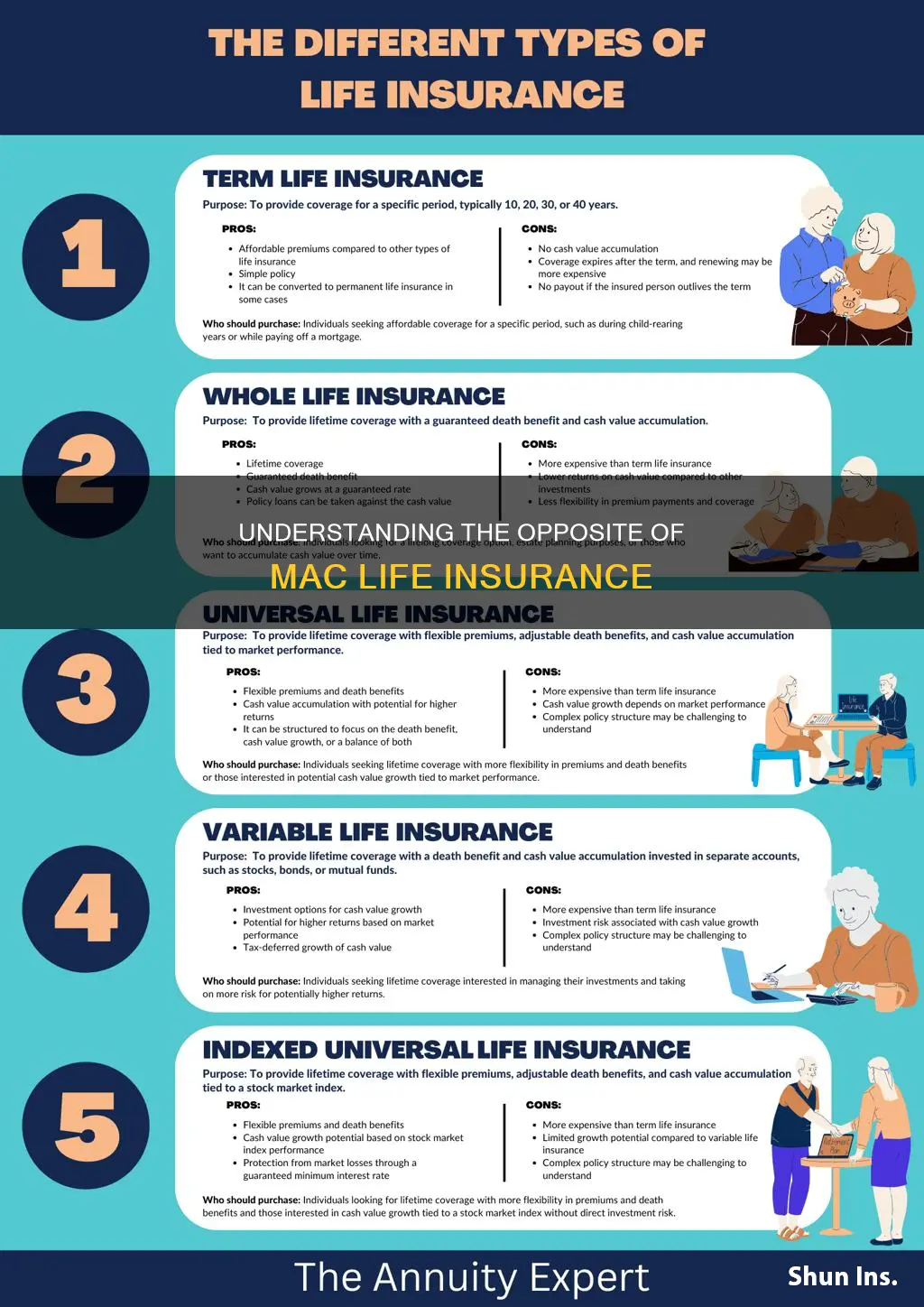

The opposite of MAC Life Insurance, which stands for Maximum Age Coverage, is typically referred to as Term Life Insurance. Term life insurance provides coverage for a specific period, such as 10, 20, or 30 years, and it does not have a cash value component. This type of insurance is often more affordable than permanent life insurance, such as whole life or universal life, as it is designed to cover a specific need or period of time, making it a popular choice for those seeking temporary coverage.

What You'll Learn

- Traditional Insurance: Opposite of MAC life insurance is conventional, non-MAC coverage

- Term Life: Opposite of MAC is pure term life, offering coverage for a set period

- Whole Life: Opposite of MAC is whole life, providing permanent coverage with cash value

- Universal Life: Opposite of MAC is universal life, offering flexible premiums and potential investment growth

- Variable Life: Opposite of MAC is variable life, combining insurance with investment options

Traditional Insurance: Opposite of MAC life insurance is conventional, non-MAC coverage

The opposite of MAC (Mostly Assured Coverage) life insurance is indeed traditional, conventional insurance, which offers a different approach to life coverage. When we talk about conventional life insurance, we are referring to a more standard and traditional method of providing financial protection to individuals and their families. This type of insurance is designed to offer a set amount of coverage, often with a guaranteed death benefit, and it operates on a more straightforward and conventional principle.

In contrast to MAC, which focuses on providing coverage for specific risks and may offer more personalized protection, conventional insurance typically follows a one-size-fits-all approach. It is a more standardized product, where the insurance company sets the terms, conditions, and benefits, and the policyholder agrees to these terms. This traditional insurance model is often more widely available and accessible to a broader range of individuals, as it does not require the same level of customization and risk assessment as MAC.

The key difference lies in the level of customization and the underlying principles of coverage. MAC life insurance is tailored to individual needs, offering a more personalized and flexible approach. It may include various riders and options to customize the policy, ensuring that the coverage aligns with the specific risks and preferences of the insured. On the other hand, conventional insurance provides a more standardized and less flexible coverage, where the terms are predetermined, and the policyholder has limited options for customization.

Traditional insurance policies often have fixed premiums and benefits, providing a sense of predictability and stability. This type of coverage is typically more straightforward to understand and may be more suitable for those seeking a simpler and more conventional insurance experience. While MAC offers a more tailored and comprehensive solution, conventional insurance provides a solid foundation for life coverage, ensuring that individuals have a basic level of financial protection without the extensive customization.

In summary, the opposite of MAC life insurance is conventional, non-MAC coverage, which represents a more traditional and standardized approach to life insurance. It offers a different set of advantages and considerations, catering to those who prefer a simpler, more conventional insurance experience. Understanding the differences between MAC and conventional insurance can help individuals make informed decisions when choosing the right life coverage for their needs.

Using Life Insurance Logos: Website Do's and Don'ts

You may want to see also

Term Life: Opposite of MAC is pure term life, offering coverage for a set period

The opposite of MAC life insurance, which typically refers to a whole life policy with a cash value component, is indeed "pure term life." This type of insurance provides coverage for a specific period, often 10, 20, or 30 years, and it does not accumulate cash value over time. Here's a detailed breakdown:

Pure term life insurance is a straightforward and cost-effective way to secure financial protection for a predetermined duration. It is an excellent choice for individuals who want coverage for a particular period, such as until a child becomes financially independent or a mortgage is paid off. The primary advantage of term life is its simplicity and affordability. Since there is no investment component, the premiums are generally lower compared to whole life insurance. This makes it an attractive option for those seeking high coverage amounts without the long-term financial commitment.

When you purchase a term life policy, you agree to pay premiums for a set period, and in return, you receive a death benefit if you pass away during that term. Once the term ends, the policy expires, and coverage ceases unless you decide to renew or convert it. This lack of long-term commitment is a significant departure from MAC life insurance, where the policy remains active for the entire life of the insured, and the cash value grows over time.

In contrast to MAC, which offers lifelong coverage with an investment aspect, term life is a more flexible and temporary solution. It is ideal for those who prioritize coverage for a specific goal or period, ensuring financial security without the added complexity of cash value accumulation. For instance, a young professional might choose a 20-year term life policy to cover their mortgage and provide for their family during their prime earning years.

Understanding the difference between these two types of life insurance is crucial for making informed financial decisions. While MAC life insurance provides long-term financial security and a potential investment opportunity, term life offers a more focused and temporary solution, making it the opposite in terms of coverage duration and financial commitment.

Exercise and Life Insurance: Is There a Catch?

You may want to see also

Whole Life: Opposite of MAC is whole life, providing permanent coverage with cash value

The opposite of MAC life insurance, which typically refers to a term life policy with a limited duration, is indeed Whole Life insurance. This type of policy offers a range of unique advantages that set it apart from other life insurance options.

Whole Life insurance is a permanent coverage solution, providing financial protection for the entire lifetime of the insured individual. Unlike term life insurance, which only covers a specified period, whole life insurance remains in force as long as the premium payments are made. This feature ensures that the insured's beneficiaries will receive a death benefit when the insured passes away, offering a sense of security and peace of mind.

One of the key advantages of whole life insurance is its ability to accumulate cash value over time. With each premium payment, a portion of the premium goes towards building a cash reserve. This cash value can be borrowed against or withdrawn, providing policyholders with a valuable financial asset. The cash value grows tax-deferred, allowing it to accumulate and potentially be used for various purposes, such as funding education, starting a business, or providing financial security during retirement.

In contrast to MAC life insurance, which focuses on providing coverage for a specific period, whole life insurance offers long-term financial security. It is a comprehensive solution that combines insurance protection with an investment component. Policyholders can customize their whole life policy to suit their specific needs, choosing the death benefit amount and the premium payments that fit their budget. This flexibility allows individuals to tailor the policy to their unique circumstances, ensuring they have the right level of coverage and financial protection.

When considering life insurance options, it is essential to understand the differences between various types of policies. Whole life insurance, with its permanent coverage and cash value accumulation, provides a robust financial safety net. It is a valuable tool for individuals seeking long-term financial security and the potential for tax-advantaged wealth accumulation. By choosing whole life insurance, individuals can ensure that their loved ones are protected, and they have a financial asset that can be utilized for various life goals.

Overdose Death: Life Insurance Payouts and Consequences

You may want to see also

Universal Life: Opposite of MAC is universal life, offering flexible premiums and potential investment growth

The opposite of MAC life insurance, which typically refers to a traditional whole life insurance policy with fixed premiums and guaranteed death benefits, is Universal Life. This type of insurance offers a more flexible and customizable approach to coverage, providing a unique alternative to the traditional MAC policy.

Universal Life insurance is designed to provide long-term financial security while offering policyholders greater control over their insurance plan. One of its key features is the flexibility in premium payments. Unlike MAC, where premiums are set and non-negotiable, universal life policies allow policyholders to adjust their monthly, quarterly, or annual payments based on their financial situation and goals. This flexibility can be particularly beneficial for those who experience changes in income or prefer to manage their insurance costs more dynamically.

Another significant aspect of Universal Life is the potential for investment growth. The policyholder's premium payments can be invested in a variety of investment options, such as stocks, bonds, or mutual funds, managed by the insurance company. This investment component allows the policy's cash value to grow over time, providing a financial asset that can be borrowed against or withdrawn if needed. The growth potential of universal life can be an attractive feature for those seeking to maximize their insurance benefits while also investing in their financial future.

In contrast to MAC, which guarantees a fixed death benefit, universal life policies offer a flexible death benefit that can be adjusted by the policyholder. This means that the amount of coverage provided can be increased or decreased as the policyholder's needs change over time. For example, a policyholder might choose to increase the death benefit during periods of financial stability and reduce it when their financial situation changes. This flexibility ensures that the insurance coverage remains tailored to the individual's evolving circumstances.

Universal Life insurance provides a comprehensive and adaptable solution for individuals seeking an alternative to traditional MAC life insurance. With its flexible premium payments and potential for investment growth, universal life offers policyholders the opportunity to customize their insurance plan to fit their unique financial needs and goals. This type of insurance is particularly appealing to those who value financial flexibility and the ability to adapt their coverage as their life circumstances change.

Direct Recognition Life Insurance: How Does It Work?

You may want to see also

Variable Life: Opposite of MAC is variable life, combining insurance with investment options

The opposite of MAC life insurance, which is a fixed-benefit term life insurance, is indeed Variable Life. This type of insurance offers a unique blend of insurance coverage and investment opportunities, providing policyholders with a more flexible and customizable approach to their financial planning.

Variable life insurance is a permanent life insurance policy that allows policyholders to invest a portion of their premium payments in various investment options. These investment options can include stocks, bonds, and mutual funds, among others. The beauty of this arrangement is that it empowers individuals to actively participate in the management of their investments, potentially offering higher returns compared to traditional fixed-rate insurance products.

In a variable life policy, the death benefit, which is the amount paid to the beneficiary upon the insured's passing, is not guaranteed and can fluctuate based on the performance of the underlying investments. This means that the value of the policy's cash value account, which is the investment portion, can increase or decrease over time. Policyholders can access this cash value through loans or withdrawals, providing them with a source of funds that can be used for various financial needs.

One of the key advantages of variable life insurance is its flexibility. Policyholders can adjust their investment strategy according to their financial goals and market conditions. They can choose to allocate more funds to aggressive investment options for potential higher returns or opt for more conservative investments to minimize risk. This adaptability sets variable life insurance apart from MAC life insurance, where the death benefit and investment component are fixed, offering limited customization.

Additionally, variable life insurance provides policyholders with a long-term financial strategy. As the policyholder invests in various assets, they can build a substantial cash value over time, which can be used for various purposes, such as funding education expenses, starting a business, or planning for retirement. This aspect of variable life insurance makes it a comprehensive financial tool, offering both insurance protection and investment growth.

Hypothyroidism and Life Insurance: What's the Impact?

You may want to see also

Frequently asked questions

The opposite of MAC Life Insurance would be a term that describes the absence or lack of such insurance. This could be referred to as "no life insurance" or "lacks life insurance coverage."

Without life insurance, individuals and their families may face significant financial challenges in the event of the insured person's death. Life insurance provides a financial safety net, ensuring that loved ones have the necessary support to cover expenses, pay off debts, and maintain their standard of living.

Yes, there are several alternatives to consider. These include term life insurance, which provides coverage for a specific period; whole life insurance, offering lifelong coverage with an accumulation of cash value; and universal life insurance, which provides flexible coverage with potential investment options.

When choosing life insurance, several factors come into play. These include assessing your financial needs, evaluating the number of dependents and their long-term expenses, considering the duration of coverage required, and understanding the different types of policies available to find the best fit for your specific situation.