Life insurance is a crucial aspect of financial planning, and it's important to understand the coverage provided by different organizations, including professional sports leagues like the NFL. The National Football League (NFL) offers life insurance as part of its comprehensive benefits package for players, ensuring financial security for athletes and their families. This insurance coverage is designed to provide financial support in the event of a player's untimely death, offering peace of mind and financial stability to players and their loved ones. Understanding the specifics of the NFL's life insurance program can help players and fans alike appreciate the league's commitment to player welfare and the importance of financial planning in professional sports.

What You'll Learn

NFL Player Benefits: Life Insurance Coverage Explained

The National Football League (NFL) recognizes the importance of providing comprehensive benefits to its players, and life insurance is a significant part of this support system. NFL players are offered life insurance coverage as a crucial component of their overall compensation package, ensuring financial security for themselves and their families in the event of their passing. This benefit is a testament to the league's commitment to player welfare and long-term financial planning.

Life insurance for NFL players typically operates as a group policy, where the entire player roster is covered under a single insurance plan. This approach simplifies the process for both the league and the players, making it more accessible and efficient. The coverage amount is often substantial, reflecting the high-risk nature of the sport and the need to provide adequate financial support to players' families. The insurance policy may include various death benefits, such as a lump sum payment, income replacement, or a combination of both, to ensure the financial stability of the player's dependents.

The NFL's life insurance program is designed to provide peace of mind and financial security, especially during the player's career and beyond. In the unfortunate event of a player's death, the insurance payout can help cover essential expenses, such as funeral costs, outstanding debts, and ongoing living expenses for the player's family. This financial support can significantly ease the burden on the player's loved ones during a challenging time.

Furthermore, the NFL's life insurance coverage may also extend to other aspects of player welfare. For instance, some policies could include critical illness coverage, offering financial assistance for serious health conditions. Additionally, the insurance provider might offer disability coverage, ensuring players receive income replacement if they become unable to perform their duties due to injury or illness. These additional benefits showcase the NFL's comprehensive approach to player benefits, addressing both life-threatening and health-related concerns.

In summary, NFL players are entitled to life insurance coverage as a valuable benefit, providing financial security and peace of mind. The group policy approach simplifies the process, ensuring that players and their families receive the necessary support. With substantial coverage amounts and potential additional benefits, the NFL's life insurance program is a vital component of the league's commitment to player welfare, offering protection and assistance throughout the players' careers and beyond.

Life Insurance: Government's Role and Your Options

You may want to see also

NFL's Financial Security Measures: Life Insurance for Players

The NFL has implemented comprehensive financial security measures to protect its players, and one of the key components is life insurance. This is a critical aspect of ensuring the financial well-being of players and their families, especially in the event of a tragic accident or premature death. The league recognizes the importance of providing long-term financial stability to its athletes, and life insurance is a vital tool to achieve this.

NFL players are offered group life insurance policies, which provide a substantial financial benefit to their beneficiaries in the unfortunate event of their passing. The amount of coverage can vary, but it is typically a significant sum, often equivalent to a player's annual salary or a multiple of it. This financial safety net ensures that the player's family is provided for, covering essential expenses and providing financial security during a difficult time. The insurance coverage is an essential part of the overall compensation package, offering peace of mind to players and their loved ones.

The NFL's approach to life insurance is a proactive measure to address the unique risks associated with professional sports. Players engage in high-impact, high-risk activities, and the potential for injury or death is ever-present. By providing comprehensive life insurance, the league aims to alleviate some of the financial burdens that may arise from such risks. This includes covering funeral expenses, outstanding debts, and ongoing living costs for the player's family, ensuring they are supported even if the player is no longer able to provide for them.

Furthermore, the NFL's life insurance program extends beyond the basic coverage. It often includes additional benefits such as accidental death insurance, which provides an extra layer of protection. This means that if a player's death is a result of an accident, the beneficiaries will receive the full death benefit, ensuring a more secure financial future. The league also offers long-term disability insurance, which provides income replacement if a player becomes permanently disabled, further enhancing the financial security of the players.

In summary, the NFL's financial security measures for players include a robust life insurance program. This initiative is a testament to the league's commitment to the well-being of its athletes and their families. By providing substantial coverage and additional benefits, the NFL ensures that players and their beneficiaries are protected financially, even in the face of adversity. It is a crucial aspect of the NFL's comprehensive approach to player welfare and a significant factor in the overall compensation and support system for professional athletes.

Life Insurance: When Less is More

You may want to see also

Player Welfare: NFL's Life Insurance Policies and Benefits

The NFL has implemented comprehensive life insurance policies as part of its commitment to player welfare, ensuring financial security for athletes and their families. These policies are a crucial aspect of the league's long-term strategy to support players' well-being, both during their active careers and after retirement. The primary objective is to provide financial protection and peace of mind, knowing that their loved ones will be taken care of in the event of any unforeseen circumstances.

NFL life insurance policies are designed to offer substantial coverage, often tailored to each player's needs and position. For instance, offensive and defensive linemen, who face higher physical risks, may have higher coverage amounts compared to players in other positions. The insurance coverage can extend to various aspects of a player's life, including death benefits, which provide a lump sum payment to the player's beneficiaries in the event of their passing. This financial support can help cover funeral expenses, outstanding debts, and provide financial stability for the player's family.

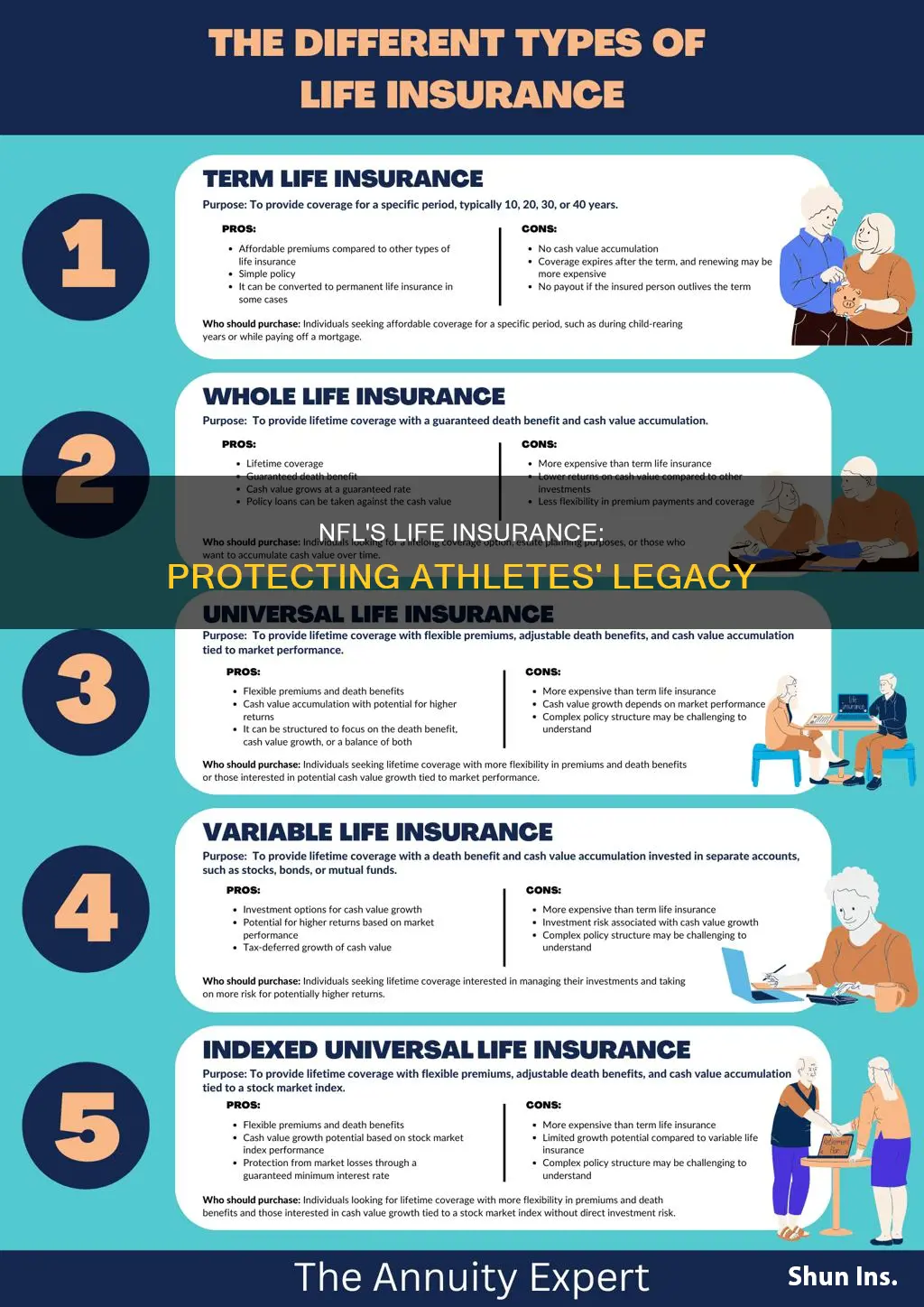

One of the key benefits of the NFL's life insurance program is the flexibility it offers. Players can choose different coverage options, such as term life insurance, which provides coverage for a specific period, or permanent life insurance, which offers lifelong coverage. This flexibility allows athletes to select a policy that best suits their individual circumstances and financial goals. Additionally, the NFL's policies often include additional benefits, such as disability insurance, which provides income replacement if a player becomes unable to perform due to injury or illness.

The NFL's commitment to player welfare is further demonstrated through the support and guidance provided to athletes regarding their insurance choices. The league offers resources and counseling services to help players understand their options and make informed decisions. This includes financial planning advice, ensuring that players can maximize the benefits of their life insurance policies and make the most of the financial security they provide.

In summary, the NFL's life insurance policies are a vital component of the league's player welfare program, offering financial protection and peace of mind to athletes and their families. With comprehensive coverage, flexibility in policy options, and additional support services, the NFL ensures that players can focus on their performance while knowing their long-term financial security is taken care of. This approach reflects the league's dedication to the well-being of its players, both on and off the field.

Creditor Life Insurance: Protecting Your Loved Ones' Finances

You may want to see also

NFL's Commitment to Player Health: Life Insurance and Support

The NFL has made significant strides in prioritizing player health and well-being, and one of the key aspects of this commitment is the provision of comprehensive life insurance coverage for its athletes. This initiative is a testament to the league's understanding of the long-term impact of injuries and the importance of financial security for players, especially after their professional careers.

NFL players, who are at a higher risk of sustaining severe injuries due to the nature of their sport, often face challenges in maintaining financial stability post-retirement or in the event of an untimely demise. To address this, the NFL has implemented a robust life insurance program as part of its commitment to player health and welfare. This coverage is designed to provide financial security and peace of mind to players and their families, ensuring that they are protected even when the athlete is no longer part of the game.

The life insurance policy offered to NFL players is typically a term life insurance, which provides coverage for a specific period, often aligned with the player's career duration. This type of insurance is known for its simplicity and affordability, making it an ideal choice for the league's extensive athlete population. The coverage amount is usually substantial, reflecting the high-risk nature of the sport and the potential long-term consequences of injuries. For instance, a player might be insured for a significant sum, ensuring that their family is financially secure in the event of a career-ending injury or death.

Moreover, the NFL's commitment to player health goes beyond just providing insurance. The league has also established support systems and resources to assist players in managing their financial affairs and making informed decisions about their insurance coverage. This includes financial advisors and educational programs that help players understand the value of life insurance and how it can provide financial protection for their loved ones. By offering such comprehensive support, the NFL ensures that players are not only protected by insurance but also empowered to make the most of this benefit.

In summary, the NFL's provision of life insurance is a crucial component of its player health initiative, demonstrating a proactive approach to addressing the unique challenges faced by athletes. This insurance coverage, coupled with the league's support systems, ensures that players can focus on their performance and well-being, knowing that their financial future and the welfare of their families are secure. The NFL's commitment to player health is a shining example of how sports organizations can actively contribute to the long-term prosperity and safety of their athletes.

Nurses Aid Life Insurance Applications at Home

You may want to see also

Life Insurance for NFL Athletes: A Comprehensive Overview

Life insurance is a critical aspect of financial planning for NFL athletes, offering a safety net for their families and providing financial security in the event of unforeseen circumstances. The NFL has recognized the importance of this benefit and has implemented various life insurance programs to support its players. Here's an overview of the life insurance options available to NFL athletes:

The NFL offers group term life insurance as a standard benefit to all players. This type of insurance provides a lump-sum payment to the designated beneficiaries if the insured athlete passes away during the term of the policy. The coverage amount is typically a multiple of the athlete's salary, ensuring that the financial impact of their absence is adequately compensated. Group term life insurance is often more affordable and accessible compared to individual policies, making it an attractive option for players.

In addition to the standard group term life insurance, the NFL also provides a more comprehensive life insurance program known as the NFL Player Benefits Plan. This plan offers additional coverage and customization options to suit the specific needs of each athlete. It includes a higher death benefit, allowing players to choose a coverage amount that aligns with their financial goals and family circumstances. The NFL Player Benefits Plan may also offer accelerated death benefits, which can provide financial assistance to the insured athlete or their family if they are diagnosed with a critical illness or face a severe medical condition.

NFL athletes can also explore individual life insurance policies to supplement the group coverage. This option provides flexibility in terms of coverage amount, term length, and additional benefits. Individual policies can be tailored to the athlete's unique circumstances, ensuring that their family's financial needs are met in the long term. It is essential for players to carefully consider their options and choose a policy that aligns with their expected career duration and financial obligations.

When considering life insurance, NFL athletes should also be aware of the potential impact of their profession on insurance rates. The high-risk nature of professional sports can sometimes result in higher premiums. However, the NFL's group insurance programs often negotiate favorable rates with insurance providers, making coverage more accessible and cost-effective for players.

In summary, NFL athletes have access to a range of life insurance options, including group term life insurance and the comprehensive NFL Player Benefits Plan. These programs provide financial security and peace of mind, ensuring that their families are protected in the event of their passing. By understanding the available options and carefully selecting the appropriate coverage, NFL players can make informed decisions to safeguard their loved ones' financial well-being.

Understanding Legal Reserves: The Foundation of Life Insurance

You may want to see also

Frequently asked questions

The NFL offers a comprehensive life insurance program as part of its benefits package for players, coaches, and staff. This program is designed to provide financial security and peace of mind to members of the NFL community.

The coverage amount varies depending on the position and experience of the player. Typically, the NFL provides a standard basic life insurance policy with a coverage amount of $500,000 for each player. However, more experienced players may be eligible for additional coverage options.

Yes, the NFL's life insurance program includes provisions for the families of deceased players. The policy usually provides a substantial death benefit to the player's designated beneficiaries, ensuring financial support for their loved ones. This benefit can be a significant source of financial security during difficult times.

Absolutely. The NFL's life insurance program is not limited to players. Coaches, scouts, and other staff members are also eligible to participate and receive coverage tailored to their roles and needs. This ensures that the entire NFL community has access to valuable financial protection.