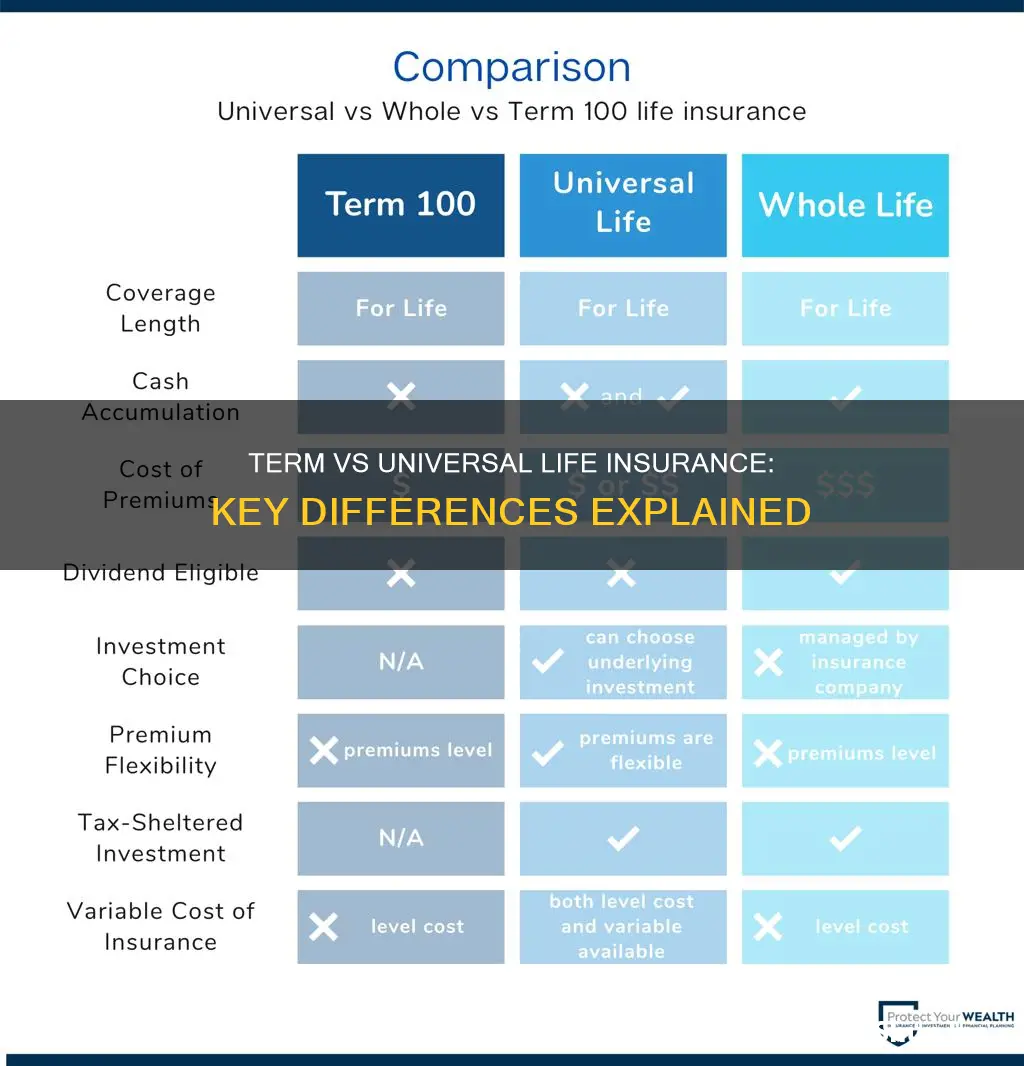

Life insurance is an important component of any financial plan. It can provide peace of mind that your family will be financially secure if you pass away. However, the variety of types available can be confusing, and many people may delay buying insurance because they are unsure of which is right for them. This paragraph will introduce the topic of the difference between term and universal life insurance, two of the most common types of life insurance, and each with its own unique advantages and disadvantages.

What You'll Learn

- Term life insurance is cheaper but has a set end date

- Universal life insurance is more expensive but lasts the policyholder's lifetime

- Term life insurance is the most basic type of insurance policy

- Universal life insurance has a savings component

- Term life insurance is appropriate for those who want to insure themselves and their loved ones against unforeseen events

Term life insurance is cheaper but has a set end date

Term life insurance is the most basic type of life insurance. It is significantly more affordable than universal life insurance, but it has a set end date. This means that you will only be covered for a specific period, such as 10, 20, or 30 years. After this period, your policy will expire, and you will need to renew it at a higher rate or purchase a new policy.

The low cost of term life insurance makes it a good option for those who want to ensure their loved ones are financially protected in the event of their death, but may not be able to afford the high premiums of universal life insurance. It is also a good choice for those who only need coverage for a specific period, such as the number of years until their children become financially independent or until their mortgage is paid off.

Term life insurance is also simple and easy to understand. You pay your premiums, and if you pass away during the policy term, your beneficiaries receive a payout. There is no complex fine print to navigate, and you can cancel the policy at any time without penalties. Additionally, term life insurance is customizable, as you can choose the policy term and coverage amount that best suits your needs.

However, one of the main drawbacks of term life insurance is that it only provides coverage for a limited period. If you pass away after the policy expires, your beneficiaries will not receive any benefits. Another disadvantage is that term life insurance does not accumulate any cash value, so you cannot borrow against it or use it to pay your premiums later in life.

In contrast, universal life insurance is a type of permanent life insurance that offers long-term protection and can last for the lifetime of the policyholder. It also has a cash value component that grows over time, which you can access for other purposes. While term life insurance premiums are generally affordable and remain the same throughout the policy term, universal life insurance premiums are significantly more expensive and can increase over time.

Get Your Life Insurance License: Steps to Success

You may want to see also

Universal life insurance is more expensive but lasts the policyholder's lifetime

Universal life insurance is a type of permanent life insurance that offers long-term protection and can last a lifetime. It is more expensive than term life insurance but comes with several benefits that make it a valuable investment for individuals seeking comprehensive coverage.

One key advantage of universal life insurance is its flexibility. Policyholders can adjust the amount and frequency of premium payments within certain limits and even increase or decrease their policy's coverage to align with their changing financial goals. This adaptability ensures that the policy remains relevant and suitable over time.

Universal life insurance also offers a savings component, known as the cash value, which builds up over time, tax-deferred. Policyholders can access this cash value for other financial needs, such as through a life insurance policy loan. The cash value aspect of universal life insurance distinguishes it from term life insurance, which does not have a similar savings feature.

While term life insurance is more affordable in terms of premium payments, it only provides coverage for a specified period, such as 10, 20, or 30 years. After this set term, the policy expires, and beneficiaries will not receive any payment unless it is renewed, typically at a higher rate. On the other hand, universal life insurance is designed to last the policyholder's lifetime, providing peace of mind and ensuring that loved ones are financially protected.

The longevity of universal life insurance makes it a good choice for individuals who want coverage that extends beyond a specific period, such as those with lifelong dependents or those seeking to fund a life insurance trust. While the higher premiums of universal life insurance may be a consideration, the long-term protection and flexibility it offers can provide valuable financial security for individuals and their families.

In summary, while universal life insurance is more expensive than term life insurance, it offers the advantage of lasting the policyholder's lifetime, along with the ability to build cash value and adjust coverage to meet evolving financial needs. These features make universal life insurance a compelling option for those seeking comprehensive and adaptable coverage.

Life Insurance Licenses: Felony Impact Explained

You may want to see also

Term life insurance is the most basic type of insurance policy

Term life insurance is also flexible, as it comes in a variety of durations, from one to 20 years, and can be renewed at the end of the term. However, the renewal rates are usually very expensive. You can also often convert a term policy into a permanent policy, which has no expiration date.

Term life insurance is a good fit if you have a specific debt you want covered after you're gone, such as a mortgage, or if you have children you want to make sure get financial help if you pass away. It is also a good option if you want coverage for a specific period, such as the number of years until retirement.

However, term life insurance does have some disadvantages. For example, if you still need life insurance after the term ends, renewal rates can be unaffordable. Additionally, term life insurance does not accumulate any cash value, so you cannot tap into it while you are alive.

Primerica Life Insurance: Job Loss Protection and Benefits

You may want to see also

Universal life insurance has a savings component

During the initial years of the policy, a large chunk of the premiums will go towards the savings component, with a smaller amount going towards the cost of insuring the policyholder. As the policyholder gets older and the cost of insuring them increases, more of the premium will go towards the cost of insurance and less into savings.

The savings component of universal life insurance is flexible and can be adjusted to meet the policyholder's needs. For example, the policyholder can pay more than the minimum premium to grow their savings or pay less and have the savings cover the rest. However, this may result in a decrease in the account balance.

The savings component also offers the opportunity to invest in the growth of the market, which can help grow assets for future goals such as college funding or retirement. It is important to note that accessing the savings of a universal life insurance policy will reduce the available cash surrender value and the death benefit.

The savings component of universal life insurance provides a safety net during the lifetime of the policyholder, allowing them to borrow against the cash value to pay for unexpected expenses. It is a valuable way to save for the future, providing financial security for loved ones after the policyholder's death.

Life Insurance and Financial Aid: What's the Connection?

You may want to see also

Term life insurance is appropriate for those who want to insure themselves and their loved ones against unforeseen events

Term life insurance is a good option for those who want to insure themselves and their loved ones against unforeseen events. It is a basic type of insurance that provides coverage for a specific period, such as 10, 20, or 30 years. If the policyholder passes away during the term, their beneficiaries will receive a payment. Term life insurance is also more affordable than other types of insurance, making it a good choice for those on a budget.

One of the main advantages of term life insurance is its flexibility. Policyholders can choose the term length and coverage amount that best suits their needs and budget. Additionally, term life insurance policies often include a term life conversion option, allowing policyholders to convert to a permanent life insurance policy if their needs change. This flexibility ensures that individuals can adapt their coverage as their circumstances evolve.

Term life insurance also offers guaranteed death benefits. The amount of coverage selected is the exact amount that beneficiaries will receive if the policyholder passes away during the policy term. This provides peace of mind and financial security for loved ones.

Another benefit of term life insurance is the ease of understanding. It is a simple product where individuals pay their premiums, and their beneficiaries receive a payment if the policyholder passes away during the term. There is no complex fine print or intricate details to navigate, making it a straightforward option for those seeking insurance.

Furthermore, term life insurance policies often allow for no-penalty cancellation. If an individual feels they no longer need the policy or finds a better option, they can cancel without facing financial consequences. This flexibility provides individuals with the freedom to make changes as their circumstances and preferences evolve.

While term life insurance offers limited coverage for a set period, it is an affordable and understandable option for those seeking to insure themselves and their loved ones against unforeseen events. The flexibility, guaranteed death benefits, and simplicity of term life insurance make it a popular choice for individuals and families.

Life Insurance and Suicide: Understanding the Payout

You may want to see also

Frequently asked questions

Term life insurance covers the policyholder for a specific period, such as 10, 20 or 30 years, whereas universal life insurance is a type of permanent coverage that lasts for the lifetime of the policyholder.

Term life insurance is the most affordable type of life insurance and offers flexible coverage terms and benefit amounts. It is also easy to understand and has no-penalty cancellations.

Term life insurance has limited coverage, and if the policyholder outlives the term, their beneficiaries will receive nothing. Renewal rates can also be unaffordable, and term life insurance does not accumulate cash value.

Universal life insurance offers lifetime coverage and has a cash value component that can be used to pay premiums later on. It also offers tax advantages and flexible death benefits.