the specific circumstances. In many countries, life insurance policies are considered long-term capital assets, similar to stocks or real estate. As such, the tax rules for life insurance gains often align with those for other capital gains. The tax rate applied to these gains can vary, typically ranging from 0% to 20%, depending on the individual's income and the holding period of the policy.

It's important to note that not all life insurance policies are subject to capital gains tax. Policies that are held for a long period, often referred to as permanent or whole life insurance, may be exempt from this tax. These policies typically build cash value over time, and the death benefit is paid out tax-free upon the insured's passing. However, if the policy is surrendered or sold, the gains may be taxed as ordinary income or capital gains, depending on the tax laws in the relevant country.

To minimize the tax impact, policyholders can explore various strategies. One approach is to carefully time the sale or surrender of the policy to take advantage of lower tax rates or tax-free periods. Additionally, individuals can consider converting a term life insurance policy to a permanent policy, which may offer tax advantages in the long run. Seeking professional advice from financial advisors or tax specialists can provide valuable insights into navigating the tax complexities associated with life insurance policies.

BDO Life Insurance: Checking Your Policy Status

You may want to see also

Estate Tax Implications: Life insurance proceeds can be exempt from estate tax, but proper planning is essential

Life insurance can be a valuable tool for estate planning, but understanding its tax implications is crucial, especially when it comes to estate taxes. When an individual purchases life insurance, they essentially enter into a contract with an insurance company, where they pay premiums in exchange for a death benefit that will be paid out upon their passing. The key point to note here is that the proceeds from a life insurance policy can be exempt from estate taxes, but this is not automatic and requires careful planning.

Estate taxes can be complex and are levied on the transfer of assets after an individual's death. In many jurisdictions, life insurance proceeds are considered a form of death benefit and are often exempt from estate tax treatment. This means that the money paid out by the insurance company to the policy's beneficiaries can be received tax-free, provided certain conditions are met. However, it is essential to understand that this exemption is not guaranteed and can vary depending on the jurisdiction and the specific policy details.

To ensure that life insurance proceeds are exempt from estate tax, proper planning is imperative. One common strategy is to name beneficiaries for the policy, who will receive the death benefit upon the insured individual's death. By doing so, the proceeds are more likely to be treated as a gift or a transfer outside of the estate, thus potentially avoiding estate tax. Additionally, the policy should be structured in a way that maximizes this exemption. For instance, an individual can take out a policy with a face value that is a significant portion of their estate, ensuring that the proceeds exceed the estate tax exemption amount.

Another important consideration is the use of a trust. Placing the life insurance policy within a trust can provide additional layers of protection and control over how the proceeds are distributed. A properly drafted trust can ensure that the insurance proceeds are not included in the insured individual's estate, thus avoiding potential estate tax liabilities. It is advisable to consult with legal and financial professionals to structure the policy and trust in a way that aligns with one's specific goals and the applicable tax laws.

In summary, life insurance can be a powerful tool for estate planning, offering potential tax advantages. However, to maximize the benefits, individuals should carefully plan and structure their policies. By understanding the estate tax implications and taking the necessary steps, such as naming beneficiaries and utilizing trusts, one can ensure that life insurance proceeds are exempt from estate taxes, providing financial security for beneficiaries and peace of mind for the policyholder.

Life Insurance and Experimental Vaccines: What's Covered?

You may want to see also

State-Specific Tax Laws: Tax rules vary by state, affecting the taxation of life insurance benefits and policy values

Life insurance is a valuable financial tool that provides financial security and peace of mind to individuals and their families. However, the taxation of life insurance benefits and policy values can vary significantly depending on the state where the policy is held. Understanding these state-specific tax laws is crucial for policyholders to ensure they are in compliance with the law and to maximize the benefits of their life insurance policies.

In the United States, life insurance policies are generally not subject to income tax on the death benefit paid to the beneficiary. This means that the proceeds from a life insurance policy are typically tax-free when received by the designated recipient. However, there are exceptions and variations that depend on the state of residence and the specific circumstances of the policyholder. For instance, some states may impose taxes on the policy's cash value or surrenders, especially if the policy is surrendered for a lump sum payment.

State tax laws can significantly impact the taxation of life insurance. Each state has its own set of rules regarding the taxation of insurance proceeds, policy values, and surrenders. For example, some states may exempt life insurance death benefits from state income tax, while others may impose taxes on the policy's cash value or the policyholder's earnings. These variations can result in substantial differences in the tax treatment of life insurance policies across different states.

One critical aspect to consider is the state's treatment of life insurance policy loans and surrenders. Some states may tax the loan proceeds or the surrender value of the policy as ordinary income. This means that if a policyholder takes a loan against their policy or surrenders the policy for a lump sum, they may be subject to state income tax on that amount. Understanding the specific tax implications in one's state of residence is essential to avoid unexpected tax liabilities.

Additionally, state tax laws can affect the taxation of life insurance policy values and dividends. Some states may tax the policy's cash value or accumulated dividends as investment income. This can impact the overall tax efficiency of the policy, especially for those who have invested a significant portion of their policy's value in tax-deferred accounts. Policyholders should consult with tax professionals or insurance advisors to navigate these state-specific tax rules and ensure their life insurance policies are structured to minimize tax consequences.

Life Insurance Payouts: Taxable in Australia?

You may want to see also

Frequently asked questions

Life insurance proceeds are generally not taxable as income to the beneficiary. The death benefit received by the beneficiary is typically tax-free and is considered a form of insurance payment, not income.

Yes, there are a few exceptions. If the policy is considered a modified endowment contract (MEC) in the US, the death benefit may be taxable. Additionally, if the policy has a cash value component and the policyholder makes regular premium payments, the cash value growth might be taxable if the policy is surrendered or the proceeds are taken out early.

In most cases, no. The tax laws generally treat life insurance benefits as a form of insurance compensation, not income. However, if you are a high-income individual and have a large life insurance policy, you may need to file a Form 7129 with your tax return to report the policy's value.

Yes, in many countries, life insurance premiums can be tax-deductible. For example, in the US, if you itemize your deductions, you can deduct the premiums paid for certain types of life insurance policies. It's important to consult tax regulations in your specific jurisdiction to understand the eligibility criteria and limits for such deductions.