Life insurance is a crucial financial tool that provides financial security and peace of mind for individuals and their loved ones. When choosing a life insurance policy, several key factors contribute to its effectiveness. Firstly, the coverage amount should be sufficient to cover essential expenses and provide for the family's long-term needs, such as mortgage payments, education costs, and living expenses. Secondly, the policy should offer a combination of term life and permanent life insurance to ensure coverage for a specific period and long-term financial protection. Additionally, considering the insurer's financial strength and reputation is essential to ensure timely and reliable payouts. Lastly, understanding the policy's terms, conditions, and exclusions is vital to make an informed decision and ensure the policy meets individual requirements.

What You'll Learn

- Affordability: Cost-effective premiums and coverage tailored to individual financial situations

- Comprehensive Coverage: Adequate protection for various risks, including death, disability, and critical illness

- Flexibility: Customizable policies to meet changing needs and life circumstances

- Financial Security: Ensures financial stability for dependents and long-term goals

- Trustworthiness: Reputable insurers with strong financial ratings and customer service

Affordability: Cost-effective premiums and coverage tailored to individual financial situations

When considering life insurance, affordability is a crucial aspect that often determines whether an individual can secure the necessary coverage. The cost-effectiveness of premiums is a key factor in making life insurance accessible to a wide range of people. A good life insurance policy should offer competitive rates that align with the policyholder's financial capabilities. This means that the premiums should be reasonable and not strain the individual's budget. It is essential to find a balance between the cost and the coverage provided, ensuring that the policy is not overly expensive while still offering adequate protection.

Tailoring the coverage to individual financial situations is an art that separates good life insurance from mediocre ones. Insurance providers should offer customizable plans that cater to diverse needs and circumstances. For instance, a young adult might opt for term life insurance, which provides coverage for a specific period, allowing them to secure their family's financial future without incurring long-term costs. On the other hand, an older individual might require a permanent life insurance policy to ensure their estate is protected and their beneficiaries are cared for. The flexibility to choose the coverage duration and amount based on personal financial goals is vital.

Affordability also extends to the overall value and benefits provided by the policy. A good life insurance company should offer comprehensive coverage options, such as accidental death and dismemberment (AD&D) riders, critical illness coverage, and waiver of premium clauses. These additional benefits can significantly enhance the policy's value without substantially increasing the premiums. By providing a range of optional riders and add-ons, insurance providers can customize the policy to meet specific needs, ensuring that the coverage is both affordable and comprehensive.

Furthermore, understanding one's financial situation is essential in making informed decisions about life insurance. Policyholders should assess their income, expenses, savings, and debt obligations to determine the appropriate level of coverage. A financial advisor can be a valuable resource in this process, helping individuals navigate the complexities of life insurance and ensuring they select a policy that aligns with their financial goals. This personalized approach to affordability ensures that the chosen life insurance plan is not only cost-effective but also suitable for the individual's unique circumstances.

In summary, affordability in life insurance is about offering cost-effective premiums and flexible coverage options that cater to individual financial situations. It involves providing competitive rates, customizable plans, and valuable add-ons without compromising the policy's value. By understanding one's financial needs and seeking professional guidance, individuals can make informed decisions, ensuring they have the right life insurance coverage at a price they can afford. This approach to affordability is essential in making life insurance accessible and beneficial to a broad spectrum of policyholders.

Life Insurance: Understanding the Legal Requirements

You may want to see also

Comprehensive Coverage: Adequate protection for various risks, including death, disability, and critical illness

When considering what constitutes good life insurance, comprehensive coverage is a cornerstone of a robust policy. This type of coverage ensures that your loved ones are financially protected in the event of your untimely demise, providing a safety net for their future needs. Adequate protection against death is essential, as it offers a financial cushion to cover expenses such as funeral costs, outstanding debts, and ongoing living expenses, ensuring your family can maintain their standard of living.

In addition to death coverage, disability insurance is a critical component. This aspect of life insurance safeguards your income if you become unable to work due to illness or injury. It replaces a portion of your salary, helping to cover living expenses and maintain financial stability during a challenging period. Disability insurance is particularly important for those with dependents or significant financial commitments, as it prevents the loss of essential income.

Critical illness insurance is another vital element of comprehensive coverage. This type of insurance provides a lump-sum payment if you are diagnosed with a severe illness or condition that requires extensive treatment. It can cover the costs of specialized medical care, medications, and rehabilitation, ensuring you receive the best possible treatment without incurring substantial financial burdens. This coverage is especially valuable, as it addresses the potential financial impact of a critical illness, which can be devastating without proper insurance.

A good life insurance policy should offer a combination of these protections, tailored to your specific needs and circumstances. It is essential to assess your risk factors, lifestyle, and financial obligations to determine the appropriate level of coverage. Consulting with an insurance advisor can help you navigate the options and select the most suitable policy, ensuring you and your loved ones are adequately protected.

In summary, comprehensive coverage in life insurance includes death, disability, and critical illness protections. These components work together to provide a comprehensive safety net, ensuring your family's financial security and peace of mind. By understanding and addressing these various risks, you can make informed decisions about your life insurance, creating a solid foundation for a secure future.

Life Insurance Agents: Fiduciary Duty or Not?

You may want to see also

Flexibility: Customizable policies to meet changing needs and life circumstances

When it comes to life insurance, flexibility is a key feature that ensures your policy remains relevant and beneficial throughout your life's journey. Life is unpredictable, and your insurance should adapt to these changes. A good life insurance policy should offer customizable options, allowing you to tailor the coverage to your specific needs and evolving circumstances. This flexibility is essential to ensure that you are adequately protected when you need it the most.

As your life progresses, your insurance requirements will likely change. For instance, starting a family, purchasing a home, or experiencing career advancements might necessitate an increase in coverage. With a flexible policy, you can easily adjust the terms to reflect these life events. This might involve adding or removing beneficiaries, changing the death benefit amount, or even converting the policy to better suit your new financial situation. The ability to customize ensures that your insurance remains a reliable safety net, providing peace of mind as your life unfolds.

Furthermore, life insurance should adapt to your changing health and financial status. As you age, your health may require more frequent medical check-ups, and your insurance should accommodate these needs. Additionally, as your financial situation improves, you might want to increase the coverage to ensure a more substantial financial safety net for your loved ones. A flexible policy allows you to make these adjustments without the hassle of switching providers or starting the entire process over again.

Customizable policies often provide various riders and add-ons, allowing you to enhance your coverage. For example, you might opt for an accidental death rider, which increases the payout if your death is caused by an accident. Or, you could add a critical illness rider, providing financial support if you are diagnosed with a critical illness. These add-ons offer additional protection and can be tailored to your specific risks and priorities.

In summary, flexibility in life insurance is about ensuring your policy evolves with your life. It empowers you to make changes when necessary, whether it's adjusting coverage for new family members, modifying terms for changing health conditions, or increasing benefits as your financial situation improves. By choosing a provider that offers customizable policies, you gain the freedom to create a personalized insurance plan, ensuring that your loved ones are protected in all life's circumstances.

Aviva Life Insurance: Suicide Payouts and Their Conditions

You may want to see also

Financial Security: Ensures financial stability for dependents and long-term goals

Financial security is a cornerstone of good life insurance, providing a safety net for your loved ones and long-term financial goals. It ensures that your family is protected in the event of your untimely passing, and it also helps you plan for the future. Here's a detailed look at why financial security is essential and how it relates to life insurance:

Protecting Dependents: Life insurance is a vital tool for protecting your dependents, which typically include your spouse, children, or anyone who relies on your income. When you have dependents, your financial responsibilities extend beyond your own needs. A life insurance policy can provide a regular income stream to cover their living expenses, education costs, and other essential needs. This financial support ensures that your dependents can maintain their standard of living and have the resources to make important life decisions, such as choosing a suitable education or pursuing career goals, even if you're no longer there to provide directly.

Long-Term Financial Goals: Financial security through life insurance also helps you plan for long-term goals and milestones. This includes major life events like purchasing a home, funding your children's education, starting a business, or planning for retirement. A life insurance policy can provide the necessary financial resources to achieve these goals. For instance, the death benefit from a life insurance policy can be used to pay off a mortgage, ensuring your family doesn't face financial strain when making a significant purchase. It can also cover the costs associated with higher education, allowing your children to pursue their dreams without the burden of overwhelming debt.

Peace of Mind: Knowing that your financial affairs are in order provides peace of mind. It reduces the stress and worry associated with the future, allowing you to focus on the present and enjoy your life. With proper life insurance coverage, you can rest assured that your family will be taken care of, and your long-term goals will remain on track, even if something happens to you. This peace of mind is invaluable and contributes to overall well-being.

Building Wealth: Life insurance can also be a strategic tool for building wealth. Certain types of life insurance policies, such as whole life or universal life, offer investment components. These policies allow you to accumulate cash value over time, which can be borrowed against or withdrawn to fund various financial goals. This feature can be particularly useful for long-term wealth creation and ensuring financial security for your dependents in the future.

In summary, financial security is a critical aspect of good life insurance. It ensures that your dependents are protected and that your long-term financial goals remain achievable. By providing a safety net and the means to plan for the future, life insurance empowers you to take control of your financial destiny and provide for those who depend on you. It is a wise investment in your family's well-being and future.

Trustworthiness: Reputable insurers with strong financial ratings and customer service

When considering life insurance, trustworthiness is a critical factor that can significantly impact your decision. It's essential to choose an insurer that is reliable, financially stable, and committed to providing excellent customer service. Here's why these aspects are crucial:

Financial Stability: Reputable life insurance companies should have a strong financial foundation. Look for insurers with high financial ratings from independent agencies like A.M. Best, Moody's, or Standard & Poor's. These ratings indicate the insurer's ability to meet its financial obligations and provide policyholders with a secure investment. A financially strong insurer can ensure that your policy is well-managed and that your benefits are protected, even in challenging economic times.

Customer Service Excellence: Trustworthy insurers understand the importance of customer satisfaction. They should offer prompt and efficient service, ensuring that policyholders can easily access information, file claims, and receive assistance when needed. A company with a dedicated customer support team, multiple communication channels, and a history of addressing customer concerns is more likely to provide a positive experience. Quick response times, clear communication, and a willingness to help can make a significant difference in how you perceive and utilize your life insurance policy.

Transparency and Communication: Trustworthy insurers are transparent about their policies, terms, and conditions. They provide clear explanations of coverage, exclusions, and any potential changes to the policy. Regular updates and notifications about policy changes or updates can help you stay informed. Additionally, insurers should be open to answering your questions and addressing any concerns you may have, ensuring you fully understand your coverage.

Long-Term Reliability: Choosing a reputable insurer with a history of stability and a positive track record is essential. This ensures that your policy remains valid and that the insurer is committed to honoring its promises over the long term. A trustworthy insurer will be there to provide financial security and peace of mind, especially during challenging life events or when you need to make a claim.

By considering these aspects of trustworthiness, you can make an informed decision when selecting a life insurance provider. It's about finding an insurer that not only offers competitive products but also demonstrates a strong commitment to its customers, ensuring a reliable and secure financial partnership.

Executor's Power: Changing Life Insurance in Indiana Post-Death

You may want to see also

Frequently asked questions

The cost of life insurance is influenced by several factors, including age, health, lifestyle, and the amount of coverage desired. Younger individuals generally pay lower premiums as they are considered less risky. Good health and a healthy lifestyle can also result in more affordable rates, as insurers may offer discounts for non-smokers, regular exercise, and maintaining a healthy weight. Additionally, the desired coverage amount plays a significant role, with higher coverage amounts typically leading to higher premiums.

Adequate coverage depends on various personal and financial considerations. It's essential to evaluate your current financial obligations, such as mortgage or rent, children's education costs, outstanding debts, and future expenses. Multiply these obligations by a reasonable number, often suggested as 10 to 15 years, to estimate the necessary coverage amount. It's also beneficial to consider your family's future needs, such as potential education costs for children or dependent relatives. Consulting with a financial advisor can help tailor the coverage to your specific circumstances.

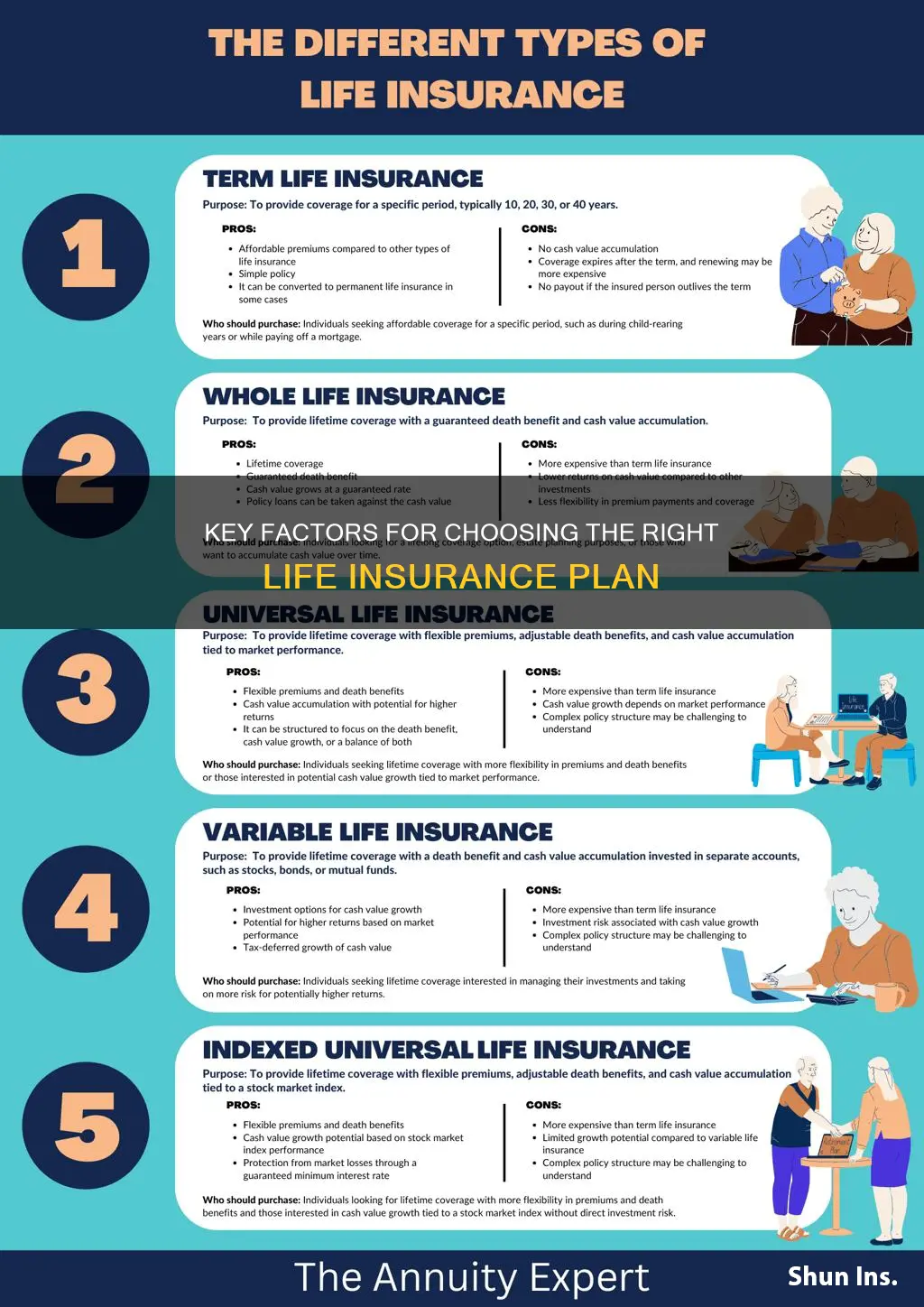

Yes, there are several types of life insurance policies, each with its own advantages. Term life insurance provides coverage for a specified period, offering a straightforward and often cost-effective solution for a defined period. Permanent life insurance, on the other hand, includes a savings component and remains in force for the insured's entire life. Whole life insurance is a type of permanent policy with fixed premiums and a cash value accumulation. The best type of insurance depends on your individual needs and financial goals. For short-term needs, term life might be sufficient, while permanent insurance could be more suitable for long-term financial planning.

Insurers heavily consider an individual's health and medical history when assessing risk and determining premiums. Pre-existing conditions, chronic illnesses, or recent medical procedures can impact the insurance company's decision and the cost of coverage. It's essential to be transparent and accurate when disclosing health information. Some insurers may offer guaranteed issue policies, which do not require a medical examination but may have higher premiums. However, for comprehensive coverage, a medical exam is often necessary to assess the insured's overall health and risk profile.