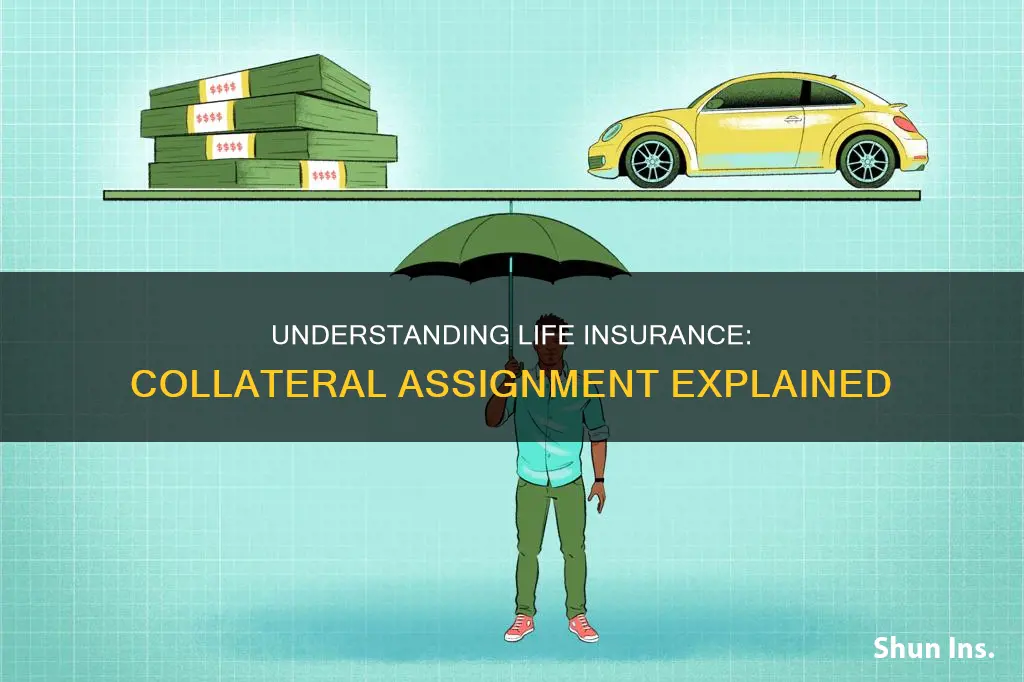

A collateral assignment of life insurance is a method of providing a lender with collateral when you apply for a loan. In this case, the collateral is your life insurance policy's face value, which could be used to pay back the amount you owe in case you die while in debt. It involves using your life insurance policy's death benefit as loan collateral. This means that if you can't repay what you owe, the lender has the right to collect the collateral amount from your policy.

What You'll Learn

- Collateral assignment of life insurance is a method of providing a lender with collateral when you apply for a loan

- The collateral is your life insurance policy's face value, which could be used to pay back the amount you owe in case you die while in debt

- The lender has a claim to some or all of the death benefit until the loan is repaid

- The borrower must be the owner of the policy, but they do not have to be the insured

- The collateral assignment may be against all or part of the policy's value

Collateral assignment of life insurance is a method of providing a lender with collateral when you apply for a loan

Collateral assignment of life insurance allows you to specify the amount of your death benefit that your lender receives if you pass away during your loan's term. This can be a worthwhile alternative to using your house, car, or other assets to secure a loan.

If you die before fully repaying your loan, the collateral assignment will allow the lender or "assignee" to be repaid for the outstanding loan amount using your death benefit. If you pay back your loan fully before passing away, or if only a portion of your death benefit is needed to pay off your loan, your beneficiaries can still file a claim for the policy's death benefit.

Both term and permanent life insurance policies may be used as collateral, though some lenders may not accept term life policies since they don't have cash value. Using a cash value life insurance policy as collateral allows your lender to access the cash value, providing an additional safeguard in case you default on your loan.

The borrower of a business loan using life insurance as collateral must be the policy owner, but they do not have to be the insured. The policy must remain current for the life of the loan, with the policy owner continuing to pay all premiums.

The collateral assignment helps you avoid naming a lender as a beneficiary. The lender is a collateral assignee, and you can specify that they are only entitled to a certain amount, namely the amount of the outstanding loan. That would allow your beneficiaries to still be entitled to any remaining death benefit.

The process of applying for a collateral assignment of life insurance involves understanding the requirements, applying for life insurance, completing a collateral assignment form, and proceeding with your loan application.

Using Life Insurance for Funeral Expenses: Immediate Access?

You may want to see also

The collateral is your life insurance policy's face value, which could be used to pay back the amount you owe in case you die while in debt

When you apply for a loan, collateral assignment of life insurance allows you to use your life insurance policy's face value as collateral. This means that if you pass away before fully repaying your loan, the lender or "assignee" can be repaid the outstanding loan amount using your death benefit.

Collateral assignment of life insurance is a common requirement for business loans. Lenders may even require you to get a life insurance policy to be used for this purpose. It is a worthwhile alternative to using your house, car, or other assets to secure a loan.

The process of applying for a collateral assignment of life insurance involves the following steps:

- Understand the requirements: Find out if your lender will accept the collateral assignment of an existing permanent or term life insurance policy. Confirm that your current policy's death benefit amount meets the lender's loan requirements. Some lenders may require you to get a new life insurance policy for the collateral assignment.

- Apply for life insurance: If you need to purchase a new life insurance policy, apply with the insurer. Make sure to double-check with your lender that the policy meets their loan requirements.

- Complete the collateral assignment form: Once your first life insurance premium is paid, fill out a collateral assignment form provided by your insurer. On this form, you will need to provide your lender's contact information so they can be added as the death benefit collateral assignee until your loan is repaid. Both you (the assignor) and the lender (the assignee) will need to sign the form.

- Proceed with your loan application: Once your bank confirms that they are the collateral assignee, you can proceed with submitting your loan application.

It is important to note that using your life insurance policy as collateral may impact your beneficiaries. If you pass away before fully repaying your loan, the total death benefit available to your beneficiaries will be reduced by the amount needed to repay the lender. Therefore, it is crucial to update your beneficiaries as needed while your policy is active.

Term vs Life Insurance: Is It Worth the Switch?

You may want to see also

The lender has a claim to some or all of the death benefit until the loan is repaid

When a life insurance policy is used as collateral for a loan, the lender has a claim to some or all of the death benefit until the loan is repaid. This is known as a collateral assignment of life insurance. In this arrangement, the lender becomes the assignee of the policy and has the right to collect the collateral amount from the policy if the borrower cannot repay what they owe. The collateral assignment may be against all or part of the policy's value.

The borrower must be the owner of the policy, but they do not have to be the insured person. The policy must remain current for the life of the loan, with the policy owner continuing to pay all premiums. The death benefit must meet the lender's terms.

Using a collateral assignee allows the borrower to specify that the lender is only entitled to a certain amount, namely the amount of the outstanding loan. This means that any remaining death benefit can still be claimed by beneficiaries.

Once the loan is fully repaid, the life insurance policy is no longer used as collateral.

Life Insurance and Jail: What's the Verdict?

You may want to see also

The borrower must be the owner of the policy, but they do not have to be the insured

When it comes to collateral assignment of life insurance, one key requirement is that the borrower must be the owner of the policy in question. This is a fundamental aspect that distinguishes collateral assignments from other types of life insurance arrangements. By owning the policy, the borrower has certain rights and responsibilities that are crucial to the collateral assignment process.

Ownership of the life insurance policy gives the borrower the authority to make changes to the policy, such as updating beneficiaries or adjusting coverage amounts. This level of control is essential when using the policy as collateral because it allows the borrower to align the policy with the terms of the loan agreement. The borrower, as the policy owner, can ensure that the death benefit provided as collateral remains in force and is sufficient to cover the outstanding debt.

While the borrower must be the owner of the policy, it is important to note that they do not have to be the insured person. This separation of roles is another distinctive feature of collateral assignments. The insured person is typically the individual whose life is covered by the policy, and their death triggers the payout of the death benefit. In a collateral assignment, the borrower and the insured can be different people, which offers flexibility in how the policy is structured and utilized.

For example, consider a business partnership where one partner takes out a loan to expand the business, using a life insurance policy as collateral. In this scenario, the borrowing partner would be the owner of the policy and is responsible for maintaining the policy and ensuring it adheres to the loan agreement. The insured person under the policy could be the other partner, whose life is insured, and upon their death, the death benefit would be used to repay the loan. This arrangement protects both the borrower and the lender, as it guarantees repayment while also allowing the borrower to retain ownership and control over the policy.

Financial Advisors and Life Insurance: What's the Real Deal?

You may want to see also

The collateral assignment may be against all or part of the policy's value

The collateral assignment of a life insurance policy is a method of providing a lender with collateral when applying for a loan. The death benefit of the policy is used as collateral, which the lender can claim in the event of the borrower's death or default. This arrangement allows the borrower to avoid naming the lender as the beneficiary of the policy, which would entitle the lender to the full death benefit. Instead, the borrower can specify that the lender is only entitled to a certain amount, i.e., the amount of the outstanding loan.

The borrower must be the owner of the policy and must continue to pay all premiums during the loan term. The policy must also meet the lender's requirements, such as having a sufficient death benefit amount and, in some cases, accumulating cash value. The collateral assignment remains in effect until the loan is fully repaid, at which point the lender is no longer the beneficiary, and the policy is no longer used as collateral.

By using a collateral assignment, borrowers can access needed funding, especially for business loans, without putting their personal assets, such as their home or car, at risk. It also provides lenders with a guarantee of repayment, which can lead to more favourable loan terms and interest rates for the borrower. However, it is important to consider the risks involved, as the death benefit for beneficiaries will be reduced if the borrower passes away before repaying the loan.

Surrendering VA Life Insurance: Taxable Event or Not?

You may want to see also

Frequently asked questions

Collateral assignment of life insurance is a method of providing a lender with collateral when you apply for a loan. The collateral, in this case, is the face value of your life insurance policy, which could be used to pay back the amount you owe in case you die while in debt.

Collateral assignment can help you secure a loan without putting up your house, car, or other personal property as collateral. It can also help you get a lower interest rate on the loan.

The main drawback is that your life insurance benefits are reduced. In the event of your death, the lender gets first priority for collecting the death benefit, and your beneficiaries receive only the remaining amount. Additionally, you must continue to make premium payments on the policy for the collateral assignment to remain in effect.