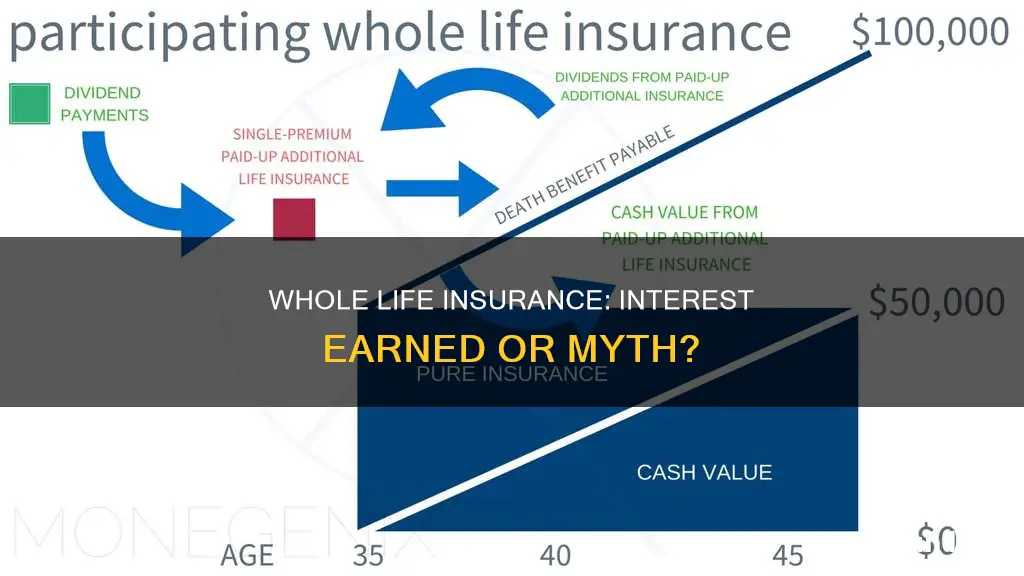

Whole life insurance is a type of permanent life insurance that covers the insured's entire life, with fixed premiums and a guaranteed death benefit. One of the distinctive features of whole life insurance is its cash value component, which grows over time and can be borrowed against or withdrawn. This cash value grows tax-deferred, providing a potential source of funds for emergencies or retirement. Whole life insurance policies are also one of the largest purchasers of bonds and mortgages in the United States, and interest rates have a direct impact on insurance companies and their products. As a result, whole life insurance policies can earn interest, and this interest rate is typically set at a fixed rate.

What You'll Learn

Whole life insurance as an investment

Whole life insurance is a type of permanent life insurance that provides coverage for your whole life as long as you continue to pay your premiums. It is more expensive than term life insurance due to its built-in cash value component, which accumulates tax-deferred interest over time. This cash value can be accessed by the policyholder during their lifetime, usually in the form of a loan or withdrawal, and can be used for various financial goals, such as supplementing retirement income, creating generational wealth, or paying for large expenses. However, utilising the cash value may reduce the death benefit and could result in tax implications.

- Withdrawals or loans: The policyholder can withdraw from or take out a loan against the accumulated cash value to fund major expenses, such as college tuition or a down payment on a house. Withdrawals are typically tax-free up to the total amount of premiums paid, but loans may need to be repaid to avoid reducing the death benefit for beneficiaries.

- Creating generational wealth: Whole life insurance can be used as part of an estate plan to help heirs navigate federal estate taxes, which can reduce inheritances by up to 40% for large estates. By creating an irrevocable life insurance trust (ILIT), death benefit proceeds from the policy can pass to heirs outside of the taxable estate, preserving wealth for future generations.

- Collecting dividends: Some whole life insurance policies offer dividends when the insurance company performs better financially than expected. These dividends can be credited towards premiums, paid out directly, used to earn interest, or used to purchase additional insurance coverage.

- Surrendering the policy: If the policy is no longer needed, it can be surrendered to receive the accumulated cash value, minus any fees and outstanding loan balances. However, this may create a taxable event, and the death benefit will no longer be available to beneficiaries.

While whole life insurance offers guaranteed returns and financial security, it may not be suitable for everyone due to its high premiums, slow growth of cash value, and lack of flexibility in modifying coverage and investment choices. It is important to carefully consider one's financial goals, risk tolerance, and budget before deciding if whole life insurance is a good investment fit.

Geico's Whole Life Insurance: What You Need to Know

You may want to see also

Whole life insurance rates

- Age: Younger individuals generally pay lower premiums than older people due to longer life expectancy and better health.

- Gender: Women tend to have lower rates than men since they have a higher life expectancy.

- Health Status: Individuals with significant health issues or chronic illnesses may have higher rates due to a potentially shorter life expectancy.

- Lifestyle and Hobbies: Risky activities, such as smoking, racing cars, or extreme sports, can increase premiums as they impact life expectancy.

- Coverage Amount: Higher coverage amounts typically lead to higher premiums.

- Company and Policy Type: Different insurance companies have varying rates, and whole life insurance policies tend to be more expensive than term life policies due to their permanent coverage and cash value component.

| Age | Male | Female |

|---|---|---|

| 30 | $193 | $157 |

| 40 | $254 | $199 |

| 50 | $400 | $315 |

| 60 | $706 | $553 |

It's important to note that these rates are averages and may vary across different insurance providers and based on individual circumstances. Additionally, whole life insurance policies have a cash value component that grows over time. This cash value can be accessed through loans or withdrawals and typically earns a fixed interest rate.

Seizure's Impact: Life Insurance and Your Health

You may want to see also

Whole life insurance cash value

Whole life insurance is a type of permanent life insurance that covers the insured person for their entire life. It is designed for the long term and offers steady cash value growth. Whole life insurance has two components: the death benefit and the cash value.

The death benefit is paid out to beneficiaries when the insured person dies. The cash value, on the other hand, is a savings component that the policyholder can draw on or borrow from while they are still alive. This cash value typically earns a fixed rate of interest, which accrues on a tax-deferred basis. Interest rates on whole life insurance policies tend to be low, often around 1.5%.

The cash value in a whole life insurance policy can be built up in several ways. Policyholders can make payments greater than the scheduled premium, which purchases extra coverage. Policy dividends can also be reinvested into the cash value. Over time, the cash value can be used to make large purchases, such as buying a home, or to supplement retirement income.

However, withdrawals and outstanding loan balances will reduce the death benefit. If the policyholder decides they no longer need life insurance, they can surrender the policy and receive the remaining cash value.

Life Insurance and SMSFs: What's the Connection?

You may want to see also

Whole life insurance pros and cons

Whole life insurance is a permanent policy that offers lifelong coverage. This means that it will pay out to your loved ones no matter when you pass away. Here are some of the pros and cons of whole life insurance:

Pros

- Lifelong coverage: Whole life insurance can provide coverage for life, no matter your age when you pass away. There is no termination date, unlike with term life insurance policies.

- Fixed premiums: Once you receive a premium amount based on factors like your age and health, you won't have to worry about it changing. This makes budgeting easier.

- Cash value growth: Whole life insurance policies offer a cash value growth component. As your cash value increases, you can withdraw funds or borrow against them to help cover expenses or meet financial goals. Depending on the company, whole life insurance may be eligible for dividends, which can be redeemed for cash.

- Peace of mind: Whole life insurance provides the peace of mind that comes with knowing your loved ones will be financially protected in the event of your death.

Cons

- Higher premiums: Due to the lifelong coverage and cash value component, whole life insurance comes with higher premiums. This may be a challenge for those who are young or have limited financial resources.

- Complexity: Compared to other types of life insurance, whole life insurance can be complex and more difficult to understand. Policyholders may need to review their policy multiple times or speak to a company representative to fully understand it.

- Limited flexibility: Whole life insurance policies do not allow for changes to the death benefit or premiums, which are set when the policy is issued.

- Slower cash value growth: The growth rate of whole life policy cash values is fixed when purchased, while returns on other types of permanent coverage, such as universal life, can be higher as they vary based on factors like investment returns and interest rate fluctuations.

Portable Life Insurance: Rates Rising, What to Know

You may want to see also

Whole life insurance companies

Whole life insurance is a permanent life insurance policy that covers the policyholder for their entire life, as long as they pay the premiums on time. It is more expensive than term life insurance but offers additional benefits. These include a cash value component, which accumulates over time and can be withdrawn or borrowed against, and a guaranteed rate of return.

Northwestern Mutual

Northwestern Mutual offers a cash value that is guaranteed to grow over time and can be used for anything.

MassMutual

MassMutual offers policies that provide the opportunity to earn dividends, which can then be used to increase coverage limits.

Globe Life

Globe Life offers benefits that can never be cancelled or reduced.

State Farm

State Farm offers premiums paid to 100.

Transamerica

Transamerica offers policies that do not require a medical exam, provided certain criteria are met.

Aflac

Aflac offers whole life insurance that is portable, so you can take your plan with you wherever you go. They also offer no-medical-exam whole life insurance.

Liberty Mutual

Liberty Mutual has partnered with TruStage to offer Advantage Whole Life Insurance, which can be purchased without a lengthy application process or medical exam.

Liberty Mutual's Life Insurance: Drug Testing and Policy Details

You may want to see also

Frequently asked questions

Yes, whole life insurance has a cash value that grows over time and can be borrowed against or withdrawn. This cash value grows tax-deferred, and interest accrues on a tax-deferred basis.

The cash value of whole life insurance is the portion of the policy that gains interest over time. This money can be used for anything, but taxes must be paid upon withdrawal.

Whole life insurance provides coverage for the insured's entire life, with fixed premiums and a guaranteed death benefit. It also includes a savings component, known as the cash value, which the policy owner can draw on or borrow from.

Whole life insurance offers several benefits, including lifetime coverage, a guaranteed death benefit, predictable premium payments, and a cash value that can be used for loans or withdrawals. It also provides financial security for beneficiaries and can be used as an investment.