Whole life insurance is a type of permanent life insurance that offers lifelong coverage and a guaranteed death benefit. One of the key factors that influence the cost of whole life insurance is the interest rate. The current interest rate for whole life insurance is a critical consideration for policyholders and prospective buyers. It determines the investment component of the policy, which can grow over time and provide additional benefits. Understanding the current interest rate is essential as it directly impacts the policy's cash value, dividends, and overall long-term value. This paragraph aims to explore the significance of the current interest rate in whole life insurance and its implications for policyholders.

What You'll Learn

- Interest Rate Calculation: How interest rates are determined for whole life insurance policies

- Market Influence: Factors affecting interest rates in the insurance market

- Policyholder Benefits: How interest rates impact policyholder returns

- Regulatory Oversight: Government rules governing interest rates in insurance

- Comparison with Savings: Interest rates compared to savings accounts

Interest Rate Calculation: How interest rates are determined for whole life insurance policies

The interest rates associated with whole life insurance policies are a crucial aspect of understanding the financial value and growth potential of these long-term insurance products. When considering a whole life insurance policy, it's essential to grasp how the interest rates are calculated and applied to ensure you make informed decisions about your financial security.

Interest rates in whole life insurance are primarily determined by the insurance company's investment strategy and the policyholder's financial goals. Whole life insurance policies typically offer a guaranteed interest rate, which is a fixed percentage that the policyholder can earn on the cash value of the policy over time. This interest rate is a key factor in attracting policyholders who seek stable and predictable returns on their investments.

The calculation of interest rates for whole life insurance involves a complex process that takes into account various factors. Firstly, the insurance company assesses the policyholder's risk profile, considering their age, health, and financial situation. This assessment helps determine the likelihood of the insured individual passing away or experiencing a claim, which directly impacts the policy's cash value growth. Younger and healthier individuals often qualify for higher interest rates as they present lower risks.

Secondly, the insurance company evaluates the investment options available to them. They may invest in a diversified portfolio of assets, including stocks, bonds, and real estate. The performance of these investments directly influences the interest rate offered to policyholders. If the company's investments yield higher returns, they can potentially offer more attractive interest rates to policyholders.

The interest rate calculation also considers the policy's surrender charge period. During this period, typically the first few years of the policy, the insurance company may impose a penalty if the policyholder decides to surrender the policy. This surrender charge is designed to compensate the company for the initial costs and risks associated with issuing the policy. As the policy ages and the surrender charge period expires, the interest rate offered may increase, providing more flexibility for policyholders.

In summary, the interest rates for whole life insurance policies are calculated based on a combination of factors, including the policyholder's risk profile, the insurance company's investment performance, and the policy's surrender charge period. Understanding these calculations is essential for individuals seeking to maximize the financial benefits of their whole life insurance policies.

Life Insurance Dividends: When and Why Distributed?

You may want to see also

Market Influence: Factors affecting interest rates in the insurance market

The insurance market, particularly the whole life insurance sector, is influenced by a myriad of factors that impact interest rates. One of the primary drivers is the economic climate. During periods of economic growth, interest rates tend to rise as investors seek higher returns. This increased demand for investment opportunities can lead to higher interest rates for whole life insurance policies, as insurers compete for customers. Conversely, in a recession, interest rates may drop, making it more attractive for insurers to offer competitive rates to attract policyholders.

Demographic trends also play a significant role. An aging population, for instance, can impact interest rates. As the average age of policyholders increases, insurers may adjust rates to account for the higher expected costs associated with longer policy durations. This is especially relevant for whole life insurance, where the policyholder's age at the time of purchase can significantly affect the premium and interest rate.

Regulatory changes are another critical factor. Insurance regulators often set guidelines and standards that insurers must follow. These regulations can impact interest rates, especially in terms of capital requirements and solvency standards. For instance, stricter regulations may force insurers to hold more capital, potentially leading to higher interest rates to ensure they can meet these financial obligations.

Market competition is a powerful force in determining interest rates. A highly competitive market can drive rates down as insurers strive to attract customers. This competition often results from technological advancements, allowing insurers to streamline processes and reduce costs, which can then be passed on to policyholders in the form of lower interest rates.

Additionally, the investment performance of insurance companies' portfolios can significantly affect interest rates. If an insurer's investments yield high returns, they may be more inclined to offer competitive interest rates to whole life insurance policyholders. This is because they can afford to provide more attractive rates without compromising their financial stability. Conversely, poor investment performance might lead to higher interest rates to maintain profitability.

Life Insurance and Suicide: What Families Need to Know

You may want to see also

Policyholder Benefits: How interest rates impact policyholder returns

The current interest rates for whole life insurance policies are a crucial aspect for policyholders, as they significantly impact the overall returns and benefits received by policyholders. When you purchase a whole life insurance policy, you essentially enter into a long-term investment contract with the insurance company. The interest rates set by the insurer play a pivotal role in determining the value of your investment over time.

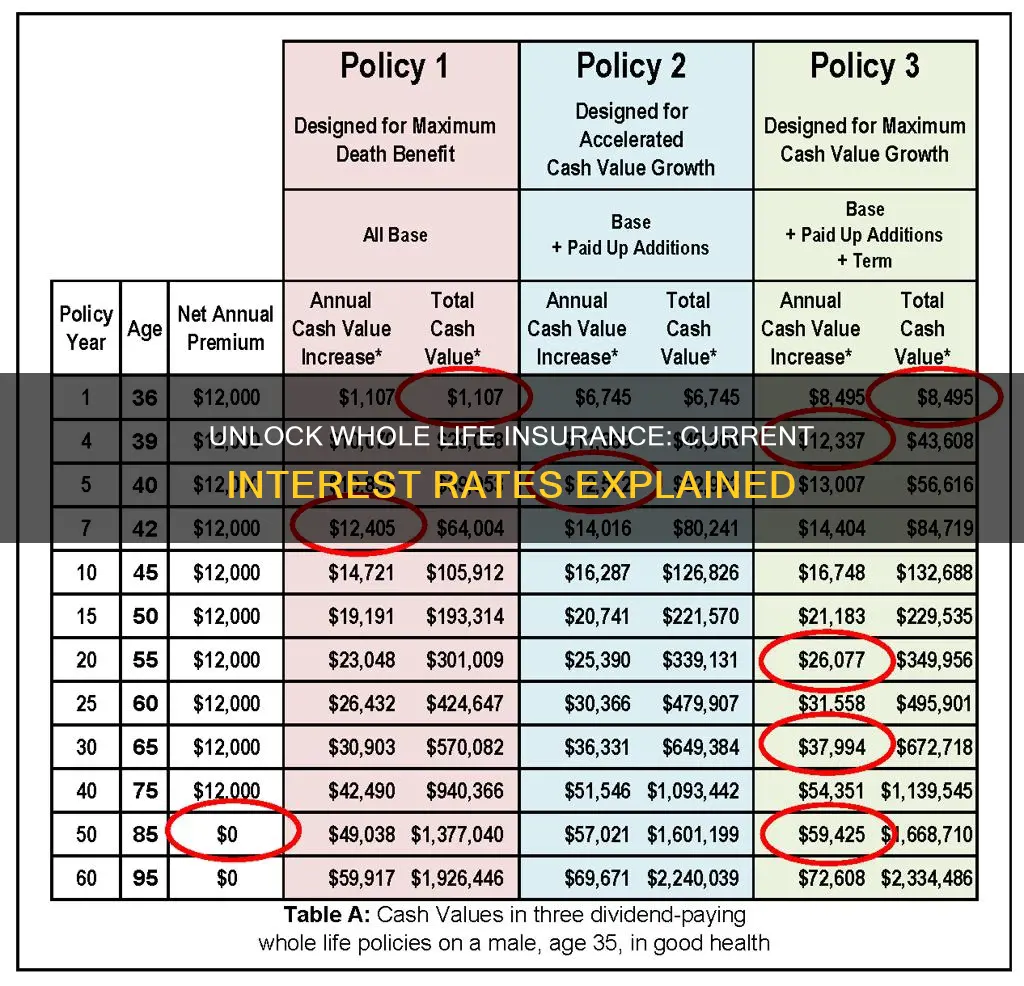

One of the primary benefits for policyholders is the guaranteed interest rate offered by whole life insurance companies. This interest rate is typically fixed and applies to the cash value of your policy, which grows tax-deferred. As interest rates rise, the cash value of your policy will also increase, providing a higher return on your initial investment. For instance, if the current interest rate is 3%, and your policy offers this rate, your cash value will grow by 3% annually, ensuring a steady and predictable return.

Over time, this compounded interest can accumulate significantly. Policyholders can benefit from this growth, especially if they opt for policy loans or withdrawals. When interest rates are favorable, policyholders can borrow against their policy's cash value at relatively low interest rates, allowing them to access funds for various purposes while still benefiting from the growing value of their policy. Additionally, some insurance companies offer policyholders the option to participate in the investment performance of their general account, where the insurer invests the premiums collected. If the general account performs well, it can enhance the overall returns for policyholders.

In summary, understanding the current interest rates for whole life insurance is essential for policyholders as it directly influences their returns. Higher interest rates can lead to increased cash value growth, providing policyholders with more substantial returns on their investments. This aspect of whole life insurance makes it an attractive financial tool for those seeking long-term savings and investment opportunities with guaranteed returns.

Life Insurance for NC Teachers: What's Covered Automatically?

You may want to see also

Regulatory Oversight: Government rules governing interest rates in insurance

The regulation of interest rates in insurance, particularly in whole life insurance policies, is a critical aspect of financial governance. Governments worldwide have established regulatory frameworks to ensure fair practices and protect policyholders' interests. These rules are designed to prevent insurance companies from exploiting policyholders by offering artificially high interest rates, which could lead to financial instability and unfair competition.

In many countries, insurance regulators set guidelines and standards for interest rate calculations and disclosures. These regulations often mandate that insurance companies provide transparent information about the interest rates they offer on whole life insurance policies. Policyholders have a right to understand the potential returns on their investments and the factors influencing these rates. Regulatory bodies typically require insurers to disclose the interest rate assumptions, calculation methods, and any guarantees or caps on interest earnings.

One common approach is for governments to establish a maximum interest rate that insurance companies can offer on whole life policies. This ensures that policyholders do not bear the burden of excessive profits for insurers. For instance, in some jurisdictions, the interest rate on whole life insurance policies is capped at a specific percentage, often linked to the prevailing market rates or an index. This regulatory measure provides a fair balance between the insurer's profitability and the policyholder's returns.

Regulatory oversight also involves monitoring and enforcing compliance with these rules. Insurance regulators conduct regular audits and assessments to verify that companies adhere to the established interest rate guidelines. This includes examining interest rate calculations, ensuring proper disclosure to policyholders, and investigating any potential misconduct or unfair practices. By doing so, regulators aim to maintain market integrity and protect consumers from fraudulent or misleading insurance products.

Additionally, governments may provide guidelines on the frequency of interest rate adjustments. Some policies offer variable interest rates that can fluctuate over time, and regulatory bodies ensure that these changes are communicated transparently to policyholders. This transparency is crucial for policyholders to make informed decisions about their insurance and investment choices.

Life Insurance and Debt: Can Garnishments Be Withheld?

You may want to see also

Comparison with Savings: Interest rates compared to savings accounts

When considering whole life insurance, it's essential to understand how its interest rates compare to those of traditional savings accounts. Whole life insurance policies offer a unique financial product that combines insurance coverage with a savings component, known as cash value. This cash value grows over time, often at a guaranteed interest rate, which is a key feature that sets it apart from savings accounts.

The interest rates on whole life insurance policies can vary depending on the insurance company and the specific policy. Typically, these policies offer a fixed interest rate, which means the rate remains the same for the life of the policy. This is in contrast to savings accounts, where interest rates can fluctuate based on market conditions and the policies set by financial institutions. As of my knowledge cutoff in January 2023, the average interest rate for whole life insurance cash value accounts is around 3-4%, but this can range from 2% to 5% or even higher in some cases.

In comparison, savings accounts generally offer lower interest rates, which are often influenced by the Federal Reserve's monetary policies and the overall economic environment. As of the latest data, the average annual interest rate for savings accounts in the United States is around 0.50% to 1.00%, with some high-yield savings accounts offering slightly higher rates. While savings accounts provide liquidity and the ability to withdraw funds without penalties, the interest earned is typically lower than the guaranteed rate offered by whole life insurance.

One advantage of whole life insurance is that the interest rate is locked in for the policy's duration, providing a predictable return on investment. This predictability can be appealing to those seeking a stable and consistent growth rate for their savings. Additionally, the interest earned on the cash value of a whole life insurance policy is tax-deferred, allowing the savings to grow faster over time. In contrast, savings account interest is often subject to income tax, which can reduce the overall return on savings.

However, it's important to note that the interest rates on whole life insurance policies are generally lower than those offered by investment vehicles like certificates of deposit (CDs) or certain types of annuities. These investment options often provide higher interest rates but may come with longer commitment periods and potential penalties for early withdrawals. When comparing whole life insurance to savings, it's crucial to consider individual financial goals, risk tolerance, and the time horizon for savings or investments.

Maximizing Life Insurance Payouts: Strategies for Beneficiaries

You may want to see also

Frequently asked questions

The interest rate for whole life insurance can vary depending on the insurance company and the specific policy. As of my cut-off date in January 2023, the current interest rates for whole life insurance policies range from 0.5% to 2.5% per year. These rates are typically guaranteed and can provide a steady return on your policy's cash value.

The interest rate is a crucial factor in the performance of your whole life insurance policy. It determines the growth of your policy's cash value, which is the portion of your premium payments that accumulates over time. Higher interest rates mean faster growth of your cash value, allowing you to build a substantial savings component within your insurance policy.

Typically, the interest rate on a whole life insurance policy is guaranteed and locked in for the life of the policy. This means that once you've chosen a specific interest rate when purchasing the policy, that rate remains fixed. However, some insurance companies may offer options to increase the interest rate over time, but these features are usually available during the initial policy term.

Several factors can influence the interest rates set by insurance companies for whole life insurance policies. These include the company's financial strength, investment strategies, market conditions, and the overall interest rate environment. Additionally, the age and health of the insured individual can also play a role, as younger and healthier individuals may be offered more competitive interest rates.