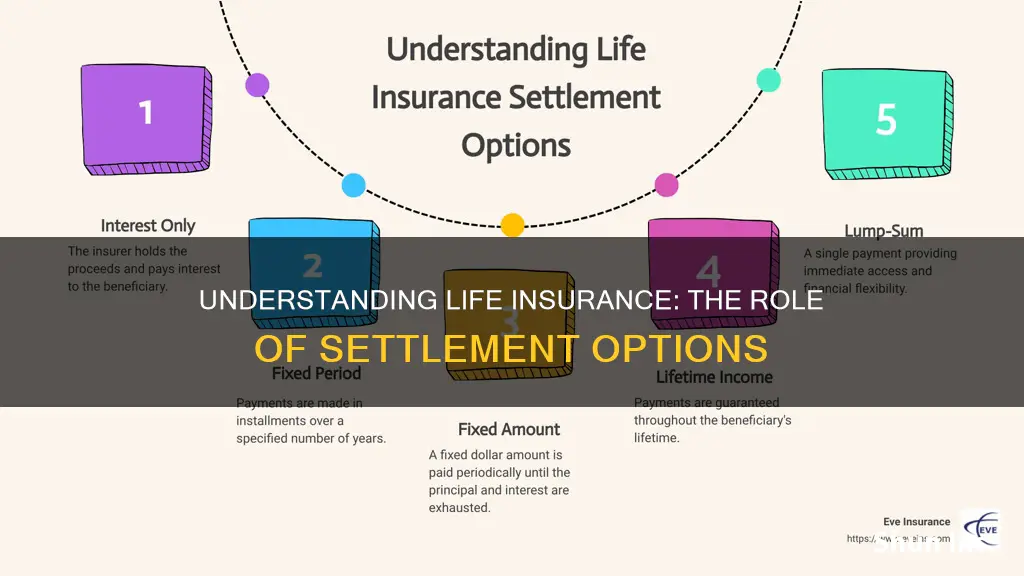

Life insurance is a financial tool that provides a safety net for individuals and their families in the event of the insured's death. One of the key features of life insurance policies is the option to choose between different settlement options. These options determine how the death benefit is paid out, offering policyholders flexibility and control over how they receive the financial support. Understanding the purpose of settlement options is crucial for making informed decisions about life insurance, ensuring that the chosen plan aligns with one's financial goals and needs.

What You'll Learn

- Financial Security: Settlement options provide a safety net for beneficiaries in the event of the insured's death

- Flexibility: These options allow policyholders to choose when and how to receive their death benefit

- Tax Advantages: Settlement options can offer tax benefits, depending on the jurisdiction and policy type

- Customized Payouts: They enable tailored payout structures to meet individual financial goals and needs

- Peace of Mind: Knowing about settlement options can reduce anxiety and provide reassurance to policyholders and their families

Financial Security: Settlement options provide a safety net for beneficiaries in the event of the insured's death

The concept of settlement options in life insurance is an essential aspect of financial planning, offering a safety net and peace of mind to both the insured and their beneficiaries. When an individual purchases life insurance, they have the option to choose how the death benefit is distributed upon their passing. This decision is crucial as it directly impacts the financial security of the insured's loved ones.

In the event of the insured's death, the settlement options come into play, ensuring that the beneficiaries receive the intended financial support. These options provide a structured approach to managing the payout, allowing the insured to specify how the death benefit should be distributed. The primary purpose is to offer flexibility and control, ensuring that the financial needs of the beneficiaries are met according to the insured's wishes.

One common settlement option is a lump-sum payment, where the entire death benefit is paid out as a single amount. This option provides immediate financial relief to the beneficiaries, allowing them to cover immediate expenses, such as funeral costs, outstanding debts, or any other short-term financial obligations. It offers a quick and efficient way to provide financial assistance during a challenging time.

Another settlement option is an income stream, where the death benefit is paid out over a period, providing a regular income to the beneficiaries. This can be particularly beneficial for those who rely on a consistent financial flow, such as a spouse or dependent children. By choosing this option, the insured can ensure that their beneficiaries have a steady source of income, allowing them to maintain their standard of living and cover essential expenses.

Additionally, some life insurance policies offer flexible settlement options, allowing the insured to customize the payout according to their specific needs. This flexibility enables individuals to cater to the unique circumstances of their beneficiaries, ensuring that the financial support is tailored to their requirements. For instance, a beneficiary may need a lump sum to start a business, while another might require a steady income to fund their education.

In summary, settlement options in life insurance are designed to provide financial security and peace of mind. By offering various distribution methods, such as lump-sum payments or income streams, these options empower the insured to make decisions that best suit the needs of their beneficiaries. This ensures that the financial impact of the insured's passing is minimized, and the loved ones are provided with the necessary support during a difficult period.

Life Insurance: Cheaper With Union?

You may want to see also

Flexibility: These options allow policyholders to choose when and how to receive their death benefit

The concept of settlement options in life insurance is designed to provide policyholders with a degree of flexibility and control over their death benefit, which is a crucial aspect of the insurance policy. This flexibility is a significant advantage, allowing individuals to tailor their insurance plans to their specific needs and circumstances. One of the primary purposes of these options is to empower policyholders to make decisions regarding the timing and method of receiving the financial support intended for their beneficiaries upon their passing.

In the context of life insurance, the death benefit is the monetary amount paid out to the designated beneficiaries when the insured individual dies. Traditionally, this benefit was typically paid out as a lump sum, providing a one-time financial assistance to the beneficiaries. However, settlement options introduce a range of choices, ensuring that policyholders can select the most suitable option for their unique situations.

One of the key settlement options is the choice between a lump sum payment and an income stream. Policyholders can decide whether they want the entire death benefit to be paid out as a lump sum, providing a significant financial windfall to the beneficiaries. Alternatively, they can opt for an income stream, which involves receiving regular payments over a specified period. This option offers a steady financial flow, ensuring a consistent income for the beneficiaries, which can be particularly useful for long-term financial planning.

Additionally, some life insurance policies offer further flexibility by allowing policyholders to choose the frequency of payments. This means they can decide whether they want the death benefit paid out annually, semi-annually, quarterly, or even monthly. Such customization enables individuals to align the payment schedule with their financial goals and the needs of their beneficiaries. For instance, a policyholder might prefer annual payments to match the beneficiary's tax planning, ensuring efficient utilization of the death benefit.

The flexibility provided by settlement options is a powerful tool for policyholders, offering them the ability to adapt their life insurance policies to changing circumstances and personal preferences. It allows individuals to make informed decisions about their death benefit, ensuring that the financial support provided to their loved ones is managed according to their wishes. This level of control can provide peace of mind, knowing that the insurance policy is tailored to the specific needs of the policyholder and their beneficiaries.

Life Insurance and Credit: Any Connection?

You may want to see also

Tax Advantages: Settlement options can offer tax benefits, depending on the jurisdiction and policy type

The settlement options in life insurance policies can provide significant tax advantages, which can be a crucial factor for policyholders when considering their financial planning. These tax benefits vary depending on the country's regulations and the specific type of life insurance policy. Understanding these advantages is essential to maximizing the value of your insurance investment.

In many jurisdictions, life insurance policies are treated favorably from a tax perspective. When an insured individual passes away, the death benefit paid to the beneficiaries is often exempt from income tax. This means that the beneficiaries can receive a substantial tax-free sum, which can be a substantial financial benefit, especially for high-income earners or those with substantial estates. For example, in the United States, the proceeds of a life insurance policy are generally not subject to income tax, providing a clear tax advantage.

Additionally, certain settlement options, such as the option to receive a lump sum or periodic payments, can offer tax efficiencies. For instance, if a policyholder opts for a lump sum payment, they may be able to utilize that amount for immediate financial needs or investments, potentially reducing their taxable income for the year. This can be particularly advantageous for those who have already utilized their tax-free allowance or have other sources of income that could be taxed at a higher rate.

Furthermore, some life insurance policies offer tax-deferred growth options, allowing the cash value of the policy to accumulate tax-free until it is withdrawn. This feature can be beneficial for long-term savings and investment, as the policyholder can build a substantial fund over time without incurring annual tax liabilities. When the policy is surrendered or the death benefit is paid out, the growth may be taxed at a lower rate, especially if the policy has been in place for an extended period.

However, it is important to note that tax regulations can be complex and vary significantly between countries. Therefore, it is advisable to consult with a tax professional or financial advisor who can provide personalized guidance based on your specific circumstances and the laws of your jurisdiction. They can help you navigate the tax implications of different settlement options and ensure that your life insurance policy aligns with your overall financial goals and tax strategy.

Life Insurance Payouts: Taxable or Not?

You may want to see also

Customized Payouts: They enable tailored payout structures to meet individual financial goals and needs

The concept of customized payouts in life insurance is a powerful tool that allows individuals to shape their financial future according to their unique needs and aspirations. This feature is particularly valuable as it provides a level of flexibility and control that is often lacking in traditional insurance products. By offering tailored payout structures, life insurance companies empower policyholders to design a plan that aligns perfectly with their financial objectives.

One of the primary benefits of customized payouts is the ability to adapt the insurance policy to an individual's changing circumstances. Life insurance is not a one-size-fits-all product; it is a long-term commitment that should evolve with the policyholder's life stage. For instance, a young professional might opt for a policy with a higher death benefit to ensure their family's financial security, while a retiree may prioritize a steady income stream to cover living expenses. Customized payouts allow for such adjustments, ensuring that the insurance policy remains relevant and beneficial throughout the policyholder's life.

These tailored payout structures can take various forms, each catering to different financial goals. For instance, a policyholder might choose to receive a lump sum payment upon the insured's passing, which can be used to pay off debts, fund education, or provide a financial cushion for loved ones. Alternatively, some policies offer periodic payments, providing a consistent income stream that can be particularly useful for retirement planning or covering long-term expenses. The beauty of this customization lies in its ability to cater to diverse financial needs, ensuring that the insurance policy becomes a valuable asset rather than a static liability.

Furthermore, customized payouts can be designed to accommodate specific financial milestones and goals. For example, a policyholder might set up a payout structure that includes a significant sum for a child's wedding or a smaller, regular payment to support a business venture. This level of customization ensures that the life insurance policy becomes a versatile financial tool, capable of contributing to various life events and objectives.

In summary, customized payouts in life insurance are a critical aspect of tailoring the policy to the individual's financial journey. They provide the flexibility to adapt to changing life stages, accommodate diverse financial goals, and ensure that the insurance policy remains a valuable and relevant asset. By offering these tailored payout structures, life insurance companies empower individuals to take control of their financial future, providing peace of mind and security for themselves and their loved ones.

Longevity and Life Insurance: Understanding the Oldest Age Limits

You may want to see also

Peace of Mind: Knowing about settlement options can reduce anxiety and provide reassurance to policyholders and their families

Understanding the settlement options available in life insurance policies can significantly alleviate concerns and offer a sense of security to both the policyholder and their beneficiaries. When an individual purchases a life insurance policy, they essentially enter into a contract with the insurance company, agreeing to pay regular premiums in exchange for a financial benefit upon the occurrence of a specified event, typically the death of the insured. The settlement options are the various ways in which this financial benefit, often referred to as the death benefit, can be received.

One of the primary purposes of settlement options is to provide flexibility to policyholders, allowing them to choose the method that best suits their needs and circumstances. This flexibility is crucial as it empowers individuals to make decisions that align with their personal goals and financial situations. For instance, a policyholder might opt for a lump sum payment, which provides a one-time, full payout of the death benefit. This option can be particularly useful for those who wish to use the proceeds for immediate, large-scale financial needs, such as paying off debts or funding a child's education. Alternatively, some individuals may prefer a structured settlement, where the death benefit is paid out over a predetermined period, providing a steady income stream that can be valuable for long-term financial planning.

The availability of different settlement options also ensures that policyholders can adapt to changing circumstances. Life is unpredictable, and what might be a suitable financial plan today could change in the future due to various life events, such as marriage, the birth of children, or career advancements. By offering a range of settlement options, insurance companies enable policyholders to review and adjust their policies as their lives evolve, ensuring that the financial security provided by the life insurance remains relevant and effective.

Moreover, knowing about these settlement options can provide peace of mind to policyholders and their families. It ensures that the financial security promised by the insurance policy is not just a theoretical concept but a tangible, customizable benefit. This knowledge can reduce anxiety and uncertainty, especially during challenging times, as it provides a clear understanding of how the death benefit will be received and utilized. For beneficiaries, it means they can rely on a predetermined financial plan, knowing exactly how the proceeds will be distributed, which can be a significant source of comfort during a difficult period.

In summary, settlement options in life insurance are designed to offer policyholders and their families a sense of control, flexibility, and security. By understanding and utilizing these options, individuals can make informed decisions about their financial future, ensuring that the life insurance policy provides the necessary support when it is needed most. This knowledge empowers people to navigate life's uncertainties with greater confidence and peace of mind.

Life Insurance Disintermediation: Risks and CFA Implications

You may want to see also