Property and casualty insurance is an umbrella term for various types of insurance policies, including auto, homeowners, renters, and condo insurance. It covers damage to property and belongings, as well as liability for injuries to others and their property. While property insurance covers your property and belongings, casualty insurance covers your liability. For example, if you damage someone else's property or cause injury to another person, casualty insurance can help cover the costs. Property and casualty insurance are typically sold together and are bundled in most standard insurance policies. Life insurance, on the other hand, covers expenses associated with death and does not fall under property and casualty insurance.

| Characteristics | Values |

|---|---|

| Type | Property and casualty insurance is an umbrella term for many types of insurance policies. |

| What it covers | Property and casualty insurance covers your personal belongings, property, and liabilities. |

| Examples | Homeowners insurance, renters insurance, auto insurance, powersports insurance, and business insurance. |

| What it doesn't cover | Health and life insurance. |

What You'll Learn

Homeowners insurance

There are three basic levels of coverage: actual cash value, replacement cost, and extended replacement cost/value. Actual cash value covers the cost of the house and belongings, minus depreciation. Replacement cost covers the actual cash value without deducting depreciation, so you can repair or rebuild your home up to the original value. Extended replacement cost/value covers whatever it costs to repair or rebuild your home, even if it exceeds the policy limit.

Standard homeowners insurance policies usually don't cover damage caused by:

- Flooding

- Earthquakes

- Sewer or drain backups

- Termites, rodents, or other pests

- Mold or mildew

- Acts of war, terrorism, or civil unrest

- Nuclear accidents or radiation

Euthanasia and Life Insurance: What's the Connection?

You may want to see also

Car insurance

Property and casualty insurance is an umbrella term that includes many forms of insurance. It covers two primary types: property protection and liability coverage. Car insurance falls under the property and casualty insurance umbrella.

Property and Casualty Insurance

Property and casualty insurance covers the costs that you are legally responsible for, up to your policy's limits. It is a general term that covers various forms of insurance, protecting you and your physical property. It includes types of insurance that cover your car, home, and businesses, as well as situations where you are responsible for an accident that causes injuries to another person or their belongings.

When purchasing car insurance, it is important to ensure your coverage limits are appropriate for your situation. For example, if you have $200,000 worth of belongings in your home, your coverage limit should match that amount. If your coverage limit is too low, you may have to pay out of pocket for any losses that exceed your policy's limit.

Life Insurance: Adding to Your Net Worth?

You may want to see also

Casualty insurance

Liability losses are losses that occur as a result of the insured’s interactions with others or their property. To be legally liable, one must have demonstrated negligence—the failure to use proper care in personal actions. If negligence results in harm to another, the offending party is liable for resulting damages.

Life Insurance and Short-Form Death Certificates: What's Accepted?

You may want to see also

Property insurance

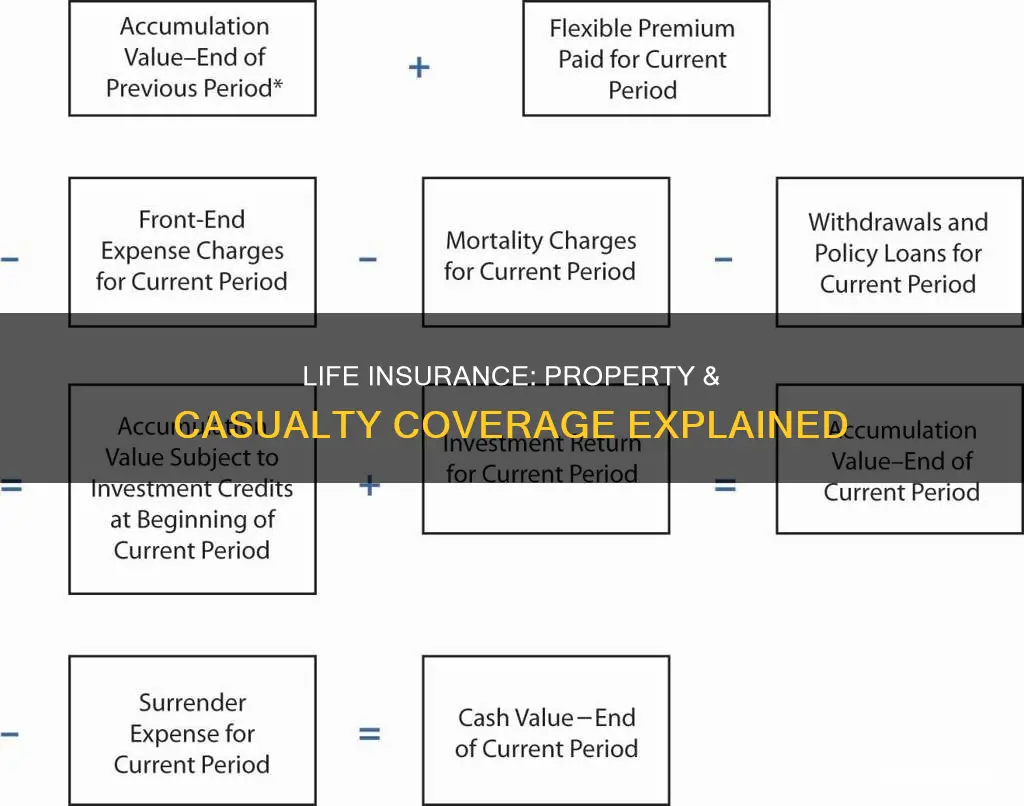

The three types of property insurance coverage are replacement cost, actual cash value, and extended replacement costs. Replacement cost covers the cost of repairing or replacing property at the same or equal value. Actual cash value coverage pays the owner or renter the replacement cost minus depreciation. Extended replacement costs will pay more than the coverage limit if the costs for construction have gone up.

Overdose Death: Life Insurance Payouts and Consequences

You may want to see also

Business insurance

Property Insurance

Property insurance serves as a safeguard for a business's physical assets, also known as first-party assets. This coverage includes protection against financial losses stemming from incidents like fire, theft, or vandalism affecting property owned by the business. For instance, if a business's building or equipment is damaged or destroyed, property insurance would cover the costs of repair or replacement. It's important to note that property insurance typically doesn't cover leased spaces; it's meant for assets the business owns.

Casualty Insurance

Casualty insurance, also known as liability insurance, is the other half of the equation, shielding businesses from third-party liabilities. This type of insurance covers expenses arising from accidents that occur on business premises or due to company operations, even if the claims aren't valid. For example, if a customer trips over equipment left out by a business or its employees and sustains injuries, the customer's medical costs would fall under casualty insurance.

Business Owner's Policy (BOP)

While property insurance and casualty insurance are often sold separately, they are frequently bundled together in package policies known as Business Owner's Policies (BOPs). These policies are specifically designed for small businesses and typically include commercial property insurance and general liability insurance. BOPs may also feature business interruption insurance, which covers lost income due to property damage or loss that disrupts normal operations. However, BOPs usually exclude professional liability, commercial auto insurance, workers' compensation, and health and disability insurance, necessitating separate policies for these coverages.

Additional Considerations

When considering business insurance, it's important to remember that certain types of insurance are legally mandated, such as workers' compensation, depending on the nature and size of the business. Additionally, lenders or landlords may require commercial property insurance or renters insurance, respectively, as a condition of their agreements. Beyond legal requirements, business insurance is a prudent measure to protect against financial disasters that could cripple a company's operations.

Fidelity's Life Insurance Offerings: What You Need to Know

You may want to see also

Frequently asked questions

No, life insurance is separate from property and casualty insurance. Property and casualty insurance is an umbrella term for various insurance types, including homeowners, renters, auto, and business insurance. It covers damage to property and liability for losses/damages to others. Life insurance, on the other hand, covers expenses associated with death and does not fall under the property and casualty insurance umbrella.

Property insurance covers your physical property, such as your house, car, clothing, furniture, electronics, and valuables. It provides financial protection in case of damage, theft, or destruction of your personal belongings.

Casualty insurance covers your liability and legal responsibility for losses or damage to another person or their property. It includes vehicle insurance, liability insurance, and theft insurance. If you are found legally liable for injury or damage, casualty insurance can help cover the costs.

Property and casualty insurance can cover a range of situations. For example, if a visitor gets injured on your property due to your negligence, this insurance can cover their medical bills and your legal fees if you are sued. It can also cover damage to your home and belongings due to vandalism, theft, or specific weather incidents.