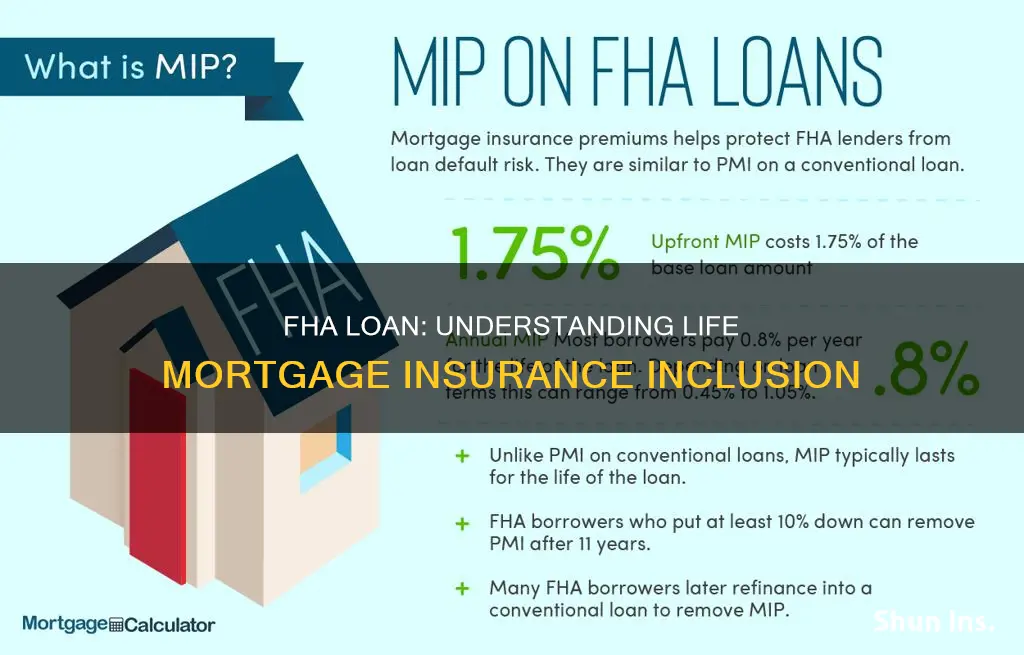

FHA loans are a type of mortgage that is backed by the Federal Housing Administration. They are often chosen by borrowers due to their more lenient standards, such as lower credit score and down payment requirements. However, FHA loans come with a mandatory mortgage insurance premium (MIP) which is an additional payment that provides protection to the lender in case the borrower defaults on their loan. This insurance premium is usually required to be paid for the entire duration of the loan term and can be broken down into an upfront premium and an annual payment. While it is difficult to avoid paying MIP on an FHA loan, there are ways to lower the amount or remove it after a certain number of years.

| Characteristics | Values |

|---|---|

| Required | Yes |

| Purpose | Protect lenders against losses that result from defaults on home mortgages |

| Payment | Two payments: upfront premium and annual premium |

| Upfront premium | 1.75% of the total value of the loan |

| Annual premium | Varies depending on loan-to-value ratio (LTV), size of down payment, length of mortgage term, and base loan amount |

| Duration | For loans with FHA case numbers assigned before June 3, 2013, MIP will be cancelled when loan-to-value ratio (LTV) reaches 78%. For loans with FHA case numbers assigned after June 3, 2013, MIP will be cancelled after 11 years if the down payment was at least 10%. MIP will be paid for the entire loan term if the down payment was less than 10%. |

What You'll Learn

FHA loans are backed by the Federal Housing Administration

FHA loans are insured by the Federal Housing Administration (FHA). This means that if a borrower defaults on their mortgage, the FHA will compensate the lender for the outstanding balance. This insurance encourages lenders to provide financing to borrowers who might not otherwise meet the lender's criteria.

FHA loans are popular with first-time homebuyers as they have more lenient standards than other mortgage options. For example, FHA loans typically have more relaxed requirements for credit scores and down payments. However, FHA loans do require borrowers to pay a mortgage insurance premium (MIP), which is an additional payment that provides the mortgage lender with some protection in the event of a default on the loan.

The FHA MIP includes an upfront premium, typically paid at closing, and annual premiums. The upfront premium is currently 1.75% of the loan amount and can be paid all at once at closing or added to the mortgage and paid over time. The annual premium is based on the loan amount, loan term, and loan-to-value (LTV) ratio, or size of the down payment. Most borrowers will pay MIP for the entire term of their loan, but if a borrower makes a down payment of at least 10%, they will only pay MIP for the first 11 years.

It is not possible to completely avoid paying MIP on an FHA loan. However, there are ways to lower the amount or stop paying after a few years. For example, borrowers can make a larger down payment of at least 10% or refinance their FHA loan into a conventional mortgage.

Convertable Life Insurance: Cash Value and Benefits Explained

You may want to see also

FHA loans require mortgage insurance

FHA loans are a type of mortgage that's backed by the Federal Housing Administration (FHA). Compared to other mortgage options, FHA loans typically have more lenient standards for borrowers, like credit score and down payment requirements.

FHA loans require borrowers to pay a mortgage insurance premium (MIP). This is an additional payment you make to secure the mortgage loan. MIP provides your mortgage lender with some protection in the event that you default on your loan. It is beneficial to home buyers because, without it, lenders would likely require a much larger down payment for qualification for a mortgage.

FHA MIP includes two payments: an upfront premium and an additional annual payment. The upfront premium is typically 1.75% of the total value of your loan, which is paid at closing or added to the balance of the loan. The annual payment varies depending on your loan-to-value ratio (LTV), the size of your down payment, the length of your mortgage term, and the base loan amount.

If you make at least a 10% down payment on an FHA loan, you'll only need to pay MIP for the first 11 years of the loan term. If you put down less than 10%, you'll pay MIP for the entire life of your loan.

While it is not possible to completely avoid paying MIP when taking out an FHA loan, there are ways to lower your payments or stop paying a few years into your loan. One way is to make a larger down payment of at least 10% to remove MIP after 11 years. Another option is to refinance and change your FHA loan into a conventional mortgage, which does not require MIP.

Life Insurance and CT: Taxing the Payout?

You may want to see also

FHA mortgage insurance is paid upfront and annually

In addition to the upfront premium, you'll also pay a monthly mortgage insurance premium, or MIP, that is added to your mortgage payments. The MIP is an ongoing cost that you'll pay over the life of the loan. This premium is calculated based on your base loan amount, mortgage term, and loan-to-value ratio (LTV). The premium is divided by 12 and charged in monthly installments that are added to your regular mortgage payment. For most borrowers, the annual MIP rate is 0.85% of the loan amount.

For example, on a $200,000 loan, this would translate to $1,700 per year, or about $142 per month. However, if your original down payment was 10% or more, your annual MIP may be lower. The cost of annual MIP ranges between 15 and 75 basis points, or 0.15% to 0.75% of your loan amount. The larger your down payment, the less you'll pay annually.

It's important to note that FHA mortgage insurance is required for all FHA loans and cannot be cancelled. If you make a down payment of at least 10%, you'll only need to pay MIP for the first 11 years of the loan term. If you put down less than 10%, you'll pay MIP for the entire duration of the loan.

Understanding Life Insurance: Face Value and Payouts Explained

You may want to see also

FHA mortgage insurance rates are set by the loan term and amount

The UFMIP is typically paid as a lump sum at closing and is equal to 1.75% of the loan amount. This can be financed into the loan amount and paid over the term of the loan or paid in cash.

The annual MIP is charged annually and is divided by 12 to be added to the borrower's monthly mortgage payment. The rate of the annual MIP depends on the loan term, loan amount, and loan-to-value (LTV) ratio. For loans with terms longer than 15 years, the annual MIP ranges from 0.50% to 0.75% of the loan amount. For loans with terms of 15 years or less, the annual MIP ranges from 0.15% to 0.65% of the loan amount.

The longer the loan term and the higher the loan amount, the higher the MIP rates will be. Additionally, if the down payment is less than 10% of the purchase price, the borrower will have to pay MIP for the entire loan term. If the down payment is at least 10%, the MIP will be removed after 11 years.

Ezlynx Life Insurance Support: What You Need to Know

You may want to see also

FHA mortgage insurance can be removed in certain circumstances

If your FHA loan was taken out after the year 2000, you may be able to cancel your FHA mortgage insurance. If your loan was taken out before 2000, you will likely continue paying the premiums for the life of the loan.

Loans originated before June 3, 2013:

- You've made all your monthly mortgage payments on time.

- You've paid for at least 5 years of a 20, 25, or 30-year loan (there's no time limit for a 15-year mortgage).

- Your mortgage has a 78% or lower loan-to-value ratio (LTV).

Loans originated on or after June 3, 2013:

- You made a down payment of 10% or more when purchasing the home.

- You've made on-time mortgage payments for the last 11 years.

If you don't meet either of these sets of conditions, you won't be able to cancel your FHA mortgage insurance without refinancing. If you refinance your FHA loan into a conventional mortgage, you may be able to remove the mortgage insurance, but you'll need to meet certain requirements, such as having a credit score of 620 or higher and having at least 5%-25% equity in your home.

It's important to note that even if you remove your FHA mortgage insurance, you may still need to pay private mortgage insurance (PMI) on a conventional loan if your LTV ratio is above 80%.

Farm Bureau of Michigan: Life Insurance Options and More

You may want to see also

Frequently asked questions

An FHA loan is a type of mortgage that is backed by the Federal Housing Administration (FHA). FHA loans typically have more lenient standards for borrowers, such as lower credit score and down payment requirements.

An FHA mortgage insurance premium (MIP) is an additional fee that borrowers with FHA loans have to pay, both upfront and over the course of the mortgage term. This insurance protects the lender against default by the borrower.

The upfront MIP payment is typically 1.75% of the total value of the loan. Annual MIP payments vary depending on factors such as the loan amount, loan term, and loan-to-value (LTV) ratio.

The duration of FHA MIP payments depends on the down payment and the origination date of the loan. For loans originated after June 3, 2013, with a down payment of at least 10%, MIP will be cancelled after 11 years. For loans with a down payment of less than 10%, MIP will be paid for the life of the loan.

All FHA loans require mortgage insurance, but there are ways to mitigate or remove it. One way is to increase your down payment to at least 10%, which can help reduce the duration of MIP payments. Refinancing to a conventional loan without mortgage insurance is another option, but this requires meeting certain criteria such as having sufficient home equity and a strong credit score.