Diabetes is a chronic disease that affects blood glucose levels and can lead to severe damage to vital organs. It is a common condition that impacts many people worldwide, and those affected often face challenges in their daily lives, including monetary hurdles. One such hurdle is the difficulty in obtaining life insurance, as diabetes is considered a pre-existing medical condition that increases the risk of future health complications. This has led to the development of specialised term life insurance plans for diabetics, which offer financial protection to their families in the event of their demise.

Term life insurance for diabetics is designed to address the unique needs and risks associated with the condition. These plans provide financial security and peace of mind to individuals living with diabetes, ensuring that their loved ones will be taken care of financially in their absence. While standard life insurance policies may be out of reach for many diabetics due to high premiums, specialised diabetic plans offer more affordable options.

The availability and cost of term life insurance for diabetics can vary depending on several factors, including the type of diabetes, age of diagnosis, blood sugar control, and the presence of any related health issues. It is important for diabetics to carefully consider their options and choose a plan that suits their specific needs and provides adequate coverage at affordable premiums.

What You'll Learn

Type of diabetes and its impact on insurance

The type of diabetes you have can significantly impact the cost and coverage of your term life insurance policy. Here's how it works:

Type 1 Diabetes

Type 1 diabetes can start at a young age and is harder to control. People with Type 1 diabetes are considered high-risk, so the life insurance premium will be higher for these individuals. The premium rates of a term insurance plan will be more than regular premiums due to the associated risk factors.

Type 2 Diabetes

Type 2 diabetes usually occurs later in life and is easier to control with treatments. Therefore, it poses a lower risk than Type 1 diabetes, and the premium rates for term insurance plans are typically lower. However, if the policyholder is dependent on regular insulin intake, the premium will be subject to an increase.

Gestational Diabetes

Gestational diabetes is caused by a hormonal imbalance during pregnancy. It is advisable to wait until after childbirth to see if the condition improves. If the condition goes away, you may be able to purchase a term insurance plan at lower premium rates.

When applying for term life insurance, it's important to disclose your type of diabetes and any associated health complications. The insurance provider will consider factors such as age, blood sugar levels, and other health issues to determine the cost and coverage of your policy.

MetLife Insurance Agencies: Are They Franchises or Not?

You may want to see also

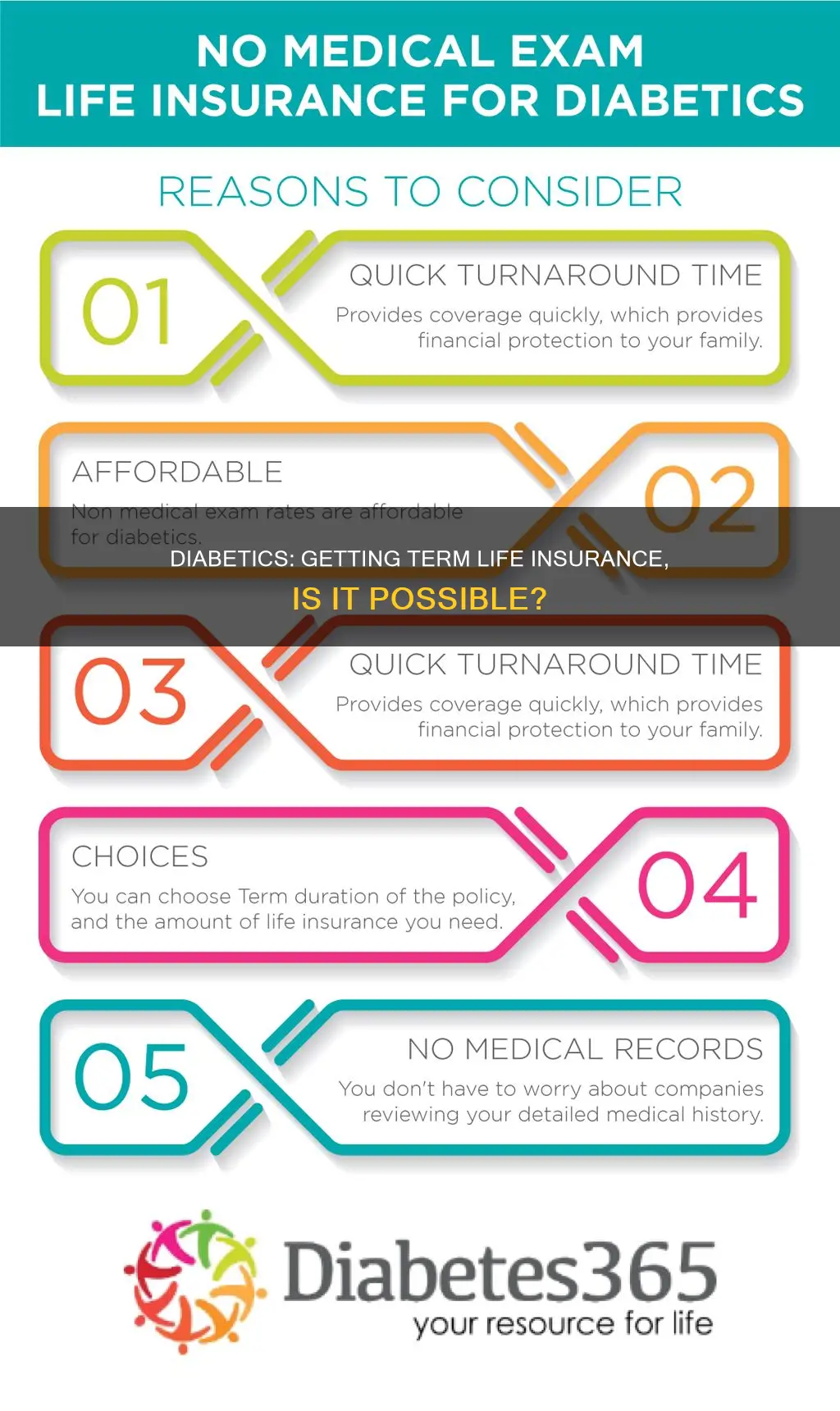

Importance of term insurance for diabetics

Term insurance for diabetics is a vital financial safety net for those living with this chronic condition. Here are several reasons why term insurance is essential for diabetics:

Financial Protection for Families

Term insurance provides financial security for the family of a diabetic person in the event of their untimely death. It ensures that the family can maintain their standard of living and cover any outstanding debts or medical expenses.

Affordable Coverage

Term insurance plans are cost-effective, offering high coverage at low premium rates. Diabetics can secure their family's future at affordable prices, which is especially important given the potential future health complications and expenses associated with diabetes.

Tax Benefits

Term insurance plans offer tax advantages under the prevailing tax laws, providing additional financial relief to policyholders and their families.

Encouraging Health Management

Knowing that better health management can lead to more favourable insurance terms may motivate diabetics to adopt healthier lifestyle practices and proactively manage their condition.

Customised Plans

Many insurers offer plans specifically tailored for diabetics, taking into account their unique health needs and risks. These plans provide peace of mind, knowing that the policy suits their specific health situation.

Comprehensive Coverage

Term insurance plans for diabetics often include additional riders, such as critical illness cover, which are particularly relevant to their health needs. This ensures that treatment costs for diabetes-related complications are covered.

Easy Approval with Controlled Diabetes

If a diabetic person's condition has been under control for a certain period, insurers may offer term insurance plans at more affordable premiums. This incentivises diabetics to proactively manage their health and can result in lower premium rates.

Flexible Payment Options

Term insurance plans typically offer multiple premium payment modes, including monthly, quarterly, annual, or bi-annual options, allowing diabetics to choose the most convenient payment method for their circumstances.

In conclusion, term insurance is crucial for diabetics as it provides financial security for their families, encourages better health management, and offers affordable coverage with tailored benefits to meet their unique needs.

Life Insurance and CT: Taxing the Payout?

You may want to see also

Factors affecting insurance eligibility

Several factors affect a diabetic's eligibility for life insurance. Here are the key considerations:

- Type of diabetes: Type 1 diabetes is typically considered riskier than Type 2 by insurers. Type 1 diabetes often requires frequent blood sugar monitoring and insulin therapy, whereas Type 2 can usually be managed through lifestyle changes such as a healthy diet, exercise, adequate sleep, and stress reduction. Consequently, individuals with Type 1 diabetes may have to pay higher premiums for the same coverage amount.

- Manageability of the condition: If an individual's diabetes is well-controlled through lifestyle changes, they may be offered lower premiums. However, if they are dependent on insulin, the premiums are likely to be higher.

- Age of diagnosis: Being diagnosed with diabetes at a younger age increases the chances of developing serious illnesses in the future. Therefore, insurers will charge a higher premium for the required coverage amount. Conversely, if diabetes is diagnosed at a later age, the risk is relatively lower, resulting in lower premiums.

- Blood sugar levels: Insurers consider the results of HbA1c tests, which measure average blood glucose levels over the previous two to three months, to determine the insurance cost and benefits. Below 6% is considered normal, between 6% and 6.5% indicates prediabetes, and above 6.5% indicates diabetes.

- Other health issues: It is crucial to disclose any other health conditions to the insurer, as this can impact the premium and coverage. Nondisclosure may lead to policy claim rejections later.

- Pre-medical screening: It is advisable to undergo a pre-medical screening to ascertain the exact health condition, which helps determine the appropriate coverage and premium to maximise benefits.

- Treatment method: The likelihood of obtaining insurance also depends on the treatment method. Insurers generally prefer applicants who control their diabetes through oral medications rather than insulin injections.

- Associated risks and health complications: Diabetics who are overweight, have high blood pressure, cardiovascular diseases, or smoking habits may face higher premiums or rejection. These additional health conditions further increase the risks for patients whose diabetes is not under control.

Life Insurance Settlements: Taxable Income or Tax-Free Windfall?

You may want to see also

Benefits of buying life insurance for diabetics

Financial Security for Your Family

One of the most significant benefits of life insurance for diabetics is providing financial security for your loved ones in the event of your absence or unexpected demise. It can help reduce the financial burden on your family, especially if you are the sole breadwinner. The death benefit payout can assist your family in paying off debts, covering medical expenses, and maintaining their standard of living.

Comprehensive Coverage at Competitive Rates

Diabetics can often obtain life insurance coverage at competitive rates, especially if their condition is well-managed. Maintaining stable blood glucose and A1C levels within the recommended range can result in more coverage options and lower premiums. Additionally, some insurance providers offer comprehensive coverage specifically tailored for diabetics, ensuring they can access the financial protection they need.

Add-on Riders for Enhanced Coverage

Life insurance policies often come with add-on riders, which provide additional benefits. For instance, a critical illness rider can offer supplementary funds to cover medical expenses if you are diagnosed with a critical illness during the policy term. These optional riders allow you to customise your policy and increase the overall financial benefit.

Tax Benefits

In many cases, the premiums paid and payouts received on term insurance policies are eligible for tax deductions and exemptions. This can help reduce the overall cost of the life insurance plan and provide additional financial relief to you and your family. Be sure to review the applicable tax laws in your region to understand the specific benefits available.

Peace of Mind

Having adequate life insurance coverage provides peace of mind for both you and your family. Knowing that your loved ones will be financially secure in the event of your death can reduce stress and worry. Additionally, life insurance can help ensure that your family is not burdened with end-of-life expenses, allowing them to focus on their well-being during a difficult time.

Updating Military Life Insurance: Changing Your Beneficiary Details

You may want to see also

Points to consider when choosing a plan

When choosing a term life insurance plan as a diabetic, there are several points to consider to ensure you get the best coverage for your needs. Here are some key factors to keep in mind:

- Age of Diabetes Diagnosis: The age at which diabetes is diagnosed can impact the premium rates. If the diagnosis occurs at a younger age, the risk of developing serious illnesses in the future is higher, resulting in higher premiums. Conversely, if diabetes is diagnosed later in life and there are no other significant health issues, the risk is lower, leading to lower premiums.

- Type of Diabetes: The type of diabetes plays a crucial role in determining the premium rates and policy terms. Type 1 diabetes is often considered a higher risk due to its early onset and the need for insulin management, resulting in more stringent underwriting criteria and higher premiums. On the other hand, Type 2 diabetes is generally perceived as a lower risk, especially if managed well with lifestyle changes and medication.

- Blood Sugar Control: Insurance companies will consider the HbA1c test results, which indicate average blood sugar levels over the past two to three months. Maintaining HbA1c levels below 6.4% without any other health issues can help secure a term plan at a standard premium rate. Higher HbA1c levels may result in higher premiums.

- Overall Health and Lifestyle: Other health issues, such as obesity, uncontrolled blood sugar, heart conditions, or smoking habits, can increase the risk assessment and lead to higher premium rates or even rejection by insurers. Lifestyle factors like diet, exercise, smoking, and alcohol consumption will also be taken into account.

- Pre-policy Medical Screening: Insurers may require applicants to undergo a pre-policy medical check-up to assess their current health condition, risk factors, age, and potential future illnesses. This evaluation helps insurers decide whether to approve the application and at what premium rate.

- Policy Features and Benefits: Compare the features and benefits offered by different insurers, including the sum assured, term length, premium payment frequency, health management services, and additional riders like critical illness cover.

- Insurers' Reputation and Reliability: Opt for insurers with a good reputation and a high claim settlement ratio to ensure peace of mind and reliable coverage.

- Cost and Affordability: Given the potential for higher premiums due to diabetes, balance the need for comprehensive coverage with the affordability of premiums. Compare policies from different insurers to find the best value for your money.

Understanding Residuary Estate: Does Life Insurance Factor In?

You may want to see also

Frequently asked questions

Yes, a diabetic can get term life insurance. However, there may be certain conditions that need to be fulfilled, and the coverage and premium rates will depend on factors such as the type of diabetes, age, and overall health.

The type of diabetes plays a significant role. Type 1 diabetes is often considered higher risk due to its early onset and the need for insulin management, leading to higher premiums. Type 2 diabetes is generally perceived as lower risk, especially if managed well with lifestyle changes and medication, resulting in lower premiums.

Buying term life insurance ensures financial security for loved ones, encourages better health management, covers treatment costs for diabetes-related complications, and provides peace of mind. Additionally, many insurers offer plans specifically tailored for diabetics, ensuring suitable coverage for their unique health situation.