First Community Credit Union (FCCU) offers life insurance to its members. Their credit life insurance product is designed to pay off a member's outstanding loan balance, up to the policy maximum, in the event of their death before the loan is fully repaid. FCCU also offers TruStage life insurance, which provides members' loved ones with money to help pay for expenses such as rent, bills, and funeral costs.

| Characteristics | Values |

|---|---|

| Company Name | First Community Credit Union |

| Insurance Type | Life Insurance |

| Insurance Provider | TruStage Insurance Agency, LLC |

| Underwriter | CMFG Life Insurance Company |

| Coverage | Up to $50,000 for personal or vehicle loans |

| Additional Coverage | Accidental Death & Dismemberment Insurance |

| Cost | Included in loan payment |

| Enrollment | Easy when applying for a loan |

| Contact | Visit a branch or call 1-800-814-2914 |

What You'll Learn

TruStage Life Insurance

TruStage makes it easy to compare insurance options and explore your choices. You can compare life insurance options, see instant quotes based on your budget, and apply online or over the phone. TruStage also offers Accidental Death & Dismemberment Insurance, which provides a safety net for your family in the event of your accidental death. This insurance can pay your beneficiary a cash benefit and also pays benefits if you are hospitalized or suffer dismemberment due to a covered accident.

As a member of Fort Community Credit Union, you are eligible to enroll for $1000 of no-cost TruStage® Accidental Death & Dismemberment Insurance. Credit union members ages 18 and over can also choose to increase their protection with up to an additional $300,000 in coverage. Enrollment is easy, and you can get an instant online quote or call 1-800-814-2914 to speak to a licensed agent.

Overdose Death: Life Insurance Payouts and Consequences

You may want to see also

Credit Life Insurance

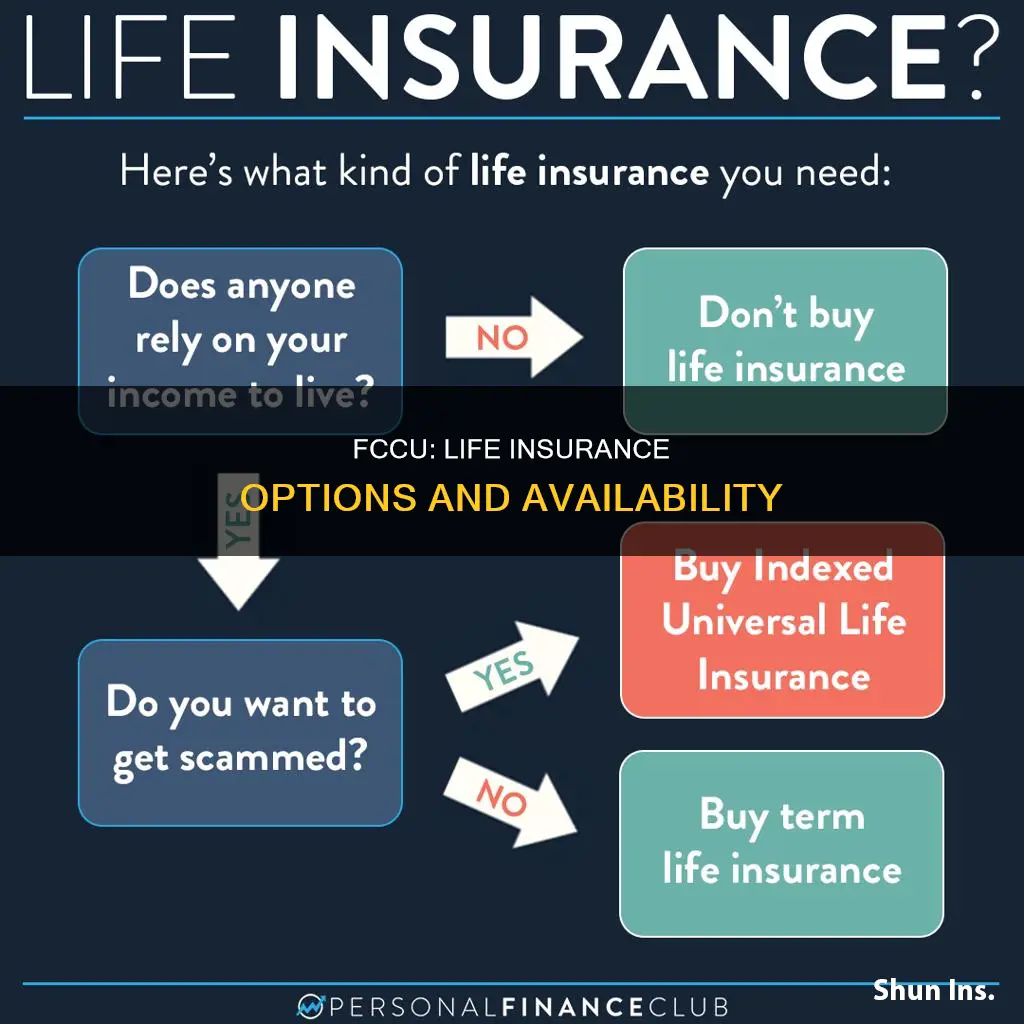

Compared to other types of insurance, credit life insurance has limited advantages and more serious drawbacks. For instance, mortgage protection insurance (MPI) is another type of credit life insurance that pays off the balance of your mortgage when you die. However, the payout declines as you pay down your mortgage, and the premiums remain the same. Term life insurance is often a better option as it offers more flexibility, lower premiums, and the payout can be used for any purpose, including paying off a mortgage.

FBI Life Insurance: What's the Deal?

You may want to see also

Credit Disability Insurance

First Community Credit Union (FCCU) offers credit disability insurance at a reasonable cost. The premium is included with your loan payment, and you can enrol easily when you apply for your loan.

Drug Use and Life Insurance: What's the Connection?

You may want to see also

Accidental Death & Dismemberment Insurance

First Community Credit Union (FCCU) offers credit life and disability insurance to its members. While it is not clear whether this includes accidental death and dismemberment insurance, it is a type of life insurance that is usually added as a rider to a health or life insurance policy.

Accidental death and dismemberment (AD&D) insurance covers the unintentional death or dismemberment of the insured. Dismemberment includes the loss, or loss of use, of body parts or functions, such as limbs, speech, eyesight, and hearing.

Benefits of AD&D Insurance

- Financial assistance: In the case of an accidental death, AD&D insurance can provide financial support to the surviving loved ones, lessening their financial burden.

- Supplements lost income: AD&D policies provide additional funds to the death benefit offered through traditional life insurance, usually equal to or a multiple of the traditional policy's death benefit.

- Lower premiums: Due to its limited coverage, AD&D insurance typically has lower premiums than traditional life insurance policies.

- No medical exam: Most insurance companies do not require a medical exam for AD&D coverage, especially when offered through an employer.

Limitations of AD&D Insurance

- Limited coverage: AD&D insurance only covers certain incidents, such as accidental death or specific types of dismemberment. It does not cover death from natural causes or other excludable events.

- Loss of coverage when changing jobs: If obtained through an employer, AD&D coverage may not be transferable if the insured changes jobs, leaving them unprotected until new coverage is issued.

- False sense of security: Policyholders may incorrectly assume that AD&D insurance provides the same level of coverage as traditional life insurance, which has broader coverage.

It is important to carefully review the terms and limitations of AD&D insurance policies before purchasing. While it can provide valuable financial protection in the event of an accident, it should not be considered a substitute for a comprehensive life insurance policy.

Divorce and Life Insurance: Changing Beneficiaries After Separation

You may want to see also

Life Insurance Options

First Community Credit Union (FCCU) offers TruStage Life Insurance to its members. This insurance is provided by TruStage Insurance Agency, LLC and issued by CMFG Life Insurance Company. TruStage Life Insurance is a simple and affordable way to protect your family financially if you pass away. It can provide your loved ones with money to help pay for expenses such as mortgage or rent, daily bills, medical bills, and funeral costs.

TruStage also offers Accidental Death & Dismemberment Insurance, which provides a safety net for your family in the event of your accidental death or a covered serious injury. As a member of Fort Community Credit Union, you are eligible to enrol for $1000 of no-cost Accidental Death & Dismemberment coverage. This insurance pays a cash benefit to your beneficiary if you die in an accident or suffer a covered serious injury.

In addition to TruStage, FCCU also provides Credit Life Insurance. This insurance is designed to pay off your outstanding loan balance, up to the policy maximum, in the event of your death before the loan is fully paid off. This can help lighten the financial burden for your loved ones. Credit Life Insurance is voluntary and will not affect your loan approval.

FCCU also offers Credit Disability protection, which helps make your monthly loan payments if you become totally disabled due to a covered illness or injury. This coverage is separate from any personal disability insurance policy you may already have and can provide peace of mind during uncertain times.

Child Life Insurance: Rollover Options for Parents

You may want to see also

Frequently asked questions

Yes, FCCU offers TruStage Life Insurance to its members. This insurance is underwritten by CMFG Life Insurance Company, a well-known credit union member insurance provider.

TruStage Life Insurance provides your loved ones with money to help pay for expenses such as mortgage or rent payments, day-to-day bills, and medical and funeral bills.

TruStage makes it easy to compare insurance options and explore your budget with instant quotes.

You can apply for TruStage Life Insurance online or over the phone.