Life insurance is a complex topic, and there is no one-size-fits-all solution. The best policy for you will depend on your individual needs, budget, and financial situation. Term life insurance and whole life insurance are two of the most common types of life insurance policies. Term life insurance is generally cheaper and provides coverage for a set period, whereas whole life insurance is more expensive, lasts your entire life, and builds cash value over time. Other factors to consider when choosing a policy include income replacement, education costs, and whether you want flexible premiums and adjustable death benefits.

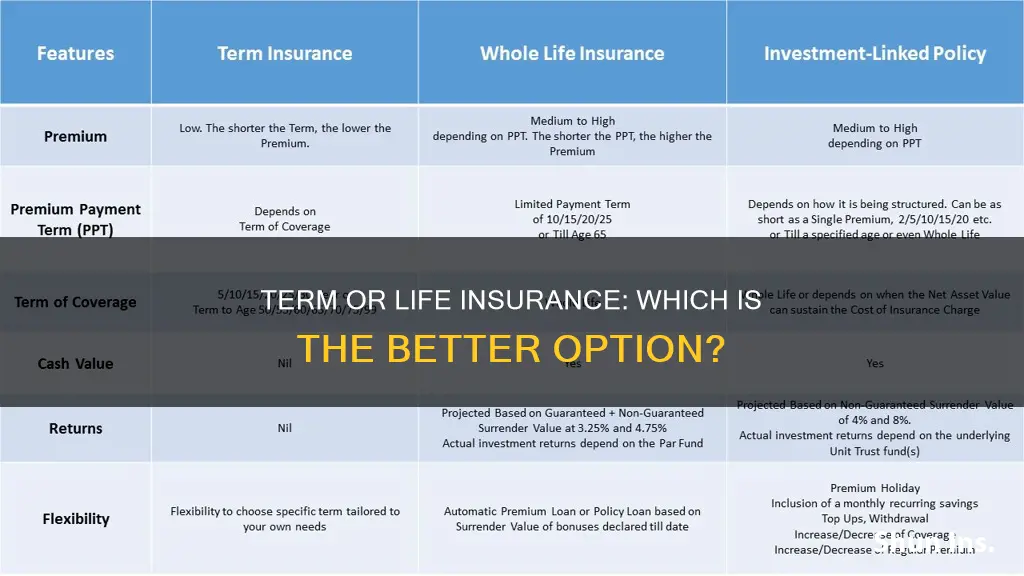

Which is the best: Term Insurance or Life Insurance?

| Characteristics | Term Insurance | Life Insurance |

|---|---|---|

| Coverage Period | Temporary, for a set number of years (5-40 years) | Permanent, lasts for the entire life |

| Cost | Affordable | More expensive |

| Death Benefit | Paid to the family in case of death during the term | Guaranteed payout as long as premiums are paid |

| Riders | Accelerated death benefit rider, waiver of premium rider | Disability rider, long-term care rider |

| Premium | Lower | Higher |

| Ideal for | People with financial obligations | People who want lifelong protection |

| Best Companies | Banner Life, SBLI, Protective, Lincoln Financial | MassMutual, Guardian, Northwestern Mutual, Pacific Life |

What You'll Learn

Term insurance is best for those on a budget

When it comes to insurance, there is no one-size-fits-all solution. The best type of insurance for an individual depends on their specific needs and financial situation. That being said, term insurance is a great option for those on a budget.

Term life insurance is a policy that is purchased for a specific period, such as 10, 15, or 20 years. It offers lower-cost coverage for that set period and is generally the cheapest type of life insurance available. This makes it a good option for those who need coverage for a finite period, such as when paying off a debt or covering a mortgage. It is also a popular choice for younger families who often need higher life insurance coverage due to higher amounts of debt and can benefit from the lower premiums.

Term insurance is also simpler than whole life insurance, which can be more complex due to its cash value feature. Whole life insurance policies build cash value over time, which can be borrowed against. However, this feature makes whole life insurance more expensive and less accessible to those on a budget. In contrast, term life insurance does not have a cash value feature, which contributes to its lower cost.

Additionally, term life insurance policies often include a conversion rider that allows the policyholder to switch from term life to whole life insurance later on. This provides flexibility, as the policyholder's needs and financial situation may change over time. By starting with a term life policy, individuals can lock in lower insurance costs at a younger age, and then complement it with a smaller permanent policy at a later date.

It is important to note that term life insurance is temporary, and coverage expires once the term is up. If the policyholder still requires insurance, they will need to purchase a new policy, which will likely be at a higher rate due to their increased age. However, the option to convert to a permanent policy before the deadline set by the insurer can help mitigate this issue.

Settlement Options: Life Insurance Flexibility and Choice

You may want to see also

Whole life insurance is best for end-of-life planning

Whole life insurance is a good option for those looking for lifelong coverage and who want to use it for end-of-life planning. It is a permanent policy that offers lifelong coverage and never expires as long as the premiums are paid. Whole life insurance can be used to cover funeral expenses, medical debt, and other end-of-life costs. It can also provide an inheritance for beneficiaries or ongoing financial support for a spouse or dependent family member.

Whole life insurance has an added cash value component that earns interest over time and can be used for retirement savings or estate planning. This cash value grows at a constant rate and can be withdrawn or borrowed against while the policyholder is still alive. However, withdrawing or borrowing against the policy's cash value will reduce the death benefit. Whole life insurance premiums are typically higher than those for term life insurance, and the policy's complexity can make it challenging to understand and manage.

Term life insurance, on the other hand, is a temporary policy that covers a fixed period, such as 10, 20, or 30 years. It is more affordable and simpler than whole life insurance, making it a good option for those with limited funds or who only need coverage for a specific period, such as while raising children or paying off a mortgage. However, term life insurance does not accumulate cash value, and if the policyholder outlives the term, they receive no benefits.

Some people choose to have a combination of both term and whole life insurance policies to suit their specific needs and financial situation. For example, a term life policy can be used to supplement a whole life policy to cover larger debts, such as a mortgage. Ultimately, the decision between term and whole life insurance depends on an individual's budget, financial goals, and need for lifelong coverage.

Life Insurance Medical Exam: How Often Do They Occur?

You may want to see also

Term insurance is best for a finite period

Term insurance is a straightforward and affordable option for those seeking coverage for a specific period. It is a popular choice for young families, as it provides a financial safety net during periods of high financial obligations, such as raising children or paying off debts. Term insurance offers lower premiums and predictable, easy-to-manage payments, making it an attractive option for those on a tight budget.

One of the key advantages of term insurance is its simplicity. When setting up a term policy, individuals select their desired coverage amount and duration, making it easy to understand and manage. Additionally, term insurance provides lower-cost coverage, with premiums that remain consistent throughout the term. This transparency ensures that beneficiaries receive the full insurance benefit if the insured passes away before the policy expires.

Term insurance is particularly beneficial for those with limited funds who need coverage for a finite period. For example, young families often struggle to find extra money to save, and term insurance offers them a cost-effective solution. It can provide coverage during critical periods, such as raising children or paying off mortgages and other debts. By selecting an appropriate term duration, individuals can ensure financial protection for their loved ones during these challenging times.

Furthermore, term insurance offers flexibility through its conversion feature. Most term life policies include this option, allowing individuals to convert their term insurance to permanent insurance without undergoing a new medical exam. This feature provides individuals with the ability to extend their coverage if their circumstances change, ensuring peace of mind and adaptability.

While term insurance has many advantages, it is important to consider the specific needs and financial situation of individuals and their families. Whole life insurance, for instance, offers lifelong coverage and builds cash value over time, making it a suitable option for end-of-life planning and building retirement wealth. However, term insurance's affordability, simplicity, and finite coverage make it a popular choice for those seeking protection during specific life stages.

Using 403(b) Money to Purchase Life Insurance: Is it Possible?

You may want to see also

Whole life insurance is best for building cash value

Term insurance and whole life insurance are two of the most common types of life insurance. Term life insurance is a policy purchased for a specific period, such as ten or twenty years. It provides coverage for a fixed term and is designed to pay money to the named beneficiaries if the insured person dies during that period. Term life insurance is generally more affordable and simpler, making it a popular choice for young families or those on a limited budget. However, it has an expiration date and does not include a cash value feature.

On the other hand, whole life insurance is a type of permanent insurance that lasts for the entire life of the policyholder. It offers lifelong coverage and builds cash value over time. The cash value of whole life insurance grows at a guaranteed rate of return and can also increase if the insurer pays dividends on participating policies, which can be reinvested. This cash value can be accessed during the lifetime of the policyholder through policy loans, withdrawals, or to pay premiums. Whole life insurance is more expensive and complex but provides permanent coverage and is a good option for end-of-life planning, such as funeral expenses or leaving an inheritance.

Now, let's focus on why whole life insurance is best for building cash value.

Whole life insurance is unique in its ability to build equity through its policy design. It offers guaranteed fixed premiums and enables policyholders to track when cash values exceed the amount of premiums paid. The cash value growth is gradual and influenced by factors such as policy design, the age and health of the insured, premium payments, and a guaranteed rate of return. Policyholders can accelerate cash value growth by reinvesting dividends through paid-up additions. Additionally, the growth of cash value in whole life insurance is tax-deferred, providing long-term tax advantages.

The cash value component of whole life insurance offers greater financial flexibility. It can be used to pay premiums or cover expenses during the policyholder's lifetime. Additionally, the death benefit is guaranteed as long as the premiums are paid, providing financial security for beneficiaries. Whole life insurance also provides the option to adjust or skip premium payments and change the death benefit amount, allowing for customization based on an individual's financial situation.

In summary, whole life insurance is best for building cash value due to its permanent nature, guaranteed fixed premiums, gradual growth influenced by various factors, tax-deferred status, and the financial flexibility it offers. It is important to review policy illustrations with a financial advisor to understand the costs, benefits, and potential for long-term growth before choosing a whole life insurance policy.

Canceling Royal London Life Insurance: A Step-by-Step Guide

You may want to see also

A combination of both term and whole life insurance is best for flexibility

When it comes to term and whole life insurance, there is no one-size-fits-all answer. The best option for you will depend on your individual needs, priorities, and financial situation. However, a combination of both term and whole life insurance can offer the best of both worlds in terms of flexibility.

Term life insurance is a temporary option that provides coverage for a specific period, such as 10, 15, or 20 years. It is generally more affordable, making it a popular choice for young families on a budget. This type of insurance is ideal if you only need coverage for a finite period, such as when paying off a debt or covering a mortgage. Additionally, most term life policies include a conversion feature, allowing you to switch to whole life insurance if your needs change.

On the other hand, whole life insurance provides coverage for your entire life. It tends to be more expensive and complex but offers the advantage of lifelong coverage and the ability to build cash value over time. This type of insurance is suitable for end-of-life planning, such as covering funeral expenses or leaving an inheritance. The cash value component also provides greater financial flexibility, as you can borrow against it or use it to pay premiums.

By combining both types of insurance, you can benefit from the affordability of term life insurance while also enjoying the long-term coverage and cash value of whole life insurance. This combination provides flexibility, ensuring that your insurance suits your needs both today and in the future. For example, a small permanent policy can be added to a term policy to lock in lower insurance costs at a younger age, resulting in more efficient growth of policy values.

When deciding on the right combination, it is essential to consider your current and future financial situation, as well as your specific needs and goals. Working with an insurance expert or financial advisor can help you navigate the complexities of different policies and choose the best combination to suit your unique circumstances.

Marketing Life Insurance: Social Media Strategies for Success

You may want to see also

Frequently asked questions

Term life insurance is a policy that is purchased for a period of time (a term). It is cheaper than whole life insurance but only covers you for a set number of years. It is intended to provide lower-cost coverage for a specific period, like a 10- or 20-year period.

Whole life insurance is more expensive and complex than term life insurance but provides lifelong coverage and builds cash value over time. It typically lasts your whole life and has an added death benefit.

Term life insurance is cheaper and suitable for those with a limited budget. It offers coverage for a set number of years and is simple. However, it has an expiration date and doesn't include a cash value feature.

Whole life insurance is more expensive and complex but provides lifelong coverage and builds cash value over time. It can be used for end-of-life planning, such as covering funeral expenses and leaving an inheritance. However, it is more difficult to fit into a budget.

The best type of life insurance depends on your individual needs and budget. You can also have a combination of both policy types. It is recommended to work with an insurance expert to set up a term policy that suits your needs and provides flexibility for your future.