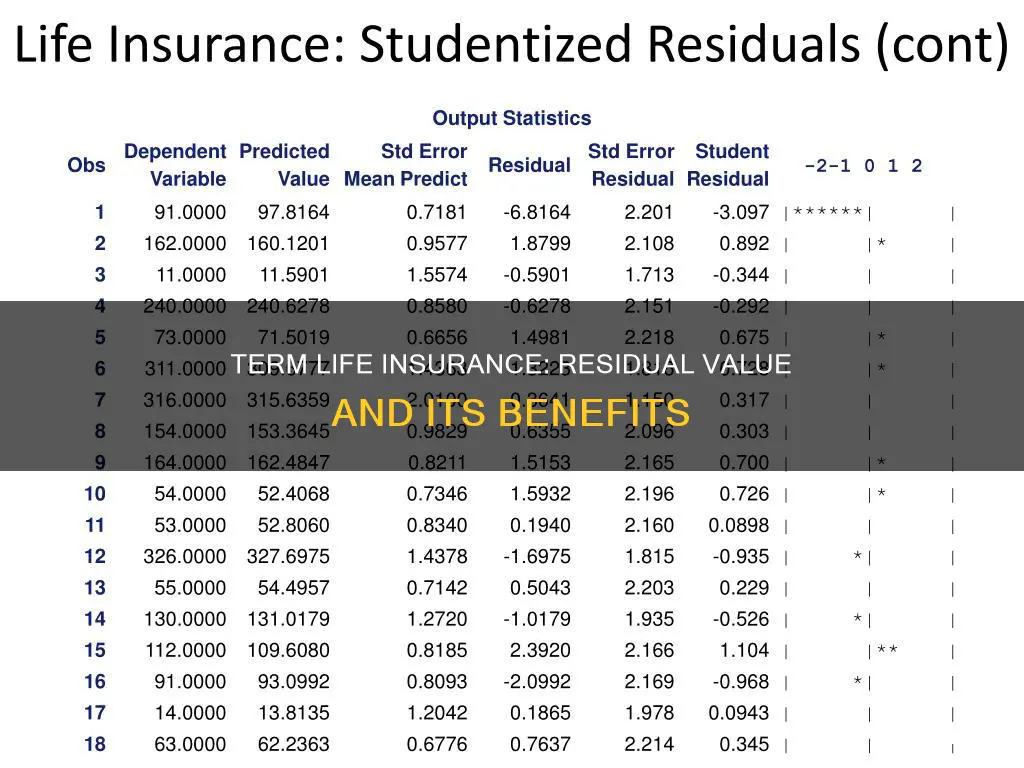

Term life insurance is a type of insurance that provides a death benefit for a specified period. It is distinct from permanent life insurance, which lasts a lifetime and has an investment component that accumulates cash value over time. Term life insurance, on the other hand, does not have a cash value component, and its sole purpose is to provide a death benefit to the insured's beneficiaries if they pass away during the specified term. While term life insurance is generally more affordable, it does not offer any residual value or payout if the policy expires before the insured's death.

| Characteristics | Values |

|---|---|

| Cost | Term life insurance is cheaper than whole life insurance |

| Coverage | Term life insurance covers a set period of time, while whole life insurance covers the entire life |

| Payout | Term life insurance pays out only if the insured dies during the term; whole life insurance pays out whenever the insured dies |

| Cash value | Term life insurance does not have a cash value component; whole life insurance has a cash value component that grows over time and can be borrowed against |

| Complexity | Term life insurance is simple and flexible; whole life insurance is more complex and has higher premiums |

| Suitability | Term life insurance is sufficient for most people, especially those who want affordable coverage for a specific period; whole life insurance is useful for those who want lifelong coverage and are comfortable with the higher premiums |

What You'll Learn

- Term life insurance is a pure insurance with no cash value component

- Term life insurance is cheaper than whole life insurance

- Term life insurance is temporary and does not build cash value

- Term life insurance is difficult to obtain after the policy expires

- Term life insurance is extendable or convertible to permanent life insurance

Term life insurance is a pure insurance with no cash value component

Term life insurance is a type of insurance that guarantees a payout to the insured's beneficiaries if the insured person dies during the specified term. It is often chosen for its affordability and flexibility in terms.

Term life insurance is considered a "pure" insurance product because it does not accumulate cash value over time, unlike permanent life insurance. This means that if the insured person outlives the policy term, they will not receive any money back from the premiums they have paid. This is a key distinction between term and permanent life insurance, with the latter often being 6 to 10 times more expensive due to its cash value component.

Term life insurance premiums are based on factors such as age, health, and life expectancy. The insurance company will also consider its business expenses, investment earnings, and mortality rates when determining the premium. While term life insurance does not offer a cash value component, it is important to note that some policies offer a return-of-premium rider, which allows the policyholder to recover their regular premium payments if they cancel their policy before the term ends.

In summary, term life insurance is a pure insurance product with no cash value component. It offers a cost-effective way to provide financial protection for loved ones during a specified term, but it does not provide any monetary benefits if the insured person outlives the policy.

Will Life Insurance Test for Adderall?

You may want to see also

Term life insurance is cheaper than whole life insurance

Term life insurance is a good option for those who want coverage for a specific period, such as the number of years until retirement, or to cover specific financial concerns with a timeline, such as a mortgage. It is also ideal for those who want affordable coverage, as it is the least expensive option, especially for those who are young and healthy.

On the other hand, whole life insurance is suitable for those who want lifelong coverage and are comfortable with the higher premiums. It is also a good choice for those who want to build cash value that can be accessed during their lifetime and for those who want to ensure their final expenses are covered, regardless of when they die.

While term life insurance is cheaper, it is important to consider your individual needs and budget when deciding between the two. Term life insurance may be sufficient for most people, but whole life insurance may be preferable if you have lifelong dependents or want to maximise your tax-advantaged retirement accounts.

Life Insurance and Subrogation: What's the Verdict?

You may want to see also

Term life insurance is temporary and does not build cash value

Term life insurance is a type of insurance that guarantees a payout to the policyholder's beneficiaries in the event of their death during the specified term. It is distinct from permanent life insurance, which lasts for the entirety of the policyholder's life and includes a savings component known as the "cash value".

The absence of a cash value component in term life insurance policies makes them much more affordable than permanent life insurance policies. Term life insurance premiums are typically lower because they only cover a specified period, usually 10, 20, or 30 years, and do not include the additional savings benefit. This makes term life insurance ideal for individuals who want substantial coverage at a low cost. It is particularly attractive to young people with children, as it provides high coverage for a low cost, ensuring financial support for their dependents in the event of their premature death.

While term life insurance does not build cash value, there are instances where policyholders may receive a refund of their premiums. For example, if a policy is cancelled within 30 days of purchase, the company is legally required to refund the money paid. Additionally, if premiums are paid ahead of schedule and the policy is subsequently cancelled, the insurance company should return the early pre-payments. Policyholders can also purchase a "return-of-premium rider", which ensures that all premiums are refunded after the term expires or if the policy is cancelled before the end of the term. However, it is important to note that the refunded premiums do not include the actual death benefit of the policy.

Life Insurance: Epidemic Coverage and Your Policy

You may want to see also

Term life insurance is difficult to obtain after the policy expires

Term life insurance is a type of insurance that guarantees a death benefit to the insured's beneficiaries if the insured person dies during the specified term. It is relatively cheap compared to whole life insurance and is usually purchased to cover specific financial obligations, such as a mortgage or supporting children until they become adults.

Term life insurance policies do not have any residual or cash value. In other words, if the policyholder outlives the policy, they do not receive any money back. This is because term life insurance is considered "pure" insurance, where the policyholder pays premiums at a set rate for a set period of time, and if they die during that time, their beneficiaries receive a payout.

Once a term life insurance policy expires, the policyholder has a few options to continue their coverage:

- Extend the current policy: Some term life insurance policies can be extended on an annual basis, but this option can be expensive as premiums increase each year based on the policyholder's current age.

- Convert to a permanent policy: Some term life insurance policies can be converted into permanent life insurance, which provides coverage for the rest of the policyholder's life. However, the premium on the new policy will be higher, and there may be age limits for making this switch.

- Shop for a new policy: The policyholder can purchase a new term life insurance policy, especially if they are in good health. However, they will likely need to undergo a medical exam, and the premium will be higher due to their increased age.

- Combine smaller policies: If the policyholder has health issues that make it difficult to obtain a large term insurance policy, they can combine multiple smaller policies to get the desired coverage. These smaller policies may not require a physical exam but may ask for some health information.

- Final expense or burial insurance: This is a type of whole life insurance policy with a relatively small payout, typically used to cover end-of-life expenses. It may not require a medical exam, but the premiums tend to be expensive.

While term life insurance policies can be difficult to obtain after the policy expires, there are options available, especially if the policyholder plans ahead. It is important to consider one's financial situation and future needs when deciding whether to maintain or purchase new life insurance coverage. Consulting with a financial advisor or licensed insurance professional can help individuals make informed decisions based on their specific circumstances.

Civil Service Life Insurance: Cash Value and Benefits Explained

You may want to see also

Term life insurance is extendable or convertible to permanent life insurance

Term life insurance does not have a residual value, but it can be converted to permanent life insurance.

Term life insurance is a "pure" insurance that offers coverage for a set period, usually 10 to 30 years. It is relatively cheap and provides a death benefit if the insured person dies during the specified term. However, it does not have a savings or investment component, and there is no payout if the policy expires before the insured person's death.

On the other hand, permanent life insurance provides coverage for the insured's entire life and includes a cash value component that grows over time. This cash value can be borrowed or withdrawn for any purpose, such as paying premiums, college tuition, or supplementing retirement.

While term life insurance is a good option for those who want substantial coverage at a low cost, permanent life insurance offers lifelong coverage and the opportunity to build cash value. Converting from term to permanent life insurance can be beneficial in several situations:

- Change in Health: Converting allows individuals to extend their coverage without undergoing a new health screening process, which can be valuable if their health deteriorates.

- Increased Budget: If an individual's financial situation improves, they may now be able to afford the higher premiums of permanent life insurance.

- Desire for Cash Value: Permanent life insurance offers a tax-free cash value accumulation benefit, which can be useful for retirement or other financial goals.

- Leaving a Legacy: Converting to permanent life insurance ensures that individuals can leave an inheritance for their children without sacrificing their retirement funds.

- Final Expense Coverage: Converting a portion of the term policy to permanent coverage can help cover funeral and final expenses, ensuring that dependents are not burdened with these costs.

When considering conversion, it is important to review the policy conditions and conversion options. Most term life insurance policies offer a conversion feature, but there may be time limits or age restrictions. Additionally, the cost of permanent life insurance will be higher due to increased age, and the type of permanent policy chosen will impact the premium. Seeking guidance from a financial advisor or insurance agent can help individuals make an informed decision about converting their term life insurance to permanent coverage.

Gina and Life Insurance: What You Need to Know

You may want to see also

Frequently asked questions

No, term life insurance does not have a cash value component. It is a "pure" insurance, meaning you pay premiums at a set rate for a set period, and if you die while covered by the term policy, the insurer will pay your beneficiaries a set amount. If you outlive your term life insurance policy, you don't get any money back.

Term life insurance is cheaper and covers you for a set period of time, while whole life insurance usually costs much more but can last your entire life. Whole life insurance can also build cash value that you can borrow against, which makes it a more complex and expensive product.

The premiums you pay for your death benefit remain with the company after your term life insurance expires. If you outlive your term policy, you don't get any money back.

Some life insurance carriers allow you to extend your term life insurance, but you may have to pay more in premiums due to your age or take a new health exam.