The Free Application for Federal Student Aid (FAFSA) is a form that collects financial information from students applying for financial aid for college. The FAFSA does not consider cash value life insurance as an asset, and therefore, it does not need to be reported. However, distributions from a life insurance policy are counted as income and must be reported as such. While the FAFSA does not require the disclosure of annuities, the CSS Profile, an additional form used by some colleges, does count non-qualified annuities as assets. It is important to note that seeking advice from qualified college financial advisors is crucial to understanding how different assets, including life insurance, can impact financial aid eligibility.

| Characteristics | Values |

|---|---|

| Does FAFSA count life insurance accounts? | No, FAFSA does not consider cash value life insurance as an asset. |

| Does FAFSA count life insurance settlements? | Yes, settlements from a life insurance policy count as income. |

| Does FAFSA count annuities? | No, annuities don't need to be reported on the FAFSA, but they are counted as an asset on the CSS Profile. |

What You'll Learn

- FAFSA doesn't consider cash value life insurance as an asset

- Settlements from a life insurance policy count as income

- Whole life and cash value life insurance policies are sheltered as retirement plans

- Distributions from a non-reportable asset may need to be reported as income

- Borrowing from a life insurance policy won't be reported as an asset

FAFSA doesn't consider cash value life insurance as an asset

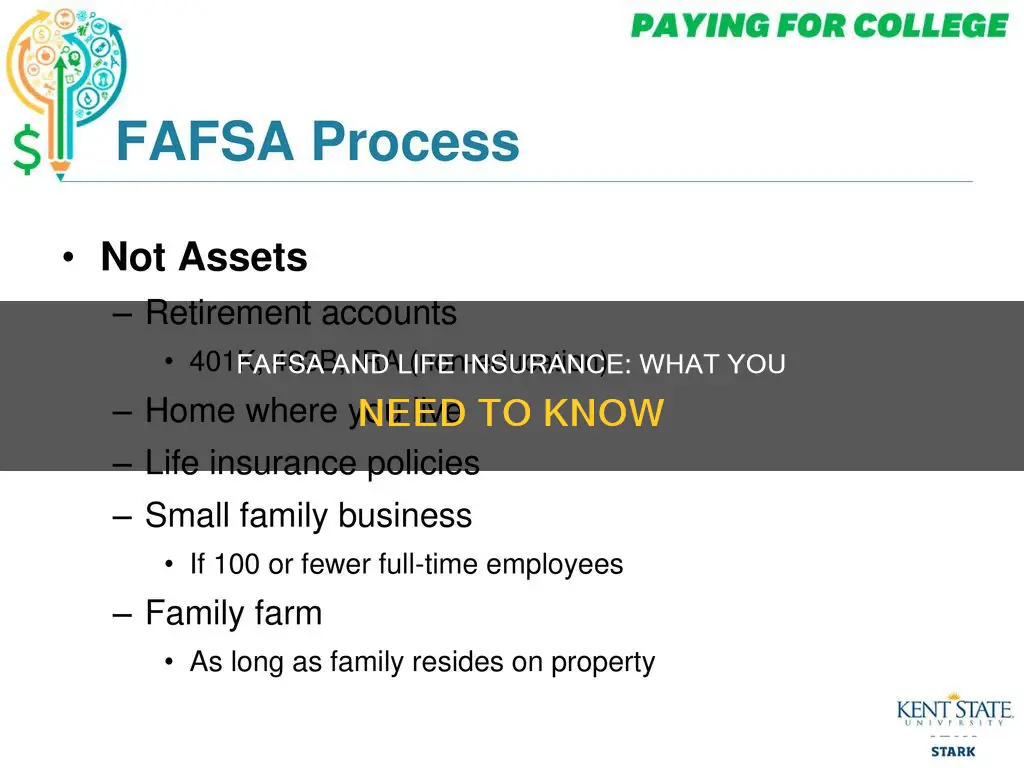

Completing the FAFSA, or the Free Application for Federal Student Aid, is a crucial step in applying for financial aid for college. It is important to understand which assets are reportable and which are not to maximize eligibility for financial aid. While some assets, such as bank accounts and investment properties, are reportable on the FAFSA, there are certain assets that are not taken into account. Notably, the FAFSA does not consider cash value life insurance as an asset.

This omission has led to some insurance agents promoting cash value life insurance as a way for parents to hide their assets and increase their children's eligibility for financial aid. However, this strategy is generally not advisable due to the high costs and low returns associated with these policies. Mark Kantrowitz and David Levy, renowned financial aid experts, caution against this approach, stating that the "high sales commissions, high premium, low return on investment, the nondeductible nature of the premiums and the surrender charges, among other problems, may cost the family more than they save from sheltering the money from the need-analysis process."

It is important to understand that while cash value life insurance is not considered an asset on the FAFSA, settlements from a life insurance policy will count as income. Additionally, distributions from a life insurance policy may need to be reported as untaxed income on the FAFSA in subsequent years. Therefore, while cash value life insurance may not directly impact the initial FAFSA application, it can still have financial implications in the future.

Furthermore, it is worth noting that the CSS Profile, used by around 200 mostly private colleges and universities, treats life insurance policies differently. While whole life and cash value life insurance policies are not reported as assets on the FAFSA, they are considered retirement plans on the CSS Profile. This distinction is important, as it can impact the financial aid calculations for students applying to private institutions.

In conclusion, while the FAFSA does not consider cash value life insurance as an asset, it is important to carefully consider the potential consequences and seek advice from reputable financial aid experts before making any decisions regarding insurance policies and college financial aid.

DCU's Term Life Insurance Offer: What You Need to Know

You may want to see also

Settlements from a life insurance policy count as income

The Free Application for Federal Student Aid (FAFSA) is a form that collects financial information from students and families to determine eligibility for financial aid. This includes need-based aid, such as Federal Pell Grants, subsidized federal student loans, and work-study programs, as well as unsubsidized student loans available to all students regardless of financial need.

When it comes to life insurance, the FAFSA treats it in the following ways:

Cash Value Life Insurance as a Non-Reportable Asset

The FAFSA does not consider cash value life insurance as an asset. This means that the value of a life insurance policy is not reported on the FAFSA form and does not directly impact the calculation of the Student Aid Index (SAI), which determines eligibility for need-based financial aid. However, some experts caution against using life insurance as a way to hide parents' assets, as it may be costly and unnecessary.

While the policy value itself is not reported, any settlements or distributions from a life insurance policy are treated as income on the FAFSA. This includes money received as the beneficiary of a life insurance policy. This income will increase the SAI and reduce eligibility for need-based financial aid. The impact of this income will depend on whether it is reported as student or parent income. Student income increases the SAI by 20% of the income amount, while parent income uses a bracketed scale, increasing the SAI by up to 5.64%.

Interest on Life Insurance Payouts is Taxable

According to the Internal Revenue Service (IRS), any interest received from a life insurance payout is considered taxable income and should be reported as such. This interest income may also need to be reported on the FAFSA, further impacting financial aid eligibility.

Borrowing from a Life Insurance Policy

Borrowing against a life insurance policy is treated differently. If money is borrowed from a life insurance policy after the FAFSA is filed, it is generally not reported as an asset. However, the interest on the borrowed amount may be considered income and could impact financial aid eligibility.

In summary, while the cash value of a life insurance policy is not reported on the FAFSA, any settlements, distributions, or interest received from the policy are typically treated as income and can reduce eligibility for need-based financial aid.

Citibank's Life Insurance Offer: What You Need to Know

You may want to see also

Whole life and cash value life insurance policies are sheltered as retirement plans

Whole life insurance provides coverage for the entirety of the insured person's life. It includes a savings component, known as the cash value, which functions similarly to a retirement savings account. The cash value of a whole life policy typically earns a fixed rate of interest, with interest accruing on a tax-deferred basis. This cash value can be withdrawn or borrowed against by the policyholder.

Cash value life insurance policies, such as whole life insurance, are considered retirement plans and are not reported as assets on the FAFSA (Free Application for Federal Student Aid). However, distributions from these policies are counted as untaxed income on the FAFSA. It's important to note that settlements from a life insurance policy are considered income.

While whole life and cash value life insurance policies offer certain benefits, such as tax advantages and a guaranteed death benefit, they also have some drawbacks. These policies are often criticised for their high sales commissions, high premiums, low return on investment, and surrender charges. As a result, some experts advise against using these policies as a way to hide parents' assets when applying for financial aid.

When considering whole life and cash value life insurance policies as part of a retirement plan, it's essential to carefully evaluate the specific features, risks, and potential returns. Seeking advice from a trusted financial professional can help individuals make informed decisions about these complex products.

Cigna's Individual Life Insurance: What You Need to Know

You may want to see also

Distributions from a non-reportable asset may need to be reported as income

Life insurance policies are sheltered as retirement plans and are not counted as assets on the FAFSA. However, distributions from a life insurance policy will count as income.

Cigna Life Insurance: Depression History and Rejection Risk

You may want to see also

Borrowing from a life insurance policy won't be reported as an asset

Borrowing from a life insurance policy is a quick and easy way to get cash in hand when you need it. However, it is important to note that this option is only available for permanent life insurance policies, such as whole or universal life insurance, and not term life insurance policies. Term life insurance is a cheaper and more suitable option for many, but it does not have a cash value component and is designed to last for a limited period.

When you borrow from your life insurance policy, you are essentially giving yourself a loan from the value you've built up over time. This process is straightforward and does not require a credit check or approval. All you need to do is reach out to your agent or insurance company and fill out a basic form. If your cash value is sufficient, you will receive the funds in a few business days.

It is important to remember that borrowing from your life insurance policy can have long-term effects. The loan is not free money, and it will need to be repaid with interest. If the loan is not repaid before your death, it will be deducted from the death benefit that your beneficiaries receive. Additionally, if the cash value dips too low and the loan remains unpaid, your policy could lapse, leaving you without coverage and potentially facing tax penalties.

While borrowing from a life insurance policy won't be reported as an asset on the FAFSA (Free Application for Federal Student Aid), it is important to consider the potential risks and long-term impacts before taking out such a loan.

Convertable Life Insurance: Cash Value and Benefits Explained

You may want to see also

Frequently asked questions

No, FAFSA does not consider cash value life insurance as an asset.

This is because of the omission of this information from the FAFSA form. However, settlements from a life insurance policy will count as income.

Whole life and cash value life insurance policies are sheltered as retirement plans, but they are bad investments. The return on investment is inferior; they have high surrender charges and high sales commissions. Distributions are counted as untaxed income on the FAFSA.

Borrowing from a life insurance policy won't be reported as an asset on the FAFSA, assuming the money is borrowed after the FAFSA is filed. However, the interest is not deductible and may eventually count as taxable income.

If you receive a large sum of money from a life insurance policy, it will count as an asset in any following years. Financial aid is typically reserved for people who don't have a substantial amount of money.