Split-dollar life insurance is a strategy that allows two parties to share the costs and benefits of a permanent life insurance policy. It is often used by employers to provide supplemental benefits for executives and retain key employees. The two types of split-dollar life insurance plans are economic benefit arrangements and loan arrangements. In an economic benefit arrangement, the employer owns the policy, pays the premium, and assigns certain rights to the employee. In a loan arrangement, the employee owns the policy, and the employer pays the premium as a loan to the employee. Split-dollar plans can offer benefits such as tax-free income through loans and withdrawals, and the opportunity for cash values to grow on a tax-deferred basis. However, they also come with complex legal and tax considerations that must be carefully navigated.

| Characteristics | Values |

|---|---|

| Definition | A strategy that allows the sharing of the cost of a premium for a permanent life insurance policy |

| Type of plan | Two types of split-life insurance plans: economic benefit arrangement and loan arrangement |

| Creation | Created by an employer and employee, or individuals, or an individual and an irrevocable life insurance trust (ILIT) |

| Termination | At the employee's death or a future date included in the agreement (often retirement) |

| Owner | Depends on the arrangement; under a loan arrangement, the employee owns the policy, under an economic benefit arrangement, the employer owns the policy |

| Benefits | Tax-free income through loans and withdrawals, cash values may grow on a tax-deferred basis, fewer restrictions than traditional plans, lower plan costs |

| Use cases | Executive compensation package, supplemental benefits for executives, employee retention, estate liquidity planning, funding large premiums |

What You'll Learn

- Split-dollar life insurance is a strategy that allows the sharing of the cost of a premium for a permanent life insurance policy

- Split-dollar life insurance plans are created by an employer and employee

- There are two types of split-life insurance plans: economic benefit arrangement and loan arrangement

- Split-dollar plans are terminated in two ways: at the employee's death or at a date included in the agreement

- Split-dollar life insurance is a popular way to purchase permanent life insurance

Split-dollar life insurance is a strategy that allows the sharing of the cost of a premium for a permanent life insurance policy

Split-dollar life insurance is a strategy that allows two or more parties to share the cost of a premium for a permanent life insurance policy. It is a contract that outlines how the costs and benefits of the life insurance policy will be split between the policy owner and non-owner. This type of arrangement has been used for decades and is particularly popular among employers looking to provide additional benefits to key employees.

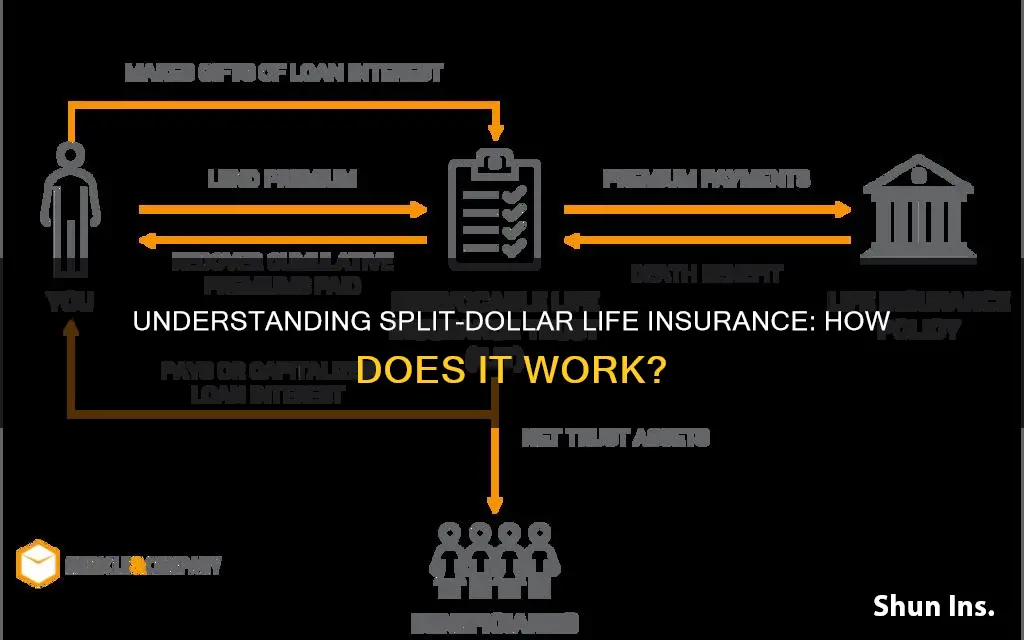

In a typical split-dollar agreement, the employer pays all or most of the policy premiums in exchange for an interest in the policy's cash value and death benefit. This allows the employer to eventually recoup their investment, while the employee gains access to high-quality life insurance. The agreement will also outline what the employee needs to accomplish to maintain the benefits, how long the plan will stay in effect, and how it will be terminated.

There are two main types of split-dollar life insurance plans: economic benefit arrangements and loan arrangements. Under an economic benefit arrangement, the employer owns the policy, pays the premium, and assigns certain rights or benefits to the employee. The employee can designate beneficiaries who will receive a portion of the policy's death benefit. On the other hand, in a loan arrangement, the employee owns the policy, and the employer lends the money required to pay the premium. The employee is taxed on the interest-free element of the loan and may choose to repay it upon leaving the company or have it forgiven by the employer.

Split-dollar plans offer several benefits, including tax advantages, low-interest rates, and the opportunity for tax-deferred growth of cash values. However, they also come with complex legal and tax considerations, and it is important to consult with financial and legal professionals when creating such an agreement.

Life Insurance: Tax Relief for Survivors?

You may want to see also

Split-dollar life insurance plans are created by an employer and employee

Split-dollar life insurance is a strategy that allows the sharing of the cost of a premium for a permanent life insurance policy. It is often a key part of an executive compensation package and can provide benefits to both the employer and employee. Typically, split-dollar life insurance plans are created by an employer and employee, with the former paying all or most of the premiums while retaining an interest in the policy's cash value and/or death benefit. This type of arrangement has been used for years to help individuals fund large premiums and/or reduce the cash flow needed for a much-needed life insurance policy.

In a split-dollar life insurance plan, the employer and employee execute a written agreement outlining how they will share the premium cost, cash value, and death benefit of a life insurance policy. The agreement also specifies what the employee needs to accomplish, how long the plan will be in effect, and how it will be terminated. It includes provisions that restrict or end benefits if the employee leaves the company or fails to meet performance metrics.

There are two main types of split-dollar life insurance plans: the economic benefit arrangement and the loan arrangement. In the economic benefit arrangement, the employer owns the policy, pays the premium, and assigns certain rights or benefits to the employee. The employee can designate beneficiaries who will receive a portion of the policy's death benefit. On the other hand, in the loan arrangement, the employee owns the policy, and the employer lends the money required to pay for it. The employee is taxed on the interest-free element of the loan.

Split-dollar life insurance plans offer several benefits to both employers and employees. Employers can use these plans to attract talented individuals or retain top executives. They can also protect against the financial impact of the early death of a key employee. Employees, on the other hand, can take advantage of the employer's assistance with the premium and may even receive tax-free income through partial withdrawals and loans. Additionally, split-dollar plans offer low start-up and administrative costs for employers and provide flexibility in plan design to meet individual employee needs.

Does Level Benefit Life Insurance Offer Cash Value?

You may want to see also

There are two types of split-life insurance plans: economic benefit arrangement and loan arrangement

Economic Benefit Arrangement

Under this arrangement, the employer owns the policy, pays the premium, and assigns certain rights and benefits to the employee. The employee can designate beneficiaries who will receive a portion of the policy's death benefit. The value of the economic benefit the employee receives is calculated each year. When the employee leaves the company, the policy can be transferred to them or they can choose to purchase it.

Loan Arrangement

The loan arrangement is more complicated than the economic benefit plan. In this arrangement, the employee owns the policy and the employer pays the premium. The employee gives an interest in the policy back to the employer through a collateral assignment, which restricts what the employee can do without the employer's consent. The premium payments by the employer are treated as a loan to the employee, with interest rates that can be below market rates. The employee is taxed on the interest-free element of the loan.

Termination of Split-Dollar Plans

Split-dollar plans are typically terminated in two ways: at the employee's death or at a future date included in the agreement, often the employee's retirement. If the employee dies, the employer recovers the premiums paid, cash value, or the amount owed in loans. If the employee fulfills the term and requirements of the agreement, all restrictions are released under the loan arrangement, or ownership of the policy is transferred to the employee under the economic benefit arrangement.

FHA Loan: Understanding Life Mortgage Insurance Inclusion

You may want to see also

Split-dollar plans are terminated in two ways: at the employee's death or at a date included in the agreement

Split-dollar life insurance is a strategy that allows two or more parties to share the costs and benefits of a life insurance policy. It is often used by employers to provide supplemental benefits for executives and to help retain key employees. The two parties involved are usually an employer and an employee, but it can also be set up between individuals or between an individual and an irrevocable life insurance trust (ILIT).

##section## Employee's Death

In the unfortunate event of the employee's death, the employer recovers either the premiums paid, the cash value, or the amount owed in loans, depending on the arrangement. Once the repayment is made, the employer releases any restrictions on the policy, and the employee's named beneficiaries receive the remainder as a tax-free death benefit. This can include an ILIT.

##section## Agreement Termination Date

If the employee fulfills the term and requirements of the agreement, all restrictions are released under the loan arrangement, or ownership of the policy is transferred to the employee under the economic benefit arrangement. Depending on the agreement, the employer may recover all or a portion of the premiums paid or the cash value. The employee then becomes the owner of the insurance policy and is taxed on the value of the policy and premiums paid by the employer.

The termination of a split-dollar plan can have different tax implications for both the employer and the employee, depending on the specifics of the agreement. It is important to carefully review the agreement and consult with a qualified attorney or tax advisor to understand the tax consequences of terminating the plan.

Life Insurance: Benefits to Reap While Alive

You may want to see also

Split-dollar life insurance is a popular way to purchase permanent life insurance

The main benefit of split-dollar life insurance is that it offers high-quality life insurance to employees at little or no cost, making it a valuable tool for employers to attract and retain top talent. The agreement outlines the ownership of the policy, the premiums paid by each party, and the distribution of the cash value and/or death benefit. It also includes provisions that restrict or end benefits if the employee leaves or fails to meet performance metrics.

There are two main types of split-dollar life insurance plans: the economic benefit arrangement and the loan arrangement. In the economic benefit arrangement, the employer owns the policy, pays the premiums, and assigns certain rights or benefits to the employee. The employee can designate beneficiaries who will receive a portion of the death benefit. On the other hand, in the loan arrangement, the employee owns the policy, and the employer lends the money required to pay the premiums. The employee is taxed on the interest-free element of the loan.

Split-dollar life insurance plans offer several advantages, such as the use of corporate dollars to pay for personal life insurance, low-interest rates, and tax benefits. They can also be customised to meet the specific needs of the employee and employer. However, it is important to consult with a qualified attorney or tax advisor when creating a split-life plan to ensure compliance with legal and tax requirements.

Overall, split-dollar life insurance is a valuable tool for employers to attract and retain key employees, and it offers a flexible and cost-effective way for individuals to purchase permanent life insurance.

HIV and Life Insurance: Can You Get Covered?

You may want to see also

Frequently asked questions

Split-dollar life insurance is a strategy that allows two or more parties to share the costs and benefits of a permanent life insurance policy. The two types of split-dollar life insurance plans are economic benefit arrangements and loan arrangements.

Split-dollar life insurance is often used by employers to provide supplemental benefits for executives and to help retain key employees. However, plans can also be set up between individuals or between an individual and an irrevocable life insurance trust (ILIT).

Split-dollar life insurance offers several benefits, including tax advantages, the ability to provide high-quality life insurance to employees at a low cost, and the opportunity for tax-deferred growth of cash values.

In a split-dollar life insurance plan, a written agreement is executed between the parties involved, outlining how they will share the premium cost, cash value, and death benefit of a life insurance policy. The agreement also includes details such as the employee's performance metrics and the duration of the plan.