Life insurance provides financial support to beneficiaries after the death of the insured person, helping to cover expenses such as funeral costs, debts, mortgage payments, and income replacement. While life insurance covers most causes of death, there are some exclusions, such as suicide, dangerous or illegal activities, substance abuse, and misrepresentation. Additionally, pre-existing medical conditions can increase premiums or prevent individuals from obtaining coverage. Critical illness cover and income protection insurance are two types of supplemental insurance that can provide additional financial protection in the event of illness or injury. Critical illness cover provides a financial payout for specific illnesses or conditions, while income protection insurance replaces a portion of lost income if the insured is unable to work due to health reasons.

| Characteristics | Values |

|---|---|

| Can life insurance cover sickness? | Yes, but it depends on the type of insurance and the illness. |

| Types of life insurance | Term life insurance, whole life insurance, universal life insurance, and guaranteed issue policies. |

| Term life insurance | Typically the cheapest form of coverage, even with a pre-existing condition. |

| Whole life insurance | Offers lifetime coverage and is often the only option for those with severe pre-existing conditions. |

| Universal life insurance | Allows for flexible payments but can be expensive. |

| Guaranteed issue policies | May have restricted coverage for the first few years and often have lower maximum payouts. |

| Pre-existing conditions | A wide range of health problems, including heart disease, obesity, and COVID-19. |

| Impact of pre-existing conditions | May increase rates, limit the death benefit, or prevent someone from applying for coverage. |

| Coverage for sickness | May depend on the illness, the policy, and whether it is a pre-existing condition. |

| Exclusions | Suicide, dangerous or illegal activities, substance abuse, and misrepresentation. |

What You'll Learn

- Critical illness cover can provide a financial payout for specific illnesses or conditions

- Life insurance may cover children or dependants

- Pre-existing conditions can increase your rates or prevent you from applying for coverage

- Life insurance policies can be invalidated by dangerous or illegal activities

- Disability income insurance can protect lost wages if you are too sick to work

Critical illness cover can provide a financial payout for specific illnesses or conditions

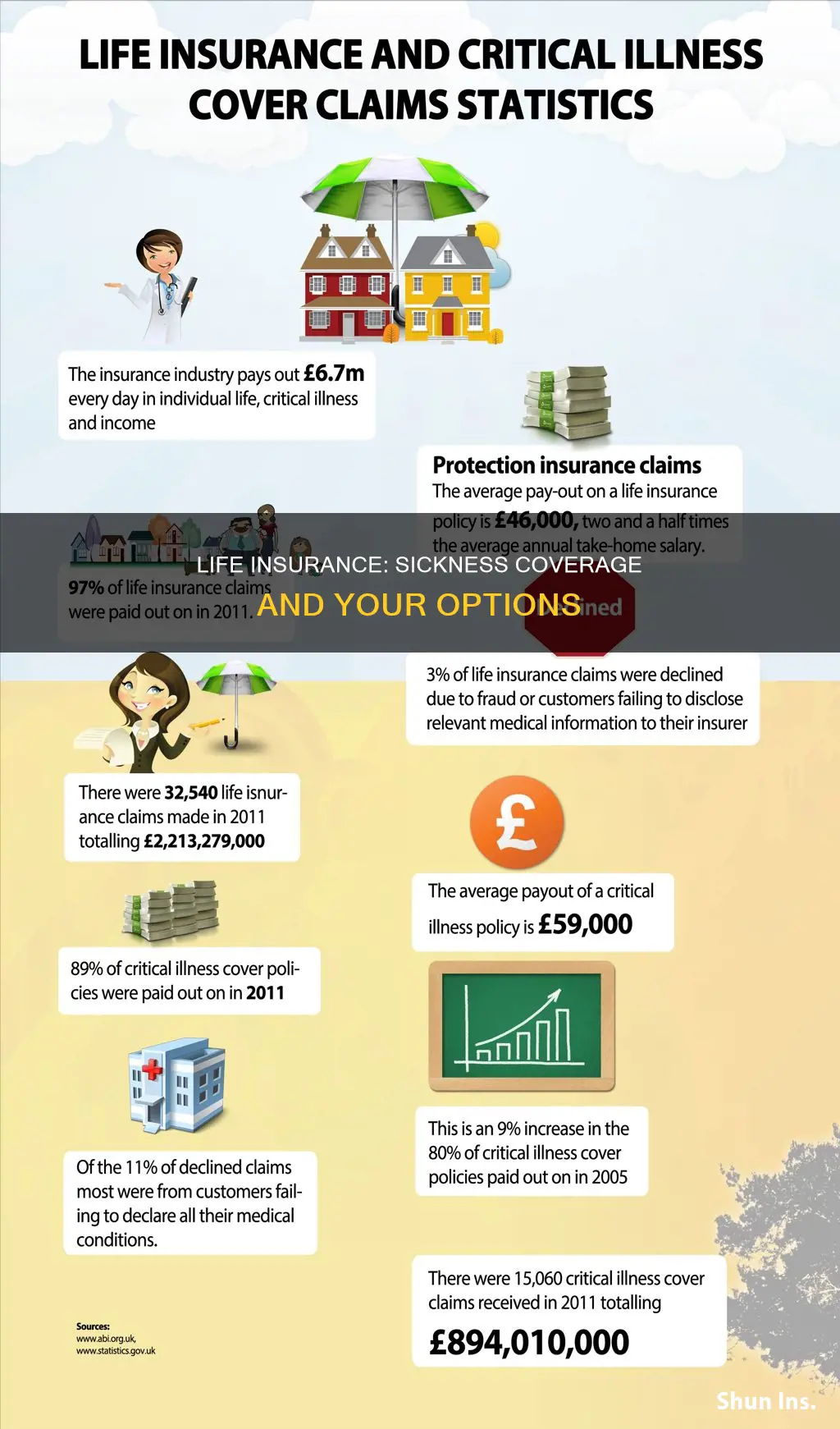

Critical illness cover typically provides a financial payout if you are diagnosed with an illness or condition that is covered by your policy, subject to a valid claim. The conditions covered can vary but may include some forms of cancer, Alzheimer's/dementia, and heart disease. The payout from a successful claim can be used to pay for private treatment, make your home more accessible, or cover living expenses while you focus on your health.

It's important to note that critical illness cover may not apply to pre-existing conditions, and there may be a defined period you must survive after a new diagnosis for the cover to apply. Additionally, receiving a payout usually depends on providing accurate information at the time of application.

Critical illness cover can be particularly reassuring for those with significant financial commitments, such as the primary earner in a family. Some insurers may also allow you to add your children to a critical illness policy, providing additional peace of mind.

When considering critical illness cover, it's essential to review the policy terms carefully to understand what is covered and any exclusions that may apply. While combined life and critical illness policies are available, separate policies may be more expensive but allow for claims to be made for both a critical illness and the death of a policyholder.

In conclusion, critical illness cover can provide valuable financial support during challenging times, helping to cover lifestyle changes, mortgage repayments, or general living costs. By understanding the features and limitations of critical illness cover, individuals can make informed decisions about their insurance needs and ensure they have the necessary protection in place.

Life Insurance and Suicide: UK Payout Scenarios

You may want to see also

Life insurance may cover children or dependants

Life insurance is a contract between you, the policyholder, and a life insurance company. The policyholder makes regular premium payments and follows the terms within the plan, and the company provides a death benefit or payout to the beneficiaries when the policyholder passes away. The death benefit can be used to cover expenses such as end-of-life costs, debts, and essential day-to-day purchases.

Life insurance policies often include additional benefits through riders, which can be purchased for an additional charge. One such rider is the disability waiver, which covers the policyholder in the event that they become sick, injured, or disabled and can no longer work. The insurer will then provide a waiver of the monthly deduction for the cost of insurance. The specific conditions under which this rider applies will be outlined in the policy.

In addition to the death benefit and riders, some life insurance policies also include a cash value component. This is essentially a tax-deferred savings account that grows over time and can be borrowed against or withdrawn. However, withdrawals or loans against the cash value may generate an income tax liability and reduce the account value and death benefit.

While the specific terms of each policy may vary, it is possible to add children or dependents to a critical illness cover policy. This ensures that they are also covered in the event of a critical illness diagnosis. It is important to carefully review the policy terms and conditions to understand the specific coverage, exclusions, and age restrictions for children or dependents.

By including children or dependents on a critical illness policy, families can benefit from added peace of mind and financial protection. This can be especially important if the primary earner becomes ill and is unable to work, as the policy can help cover living expenses, medical treatment, or necessary lifestyle changes.

In summary, life insurance can provide financial support for beneficiaries in the event of the policyholder's death, and certain riders can offer additional benefits during the policyholder's lifetime. Critical illness cover can be extended to children or dependents, providing reassurance and a financial safety net for the entire family.

AARP Life Insurance: Can It Be Cancelled?

You may want to see also

Pre-existing conditions can increase your rates or prevent you from applying for coverage

Pre-existing conditions can have a significant impact on your life insurance options, as they may increase your rates or even prevent you from obtaining coverage altogether. This is because insurers use health as a key factor in determining the cost of coverage, and pre-existing conditions can indicate a higher risk of early or unexpected death.

When it comes to life insurance, pre-existing medical conditions cover a wide range of health issues, including cardiovascular disease, heart conditions requiring a pacemaker, irritable bowel syndrome, pulmonary heart disease, and rheumatoid arthritis. These conditions can vary in severity and their impact on your insurance options.

Insurers typically group applicants into rate classes based on their health, such as standard, preferred, or super preferred. If you have a pre-existing condition, you may only qualify for substandard rates, resulting in higher costs. The specific rate class you fall into will depend on the insurer's underwriting process, which assesses an applicant's risk profile. Some insurers may be more flexible about certain health conditions than others, so it is important to shop around.

The cost of life insurance with a pre-existing condition will depend on the severity and nature of the condition. For example, a condition that is well-managed or in remission may result in lower rates than a condition that is not under control. Additionally, certain pre-existing conditions may be excluded from coverage altogether, such as illnesses that were present before the policy was taken out.

If you have a pre-existing condition, there are still options available to obtain life insurance coverage. Guaranteed acceptance policies, for example, do not require a medical exam or health questions on the application, making them ideal for those with severe pre-existing conditions. However, these policies usually come with higher premiums and limited death benefits, typically capped at around $25,000.

Another option is simplified issue life insurance, which has fewer requirements to qualify and can offer coverage up to $250,000. However, these policies may disqualify individuals with certain high-risk illnesses or recent diagnoses. It is important to be honest when applying for simplified issue life insurance, as providing inaccurate information can result in coverage being cancelled.

In summary, while pre-existing conditions can increase rates or prevent you from applying for life insurance coverage, there are alternatives available. It is important to consult an independent insurance agent who can help you find the lowest rate and determine the best option for your specific circumstances.

Life Insurance Options: Minnesota Life's Whole Life Insurance

You may want to see also

Life insurance policies can be invalidated by dangerous or illegal activities

Life insurance policies can provide peace of mind and financial protection for your loved ones in the event of your death. However, it's important to understand that certain activities can invalidate your policy, leaving your beneficiaries without the expected payout. Engaging in dangerous or illegal activities is one of the main reasons why a life insurance claim may be denied. Here are some important considerations regarding how dangerous and illegal activities can impact your life insurance coverage:

Dangerous Activities:

Participating in dangerous activities or having a dangerous occupation can affect your life insurance coverage. Certain hobbies and occupations are considered risky by insurance companies due to their increased potential for injury or death. These can include activities such as skydiving, rock climbing, scuba diving, and aviation. If you engage in these activities, your insurer may deny benefits or require you to pay higher premiums. Some companies may even add an exclusion to your policy, specifically prohibiting payments if death occurs while engaged in these activities. It's crucial to disclose any risky activities during the application process to avoid issues with your coverage.

Illegal or Criminal Activities:

Death while participating in illegal or criminal activities is a standard exclusion in life insurance policies. If the insured dies while committing a crime or engaging in illegal behaviour, the insurance company will typically deny the claim, and beneficiaries will not receive any payout. This includes situations such as robbing a bank, stealing a car, or driving under the influence of drugs or alcohol. It's important to note that insurance companies have the right to decide which illegal activities they include in their exclusion clauses, so be sure to carefully review your policy for specific details.

Disclosure and Honesty:

When applying for life insurance, it's essential to be honest and disclose any relevant information. Failure to disclose dangerous or illegal activities may result in your policy being invalidated. Insurance companies have methods to identify fraud, and misrepresenting your activities could lead to a rejected claim and even recording in industry databases, impacting your chances of obtaining coverage from other companies. Being transparent during the application process ensures that your policy is valid and provides accurate coverage for your specific circumstances.

Understanding Exclusions:

Life insurance policies typically outline the specific exclusions that apply to dangerous and illegal activities. These exclusions are controlled at the state level, but insurance companies have the right to decide what they include in their policies. When purchasing a policy, carefully review the exclusions and ask questions if needed. Understanding the specific activities that are excluded will help you make informed decisions about your coverage and ensure that your beneficiaries are protected in the event of your death.

High-Risk Policies:

If you engage in dangerous or illegal activities, you may still be able to obtain life insurance coverage through high-risk policies. Some insurance companies offer policies specifically for individuals who participate in risky behaviours or occupations. These policies may come with higher premiums or additional exclusions, but they provide an option for those who may not qualify for standard coverage. It's important to shop around and compare policies to find the right coverage for your needs.

Life Insurance at 65: What You Need to Know

You may want to see also

Disability income insurance can protect lost wages if you are too sick to work

Income is a critical component of your standard of living. If you are unable to work due to sickness or injury, disability income insurance can help protect you and your family from financial uncertainty by offering coverage for lost wages. This type of insurance is designed to replace a portion of your lost income, typically ranging from 40% to 70% of your pre-disability salary, depending on your individual circumstances.

Disability income insurance is especially important considering that many Americans are financially unprepared for a period of disability. For example, 50% of adult Americans have no savings set aside for emergencies, and 25% of today's 20-year-olds will become disabled during their careers. By investing in disability income insurance, you can ensure that you have a source of income to help cover your expenses during a challenging time.

It is essential to understand the difference between short-term and long-term disability insurance. Short-term disability insurance is typically defined as coverage for 70-180 days and is often employer-paid. On the other hand, long-term disability insurance kicks in after short-term coverage has expired and can extend for years or even until you reach the age of 65, depending on the employer's offering.

When evaluating your options, it is crucial to determine the real cost of protecting your income. Disability income insurance generally costs between two and three percent of your salary. For example, if you earn $100,000 per year, you might spend around $2,000 to $3,000 annually for coverage.

In addition to disability income insurance, you may also want to consider supplemental insurance to strengthen your protection. Basic disability income insurance often has caps and may not compensate for bonuses, commissions, or profit sharing. Supplemental disability income insurance, obtained through your employer or independently, can help cover portions of your income that basic insurance may not.

Get Licensed: Ohio Life Insurance in Easy Steps

You may want to see also

Frequently asked questions

Yes, but it may be more expensive and you may have to shop around. Some companies will provide cheap quotes for the coverage you need. If you are unable to pass the underwriting stage, you can look into policies such as no medical exam or guaranteed acceptance.

Short-term disability insurance is generally defined by employers as falling within 70-180 days and is often paid by the employer. Long-term disability insurance kicks in after short-term coverage has expired and may extend for years or until you are 65, depending on the employer's offering.

Critical illness cover provides a financial payout if you are diagnosed with an illness or condition covered by your policy. You can use the money to pay for private treatment, make your home more accessible, or cover living expenses while you focus on your health.

Some companies may count COVID-19 as a pre-existing condition and ask you to reapply after you recover.