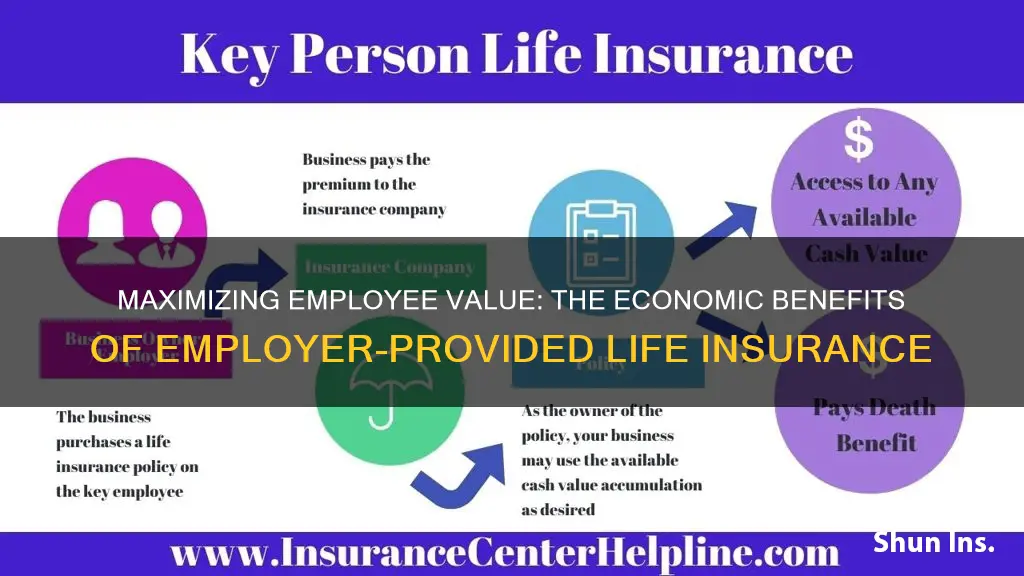

Employer-provided life insurance is a valuable benefit that offers both financial security and peace of mind to employees and their families. This type of insurance is often included as part of a comprehensive benefits package, providing a safety net in the event of the employee's untimely death. The economic value of this insurance lies in its ability to provide financial support to dependents, cover outstanding debts, and ensure that loved ones are taken care of during a difficult time. By offering this benefit, employers not only demonstrate their commitment to employee well-being but also contribute to a more stable and secure workforce, fostering a positive and productive work environment.

What You'll Learn

- Cost-Effectiveness: Compare premiums to out-of-pocket costs for similar coverage

- Tax Benefits: Understand tax advantages for both employer and employee

- Coverage Limits: Assess if the policy's payout meets financial needs

- Portability: Evaluate ease of transferring coverage to a new employer

- Alternative Options: Explore other insurance choices for personalized financial protection

Cost-Effectiveness: Compare premiums to out-of-pocket costs for similar coverage

When evaluating the economic value of employer-provided life insurance, cost-effectiveness is a critical aspect to consider. This involves a detailed comparison of the premiums paid by employees and the employer to the actual out-of-pocket costs associated with similar coverage. Here's a breakdown of this analysis:

Premium Analysis:

Employer-sponsored life insurance often offers a range of coverage options, allowing employees to choose the level of protection that suits their needs. The premium for this coverage is typically a percentage of the employee's salary, with the employer contributing a significant portion. For instance, an employer might provide a basic policy with a set premium rate, while an employee can opt for a higher coverage amount at a slightly increased premium. It's essential to compare these premiums across different plans to ensure employees are getting the best value for their money. A comprehensive analysis should consider various factors, such as age, health status, and the desired coverage amount, to determine the most cost-effective premium structure.

Out-of-Pocket Costs:

In contrast to premiums, out-of-pocket costs refer to the expenses an individual incurs when making a claim. These costs can vary widely depending on the specific policy and the circumstances of the claim. For instance, some policies may have higher out-of-pocket expenses for certain conditions or may require a higher deductible before coverage kicks in. When assessing cost-effectiveness, it's crucial to examine the likelihood and potential impact of claims. Policies with lower out-of-pocket costs for common claim scenarios might be more attractive to employees, especially those with families or financial dependents.

Comparative Analysis:

To truly understand the economic value, a side-by-side comparison of different insurance plans is necessary. This comparison should focus on similar coverage types, ensuring a fair assessment. For instance, comparing term life insurance policies with varying coverage periods and premium structures can highlight the most affordable options. Additionally, analyzing the impact of different claim scenarios on out-of-pocket costs can provide valuable insights. Employees should be encouraged to review and understand the potential costs associated with various claim events to make informed decisions.

Long-Term Financial Planning:

Cost-effectiveness also ties into long-term financial planning. Employer-provided life insurance can be a valuable component of an employee's overall financial strategy. By offering competitive premiums and low out-of-pocket costs, employers can ensure that their employees have a safety net in place without incurring excessive financial burdens. This aspect becomes even more critical when considering the potential tax benefits and the overall cost savings that can result from employer-sponsored insurance.

In summary, evaluating the economic value of employer-provided life insurance requires a comprehensive examination of premiums and out-of-pocket costs. By comparing similar coverage options and considering individual circumstances, employees can make informed choices. This analysis ensures that the insurance provided is not only valuable but also cost-effective, contributing to a more secure financial future for employees and their families.

Life Insurance: Understanding 'Paid-Up' Policies

You may want to see also

Tax Benefits: Understand tax advantages for both employer and employee

Employer-provided life insurance is a valuable benefit that offers both financial security and tax advantages to both the employer and the employee. When an employer offers life insurance as a benefit, it can have significant economic value and provide a range of tax benefits.

For the employer, providing life insurance can be a tax-efficient way to support their employees. The cost of the insurance premium is typically tax-deductible for the employer, which means it reduces their taxable income. This can result in significant tax savings, especially for businesses with a large workforce. By offering this benefit, employers can attract and retain talent, as it demonstrates a commitment to employee well-being and can enhance the overall compensation package.

From the employee's perspective, employer-provided life insurance can also offer tax advantages. The premiums paid by the employer for the employee's life insurance policy are generally not taxable income for the employee. This means that the employee does not have to report the value of the insurance as income, which can be beneficial, especially for those in lower tax brackets. Additionally, if the employee pays for part of the premium, they may be eligible for tax deductions, further reducing their taxable income.

Furthermore, the tax benefits of employer-provided life insurance can extend beyond the individual employee. If the employer's contribution is significant, it can be a valuable deduction for the business, potentially lowering their corporate tax liability. This can result in increased profitability and financial stability for the company.

It is important to note that the specific tax advantages may vary depending on the jurisdiction and the terms of the insurance policy. Consulting with tax professionals or financial advisors can provide personalized guidance on how to maximize these tax benefits while ensuring compliance with relevant tax laws. Understanding these tax advantages can encourage both employers and employees to recognize the economic value of employer-provided life insurance and its potential to enhance financial security and overall compensation.

AARP Life Insurance: Processing Time Explained

You may want to see also

Coverage Limits: Assess if the policy's payout meets financial needs

When evaluating the economic value of employer-provided life insurance, it's crucial to delve into the coverage limits, as these directly impact the financial security it offers. Coverage limits refer to the maximum amount the insurance policy will pay out in the event of the insured's death. This payout is a critical aspect of the policy's value, as it determines the financial support available to the policyholder's dependents or beneficiaries.

Assessing whether the coverage limit meets your financial needs requires a careful analysis of your personal and family circumstances. Start by calculating your annual expenses, including housing, utilities, transportation, food, and other regular outgoings. Then, consider the income your family would need to maintain its current standard of living if you were no longer there to provide financially. This calculation should also account for any specific financial goals or obligations, such as children's education or a mortgage.

The coverage limit should ideally be at least equal to, if not exceed, this calculated amount. For instance, if your annual expenses and necessary income for your family total $100,000, the life insurance policy's payout should be at least $100,000. This ensures that your loved ones have the financial resources to cover essential costs and maintain their lifestyle in your absence.

It's worth noting that life insurance policies often offer different types of coverage, such as term life, whole life, or universal life. Each type has its own coverage limits and benefits. For instance, term life insurance provides coverage for a specified period, while whole life offers lifelong coverage. Understanding these differences is essential to choosing the right policy that aligns with your financial needs.

In summary, when assessing the economic value of employer-provided life insurance, coverage limits are a critical factor. They should be evaluated in the context of your personal financial situation and the potential impact on your dependents. By ensuring that the coverage limit is adequate, you can provide a safety net for your family, offering financial security and peace of mind.

Life Insurance and Debt: Can Garnishments Be Withheld?

You may want to see also

Portability: Evaluate ease of transferring coverage to a new employer

Portability is a crucial aspect of employer-provided life insurance, especially when considering the ease of transitioning coverage to a new employer. When an employee leaves their current job, the transfer of life insurance benefits can be a seamless process or a complex one, depending on the policies and the employer's approach. Here's an evaluation of this aspect:

Many employer-sponsored life insurance plans offer a level of portability, allowing employees to continue their coverage when they change jobs. This is particularly beneficial for individuals who have built up a substantial insurance benefit over time, as it ensures that their loved ones are still protected even if they move to a new company. The process typically involves the new employer providing a new plan or allowing the employee to port their existing coverage to the new employer's plan. This portability feature is often a selling point for employees, as it provides continuity and peace of mind during career transitions.

The ease of transferring coverage depends on the employer's policies and the type of life insurance plan offered. Some employers may have standardized processes in place, making it straightforward for employees to continue their coverage. For instance, if the employer offers a group term life insurance plan, the transfer process might be as simple as notifying the new employer and providing the necessary documentation. In contrast, other employers might have more complex plans, such as individual permanent life insurance, which may require a more intricate process to transfer benefits.

When evaluating portability, it's essential to consider the time frame and any potential delays. In some cases, employees might have a grace period to continue their coverage after leaving a job, ensuring they don't experience a lapse in protection. However, if the grace period expires, the employee may need to re-qualify for coverage with the new employer, which could involve medical exams and additional paperwork. This process can be time-consuming and may deter employees from porting their coverage, especially if they are in a hurry to start a new job.

To make the transfer process smoother, employers can provide clear communication and guidance to employees. This includes educating employees about their rights and options regarding life insurance coverage. Additionally, employers can offer resources and support to help employees navigate the process of porting coverage, ensuring they understand the benefits and any potential challenges they might face. By doing so, employers can enhance employee satisfaction and retention, knowing that their life insurance coverage is portable and secure.

In summary, portability is a significant advantage of employer-provided life insurance, allowing employees to maintain their coverage during career changes. The ease of transfer depends on the employer's policies and the type of plan offered. By offering portable coverage, employers can demonstrate their commitment to employee well-being and provide a valuable benefit that contributes to a positive work environment.

Life, AD&D Insurance: What's Supplemental Coverage?

You may want to see also

Alternative Options: Explore other insurance choices for personalized financial protection

When considering your financial protection, it's important to explore various insurance options that can provide tailored coverage to meet your unique needs. While employer-provided life insurance can offer some benefits, it's worth examining alternative choices to ensure you have comprehensive coverage. Here are some alternative insurance options to consider:

Term Life Insurance: This is a popular and cost-effective choice for individuals seeking pure protection. Term life insurance provides coverage for a specified period, such as 10, 20, or 30 years. It offers a death benefit if the insured individual passes away during the term, and premiums are typically lower compared to permanent life insurance. Term plans are ideal for those who want to secure their family's financial future for a defined period, such as covering mortgage payments or children's education.

Whole Life Insurance: In contrast to term life, whole life insurance offers lifelong coverage. It provides a death benefit and also includes a savings component, allowing the policy to accumulate cash value over time. While it is more expensive than term life, whole life insurance offers the advantage of having a guaranteed death benefit and a fixed premium. This option is suitable for those seeking long-term financial security and a permanent insurance solution.

Universal Life Insurance: This type of policy offers flexibility and adaptability. It provides a death benefit and allows policyholders to adjust their premiums and death benefit amounts over time. Universal life insurance also accumulates cash value, which can be borrowed against or used to pay future premiums. This option is ideal for individuals who want control over their insurance and the potential for investment growth.

Critical Illness Insurance: This insurance focuses on providing financial protection in the event of a critical illness. It covers the cost of medical treatments and can help individuals manage the financial impact of serious health conditions. Critical illness insurance can be tailored to your specific needs and may be combined with other insurance types for comprehensive coverage.

Disability Insurance: This type of insurance replaces a portion of your income if you become unable to work due to illness or injury. It ensures that you have a steady income stream during periods of disability, helping to maintain your standard of living. Disability insurance can be purchased individually or offered as a group benefit through employers.

Exploring these alternative insurance options allows you to customize your financial protection plan. It's essential to assess your specific circumstances, such as your age, health, financial goals, and risk tolerance, to determine the most suitable insurance choices. Consulting with independent insurance advisors or brokers can provide valuable guidance in navigating the various policies and finding the best fit for your personalized needs.

Life Insurance: Who Benefits and How?

You may want to see also

Frequently asked questions

Employer-provided life insurance, also known as group life insurance, offers significant economic benefits to both employees and employers. This type of insurance provides a financial safety net for employees' families in the event of their death, ensuring financial security and peace of mind. The value lies in its ability to cover essential living expenses, mortgage payments, or other debts, preventing financial strain on the surviving family members.

For employees, this insurance is often a valuable addition to their benefits package. It provides financial protection, knowing that their loved ones will be taken care of if the worst happens. This can lead to improved job satisfaction and reduced stress, allowing employees to focus on their work without the worry of financial uncertainty.

Employers offering group life insurance demonstrate their commitment to employee well-being, which can boost morale and loyalty. It can also help attract and retain talent, as it is a highly valued benefit. Additionally, providing life insurance can reduce the financial burden on employees, allowing them to allocate resources more efficiently, potentially increasing productivity.

Yes, there are tax benefits associated with group life insurance. In many countries, the cost of group life insurance premiums is tax-deductible for the employer, and in some cases, the employee may also be eligible for tax advantages, depending on the jurisdiction's tax laws. These tax benefits can further enhance the economic value of this insurance.

Absolutely. Group life insurance policies can be tailored to meet the specific needs of the employer and their workforce. This customization may include varying death benefit amounts, coverage periods, and additional riders or options to suit different risk profiles and preferences.