Minnesota Life Insurance Company offers a range of life insurance products, including term, whole, and universal life policies. The company is a subsidiary of Securian Financial and has been in business since 1880. Minnesota Life provides coverage in all states except New York and has a strong financial standing, evidenced by its high coverage limits and minimal customer complaints. The company offers customizable coverages, allowing policyholders to add riders for personalized protection. While Minnesota Life does not provide online quotes, individuals can connect with financial professionals or utilize group policies through their employers to obtain coverage.

| Characteristics | Values |

|---|---|

| Type of Insurance | Whole life insurance |

| Provider | Minnesota Life Insurance Company |

| Parent Company | Securian Financial Group |

| Location | St. Paul, Minnesota |

| Coverage | Available in 49 US states (not available in New York) |

| Coverage Amount | Up to $65 million |

| Coverage Options | Term, permanent, and long-term care |

| Riders | Two accelerated death benefit riders included at no cost on some policies |

| No-Medical-Exam Option | Available to eligible applicants via the WriteFit Underwriting program |

| Online Quotes | Not available |

| Contact | 1-833-810-8260 |

What You'll Learn

Minnesota Life Insurance offers term, whole, and universal life insurance

Minnesota Life Insurance offers a range of life insurance products, including term, whole, and universal life insurance policies. The company provides coverage in 49 US states, excluding New York, and has a strong financial position, with over $1.4 trillion in life insurance policies in force.

Term Life Insurance

Minnesota Life Insurance offers two types of term life insurance policies: Advantage Elite Select Term and Convertible Annual Renewable Term. These policies provide temporary coverage with fixed death benefits and premiums. The Advantage Elite Select Term policy has term lengths of 10, 15, 20, or 30 years, while the Convertible Annual Renewable Term policy offers a single 10-year term that renews annually with increasing premiums.

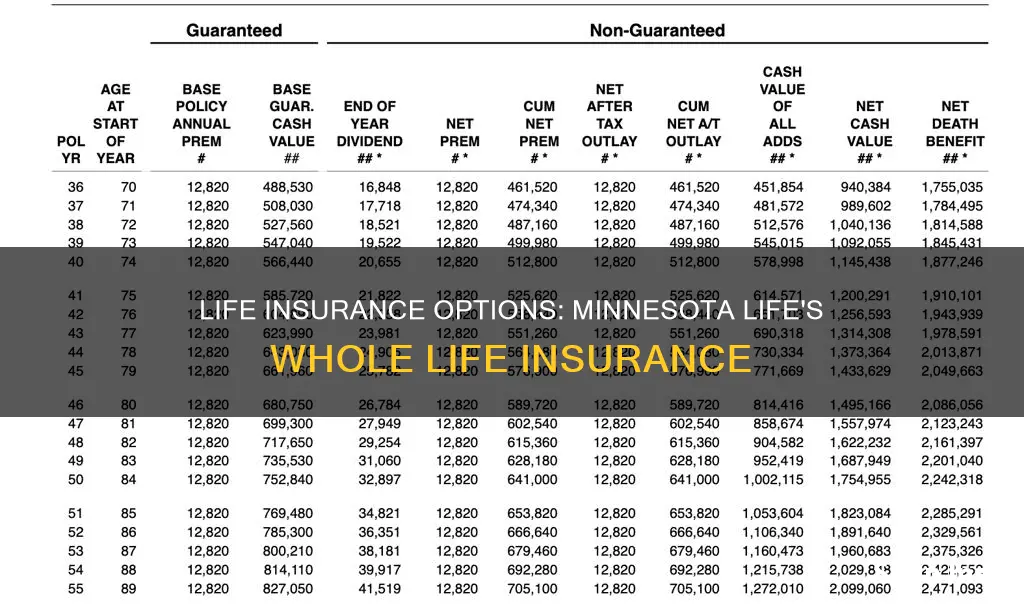

Whole Life Insurance

Whole life insurance is a type of permanent life insurance that provides lifetime coverage, a fixed death benefit, and premiums. Minnesota Life's whole life policies also include a cash value component that grows tax-deferred at a fixed interest rate. The SecureCare III whole life policy includes long-term care benefits, allowing access to long-term care indemnity benefits if needed.

Universal Life Insurance

Minnesota Life Insurance offers both variable universal and indexed universal life insurance policies. These policies provide lifetime coverage, flexible death benefits, adjustable premiums, and a cash value component. Variable universal policies allow direct investment of the cash value into the market through various subaccount choices, while indexed universal policies tie the growth of the cash value to the performance of an underlying index.

Pros and Cons of Minnesota Life Insurance

Minnesota Life Insurance has high coverage limits, often up to $65 million, and offers the option to skip medical exams. They provide a variety of customizable life insurance policies and have strong financial strength ratings. However, a notable con is the lack of cost information and average quotes on their website, requiring potential customers to contact an agent for specific pricing details.

Mountain Climbing: Is Your Life Insurance at Risk?

You may want to see also

Minnesota Life Insurance is not available in New York

While Minnesota Life Insurance offers its products in every state except New York, it is important to note that the availability of specific policies and riders may vary depending on the state. The company has a broad selection of life insurance options, making it a good choice for those seeking high coverage limits and customizable protection. Their range of policies includes permanent and term life insurance, with the latter providing temporary coverage for a specific number of years.

Whole life insurance, a type of permanent policy offered by Minnesota Life, provides lifetime protection along with fixed premiums and a guaranteed death benefit. It also includes a cash value component that grows at a fixed interest rate, allowing policyholders to borrow against it if needed. This type of coverage is generally more expensive than term insurance but offers more guarantees.

Universal life insurance is another form of permanent coverage offered by Minnesota Life. It builds cash value, similar to whole life, but offers flexible death benefits and adjustable premiums. The cash value in a universal life policy grows based on current interest rates and can be accessed by the policyholder.

Minnesota Life also provides variable universal life insurance, which is similar to universal life but with a key difference. In variable universal life policies, the cash value is invested in the stock market, offering the potential for higher growth but also carrying the risk of losing money if the market performs poorly.

While Minnesota Life Insurance is not available in New York, there are alternative options for those seeking life insurance coverage in the state. It is recommended to research and compare different insurance providers to find the best fit for your specific needs and requirements.

Life Insurance and Financial Aid: What's the Connection?

You may want to see also

Minnesota Life Insurance is a subsidiary of Securian Financial

Minnesota Life Insurance Company, a subsidiary of Securian Financial, offers a wide array of life insurance policies that can be purchased via financial professionals and are also offered as group policies. Its offerings include term, whole, and universal life policies. Some of these can come with additional coverages included in the basic price, while others may come at an extra cost. That can allow policyholders to customize these policies to better suit their needs.

Securian Financial Group is the parent corporation of Minnesota Life Insurance. Securian Financial Group is one of the largest insurers in the U.S., with over $1.4 trillion in life insurance policies in force. In 2021, Minnesota Life provided $1.4 trillion of in-force life insurance protection and paid out almost $5 billion in benefits.

Minnesota Life sells a wide range of policies, including term, universal life, whole life, equity-indexed universal life, and variable life. For comparison, some of its competitors only offer two or three policy types. Minnesota Life also offers no-medical-exam life insurance to eligible applicants via its WriteFit Underwriting program. Policies may even be issued the same day that you apply.

Securian, the parent company of Minnesota Life, has an A+ (Superior) rating from AM Best, the second-highest grade AM Best bestows. This rating suggests that the company has superior financial strength and claims-paying ability. AM Best assesses the financial strength of insurers based on factors like balance sheet strength, operating performance, and total debt.

If you have a life insurance policy from Minnesota Life, the customer service is handled by its parent company, Securian. You can contact Securian by calling (833) 810-8260 or filling out the online contact form. The company’s business hours are Monday through Friday from 7 a.m. to 6 p.m. CT.

You can also download the Securian Financial mobile app to manage your life insurance policy, make payments, update your beneficiary, and more.

Military Life Insurance: Discharge and Your Coverage

You may want to see also

Minnesota Life Insurance has high coverage limits

Minnesota Life Insurance, an affiliate of Securian Life Insurance, offers a variety of policies with high coverage limits. The company was founded in 1880 and is based in St. Paul, Minnesota. In 2021, Minnesota Life provided $1.4 trillion of in-force life insurance protection and paid out almost $5 billion in benefits.

Minnesota Life sells a wide range of policies, including term, universal life, whole life, equity-indexed universal life, and variable life. Some of its policies have exceptionally high coverage limits of up to $65 million, compared to other life insurance companies, which typically cap around $1 million.

The company offers term life insurance for up to 30 years, with coverage limits ranging from $99,999 to $3 million. Their whole life insurance policies offer lifelong coverage with a fixed death benefit and premiums, along with a cash value component that grows tax-deferred at a fixed interest rate.

Minnesota Life's universal life insurance policies include variable universal and indexed universal options, which offer lifelong coverage, flexible death benefits, adjustable premiums, and a cash value component. Their indexed universal policies have their cash value growth tied to the performance of an underlying index, providing an opportunity for faster growth than traditional universal life policies.

With a broad selection of life insurance products and high coverage limits, Minnesota Life is a strong option for those seeking substantial financial protection for their loved ones.

Drug Use and Life Insurance: What's the Connection?

You may want to see also

Minnesota Life Insurance has no online-only quote option

Minnesota Life Insurance is a financially strong insurer that offers a broad selection of life insurance products, including whole life insurance. However, one notable aspect of Minnesota Life Insurance is that it does not provide an online-only quote option for its customers. This means that those interested in purchasing a policy through Minnesota Life Insurance will need to take a different approach to obtaining a quote.

The absence of an online quote tool or application option on the Minnesota Life Insurance website may come as a surprise to some, especially in today's digital age where many companies prioritize online convenience. However, Minnesota Life Insurance takes a more traditional approach by requiring potential customers to connect with an agent or financial professional to receive a price estimate for term coverage or to initiate the application process. This process may be less immediate but ensures a personalized experience, allowing customers to have their questions answered and receive guidance in choosing a policy that suits their unique needs.

While the lack of an online quote option may be seen as a minor inconvenience, it is important to note that Minnesota Life Insurance stands out for having far fewer customer complaints than expected over the past three years, according to the National Association of Insurance Commissioners (NAIC). This suggests that customers are overall satisfied with the company's products and services, even without the convenience of online quotes. Additionally, Minnesota Life Insurance is known for its high coverage limits and the variety of riders available, allowing customers to customize their policies to their specific needs.

To obtain a quote from Minnesota Life Insurance, one must contact the company or a financial professional who sells its policies. This can be done by calling their customer service phone number at 1-833-810-8260 during their business hours, Monday through Thursday from 7:30 a.m. to 5:30 p.m. Central Time, and on Friday from 7:30 a.m. to 4:30 p.m. Alternatively, one can send a message through their online contact form and expect a response within one business day.

In summary, while Minnesota Life Insurance does not offer the convenience of online-only quotes, they make up for it with their strong financial standing, diverse product offerings, low complaint rate, and personalized customer service through their agents and financial professionals.

MetLife Group Insurance: Marijuana Testing and You

You may want to see also

Frequently asked questions

Yes, Minnesota Life offers whole life insurance policies.

Whole life insurance is a type of permanent life insurance that provides coverage for the entire life of the insured, as long as premiums are paid. It also builds a cash value over time, which can be accessed by the policyholder.

Whole life insurance offers lifelong protection and has fixed premiums and death benefits. It also allows policyholders to build a cash reserve, which can be used for various purposes, such as paying off debts or covering funeral expenses.

To purchase a whole life insurance policy from Minnesota Life, you need to contact a financial professional who sells their policies or go through your employer, financial institution, or association. You can use their online calculators to understand your insurance needs before contacting a representative.

Yes, Minnesota Life offers a range of life insurance policies, including term life insurance and universal life insurance. Term life insurance provides coverage for a specific number of years, while universal life insurance offers permanent coverage with flexible premiums, death benefits, and investment options.