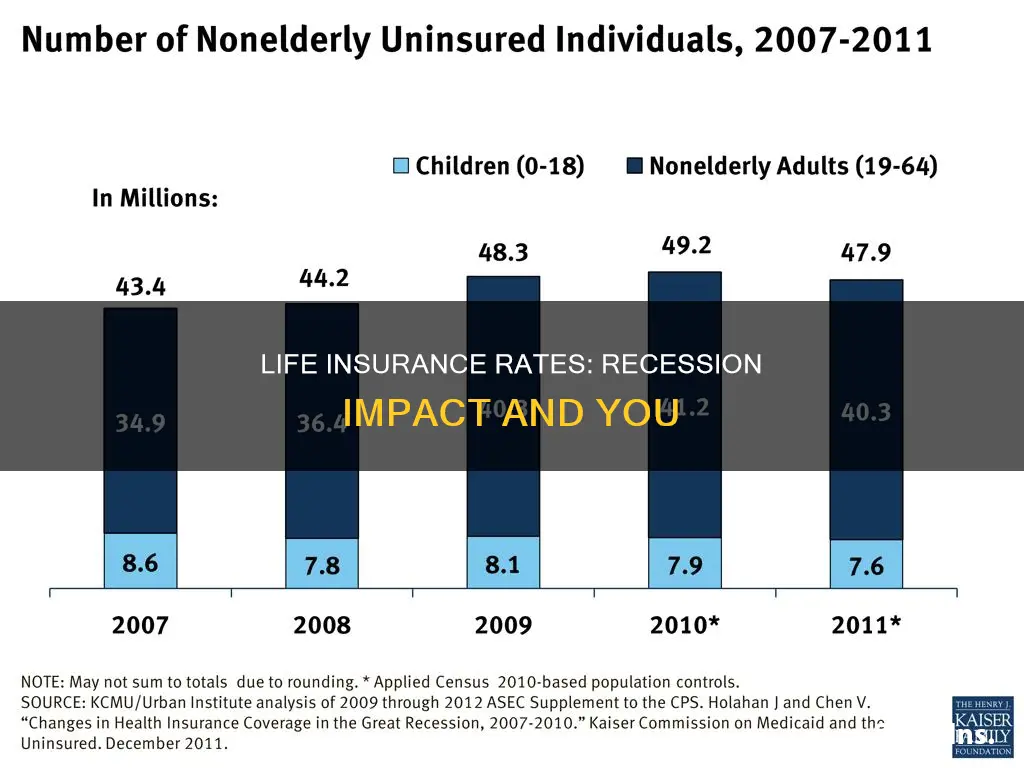

Life insurance is a vital safety net for your loved ones. It's a way to ensure they are protected financially in the event of your death. But what happens to life insurance rates during a recession? It's a common question, especially when facing economic uncertainty. During a recession, insurance companies may experience a decline in premium collections as clients cut back on expenses. However, life insurance is seen as a necessary expense by many, making it one of the safest businesses to be in during a recession. While short-term economic volatility doesn't typically affect life insurance policy rates, a prolonged recession might. Let's explore how life insurance rates can be impacted during economic downturns and why it's crucial to have a policy in place regardless of the economic climate.

| Characteristics | Values |

|---|---|

| Are life insurance rates impacted by a recession? | Not significantly. |

| What about permanent life insurance? | Permanent life insurance policies may be impacted by a recession, with rates increasing if a recession is prolonged. |

| What about term life insurance? | Term life insurance rates tend to remain stable during a recession. |

| Why are permanent life insurance rates more affected by a recession? | Permanent life insurance covers individuals for a lifetime, so the insurer is taking on more risk. |

| Why are term life insurance rates stable during a recession? | Term life insurance covers individuals for a set number of years, so the insurer is taking on less risk. |

| What factors affect life insurance rates? | Age, health history, tobacco use, profitability of the insurance company, mortality rates, company expenses, and interest rate environment. |

| How can life insurance protect you during a recession? | Life insurance provides a financial safety net for your loved ones, helping to cover funeral costs, pay off debts, and maintain living expenses. |

What You'll Learn

Life insurance rates may increase during a long-term recession

That being said, life insurance is one of the most recession-proof industries. Even during a recession, life insurance companies are comfortable offering affordable term life insurance policies. This is because term life insurance policies cover individuals for a short period of time, usually 10, 15, 20, or 30 years, depending on the coverage chosen. As these policies are for a defined period, the insurer isn't taking on as much risk of losing money if the economy declines long-term. Consumers benefit from this low-risk factor, as they can secure a monthly premium that will remain constant for the length of the insurance policy.

Additionally, permanent life insurance policies are more likely to see rate fluctuations during a period of economic uncertainty. These policies protect the policyholder for a lifetime and offer long-term cash value guarantees, which can be costly for insurance companies in a low-interest-rate environment paired with economic uncertainty. As a result, rates for new policies may increase. However, it's important to note that existing permanent life insurance policyholders with level premiums will not see a change in their premiums.

In summary, while life insurance rates may increase during a prolonged recession, the impact is relatively minimal compared to other industries. Insurance companies are generally prepared for short-term fluctuations and can handle them without significantly impacting consumers' rates.

Life Insurance for Undocumented: What Are Your Options?

You may want to see also

Term life insurance rates tend to remain stable

The shorter term lengths of term life insurance policies protect both the consumer and the life insurance company from economic fluctuations. Term life insurance policies are less impacted by low-interest-rate environments than permanent life insurance policies. This is because permanent life insurance policies offer long-term cash value guarantees, which can be costly for insurance companies in a low-interest-rate environment.

When you buy level premium term life insurance, you lock in your premium rate for the length of the term. This is known as a "guaranteed level premium". For example, if you buy a 10-year term life insurance policy, you will pay the same monthly premium for the full 10 years, regardless of any changes in the economy. This guarantee of stable premiums is difficult to find in other products and can provide peace of mind for consumers.

Term life insurance is designed to fit into a wide range of budgets, and the stability of knowing that your premiums won't increase due to economic factors can be as valuable as the policy itself. This stability is especially important during a recession, when income may be less certain and other expenses may be rising.

Farm Bureau Life Insurance: What You Need to Know

You may want to see also

Permanent life insurance rates may increase

Permanent life insurance rates are influenced by the profitability of the insurance company, which is affected by mortality rates, company expenses, and the interest rate environment. When a company's profitability decreases, it may increase rates to maintain profitability. During a recession, insurance companies may experience reduced profitability or even losses, which can lead to higher rates for permanent life insurance policies.

Additionally, permanent life insurance rates may be higher if the policy is purchased during a time of economic instability. This is because the rates for these policies are determined by the previous year's performance. If the previous year was marked by economic instability, insurance companies may set higher rates to mitigate their risks.

It's worth noting that permanent life insurance policies offer long-term stability for policyholders. Once a policy is in place, the rates remain constant for life. This means that existing policyholders won't face rate increases during a recession or economic uncertainty. The cash value of permanent life insurance policies is also not directly affected by stock market fluctuations, providing stability and peace of mind for policyholders.

Global Life: Health Insurance Provider?

You may want to see also

Life insurance is one of the safest businesses to be in during a recession

During a recession, an affordable term life insurance policy is a great way to protect your loved ones financially. This is especially important when times are tough, as a recession can bring about job losses, reduced incomes, and higher living expenses. A life insurance policy can provide a financial safety net, helping your dependents cover funeral costs, pay off debts, and maintain their standard of living.

Additionally, life insurance can provide stability during uncertain times. The stock market tends to be volatile during recessions, which can impact retirement funds and investment portfolios. However, with life insurance, the payout remains the same regardless of stock market fluctuations. This can give policyholders peace of mind, knowing that their beneficiaries will receive a payout even if their investments take a hit.

While life insurance rates may not be significantly impacted by a recession, it is worth noting that permanent life insurance policies may experience minimal rate increases during prolonged economic downturns. However, factors such as age and health history play a much larger role in determining life insurance rates.

In summary, life insurance is a crucial form of protection during a recession, providing financial security and stability for individuals and their loved ones.

Health Conditions: Life Insurance Eligibility and You

You may want to see also

Life insurance is more important during a recession

Financial Protection

Life insurance provides financial protection for your loved ones in the event of your untimely death. This support is crucial during an economic downturn when budgets are tight and unemployment is high. It can help cover funeral costs, pay off debts, and maintain living expenses for those left behind.

Peace of Mind

During a recession, the stock market tends to be volatile, which can impact retirement funds and investment portfolios. Life insurance offers peace of mind by guaranteeing a payout to your beneficiaries, regardless of market fluctuations. This stability can be invaluable during uncertain times.

Affordability

Term life insurance policies, which are valid for a set number of years, tend to be more affordable, especially if purchased when the policyholder is young and healthy. Locking in a low premium rate early on can provide financial security for your family at a relatively low cost, even during a recession.

Protection Against Debt

In a recession, job loss is a real concern, and many people may turn to credit cards and loans to cover everyday expenses. Life insurance can help cover these debts if the worst happens. It ensures that your loved ones won't be burdened with additional financial strain on top of grieving your loss.

Maintaining Living Expenses

Life insurance can help your family continue to pay rent or a mortgage after your passing. This is especially crucial if you are the primary earner or if your family relies on multiple incomes to make ends meet. During a recession, when job losses are more common, this type of financial protection can mean the difference between your family keeping their home or struggling to make payments.

In summary, while a recession may bring economic uncertainty, life insurance remains an important tool for safeguarding your loved ones' financial future. It provides a financial safety net, helps with living expenses and debts, and offers peace of mind during volatile economic times.

Haven Life Insurance: Is It Worth It?

You may want to see also

Frequently asked questions

Life insurance companies may be under threat during a recession as consumers may cut back on or downsize their plans and coverages. However, life insurance is one of the safest businesses to be in during a crisis as it is considered a necessary expense.

If you’re considering buying life insurance, there’s no need to put it off due to a recession. Life insurance companies are not greatly impacted by market volatility. In fact, life insurance is one of the most recession-proof industries.

An affordable term life insurance policy is one of the best ways to protect your family in both good times and bad. This is because it provides a financial safety net and can help cover the gap if the stock market drops.