Navigating the world of insurance can be complex, especially when it comes to understanding the impact of points on your driving record. One common question that arises is how many insurance points are allowed before you're no longer allowed to drive. This article aims to shed light on this topic, providing insights into the rules and regulations surrounding insurance points and their implications for drivers. By exploring the criteria set by insurance companies and the legal limits, readers will gain a clearer understanding of the potential consequences of accumulating too many points and the importance of maintaining a clean driving record.

What You'll Learn

- Legal Requirements: States set minimum insurance coverage to drive legally

- Penalty Points: Accumulating too many points can lead to license suspension

- Driving Record Impact: Insurance companies review driving history to determine rates

- Safe Driving Incentives: Some insurers offer discounts for safe driving behavior

- License Restoration: Process varies by state, often requiring additional steps and fees

Legal Requirements: States set minimum insurance coverage to drive legally

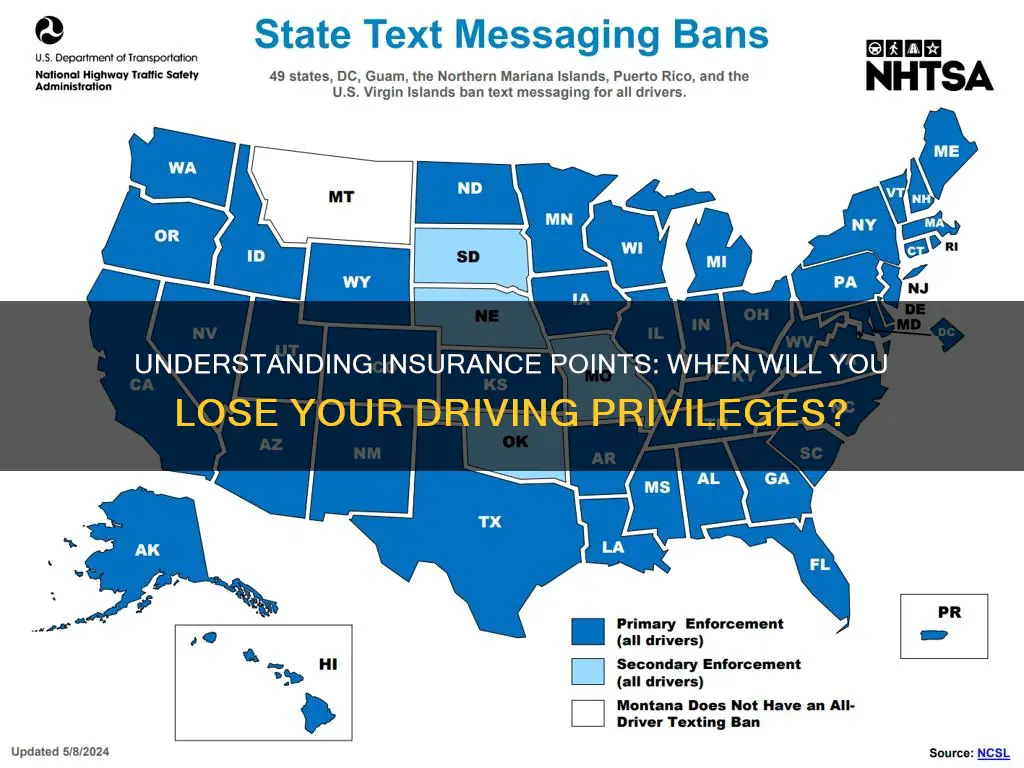

The legal requirements for car insurance vary significantly across different states in the United States, and understanding these requirements is crucial for drivers to avoid legal consequences and financial burdens. Each state has its own set of rules and regulations regarding the minimum insurance coverage that drivers must maintain to operate their vehicles legally. These regulations are in place to ensure that drivers are financially responsible for any damages or injuries they may cause in an accident.

In most states, the minimum insurance coverage typically includes liability insurance, which covers the driver's legal responsibility for bodily injury and property damage to others. The liability coverage often consists of three components: bodily injury liability (BIL), which covers medical expenses and lost wages for injured parties; property damage liability (PDL), which pays for repairs or replacements of damaged property; and personal injury protection (PIP) or no-fault insurance, which covers medical expenses and lost wages for the policyholder and their passengers, regardless of who is at fault in an accident.

The specific amounts of these coverages vary by state and can be influenced by factors such as the driver's age, driving record, and the value of the vehicle. For instance, a young, inexperienced driver may be required to carry higher liability limits compared to an older, more experienced driver. Additionally, states with a higher cost of living or a higher prevalence of traffic accidents may have more stringent insurance requirements.

It is essential for drivers to check their state's specific insurance regulations to ensure compliance. Failure to maintain the minimum required coverage can result in legal penalties, including fines, license suspension, or even revocation. In some cases, drivers may also face increased insurance premiums if they are found to be underinsured. Therefore, understanding and adhering to the legal insurance requirements is not only a matter of compliance but also a responsible approach to driving.

Drivers should also be aware that insurance requirements can change over time due to legislative updates or court rulings. Staying informed about these changes is crucial to ensure that one's insurance coverage remains adequate and compliant with the law.

Farm Bureau's Gap Insurance: What You Need to Know

You may want to see also

Penalty Points: Accumulating too many points can lead to license suspension

In many countries, driving is a privilege, not a right, and insurance companies play a crucial role in managing this privilege. One of the primary ways they do this is through the use of penalty points, also known as driving infraction points or license points. These points are assigned to drivers whenever they commit a traffic violation or driving offense. The accumulation of these points can have serious consequences, including the suspension of a driver's license.

The number of points a driver can accumulate before facing license suspension varies depending on the jurisdiction and the severity of the infractions. For instance, in the United Kingdom, the Driver and Vehicle Licensing Agency (DVLA) has a strict system. A driver can accumulate 12 penalty points within a three-year period before their license is automatically suspended. This suspension can last for a minimum of six months, during which the driver must take an extended driving test to regain their license. It's important to note that certain serious offenses, such as driving under the influence (DUI) or reckless driving, can result in an immediate license suspension, regardless of the point total.

In the United States, the rules are similar but can vary by state. For example, in California, a driver can accumulate four points for minor violations and six points for more serious offenses within a 24-month period. If a driver reaches 12 points, their license may be suspended for a period of time, and they may be required to attend a driver improvement course. In some states, a driver's license can be suspended for a specific number of points, often ranging from 6 to 12, depending on the state's regulations.

The impact of penalty points is significant and should not be taken lightly. Accumulating too many points can lead to a range of consequences, including increased insurance premiums, the inability to drive for work or personal reasons, and even legal penalties. It is essential for drivers to be aware of the points they accumulate and take steps to avoid reaching the threshold that could result in license suspension. This may involve attending defensive driving courses, improving driving habits, or seeking professional advice to manage and reduce points.

In summary, penalty points are a critical aspect of driving, and their accumulation can have far-reaching effects. Drivers should be vigilant about their driving record and take proactive measures to avoid the serious consequences of license suspension. Understanding the specific rules and thresholds in one's jurisdiction is key to maintaining a safe and legal driving record.

Postal Vehicles: Insured?

You may want to see also

Driving Record Impact: Insurance companies review driving history to determine rates

Understanding the impact of your driving record on insurance rates is crucial for any driver. Insurance companies heavily rely on an individual's driving history to assess the likelihood of future claims and set appropriate premiums. This assessment is primarily based on the points system associated with traffic violations and accidents. Each violation or incident carries a specific number of points, and the accumulation of these points over time can significantly influence your insurance rates.

When you apply for car insurance or have an existing policy, insurance providers will scrutinize your driving record. They will look for any violations, accidents, or moving violations that have occurred within a specified period, often the last three to five years. The severity and frequency of these incidents play a pivotal role in determining your insurance rates. For instance, a minor speeding ticket might carry fewer points compared to a more serious violation like reckless driving or a DUI/DWI.

The points system is designed to categorize drivers based on their risk level. Accumulating a certain number of points within a defined period can lead to increased insurance premiums or even the suspension of your driving privileges. The threshold for suspension varies by jurisdiction but often ranges from 4 to 12 points, depending on the severity of the violations and the insurance company's policies. For instance, in some states, accumulating six points within a year could result in a license suspension, while in others, it might take more points.

It's essential to note that insurance companies often use a point-based system to categorize drivers into different risk groups. These categories can range from low-risk to high-risk drivers. Low-risk drivers typically pay lower premiums, while high-risk drivers may face higher rates or even difficulty in obtaining insurance. The points system allows insurers to quickly assess a driver's risk profile and set rates accordingly.

Maintaining a clean driving record is the best way to avoid significant increases in insurance rates. This includes adhering to traffic laws, avoiding accidents, and promptly addressing any violations. If you have accumulated points, consider attending driver improvement courses or defensive driving programs, which can help reduce the impact of these points on your insurance rates. Additionally, regularly reviewing your driving record and insurance policies can ensure you are aware of any changes and take proactive steps to manage your insurance costs effectively.

Does Renters Insurance Affect Auto Policy Premiums?

You may want to see also

Safe Driving Incentives: Some insurers offer discounts for safe driving behavior

Safe driving incentives are a great way to encourage and reward drivers for maintaining a safe record on the road. Many insurance companies now offer discounts to drivers who demonstrate responsible behavior behind the wheel. These incentives can significantly reduce insurance costs for those who consistently follow traffic rules and avoid accidents.

The concept is simple: insurers provide financial rewards to drivers who actively contribute to road safety. By implementing a safe driving program, insurance providers can identify and recognize policyholders who exhibit positive driving habits. This approach not only benefits the drivers financially but also promotes a culture of responsible driving throughout the community.

To qualify for these discounts, drivers typically need to meet certain criteria. Insurance companies often monitor driving records, including the number of accidents, traffic violations, and the overall frequency of claims. Drivers with a clean record, minimal points on their license, and a history of safe driving are more likely to receive these incentives. For instance, some insurers may offer discounts after a certain number of accident-free years or provide reduced rates for drivers who have not accumulated any points on their license within a specific period.

The process usually involves the insurance company tracking the driver's performance through various means. This could include the use of telematics devices, which record driving habits and provide data on speed, acceleration, braking, and other relevant factors. Some insurers also offer mobile apps that allow drivers to log their safe driving habits voluntarily. These tools enable companies to assess and reward drivers for their positive behavior.

By offering safe driving incentives, insurance companies not only promote a safer driving environment but also foster a sense of loyalty among their customers. Drivers who actively participate in these programs can enjoy lower premiums, which can be a significant financial benefit over time. Additionally, this approach encourages individuals to take responsibility for their driving actions and make informed choices to maintain a positive driving record.

Disabled Veterans and Auto Insurance: Understanding the Unique Benefits

You may want to see also

License Restoration: Process varies by state, often requiring additional steps and fees

The process of license restoration after a certain number of insurance points can vary significantly depending on the state you reside in. Each state has its own set of rules and requirements, which can make the process confusing and complex. For instance, in some states, you might be required to complete a driver's education course or a defensive driving program, while others may mandate a period of suspension or a specific number of months without a license before restoration is possible. It's crucial to understand these nuances to ensure you follow the correct procedure.

One common aspect of license restoration is the need for additional fees. These fees can vary widely and often include a restoration fee, a late fee for any missed payments, and sometimes a fee for the specific program or course you need to complete. For example, in State X, the restoration process might involve a $50 restoration fee, a $20 late fee for each month of delay, and a $100 driver's education course fee. These fees can add up quickly, making the process financially burdensome.

The steps to restore your license can also differ. In some states, you might need to attend an administrative hearing to appeal the points assigned, while others may require you to submit a formal request for restoration along with necessary documentation. Documentation often includes proof of insurance, a clean driving record for a specified period, and sometimes a letter of recommendation or a medical assessment. The process might also involve a background check to ensure you meet the state's criteria for safe driving.

It's important to note that the number of insurance points that lead to license suspension or revocation can vary by state. For instance, in State Y, you might accumulate 12 points within a 24-month period, resulting in a license suspension, while in State Z, it could be 15 points within 18 months. Understanding the specific threshold in your state is crucial to avoid any legal complications.

Given the variations in state laws and requirements, it is advisable to consult the official government websites or local DMV offices to obtain accurate and up-to-date information. These sources can provide detailed guidance on the specific steps, fees, and timeframes associated with license restoration in your state. Being proactive and well-informed can significantly contribute to a smoother process when trying to get your license back.

Settling Auto Insurance Claims: Your Guide to Success

You may want to see also

Frequently asked questions

The number of points required to result in the suspension of your driving license varies by jurisdiction and insurance company. Typically, a certain number of points, often 10 or more, within a specific period (e.g., 12 months) can lead to a driving ban. It's essential to check your local driving regulations and insurance policies.

In some cases, you might be able to avoid a complete driving ban. Insurance companies may offer a warning or a temporary restriction instead of a full suspension. However, repeated accumulation of points can still lead to a more severe penalty. It's best to review your policy and seek professional advice if you have concerns.

Reaching the maximum points threshold often results in a driving ban or the requirement to attend a driving improvement course. The duration of the ban can vary, and you may need to pay a reinstatement fee to get your license back. It's crucial to understand the consequences and take steps to avoid accumulating points.

Yes, several strategies can help reduce your insurance points. These include maintaining a clean driving record, taking defensive driving courses, and ensuring your vehicle is properly maintained and insured. Some insurance companies also offer good driver discounts, which can help lower your premium and points.

The duration insurance points remain on your record varies by region and insurance provider. Typically, points can stay on your record for three to five years. During this period, they can impact your insurance rates and driving privileges. It's advisable to monitor your driving record regularly and take necessary actions to prevent further point accumulation.