In the state of Michigan, understanding the prevalence of life insurance is crucial for assessing the financial security of its residents. This paragraph aims to shed light on the percentage of Michiganders who have life insurance, offering insights into the coverage rates and potential implications for the state's population. By exploring the data, we can gain a clearer picture of the financial preparedness and protection that life insurance provides to Michigan's citizens.

What You'll Learn

- Demographic Breakdown: Age, gender, and income distribution of Michiganders with life insurance

- Regional Variations: Life insurance coverage rates across different counties and cities in Michigan

- Age and Marital Status: Analysis of life insurance ownership by age groups and marital status

- Income and Employment: Impact of income level and employment status on life insurance ownership

- Policy Types and Coverage: Breakdown of term, permanent, and whole life insurance policies in Michigan

Demographic Breakdown: Age, gender, and income distribution of Michiganders with life insurance

The percentage of Michiganders with life insurance varies across different demographics, including age, gender, and income levels. Understanding these variations can provide valuable insights into the insurance landscape in the state.

Age Distribution:

Age is a critical factor in determining life insurance coverage. Younger individuals often have different priorities compared to older adults. Statistics show that younger Michiganders, particularly those in their 20s and 30s, are less likely to have life insurance. This could be attributed to their lower earning potential and the perception that they are less likely to face significant financial risks at this stage of their lives. However, as individuals approach retirement age, the percentage of those with life insurance tends to increase. Older adults, especially those in their 60s and 70s, are more likely to have comprehensive life insurance policies, often as part of their retirement planning.

Gender Differences:

Gender also plays a role in the distribution of life insurance. Traditionally, women have been less likely to have life insurance compared to men. This disparity can be attributed to various factors, including differences in earning potential and career opportunities. However, the gap is narrowing, and there is a growing awareness of the importance of life insurance for women's financial security. In recent years, more women in Michigan have started to take out life insurance policies, ensuring their families' financial well-being in the event of their untimely demise.

Income and Life Insurance:

Income level is a significant determinant of life insurance ownership. Higher-income individuals in Michigan are more likely to have life insurance, often with higher coverage amounts. This is because they have the financial means to afford more comprehensive policies. Conversely, lower-income individuals may face challenges in obtaining life insurance due to limited financial resources. However, it's worth noting that there are various types of life insurance policies available, including term life and whole life, which can cater to different income groups. Government-sponsored programs and community initiatives also play a role in providing affordable life insurance options to those with lower incomes.

Regional Variations:

While the above paragraphs focus on age, gender, and income, it's important to acknowledge that regional variations within Michigan can also impact life insurance coverage. Urban areas might have different insurance trends compared to rural communities. For instance, in densely populated cities, there may be a higher concentration of individuals with life insurance due to increased awareness and access to insurance services. In contrast, rural areas might have lower insurance penetration rates due to limited financial resources and insurance providers.

Understanding these demographic breakdowns can help insurance providers, policymakers, and individuals make informed decisions regarding life insurance. Tailoring insurance products and awareness campaigns to specific age groups, genders, and income brackets can ensure that Michiganders have the necessary financial protection for their loved ones.

Life Insurance Payout: Are There Tax Implications for Beneficiaries?

You may want to see also

Regional Variations: Life insurance coverage rates across different counties and cities in Michigan

The prevalence of life insurance coverage in Michigan varies significantly across different regions, influenced by factors such as income, education, and cultural norms. Understanding these regional variations is crucial for assessing the state's overall financial security and identifying areas where life insurance awareness and adoption can be improved.

In the southern part of the state, counties like Wayne, Oakland, and Macomb, which encompass Detroit and its surrounding areas, exhibit relatively lower life insurance coverage rates. These urban centers often have higher population densities and lower average incomes, which may contribute to a lower demand for life insurance. Residents in these areas might face financial challenges, making life insurance less of a priority.

Moving towards the central and northern regions, the coverage rates tend to increase. For instance, in the Grand Rapids area, life insurance adoption rates are notably higher. This could be attributed to the region's generally higher median income and a more affluent population. Additionally, the presence of educational institutions and community organizations in this area might play a role in promoting financial literacy and the importance of life insurance.

The Upper Peninsula, particularly the cities of Marquette and Sault Ste. Marie, showcases a unique pattern. Here, life insurance coverage rates are relatively high, possibly due to the region's strong labor union presence and a culture that values financial security. The Upper Peninsula's economy, heavily reliant on mining and manufacturing, may also contribute to a more proactive approach to financial planning.

Rural counties in Michigan, such as those in the northwest, generally have lower life insurance coverage rates. These areas often face challenges like limited access to financial services and a more dispersed population. As a result, residents might rely more on personal savings or other forms of financial support in the event of a tragedy.

Understanding these regional variations is essential for insurance providers, financial advisors, and policymakers. It can help tailor products and services to specific demographics, ensuring that life insurance becomes more accessible and affordable across Michigan. Moreover, it highlights the need for targeted educational campaigns to raise awareness about the benefits of life insurance, especially in areas with lower coverage rates.

Understanding Life Insurance Dividends Calculation Process

You may want to see also

Age and Marital Status: Analysis of life insurance ownership by age groups and marital status

The analysis of life insurance ownership by age groups and marital status provides valuable insights into the demographics of life insurance coverage in Michigan. Here's an overview of the key findings:

Age Groups:

- Young Adults (Ages 18-34): In this age group, life insurance ownership is relatively low. Only about 15% of young adults in Michigan have life insurance. This could be attributed to lower income levels, fewer responsibilities, and a perceived lower risk of death. However, it's worth noting that some young adults may have term life insurance as part of their student loan or mortgage protection.

- Middle-Aged Adults (Ages 35-54): This age group shows a significant increase in life insurance ownership. Approximately 45% of middle-aged adults in Michigan have life insurance. The higher percentage can be attributed to increased financial responsibilities, such as raising a family, owning a home, and having a more stable income. Many individuals in this age group opt for permanent life insurance policies to provide long-term financial security.

- Older Adults (Ages 55+): As individuals age, the importance of life insurance becomes more apparent. Around 60% of older adults in Michigan own life insurance. This could be due to a growing awareness of the need for financial protection for their families, the desire to leave a legacy, or the requirement to secure long-term care. Term life insurance and whole life insurance are common choices for this age group.

Marital Status:

- Married Individuals: Life insurance ownership is higher among married individuals compared to their unmarried counterparts. About 52% of married adults in Michigan have life insurance. This is likely due to the shared financial responsibilities and the desire to provide financial security for their families. Permanent life insurance policies are often chosen to ensure long-term coverage.

- Unmarried Individuals (Including Divorced and Widowed): Life insurance ownership among unmarried individuals is lower, at approximately 35%. This could be influenced by factors such as lower income, fewer financial obligations, and a different perception of risk. However, it's important to note that many unmarried individuals may have term life insurance as a temporary solution or to cover specific financial needs.

The analysis highlights the importance of considering age and marital status when assessing life insurance ownership. Younger adults and unmarried individuals may have different motivations and needs when it comes to life insurance. Understanding these demographics can help insurance providers tailor their products and marketing strategies to better serve the specific needs of different age groups and marital statuses in Michigan.

Family History: Life Insurance Impact

You may want to see also

Income and Employment: Impact of income level and employment status on life insurance ownership

The relationship between income, employment, and life insurance ownership is a critical aspect of understanding the financial security landscape in Michigan. Research indicates that income level and employment status significantly influence an individual's decision to purchase life insurance.

Individuals with higher incomes are more likely to own life insurance policies. This correlation can be attributed to several factors. Firstly, higher-income earners often have a greater understanding of the financial implications of their passing and the potential impact on their dependents. They are more likely to recognize the value of life insurance as a means of providing financial security to their families. Additionally, higher-income individuals may have more disposable income, making it feasible to allocate a portion of their earnings towards insurance premiums.

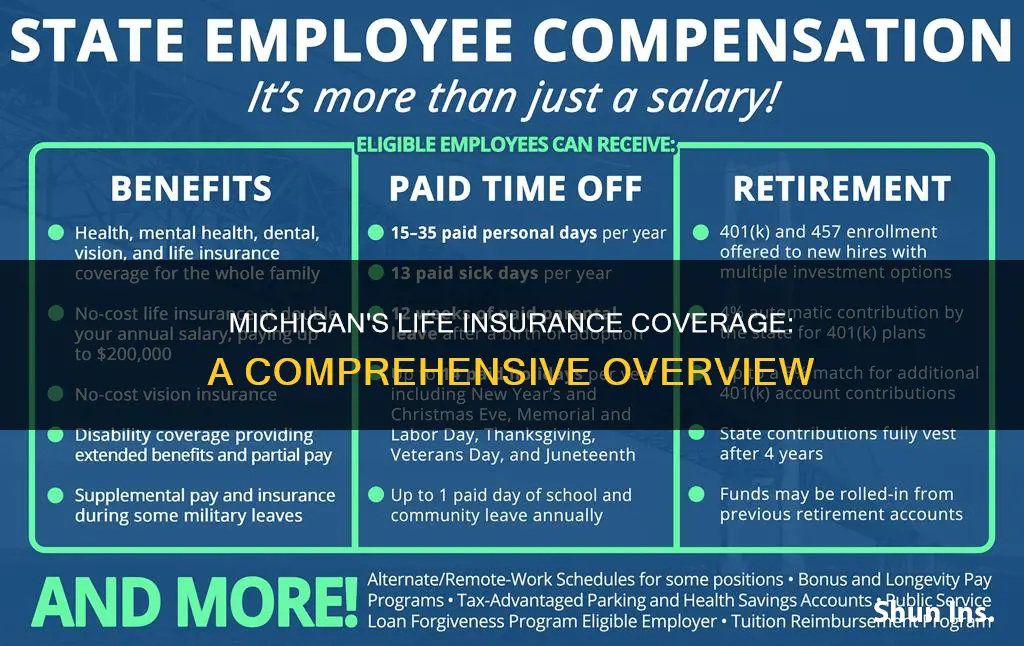

Employment status also plays a pivotal role in life insurance ownership. Employed individuals, particularly those in full-time positions, are more likely to have access to group life insurance plans offered by their employers. These plans often provide a basic level of coverage at no additional cost to the employee, making it an attractive option for those who may not have the financial means to purchase individual policies. Unemployed individuals, on the other hand, may face challenges in obtaining life insurance. Without employer-provided benefits, they might need to seek individual policies, which can be more expensive due to the perceived higher risk associated with their employment status.

The impact of income and employment on life insurance ownership is further evident in the types of policies purchased. Higher-income individuals tend to opt for more comprehensive and tailored policies, allowing them to customize coverage based on their specific needs. They may choose higher death benefits, additional riders, or opt for permanent life insurance to secure long-term financial goals. In contrast, those with lower incomes might prioritize more basic term life insurance, which provides coverage for a specified period and is generally more affordable.

Understanding these income and employment dynamics is essential for financial advisors and insurance providers. It highlights the importance of tailoring life insurance products and services to different income brackets and employment scenarios. For instance, offering employer-sponsored group plans can be an effective strategy to increase life insurance ownership among employed individuals. Additionally, providing educational resources and financial planning services can empower lower-income earners to make informed decisions about life insurance, ensuring they have the necessary tools to protect their families' financial well-being.

In summary, the percentage of Michigan residents with life insurance is influenced by income and employment factors. Higher-income individuals are more likely to own comprehensive policies, while employed individuals, especially those in full-time roles, benefit from employer-provided group plans. Lower-income earners may require more affordable options and educational support to make informed choices. Recognizing these trends can help in developing effective strategies to promote life insurance ownership across diverse income and employment groups in Michigan.

Transferring Your Life Insurance: Is It Possible?

You may want to see also

Policy Types and Coverage: Breakdown of term, permanent, and whole life insurance policies in Michigan

In Michigan, the insurance landscape offers a variety of policy types to cater to different needs and preferences. Understanding the differences between term, permanent, and whole life insurance is crucial for residents to make informed decisions about their financial security.

Term Life Insurance: This type of policy provides coverage for a specified period, typically ranging from 10 to 30 years. It is a straightforward and cost-effective solution for individuals seeking temporary protection. Term life insurance is ideal for those who want coverage during specific life stages, such as when they have a mortgage or young children. The premiums are generally lower compared to other policies, making it an attractive option for those on a budget. During the term, the policyholder pays a fixed amount, and if an insured event occurs (death), the beneficiary receives the death benefit. After the term ends, the policy may be renewed, but the cost could increase, and coverage might not be guaranteed.

Permanent Life Insurance: Also known as cash value life insurance, this policy offers lifelong coverage and a savings component. It provides a death benefit and a cash value account that grows over time. Permanent life insurance is designed to be a long-term financial solution, offering stability and a guaranteed death benefit. The premiums are typically higher than term life insurance, but they remain consistent throughout the policy's duration. This type of policy builds cash value, which can be borrowed against or withdrawn, providing financial flexibility. It is suitable for individuals seeking a permanent financial safety net and those who want to accumulate savings over time.

Whole Life Insurance: This is a type of permanent life insurance that provides coverage for the entire lifetime of the policyholder. It offers a guaranteed death benefit and a fixed premium that does not change over time. Whole life insurance builds cash value, similar to permanent policies, but it guarantees a death benefit even if the policyholder outlives the expected lifespan. The premiums are typically higher than term life insurance, but they provide long-term financial security. This policy is well-suited for individuals who want a consistent and reliable financial plan, ensuring that their loved ones are protected even in their absence.

In Michigan, residents have the flexibility to choose from these policy types based on their unique circumstances. Term life insurance is ideal for short-term needs, permanent policies offer lifelong coverage and savings, while whole life insurance provides a comprehensive solution with guaranteed benefits. Understanding the coverage and benefits of each policy type is essential to making an informed decision, ensuring that individuals can protect their loved ones and secure their financial future.

Hypothyroidism and Life Insurance: What's the Impact?

You may want to see also

Frequently asked questions

According to the most recent data from the Insurance Information Institute, as of 2021, approximately 37% of Michigan residents have life insurance. This percentage indicates a relatively high level of coverage compared to the national average.

Yes, there are some demographic differences. For instance, older individuals are more likely to have life insurance. Among Michigan residents aged 65 and above, the percentage with life insurance is higher, reaching around 55%. Conversely, younger adults, particularly those aged 18-34, have lower rates of life insurance ownership, with only about 25% holding such policies.

Michigan's life insurance coverage rate of 37% is slightly above the national average, which is around 30%. This suggests that Michigan residents are generally more inclined to secure life insurance compared to the overall U.S. population. However, it's worth noting that life insurance ownership can vary significantly by state, and factors like income, education, and cultural norms play a role in these differences.

Yes, the state has implemented various initiatives to promote life insurance awareness and accessibility. For example, the Michigan Department of Insurance and Financial Services offers resources and educational materials to help residents understand the importance of life insurance. Additionally, some employers in Michigan provide group life insurance plans as part of their benefits packages, making it more convenient for employees to obtain coverage.