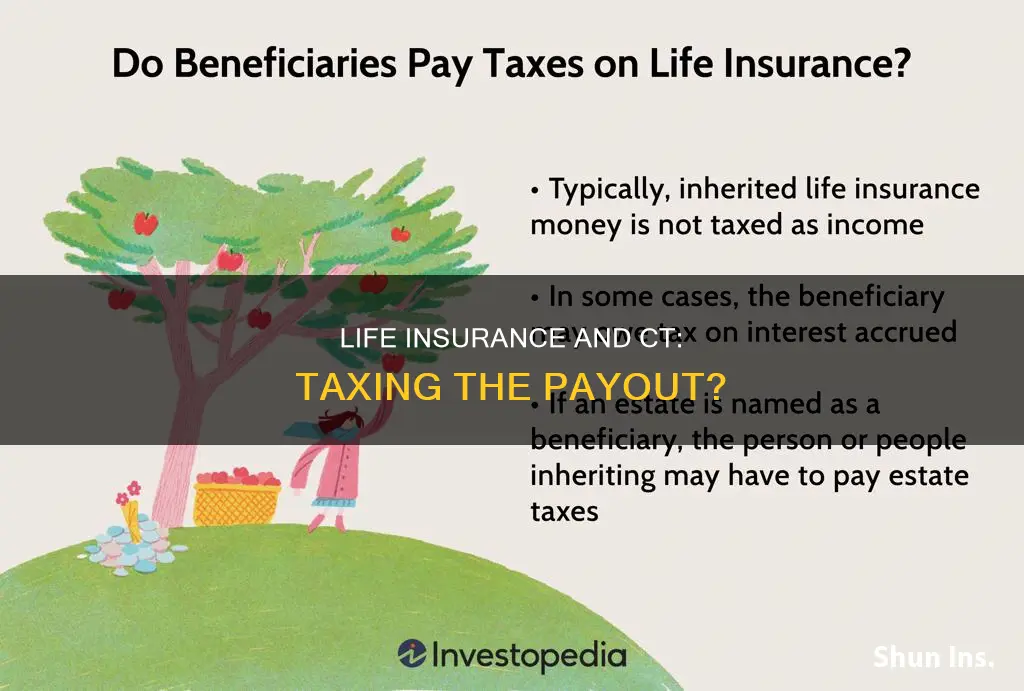

Life insurance is a complex topic, and understanding how it is taxed can be challenging. In Connecticut, the tax implications of life insurance depend on various factors, including the nature of the policy, the beneficiary, and the estate of the deceased. While Connecticut has both estate and inheritance taxes, life insurance death benefits are generally not considered taxable income for the beneficiary. However, interest accrued on delayed or instalment payouts may be subject to taxation. Additionally, if a beneficiary is not named or is deceased, the life insurance payout becomes part of the insured person's estate and may be taxed accordingly. Connecticut's estate tax applies to residents leaving behind more than $13.61 million as of 2024 and non-residents with real estate or tangible assets in the state. The state's high probate costs further complicate estate planning, and careful consideration is necessary to navigate the tax landscape effectively.

| Characteristics | Values |

|---|---|

| Life insurance taxable in CT | No |

| Inheritance tax in CT | Yes |

| Estate tax in CT | Yes |

| Estate tax cut-off in CT | $2 million |

| Estate tax rate in CT | 7.2% to 12% |

| Estate tax exemption in CT | $13.61 million |

What You'll Learn

Life insurance death benefits are usually not taxed

However, there are certain situations where a life insurance death benefit may be taxable. For instance, if a beneficiary chooses to delay the payout or receive it in installments, interest may accrue, and the interest paid to the beneficiary may be subject to taxation. Additionally, if there is no named beneficiary or if the named beneficiary is deceased, the life insurance death benefit will go into the estate of the insured person. In such cases, the benefit can be taxable along with the rest of the estate. Therefore, it is important to name both primary and contingent beneficiaries and keep those selections up to date.

Another scenario where the life insurance death benefit may be taxed is when the policy involves three different people: the policy owner, the insured, and the beneficiary. If the insured person dies and the beneficiary receives the death benefit, the IRS may consider the payout a gift from the policy owner to the beneficiary. This is known as the "Goodman triangle" or "Goodman rule," and it may trigger gift tax implications if the amount exceeds federal gift tax exemption limits.

It is worth noting that the tax status of a life insurance payout also depends on whether the premiums were paid with pre-tax or post-tax dollars. If the policy was purchased with pre-tax funds, such as through a tax-deferred retirement plan from an employer, the cash value component of the death benefit may be considered taxable. On the other hand, if the policy was purchased with after-tax dollars, beneficiaries can generally receive the benefits tax-free.

While life insurance death benefits are typically not taxed, there are other aspects of life insurance that may be subject to taxation. For example, if you have a cash value life insurance policy and choose to withdraw money from it, any amount received above the "policy basis" may be taxable. The "policy basis" refers to the money that came from your premium payments, while the amount above it includes interest or investment gains.

Coronavirus: Life Insurance Impact and Your Coverage

You may want to see also

Connecticut estate tax laws

Connecticut's estate tax laws can be a complex topic, and it's important to seek professional advice for your specific situation. Here's an overview of some key aspects of Connecticut estate tax laws:

Estate Tax Exemptions and Rates:

Connecticut has its own estate tax, separate from the federal estate tax. As of 2024, the estate tax exemption for Connecticut is $13.61 million. This means that estates valued above this amount may be subject to Connecticut estate tax. The tax rate for Connecticut estates can range from 7.2% to 12% for estates over $2 million, with the first $2 million being tax-free. The exact rate depends on the size of the estate.

Taxable Estates:

The taxable estate in Connecticut includes a wide range of assets, such as real estate, vehicles, personal property, bank and investment accounts, life insurance policies, and business interests. It's important to note that assets passing to a spouse are generally not considered part of the taxable estate.

Non-Resident Estates:

Even if you are not a resident of Connecticut, you may still be subject to its estate tax if you own real estate or other tangible assets in the state. Non-resident estates follow similar rules as resident estates but with some differences in calculations and filings.

Gift Tax:

Connecticut has its own individual gift tax. Taxable gifts refer to gifts made after January 1, 2005, that exceed $2 million in aggregate value. Gifts above this threshold will be added to the value of your estate for tax calculations.

Probate Costs:

Connecticut has the highest probate costs in the United States. The state recently removed a cap on probate fees, and they can now reach up to 0.01% of estate assets, with a maximum of $40,000. These fees are in addition to attorney's fees, appraisals, and other expenses.

Planning and Strategies:

Given the potentially high costs of probate and estate taxes in Connecticut, careful planning is essential. Strategies such as irrevocable life insurance trusts (ILITs) can help reduce the size of your taxable estate and minimize probate fees. Consulting with an experienced estate planning lawyer is crucial to navigate these laws effectively.

Companion Life Insurance: What Vision Benefits Are Covered?

You may want to see also

State and local laws

Connecticut also has an estate tax, which applies to all residents as well as anyone who owns property in the state, including businesses. The current exemption threshold for this tax is $13.61 million (for deaths in 2024), meaning estates worth more than this will have to pay the tax. The tax rate is currently 12%.

It is important to note that these laws can change over time, and it is always recommended to consult a tax professional for specific advice.

Chase Bank: Life Insurance for Account Holders?

You may want to see also

The Goodman triangle

According to the Goodman Rule, as long as the policy owner and the insured are the same person, the death benefit is typically tax-free for the beneficiary. However, when there are three different individuals in these roles, the death benefit may be considered a taxable gift to the beneficiary. This is where the concept of the Goodman Triangle comes into play.

To avoid the tax trap of the Goodman Triangle, it is essential to ensure that at least two points on the life insurance triangle are the same person. For example, the policy owner can also be the insured or the beneficiary, but the insured cannot be the beneficiary. By structuring the policy in this way, you can prevent the death benefit from being taxed as a gift.

In addition to the Goodman Triangle, there are other considerations when dealing with life insurance and taxes in Connecticut. Connecticut has its own estate and gift tax laws, with a cut-off for estate tax at $2 million, which applies to residents and property owners in the state. The state also levies a gift tax on gifts made after January 1, 2005, that exceed $2 million in aggregate value. These taxes can impact small businesses and family-owned businesses, making careful estate planning crucial.

While Connecticut's taxes and probate costs can be high, there are strategies to mitigate these costs, such as using irrevocable life insurance trusts (ILITs) to transfer wealth outside of the estate and bypass probate fees. Overall, understanding the Goodman Triangle and seeking professional advice can help individuals in Connecticut navigate the complexities of life insurance and taxes effectively.

Comcast's Life Insurance Offering: What You Need to Know

You may want to see also

Life insurance dividends

Dividends are typically paid out annually and are based on the insurance company's financial performance. If the company keeps expenses down and its investments perform well, the company declares a dividend, returning a portion of the surplus to policyowners. Dividends can be used in several ways:

- Receiving dividends in cash: The insurance company will send you a check or make an ACH payment to your bank account. This is the most flexible option as you can use the funds for anything.

- Reducing future premium payments: You can use dividends to cover a portion of your next outstanding premium. This will lower your monthly payments while keeping your coverage the same.

- Leaving dividends with the insurance company to collect interest: The dividend is retained by the insurance company and earns interest in a dividend accumulation account. You can withdraw cash from this account at any time. If the insured person dies, the account balance is added to the face amount of the policy and paid out to the beneficiaries.

- Buying paid-up additional life insurance: You can use your dividends to purchase small amounts of completely paid-up additional life insurance. This additional coverage will be the same type as your original policy and will not require an additional premium or medical exam.

- Buying one-year term life insurance: You can use your dividend to purchase as much one-year term life insurance coverage as possible, based on your age and the amount of dividend money you have.

When considering a life insurance policy, it is important to note that not all whole life policies generate dividends. The distinction lies in whether the policy is "participating" or "non-participating". Participating policies charge a higher premium and pay regular dividends to the policy owner, while non-participating policies have lower premiums and do not pay dividends.

Convertable Life Insurance: Cash Value and Benefits Explained

You may want to see also

Frequently asked questions

No, there is no tax on life insurance in Connecticut.

If the policy was purchased with pre-tax funds, the amount of the cash value component of the death benefit is considered taxable.

If you receive more than the cost of the life insurance policy, the portion of the proceeds that exceed the costs may be taxed.