A temporary life insurance license is a short-term policy that can be purchased from an insurer while waiting for them to finish underwriting and finalising a review of your policy application. The application process for traditional life insurance policies can take up to four to six weeks, and a temporary license is generally valid for up to 90 days. However, in Florida, a temporary life insurance agent license is valid for six months.

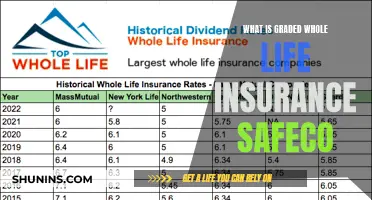

| Characteristics | Values |

|---|---|

| Duration | Temporary life insurance generally lasts up to 90 days. |

| Expiry | The temporary life insurance coverage may expire if: the insurer approves the life insurance application and activates the new policy; the insurer denies the life insurance application; the applicant receives an offer but does not proceed with coverage; the applicant does not respond to insurer requests for information on time; or the insurer pays out the temporary life insurance death benefit. |

What You'll Learn

- Who can get a temporary life insurance license in Florida?

- How long does a temporary life insurance license last in Florida?

- What is the cost of a temporary life insurance license in Florida?

- What are the steps to get a temporary life insurance license in Florida?

- What are the limitations of a temporary life insurance license in Florida?

Who can get a temporary life insurance license in Florida?

In Florida, a temporary life insurance license is only available under certain conditions. According to the Florida statutes, you can obtain a temporary life insurance agent license if you are the executor, administrator, or next of kin of a deceased life agent. This license is non-renewable and valid for six months only.

To obtain a standard life insurance license in Florida, you must be at least 18 years old, a resident of Florida, and have a Social Security Number. You must also complete a pre-licensing course, pass the state license exam, and submit your application and fingerprints. The entire process can take a few weeks.

Life Insurance for Children: Is It Worth It?

You may want to see also

How long does a temporary life insurance license last in Florida?

In Florida, a temporary life insurance agent license is valid for six months and is non-renewable. This license can be obtained if you are the executor, administrator, or next of kin of a deceased life agent, provided certain conditions are met.

Life Insurance Payouts: Insolvent Estate's Impact

You may want to see also

What is the cost of a temporary life insurance license in Florida?

In Florida, a temporary life insurance agent license is valid for six months only and is non-renewable. It is available only to the executor, administrator, or next of kin of a deceased life agent, provided certain conditions are met.

Now, let's take a look at the costs associated with obtaining a life insurance license in Florida. The total cost will depend on the type of license and the tuition fees for the required pre-licensing course.

Pre-Licensing Course Costs

The first step towards obtaining a life insurance license in Florida is to complete a pre-licensing course. There are different course providers and options available, with varying costs:

- Kaplan Education Company: $149+

- Larson Educational Services: $139 for the BASIC COURSE or $189 for the ESSENTIAL Course

Fingerprint-Based Background Check

The next step is to obtain a fingerprint-based background check from IdentoGO. The fee for this service is $48.05, plus the local Florida county sales tax.

License Application Fees

After completing the background check, you can submit your license application through Florida's MyProfile System. The application fee is $50, and there is also a $5 license ID fee, for a total of $55.

State Licensing Exam Fee

The final step is to take the Florida Life Insurance Licensing Exam administered by Pearson VUE. The exam fee is $44, payable at the time of reservation by credit card, debit card, or voucher.

Total Cost Summary

The total cost for obtaining a life insurance license in Florida, excluding the pre-licensing course tuition, is $147.55. This includes the background check fee, application fees, and exam fee.

Therefore, the total cost for obtaining a life insurance license in Florida, including the pre-licensing course, will range from $286.55 to $336.55, depending on the course provider and tuition fees.

Life Insurance and SSA: Family Death Income Considerations

You may want to see also

What are the steps to get a temporary life insurance license in Florida?

A temporary life insurance license in Florida is non-renewable and valid for six months only. To obtain one, you must be the executor, administrator, or next of kin of a deceased life agent, and meet certain conditions.

Step 1: Complete a Pre-License Course

Florida requires 40 hours of pre-license education for life insurance, including courses on annuities and variable contracts. Three of the required 40 hours must focus on ethics. The Florida Health & Life (Including Annuities & Variable Contracts) Study Manual is published under contract with the Florida Department of Financial Services by the National Association of Insurance and Financial Advisors (NAIFA).

Step 2: Get a Fingerprint-Based Background Check

After completing your pre-license education course, you must get a fingerprint-based background check from IdentoGO. The fee for fingerprinting services is $48.05, plus the local Florida county sales tax to cover the costs of a fingerprint-based criminal history record check. You must register for LiveScan and go to the nearest IdentoGo location to submit your fingerprints electronically.

Step 3: Complete a Florida Life Insurance License Application

Once you have completed the fingerprint-based background check, you can apply for your Florida life insurance license. The application fee is $50, plus a $5 license ID fee, for a total of $55. You must apply via your Florida MyProfile account.

Step 4: Take the Florida Life Insurance Licensing Exam

After applying for your life insurance license via your Florida MyProfile account, it's time to take the Florida life insurance exam. Florida uses Pearson VUE as its official testing service for delivering licensure exams. The exam outline contains 85 scored questions covering general and state-specific knowledge. You will have 120 minutes to complete the exam, and the fee is $44, payable at the time of reservation by credit card, debit card, or voucher.

Step 5: Watch for Your Application Results

After completing the previous four steps, the Florida Department of Financial Services will review your application and background check. Once the review is complete, you'll receive a notification in your Florida MyProfile account. If the state requires any additional information from you, you will be notified in that account as well. You can also use your Florida MyProfile account as a Florida insurance license search and lookup tool, as well as to print your license.

Life Insurance: Who Has It and Who Doesn't?

You may want to see also

What are the limitations of a temporary life insurance license in Florida?

A temporary life insurance license in Florida is non-renewable and valid for six months only. It is granted to the executor, administrator, or next of kin of a deceased life agent, provided certain conditions are met.

The limitations of a temporary life insurance license in Florida are primarily related to its duration and non-renewability. As the license is only valid for six months, the holder must work within this timeframe to complete any necessary tasks or transactions. The inability to renew the license means that the holder must ensure all necessary actions are taken within the six-month period.

Additionally, the scope of a temporary life insurance license in Florida is limited to life insurance policies. To sell other types of insurance, such as health insurance or variable annuities, separate licenses are required. For instance, a health insurance license is necessary to sell health insurance, and a variable annuity license is needed to offer variable annuities.

Furthermore, a temporary life insurance license in Florida does not cover the sale of securities products. A separate securities license is required to engage in this aspect of financial services.

It is important to note that the specific limitations of a temporary life insurance license in Florida may depend on the conditions outlined by the Florida Division of Insurance Agent and Agency Services (IAAS) at the time of issuance. These conditions are determined based on the circumstances of each case.

Insuring Lives Without Consent: Is It Legal?

You may want to see also

Frequently asked questions

A temporary life insurance policy is a short-term policy that you can purchase from an insurer while waiting for them to finish underwriting and finalising your official policy.

Temporary life insurance generally lasts up to 90 days, giving the insurer enough time to review your policy application without you losing coverage. However, temporary life insurance coverage may expire earlier if:

- The insurer approves your life insurance application and activates your new policy.

- The insurer denies your life insurance application.

- You receive an offer but do not proceed with coverage.

- You don’t respond to insurer requests for information on time.

- You pass away, and the insurer pays out the temporary life insurance death benefit.

Temporary life insurance premiums may be the same as the insurer’s quoted premiums.

Here are some instances where getting a temporary life insurance policy may make sense:

- You want your beneficiaries to receive the death benefit no matter what.

- You want added peace of mind during underwriting.

- You’re willing to pay the additional premiums.

- You worry about application complications.

Yes. According to the Florida statutes, you can get a temporary life insurance agent license if you are the executor, administrator, or next of kin of a deceased life agent, and you meet certain conditions. A temporary license is non-renewable and valid for six months only.