Term life insurance is a valuable financial tool that provides coverage for a specific period, typically 10, 20, or 30 years. However, there may come a time when you decide to terminate or give up this insurance policy. Understanding when to do so is essential to ensure you're making the right financial decisions. This paragraph will explore the factors and circumstances that might prompt you to consider giving up term life insurance, including changes in your personal and financial situation, the fulfillment of your initial goals, and the availability of alternative coverage options.

| Characteristics | Values |

|---|---|

| Age | Typically, term life insurance is taken out until age 65 or 70, but it can vary based on individual circumstances and financial goals. |

| Financial Situation | When you no longer have a significant financial burden or dependents, and your long-term financial goals are met, it might be time to consider giving up term life insurance. |

| Health and Lifestyle | Improved health and a reduced risk profile can lead to lower insurance premiums, making it a good time to reassess your coverage. |

| Family Status | If you no longer have a family to support or if the financial impact of your death would be less severe, you may consider reducing or ending the policy. |

| Long-Term Financial Goals | Achieving major financial milestones, such as paying off a mortgage or saving for retirement, can indicate a shift in the need for term life insurance. |

| Alternative Coverage | If you have accumulated sufficient savings, investments, or other insurance products that can provide similar protection, it's a sign to review your term life insurance needs. |

| Premium Costs | High premium costs relative to your income and financial resources might suggest that term life insurance is no longer cost-effective. |

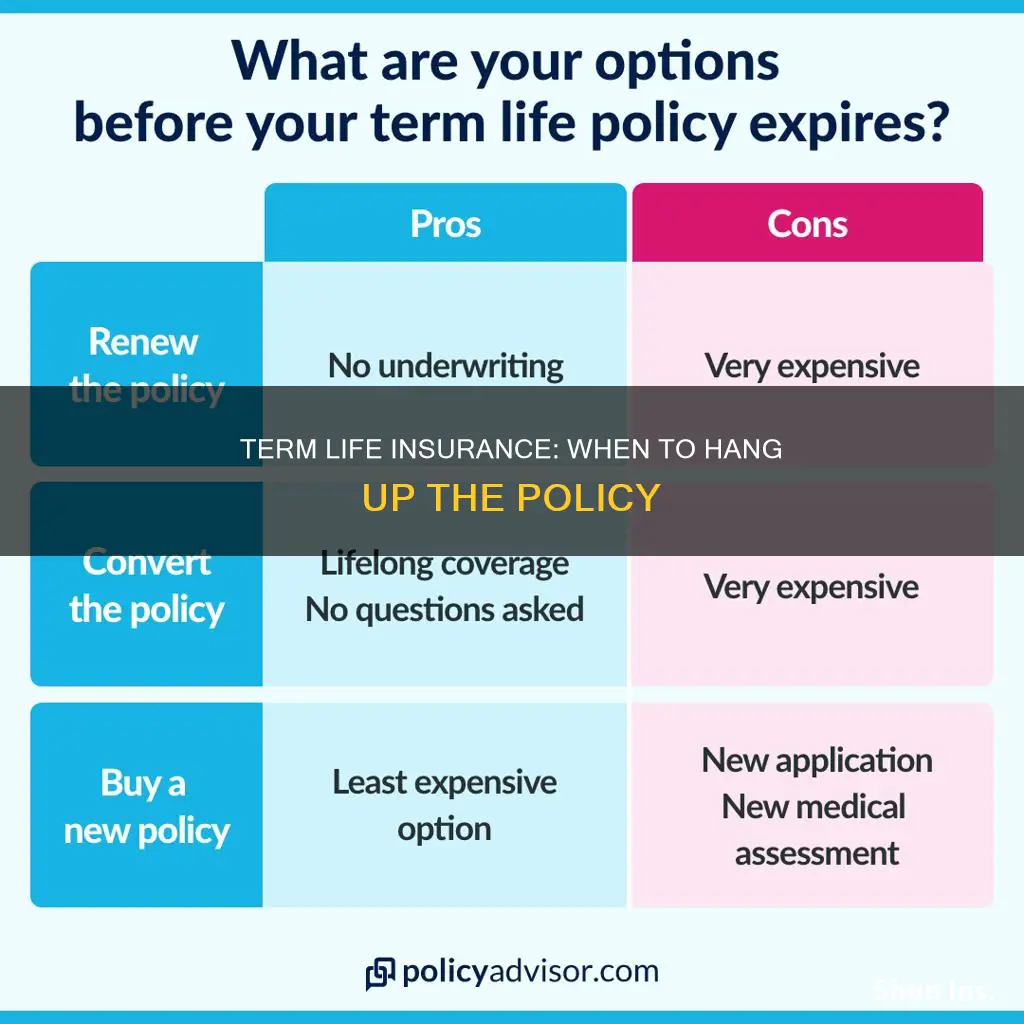

| Policy Duration | The end of the term period (e.g., 10, 20, or 30 years) is a natural point to reassess and decide whether to renew, convert, or terminate the policy. |

| Market Conditions | Economic factors and changes in insurance rates can impact the decision to continue or discontinue term life insurance. |

| Personal Preferences | Individual preferences and life changes may lead to a desire to simplify financial commitments, making it a personal decision to give up term life insurance. |

What You'll Learn

- Term Length: Evaluate when your term ends and consider extending coverage

- Financial Goals: Assess if your financial needs have changed since purchasing insurance

- Alternative Options: Research permanent life insurance as a long-term solution

- Budget Impact: Determine if the premium is no longer affordable

- Health Changes: Review health status; improved health may warrant re-evaluation

Term Length: Evaluate when your term ends and consider extending coverage

When it comes to term life insurance, the duration of your coverage is a critical aspect to consider, especially as your life circumstances and financial goals evolve. The term length you initially chose when purchasing the policy is typically a predetermined period, such as 10, 15, or 20 years. During this time, the policy provides a death benefit if you pass away, ensuring your loved ones are financially protected. However, as time passes, it's essential to evaluate whether your term is coming to an end and if it's the right time to consider extending your coverage.

One key factor to assess is your current financial situation and obligations. When you first purchased the term life insurance, you likely had specific goals in mind, such as covering mortgage payments, providing for children's education, or funding a retirement nest egg. As these obligations change, so might your need for coverage. For instance, if you've paid off your mortgage or your children have started their independent lives, the initial reason for the policy may have diminished. In such cases, you might consider reducing the coverage or even opting out of the policy, especially if the premiums have become a significant expense.

Another aspect to consider is your long-term financial planning. As you progress through life, your financial goals may shift. For example, you might have started a business, purchased a second home, or accumulated significant savings. In these scenarios, you may want to reassess your insurance needs and determine if extending your term life insurance coverage is still beneficial. Extending the term can provide continued financial security, especially if your business or investments are at a critical stage.

Additionally, life events can trigger a reevaluation of your insurance needs. Getting married, having another child, or experiencing a significant career advancement are all milestones that can impact your financial planning. If any of these events occur during the term of your policy, it's a good idea to review your coverage and consider whether extending the term would be advantageous. For instance, if you've recently started a family, extending the term can ensure your spouse and children are protected in the event of your untimely passing.

In summary, the term length of your life insurance policy is not set in stone and should be periodically reviewed. As your life circumstances change, so should your insurance coverage. By evaluating your current financial obligations, long-term goals, and significant life events, you can make an informed decision about whether to extend your term life insurance. Regularly assessing your insurance needs will help ensure that you maintain adequate protection without incurring unnecessary costs.

Life Coaching: Covered by Insurance?

You may want to see also

Financial Goals: Assess if your financial needs have changed since purchasing insurance

When considering whether to give up term life insurance, it's crucial to evaluate your current financial situation and goals. Term life insurance is a valuable tool for providing financial security during a specific period, typically 10, 20, or 30 years. However, as your life circumstances evolve, your insurance needs may change. Here's a step-by-step guide to help you assess if your financial goals have shifted and if it's time to reconsider your insurance coverage:

- Evaluate Your Current Financial Situation: Start by taking an honest look at your current financial standing. Calculate your net worth, including assets, investments, and savings. Consider your income, expenses, and any debts or liabilities you may have. This assessment will give you a clear picture of your financial health and help you understand the level of coverage you currently have. If your financial situation has improved significantly, with increased assets and a robust savings plan, you might no longer require the same level of insurance protection.

- Review Your Financial Goals: Reflect on your short-term and long-term financial goals. Have they changed since purchasing term life insurance? For instance, if you've recently started a family or purchased a home, your financial obligations and long-term goals may have expanded. Consider whether your insurance coverage still aligns with these new goals. If your family's needs have grown, or if you've taken on additional responsibilities, you might want to ensure that your insurance policy provides adequate coverage to support these changes.

- Assess the Duration of Your Needs: Term life insurance is designed to cover specific periods, often aligning with significant financial commitments like mortgages or children's education. If these commitments have been met or are approaching their end, it might be time to reevaluate your insurance needs. For example, if your children have started their careers and no longer require full-time financial support, or if your mortgage has been paid off, the need for extensive life insurance coverage may diminish.

- Consider Alternative Coverage: If you've determined that your financial needs have changed, explore alternative insurance options. Permanent life insurance, for instance, offers lifelong coverage and can be tailored to your current financial situation. It provides flexibility, allowing you to adjust the policy's value as your needs evolve. Additionally, consider whether you can reduce the coverage amount or convert the term policy to a permanent one to better suit your current financial goals.

- Consult a Financial Advisor: Seeking professional advice is essential when making significant financial decisions. A financial advisor can help you navigate the complexities of insurance policies and provide personalized recommendations. They can assist in assessing your financial goals, evaluating the appropriateness of your current coverage, and suggesting alternative solutions. This step ensures that your insurance choices remain aligned with your long-term financial objectives.

In summary, giving up term life insurance should be a thoughtful process that considers your evolving financial goals and circumstances. Regularly reviewing and reassessing your insurance needs is essential to ensure that you have the right coverage at the right time. By staying proactive and making informed decisions, you can optimize your financial security and peace of mind.

Cold Calling for Life Insurance: Strategies for Success

You may want to see also

Alternative Options: Research permanent life insurance as a long-term solution

When considering whether to give up term life insurance, it's important to explore alternative options that can provide long-term financial security. One such alternative is permanent life insurance, which offers several advantages over term life insurance. Here's why researching permanent life insurance could be a wise decision:

Long-Term Coverage: Permanent life insurance, as the name suggests, provides coverage for your entire life. Unlike term life insurance, which has a limited duration, permanent policies offer lifelong protection. This means that even as your needs change over time, you can maintain a consistent level of coverage without the worry of your policy expiring. For instance, if you initially purchased term life insurance to cover your mortgage payments, permanent life insurance can ensure that your family is protected even after the mortgage is paid off.

Cash Value Accumulation: One of the key features of permanent life insurance is the accumulation of cash value. A portion of your premium payments goes towards building a cash reserve, which grows tax-deferred. Over time, this cash value can be borrowed against or withdrawn, providing financial flexibility. For example, if you need to make a significant purchase or face a financial emergency, you can access the cash value without having to surrender the policy or take out a loan with potential interest charges.

Investment Opportunities: Permanent life insurance policies often come with an investment component. This allows you to allocate a portion of your premium payments into various investment options offered by the insurance company. These investments can potentially earn higher returns compared to traditional savings accounts. By carefully researching and selecting appropriate investment strategies, you can grow your policy's cash value and potentially increase the overall value of your permanent life insurance.

Tax Advantages: Permanent life insurance policies offer tax benefits that can be advantageous in the long run. The cash value growth within the policy is typically tax-deferred, meaning it can accumulate without being taxed annually. Additionally, policy loans and withdrawals may be tax-free, especially if used for qualified expenses. These tax advantages can make permanent life insurance a more efficient way to build wealth and secure your financial future.

Financial Planning Tool: Researching permanent life insurance can also provide valuable insights into your overall financial planning. It encourages you to assess your long-term financial goals and create a comprehensive strategy. By understanding the potential benefits of permanent life insurance, you can make informed decisions about your insurance needs and explore other financial instruments that align with your objectives.

In summary, giving up term life insurance doesn't necessarily mean giving up on long-term financial security. Exploring permanent life insurance as an alternative can offer lifelong coverage, cash value accumulation, investment opportunities, and tax advantages. It is a decision that should be made after thorough research and consideration of your personal financial goals and circumstances.

Life Insurance Ownership: A Surprising Statistic for Parents

You may want to see also

Budget Impact: Determine if the premium is no longer affordable

When considering whether to give up term life insurance, a critical aspect to evaluate is the budget impact of the premium payments. Term life insurance provides coverage for a specified period, typically 10, 15, or 20 years, and the cost of the policy is determined by various factors, including your age, health, lifestyle, and the amount of coverage you choose. Over time, as your financial situation changes, it's essential to reassess the affordability of these premiums.

One of the primary reasons to review your insurance budget is to ensure that the premium payments align with your current financial capabilities. Life circumstances can change significantly in a few years, and what was once a manageable expense might become a burden. For instance, if you've experienced a significant income increase, you might find that the premium for your term life insurance policy is now a small fraction of your overall earnings, making it more affordable. Conversely, if you've faced a financial setback, such as a job loss or a decrease in income, the premium might now constitute a larger portion of your budget, indicating a potential need to reconsider your insurance coverage.

To determine the budget impact, start by calculating your current monthly or annual budget. Include all essential expenses, such as housing, utilities, transportation, groceries, and any other regular outgoings. Then, identify the monthly or annual cost of your term life insurance premium. Compare this amount to your total budget to gauge its relative weight. If the premium is no longer a significant portion of your income, it might be an indication that you can afford to keep the policy. However, if the premium is eating into your savings or other financial commitments, it could be a sign that it's time to consider alternative insurance options or adjust the coverage amount.

Another factor to consider is the long-term financial goals you have. If you've achieved significant milestones, such as paying off student loans, saving for a house, or building an emergency fund, and you no longer require the extensive coverage provided by term life insurance, it might be a strategic move to give it up. By reassessing your budget and financial goals regularly, you can make informed decisions about your insurance needs and ensure that your coverage remains appropriate and affordable.

In summary, the budget impact of term life insurance premiums is a crucial factor in deciding when to give up this coverage. By evaluating your current financial situation, comparing premiums to your budget, and considering your long-term financial goals, you can determine if the cost of the policy is still justified. Regularly reviewing your insurance needs will help you make informed choices and ensure that your financial resources are allocated efficiently.

Dave Ramsey's Whole Life Insurance: What's the Deal?

You may want to see also

Health Changes: Review health status; improved health may warrant re-evaluation

When it comes to term life insurance, it's important to periodically review your coverage, especially if your health status has improved. This is because term life insurance policies are typically based on the health and lifestyle information provided at the time of purchase. If your health has significantly improved since you initially applied, it may be time to consider a re-evaluation of your insurance needs.

Improved health can be a result of various factors, such as successful weight loss, quitting smoking, or managing chronic conditions effectively. These positive health changes can lead to a lower risk profile for insurance companies, potentially allowing for better coverage options or even a reduction in premiums. For instance, if you've successfully managed a pre-existing condition and can now be considered less risky, you might be eligible for a lower-cost policy or even a conversion to a permanent life insurance policy.

Reviewing your health status regularly is crucial as it ensures that your insurance coverage remains appropriate for your current circumstances. Life insurance policies are designed to provide financial protection for your loved ones in the event of your death. If your health has improved, you may no longer need the full coverage amount, or you might be able to secure a more favorable rate. This is particularly important if you have a family or financial dependents who rely on the insurance payout.

During this review process, it's essential to be transparent about any changes in your health. Insurance companies often require medical examinations or health assessments to verify the information provided. By being honest about your improved health, you can make informed decisions about adjusting your policy. This might involve increasing the policy's coverage to better protect your loved ones or exploring alternative insurance options that better suit your current health status.

In summary, improved health should prompt a re-evaluation of your term life insurance policy. Regularly assessing your health status allows you to make necessary adjustments to your insurance coverage, ensuring that you and your loved ones are adequately protected. Remember, life insurance is a long-term commitment, and keeping it up-to-date with your current health status is a responsible approach to safeguarding your family's financial future.

Checking Your Kotak Life Insurance Fund Value

You may want to see also

Frequently asked questions

Term life insurance is a valuable financial tool that provides coverage for a specific period, typically 10, 20, or 30 years. It is essential to evaluate your insurance needs and financial goals periodically. You may consider giving up term life insurance when you no longer require the coverage or when you have other financial priorities that demand attention. For instance, if you've paid off your mortgage, have a substantial savings or investment portfolio, and your family's financial needs have changed, you might decide to terminate the policy.

Yes, several life events can prompt a reevaluation of your insurance needs. These include getting married or divorced, having children, purchasing a home, or experiencing significant financial changes. For example, when you start a family, term life insurance can provide essential financial protection for your loved ones. However, as your children grow older and become financially independent, the need for this coverage may diminish. Similarly, buying a home might require mortgage insurance, but once the mortgage is paid off, the need for term life insurance in that context could be reassessed.

Giving up term life insurance too soon might result in a loss of financial protection for your loved ones. Term life insurance provides a tax-free death benefit to your beneficiaries if you pass away during the policy term. If you terminate the policy prematurely, you may no longer have this financial safety net in place. Additionally, term life insurance policies often offer guaranteed premiums, and giving them up could mean losing the predictability and stability of payments. It's crucial to carefully consider your circumstances and consult with a financial advisor to determine the most appropriate time and reasons to give up term life insurance.