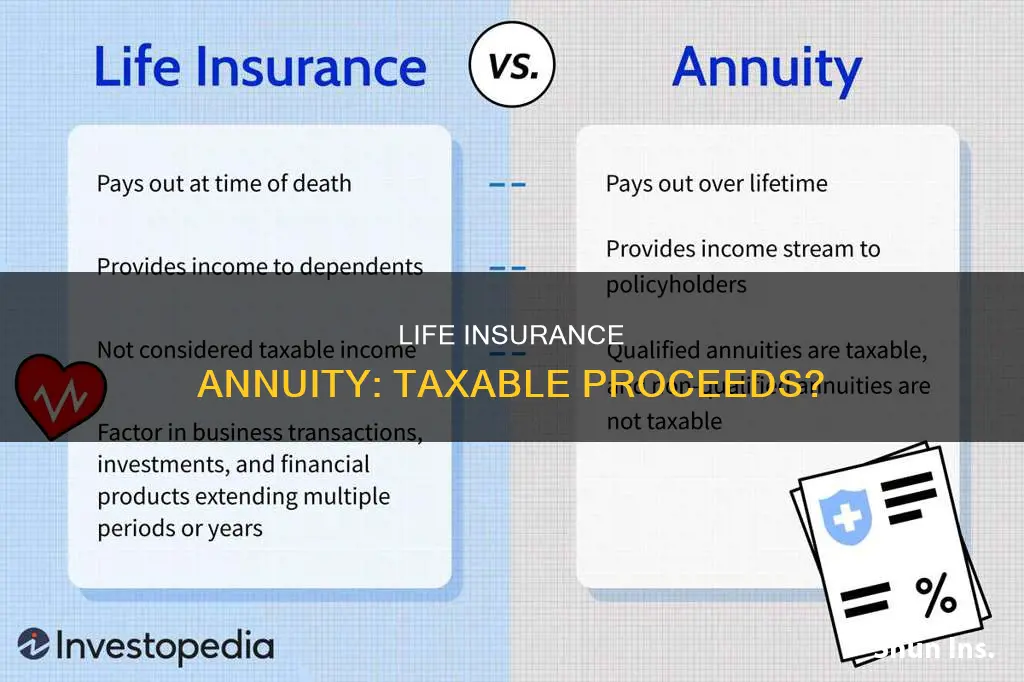

Life insurance payouts are generally not taxable, but there are some exceptions. For example, if the beneficiary chooses to receive their payout as an annuity, the interest accrued in the annuity account may be subject to taxes. This is because annuities are tax-deferred retirement investments, so when money is withdrawn or paid out from the annuity contract, it becomes taxable. The taxation of an annuity will depend on how it was funded and the type of payments or withdrawals.

What You'll Learn

Annuities funded with pre-tax money are taxable as income

Annuities are a great way to save for retirement or to generate a guaranteed income after you retire. They are tax-deferred retirement investments, meaning you don't pay taxes on the money while it grows. However, annuities funded with pre-tax money will be taxable as income when you receive payments.

Taxation of Annuities

Annuities can be funded in two ways: with pre-tax or post-tax money. This has implications for how the payouts will be taxed. Understanding how an annuity is funded is vital to understanding how it will be taxed.

Qualified Annuities

Qualified annuities are generally funded with pre-tax money through retirement accounts such as a 401(k) or IRA. Contributions to these accounts are tax-deferred, and the entire distribution amount will be subject to income taxes when withdrawals or payments are made. This means that if you've funded your annuity with pre-tax money, the entire amount of the withdrawal is taxed as ordinary income.

Qualified annuities are also subject to required minimum distribution (RMD) guidelines, which means you must start taking distributions by April 1st of the year after you reach your RMD age, which is currently 73.

Non-Qualified Annuities

Non-qualified annuities, on the other hand, are funded with post-tax money, typically from a brokerage or bank account. These contributions establish a tax basis within the annuity that is not taxable when withdrawn. Only the earnings generated within a non-qualified annuity are taxable as income.

Early Withdrawals

It's important to keep in mind that making a withdrawal from your annuity before the designated time period can result in early withdrawal penalties. Withdrawals made before the age of 59½ are typically subject to a 10% early withdrawal penalty tax. For early withdrawals from a pre-tax qualified annuity, the entire distribution amount may be subject to the penalty.

Tax Planning

The taxation of annuities can be complex, and it's always a good idea to consult with a qualified tax professional to understand how any annuity or income will impact your personal situation. They can help you navigate the tax rules and ensure your investments are structured in the most tax-efficient way.

Accidental Death and Dismemberment: A Life Insurance Alternative?

You may want to see also

Annuities funded with post-tax money have earnings that are taxable

Annuities are a great way to save for retirement or generate a guaranteed income after retirement. They can also help protect you from the risk of outliving your money. However, it is important to understand how annuities are taxed to make the most of your investment.

Annuities can be funded in two ways: with pre-tax money or post-tax money. This distinction is crucial in determining how your annuity will be taxed. Annuities funded with pre-tax money will be taxed as income when you receive payments. On the other hand, annuities funded with post-tax money will have only their earnings taxed. This means that the principal amount, or the money you put in, will be returned to you tax-free, while the growth or earnings on your investment will be taxed as ordinary income.

Non-qualified annuities are typically funded with post-tax money. When you withdraw money from a non-qualified annuity, the IRS considers the funds using the Last In, First Out (LIFO) method. This means that the earnings, considered "Last In," will be withdrawn first and taxed as ordinary income. Once the earnings have been exhausted, you will receive the principal amount tax-free.

It is important to note that if you take money out of an annuity before you turn 59 and a half years old, you may have to pay an extra 10% IRS penalty. Additionally, if you choose to receive your payout in multiple payments, such as an annuity, instead of a lump sum, the additional interest received above the face amount may be taxable.

Consulting with a qualified tax professional or financial advisor is recommended to understand how the taxes on your specific annuity type will impact your financial situation. They can help you navigate the complex world of annuity taxation and ensure you make the most tax-efficient decisions for your retirement planning.

KeyBank's Life Insurance Offerings: What You Need to Know

You may want to see also

Beneficiaries of an annuity do not receive a step-up in basis

When it comes to taxes and annuities, there are a few key things to keep in mind. Firstly, it's important to understand the difference between life insurance proceeds and annuity proceeds. Life insurance proceeds refer to the death benefit paid out to beneficiaries when the policyholder passes away. On the other hand, annuity proceeds are regular payments made to the annuitant during their lifetime.

Now, let's focus on the topic of beneficiaries and the lack of a step-up in basis for annuities. When a beneficiary inherits a non-qualified annuity from the original owner, the basis in the annuity remains unchanged. This means that the beneficiary will be responsible for paying taxes on the growth of the annuity, but not on the original investment.

In the context of taxes, a "step-up in basis" is a tax provision that adjusts the cost basis of an inherited asset to its fair market value on the date of the previous owner's death. This is significant because the cost basis determines the taxes owed when the asset is sold. While this provision applies to various financial assets, annuities do not receive this treatment.

For example, let's say your father invested $50,000 in an annuity, which grew to $80,000 over time. As the beneficiary, if you inherit this annuity, you will owe income tax on the earnings portion, which is the growth, but not on the original investment. So, in this case, you would pay taxes on the $30,000 growth when you withdraw it.

It's important to note that the tax implications of inheriting an annuity can be complex, and they may depend on factors such as the structure of the annuity contract and the relationship between the beneficiary and the original owner. Consulting with a qualified tax expert is always recommended to understand your specific tax obligations.

Whole Life Insurance: Interest Earned or Myth?

You may want to see also

Inherited annuities are taxable, depending on the payout structure

Life insurance death benefits are generally not taxable for beneficiaries, especially if they are paid out in a lump sum. However, this changes if the beneficiary chooses to receive the death benefit as an annuity. In this case, the annuity is taxed as income, and the interest accrued in the annuity account is considered taxable income.

Annuities are tax-deferred retirement investments. The taxation of an annuity depends on how it was funded—either with pre-tax or post-tax money. If an annuity is funded with pre-tax money, the entire withdrawal is taxed as ordinary income. If funded with post-tax money, only the earnings are taxable.

Inherited annuities are taxable, and the amount of tax depends on the payout structure and the beneficiary's relationship to the annuity owner. The original owner's tax basis on non-qualified annuities will remain the same, and all earnings will be taxable as income to the beneficiary. If the inherited annuity was part of the decedent's defined contribution plan, such as a 401(k), rules from the Setting Every Community Up for Retirement Enhancement (SECURE) Act may apply regarding when the beneficiary may take distributions and the amount of tax owed.

Qualified annuities, funded with pre-tax money, are taxable as income in the year the money is received. Non-qualified annuities, funded with post-tax money, are only taxable on the earnings generated.

Life Insurance and Tax Credits: Missouri's Unique Benefits

You may want to see also

Annuities are subject to state and federal taxes

Annuities can be funded from two sources: pre-tax or post-tax money. When an annuity is funded with pre-tax money, the entire withdrawal amount is taxed as ordinary income. In contrast, when an annuity is funded with post-tax money, only the earnings are taxable. This includes interest accrued, dividends, or capital gains.

For example, if a beneficiary chooses to receive their life insurance payout as an annuity (regular payments over several years) instead of a lump sum, the additional interest received is taxable. The interest accrued in the annuity account is considered taxable income.

In the United States, the federal estate tax threshold was $13.61 million as of 2024. If the value of the estate, including life insurance proceeds, exceeds this threshold, estate taxes must be paid on the amount over the limit. Some states also assess inheritance or estate taxes, depending on the estate's value and the state of residence.

It is important to note that beneficiaries of an annuity do not receive a step-up in basis, meaning that the original owner's tax basis on non-qualified annuities will remain the same, and all earnings will be taxable as income to the beneficiary.

Life Insurance Options for Diabetics: What You Need to Know

You may want to see also

Frequently asked questions

No, life insurance death benefits that are paid out to a beneficiary in a lump sum are not included as income to the recipient of the life insurance payout.

Yes, if a beneficiary chooses to receive their payout as an annuity (a series of payments over several years) instead of a lump sum, any interest accrued by the annuity account may be subject to taxes.

If you withdraw more than your cumulative premium payments, you may have to pay income taxes on the excess. Likewise, if you borrow against the cash value and the loan is still outstanding when the policy is terminated or surrendered, the loan amount in excess of the cumulative premiums may be subject to income taxes.

If you surrender the policy and your surrender proceeds exceed the cumulative premiums, the excess may be subject to income taxes.