Life insurance rates are determined by a variety of factors, including age, gender, health, lifestyle, and the type of policy chosen. While age is a primary factor, with older individuals typically paying higher premiums due to increased health risks and shorter life expectancy, other factors also play a significant role in rate determination. Gender influences rates, with men generally paying more than women due to their shorter average life expectancy. Health status, including pre-existing conditions, family medical history, and smoking status, is another key consideration, as healthier individuals often qualify for lower rates. Lifestyle choices, such as risky hobbies or occupations, can also impact rates, with safer options resulting in lower premiums. Lastly, the type of policy, term or permanent, and the amount of coverage desired, affect the cost, with term life insurance typically being more affordable than permanent life insurance.

| Characteristics | Values |

|---|---|

| Age | The older you are, the more expensive the premiums will be. |

| Health | The healthier you are, the lower the premiums will be. |

| Gender | Women tend to pay lower premiums than men. |

| Smoking status | Smokers pay higher premiums than non-smokers. |

| Driving record | A history of DUIs, DWIs and major traffic violations may result in higher premiums. |

| Occupation and lifestyle | High-risk jobs and activities may increase premiums. |

| Type of insurance | Term life insurance is cheaper than permanent life insurance. |

| Coverage amount | The more coverage, the higher the premium. |

What You'll Learn

How does age affect the rate?

Age is one of the primary factors influencing your life insurance premium rate, whether you're seeking a term or permanent policy. The older you are when you purchase a policy, the more expensive the premiums will be. This is because the cost of life insurance is based on actuarial life tables that assign a likelihood of dying while the policy is in force—and the older you are, the sooner that day is likely to come.

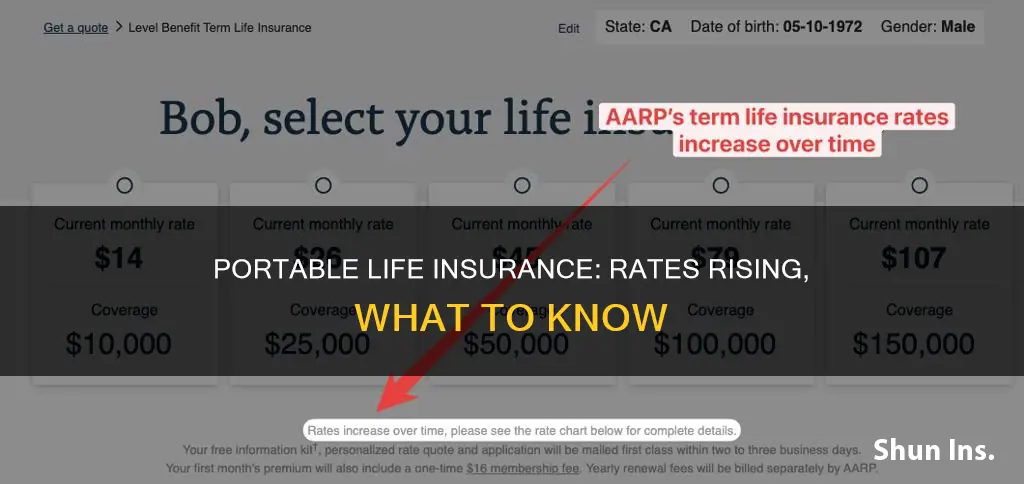

The premium amount typically increases by about 8% to 10% for every year of age; it can be as low as 5% annually in your 40s and as high as 12% annually if you're over 50. With term life insurance, your premium is established when you buy a policy and remains the same every year. With some permanent life insurance policies, the premium rises annually.

Age also affects whether a person will qualify for life insurance coverage at all, with qualifying medical exams getting increasingly stringent as you get older. The likelihood of becoming ill or dying while under coverage increases with age.

Life insurance is designed to pay out a death benefit to the person or persons you name as beneficiaries when you pass away. In exchange for this coverage, you pay a premium to the life insurance company. In the case of term life insurance, you'd pay these premiums for a set term prescribed by the policy. With permanent life insurance coverage, premiums are due as long as the policy remains in effect.

Companies that sell life insurance use actuarial tables to help set life insurance rates. These tables estimate life expectancy and mortality rates and, along with other factors, determine how much you'll pay for life insurance coverage. Term life insurance policies typically offer lower premium rates compared to permanent life insurance.

Life insurance rates increase with age as health issues become more frequent. The rationale behind using age as a major factor in setting rates is straightforward: the older you are, the closer you are to reaching your life expectancy, which poses a higher risk to the insurance company of having to pay death benefits to your beneficiaries.

Life insurance companies primarily base monthly costs on your age, along with other factors like your medical history, tobacco use, weight, and family health history. The older you are, the more your rates will increase based solely on age.

High Blood Pressure: Life Insurance Rates Impacted?

You may want to see also

How does gender affect the rate?

Life insurance rates are influenced by a number of factors, including age, health, lifestyle, and gender. While gender may not be the most significant factor, it does play a role in determining the cost of coverage.

On average, men pay higher premiums for life insurance than women. This is primarily due to the difference in life expectancy between the two genders. According to the Centers for Disease Control and Prevention, the average life expectancy for women in the United States is 79.3 years, while it is 73.5 years for men. This means that women tend to live longer than men, which results in lower insurance rates as they are expected to pay premiums for a longer period.

In addition to life expectancy, gender-specific health risks also contribute to the difference in insurance rates. Men have a higher risk of certain health conditions, such as heart attacks, which can affect their insurance premiums. The average age for a first heart attack in men is 65, while it is 72 for women. This increases the likelihood of a man dying within the coverage period of a term life insurance policy, leading to higher rates for male policyholders.

It is important to note that other factors, such as health, lifestyle choices, and family medical history, often have a more significant impact on insurance rates than gender alone. Health conditions, smoking status, and participation in risky activities are all considered when determining insurance premiums.

While gender plays a role in life insurance rates, it is just one of many factors that insurance companies consider when calculating premiums. By comparing policies and shopping around, individuals can find the best coverage options that meet their specific needs and budget.

Heart Attacks: Accident Insurance Coverage and Definition

You may want to see also

How does health affect the rate?

Health plays a significant role in determining the rate of life insurance. Insurers typically classify applicants as super preferred, preferred, standard, or substandard, with super preferred being the healthiest category. The healthier you are, the lower your premiums will be.

- Pre-existing conditions: Applicants with pre-existing conditions are often moved into higher rate classes. Major pre-existing conditions like heart disease, stroke, diabetes, or cancer usually have a greater impact on premiums. More minor conditions like asthma, being overweight, high cholesterol, or high blood pressure usually have a lower impact.

- Overall health: This includes blood pressure, weight, and the presence of pre-existing conditions. Insurance companies will also look at your height and weight, typically using your body mass index (BMI) as a measure of body fat.

- Mental health: Life insurance companies assess people with mental health issues based on their severity, whether there are tangential conditions, and whether they are being controlled with treatment. More severe or uncontrolled cases may find it challenging to get a policy.

- Family medical history: The medical history of an applicant's immediate family is often considered in the underwriting process. Insurers may ask about a family history of serious health conditions such as heart disease, cancer, or diabetes.

- Smoking status: Smokers are considered higher risk due to the increased likelihood of developing health issues. Life insurance for smokers tends to be more expensive.

- Lifestyle: Lifestyle choices such as diet, exercise, and participation in risky activities or hobbies can impact rates. For example, high-risk activities like skydiving or rock climbing can trigger higher rates or even jeopardize coverage eligibility.

- Transparency: Being transparent when applying for life insurance is crucial. Lying on a life insurance application or omitting relevant information can result in an application being denied or death benefits not being paid to beneficiaries.

Life Insurance and Social Security: Payout Impact

You may want to see also

How does lifestyle affect the rate?

Lifestyle is a key factor in determining the rate of life insurance premiums. Insurers will assess your lifestyle by looking at your occupation and hobbies, as well as your driving record and criminal history. If your job includes hazardous duties, or if you participate in risky activities like scuba diving, skydiving, or racing cars, you will likely pay more for insurance. Similarly, a history of DUIs, reckless driving, or criminal convictions will result in higher rates.

Insurers are also interested in your health and whether you smoke. If you lead a healthy lifestyle, you will generally pay less for life insurance. Smoking, on the other hand, will significantly increase your premiums as it puts you at a higher risk for many health problems. Even occasional smoking or the use of other nicotine products may result in higher rates.

Straight Life Insurance: Cash Value or Not?

You may want to see also

How does the type of insurance affect the rate?

The type of insurance you choose will have a significant impact on the rate you pay. For example, term life insurance is typically much cheaper than whole life insurance policies. Term life insurance offers coverage for a set number of years, while whole life insurance is permanent and includes a cash value component that allows you to borrow against your policy or withdraw funds later in life. The additional features and longer coverage period of whole life insurance policies are reflected in the higher premiums.

When it comes to life insurance, your age is a critical factor in determining the rate. Generally, the older you are, the higher your premiums will be. This is because insurers use actuarial tables to estimate life expectancy and mortality rates, and the likelihood of a payout increases with age. As a result, age can affect not only the rate but also your eligibility for coverage, as medical exams become more stringent for older applicants.

Your health is another significant factor. Pre-existing conditions, overall health, and family medical history can all influence your insurance rate. The presence of major pre-existing conditions, such as heart disease or cancer, will usually have a greater impact on your premiums. Lifestyle choices, such as smoking or participating in risky activities, can also increase your rates.

The amount of coverage you choose will also affect your rate. Higher coverage amounts lead to higher premiums. Additionally, your gender can play a role, as women tend to have longer life expectancies than men and therefore often pay lower rates.

It's important to note that rates can vary across different insurance providers, so it's always a good idea to compare quotes from multiple insurers to find the best rate for your specific circumstances.

Fafsa and Life Insurance: What You Need to Know

You may want to see also

Frequently asked questions

Yes, the rate for portable life insurance typically increases as you age due to the heightened risk of a death benefit claim. The likelihood of health complications and a shorter life expectancy also contribute to higher premiums for older individuals.

Age is a primary factor in determining life insurance rates. On average, the premium amount increases by about 8% to 10% for every year of age. The increase can be as low as 5% annually in your 40s and as high as 12% annually if you're over 50.

Yes, several factors contribute to the rate for portable life insurance. These include your health, gender, lifestyle choices, occupation, and the type and amount of coverage you choose.

To obtain cheaper rates, it's advisable to purchase life insurance at a younger age and maintain a healthy lifestyle. Comparing quotes from multiple insurers and working with an insurance broker can also help you find more affordable options.