Life insurance policies are often used to provide financial security for loved ones after the policyholder's death. However, in the event of outstanding debts, creditors may attempt to access these benefits to recover what they are owed. The vulnerability of life insurance benefits to garnishment varies depending on the state and the type of policy. For instance, in Texas, both the cash value and death benefit of a life insurance policy are fully protected from creditors, whereas in Florida, only the cash value is protected during the policyholder's lifetime. Additionally, the presence of co-signed loans between beneficiaries and the deceased can impact the susceptibility of life insurance benefits to garnishment.

What You'll Learn

State-specific variations in life insurance garnishment laws

In Texas, for instance, a life insurance policy's cash value and death benefit are entirely shielded from creditors, ensuring that beneficiaries receive the full payout. Conversely, in Florida, the cash value of a policy is protected from garnishment while the insured is alive, but after their passing, creditors can claim the benefits to settle debts before the beneficiaries receive their share.

The laws in Michigan also highlight state-specific variations. In the case of DC Mex Holdings LLC v Affordable Land LLC and Dale Fuller, the Michigan Court of Appeals interpreted a statute, M.C.L. 500.2207(1), which exempts insurance proceeds from creditors under certain conditions. The court ruled that the phrase "proceeds of any policy . . . including the cash value thereof" encompassed the entire amount payable to the beneficiary, protecting it from garnishment.

In summary, while federal laws provide a baseline of protection, state-specific variations in life insurance garnishment laws can significantly impact the outcome for beneficiaries. These laws determine whether creditors can access policy benefits and, if so, to what extent. As such, it is crucial for individuals to understand the laws in their state to make informed decisions about protecting their life insurance policies and beneficiaries.

Life Insurance Proceeds: Taxable or Not?

You may want to see also

Life insurance beneficiaries and their liabilities

Life insurance is a contract between a policyholder and an insurance company that pays out a death benefit when the insured person passes away. It is an asset that many people use in long-term financial planning, providing financial support to loved ones after death.

Choosing a beneficiary

When purchasing life insurance, it is important to always name a beneficiary, whether an individual or organisation. A beneficiary can be a spouse, child, legal guardian of a minor, or a charitable organisation. A primary beneficiary and one or more contingent beneficiaries can be named. A contingent beneficiary would receive death benefits if the primary beneficiary passes away.

Informing beneficiaries

It is important to inform beneficiaries that they have been named in a life insurance policy. This allows them to know what to do when the time comes to claim. If beneficiaries are not informed, death benefits may go unclaimed. It is also helpful to inform beneficiaries or trusted advisors, such as accountants and attorneys, of the name of the insurance company and where the policy is stored.

Payout options

There are several ways a beneficiary may receive a life insurance payout, including lump-sum payments, installment payments, annuities, and retained asset accounts. A retained asset account is like a checking account maintained with the life insurance company. It is important to consult with a tax professional about any potential tax consequences of the different payout options.

Liabilities and debt

If the insured person has outstanding debts when they pass away, there is a chance that creditors will be able to go after the benefits of their life insurance policy to pay off those debts. This depends on the state in which the insured person lived. In some states, life insurance is protected from creditors, while other states offer limited protection. For example, in Texas, a life insurance policy's cash value and death benefit are completely protected from creditors. In Florida, only the cash value of a policy is protected while the insured person is still living; after the insured passes away, the benefits are no longer protected.

If any beneficiaries of a life insurance policy have co-signed loans with the insured, creditors can file a lawsuit against the beneficiaries to receive the amount owed from the payouts. If the insured has any outstanding loans, the beneficiaries may have to use the payouts to cover the debt. They may also have to use some of the payouts to pay taxes on the estate.

If the insured person names their estate as the beneficiary of their life insurance, the life insurance payouts are more vulnerable to creditors. In this case, the assets listed in the estate will need to be liquidated to pay off any outstanding debts, which could include the life insurance.

To protect life insurance benefits from creditors, it is best to consult with an insurance agency or an attorney.

HIV Testing for New York Life Insurance

You may want to see also

Irrevocable life insurance trusts

ILITs are a powerful planning tool that serves as an important wealth transfer mechanism in many well-crafted estate plans. They are particularly beneficial for affluent families with sizable estates or those with loved ones with special needs who will require ongoing care.

Benefits of ILITs

ILITs provide a tax-efficient way to transfer wealth to beneficiaries outside of the taxable estate. They also help to minimise the current tax burden of the insured. By removing taxable assets from the insured's current portfolio, an ILIT may help lower their current tax burden.

ILITs also allow the insured to choose a manager of assets and how the beneficiaries receive them. This means the insured can instruct the trustee to prevent the beneficiaries from wasting the benefits or spread the assets among beneficiaries depending on their needs.

ILITs can also help protect legacy assets from potential creditors. Although each state has its own rules regarding how much of the insurance policy cash value or death benefit can be protected from creditors, when the policy is held in an ILIT, any excess value above those limits is generally protected from the creditors of both the grantor and the beneficiary.

Downsides of ILITs

The main downside of an ILIT is that it is irrevocable. A revocable trust can be easily modified or terminated because the assets remain the property of the grantor. However, with an ILIT, the grantor relinquishes control over assets when they are gifted to the trust. Therefore, the trust cannot be modified without legal action or the consent of the beneficiaries.

Another potential drawback is the cost. Setting up and maintaining an ILIT may require professional fees and the filing of a gift tax return.

Term vs Universal Life Insurance: Key Differences Explained

You may want to see also

Garnishment of life insurance death benefits

Life insurance death benefits can be garnished by creditors to pay off outstanding debts. However, this depends on the state in which the insured person lives. Some states, such as Texas, protect the cash value and death benefit of a life insurance policy from creditors, meaning the policy cannot be garnished for debts. Other states, like Florida, only protect the cash value of a policy while the insured person is still alive. After the insured person passes away, the benefits of the policy are no longer protected and can be garnished by creditors.

The vulnerability of life insurance payouts to creditors also depends on who the beneficiaries are. If any beneficiaries have co-signed loans with the insured, creditors can file a lawsuit to receive the amount owed from the policy payouts. If the insured person's estate is named as the beneficiary or if the named beneficiary has predeceased the insured, the life insurance payouts are more vulnerable to creditors. In such cases, the assets listed in the estate may need to be liquidated to pay off any outstanding debts, including those covered by the life insurance policy.

To protect life insurance benefits from creditors, one option is to set up an irrevocable life insurance trust that holds the death benefits in trust for the surviving spouse with a spendthrift provision. Another option is to have a trust set up in the beneficiary's name, with the trust as the beneficiary of the policy. Consulting with an insurance agency or a lawyer can help determine the best way to protect life insurance benefits from creditors.

Ex-Wife's Entitlement: Life Insurance Payout After Divorce

You may want to see also

Life insurance and creditors' claims

If there is no surviving designated beneficiary, the life insurance proceeds will pass into the decedent's probate estate and be available to pay off the decedent's final bills. Alternatively, the proceeds will pass directly to the decedent's living heirs-at-law, who are individuals so closely related to the decedent that they would be legally entitled to inherit from them if they had not left a will. The bottom line is that the life insurance proceeds do not have to be used to pay the decedent's final bills unless they are payable to the estate rather than the heirs-at-law.

If a beneficiary is still living when the insured passes away and they have co-signed loans with the insured, creditors can file a lawsuit against the beneficiaries to receive the amount owed from the payouts of the policy. If any of the listed beneficiaries did not co-sign any loans with the insured but the insured has outstanding loans, the beneficiaries may have to use the payouts from the policy to cover the outstanding debt. They may also have to use some of the payouts to pay for any taxes that have been placed on the estate.

To protect life insurance benefits from creditors, it is possible to set up a trust in the beneficiary's name, with the trust as the beneficiary of the policy. This means that the proceeds would not be available to the beneficiary's creditors or the trustee of their bankruptcy estate.

Life Insurance: Monumental's Comprehensive Coverage Benefits

You may want to see also

Frequently asked questions

It depends on the state you live in. In some states, life insurance is protected from creditors, meaning that creditors cannot garnish the benefits of your policy to pay off your debts. In other states, there is only limited protection for life insurance.

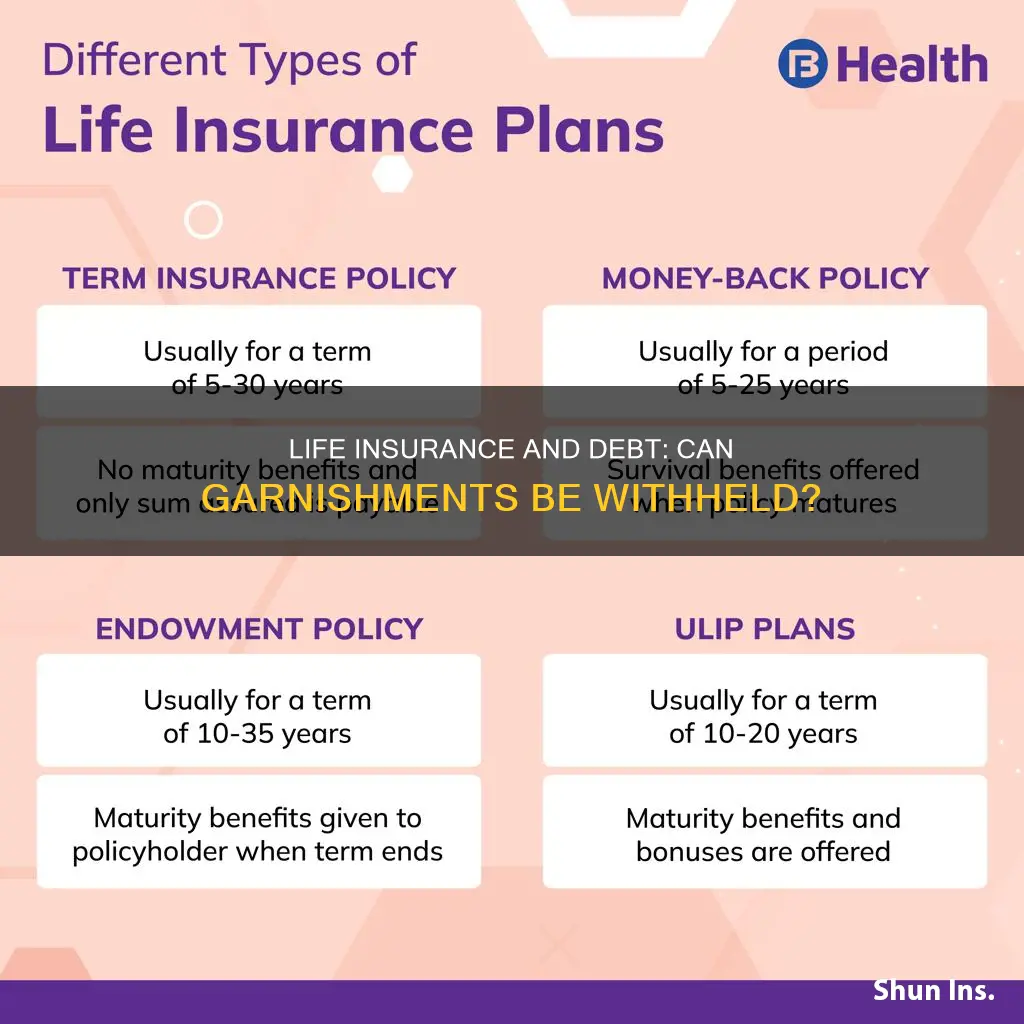

With cash value life insurance policies, premiums will be deposited into a separate account, known as a cash account, after expenses (such as insurance costs) are deducted. With a term life insurance policy, the amount of time that the policy lasts is limited (e.g. 20 or 30 years), but the monthly premiums are less expensive than with cash value policies.

Yes, if any beneficiaries are still living when the insured passes away and they have co-signed loans with you, creditors can file a lawsuit against the beneficiaries to receive the amount owed from the payouts of your policy.

A writ of garnishment is a court order requiring a third party to withhold the defendant's property (usually money) for delivery to a creditor to whom they owe an overdue debt.