Life insurance is a valuable asset for beneficiaries, helping them avoid financial hardship. However, what happens to life insurance proceeds when the beneficiary is an un-rehabilitated insolvent? In the case of Wentzel v Discovery Life Limited and Others, the Pretoria High Court considered whether the payment of a life insurance policy by an insurance provider to a nominated beneficiary, who was an un-rehabilitated insolvent, would vest in the beneficiary or the trustees of the insolvent estate. The court held that while the joint estate of the applicant and his wife was dissolved due to her death, their status as un-rehabilitated insolvents remained until changed as provided for in the Insolvency Act of 1936. This case highlights the complex interplay between life insurance and insolvency, leaving many to wonder: can you collect life insurance if your estate is insolvent?

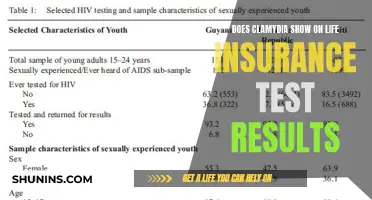

| Characteristics | Values |

|---|---|

| Life insurance proceeds | Go directly to named beneficiaries, bypassing the estate and probate process |

| If there are no beneficiaries | Proceeds may become part of the estate assets |

| If there are beneficiaries | Proceeds are not part of the estate |

| If the beneficiary is a co-signer on a loan | They are responsible for repayment of that debt |

| If the beneficiary is a surviving spouse in a community property state | They may be liable for at least part of their spouse's debt |

| If the beneficiary is an un-rehabilitated insolvent | Payment should be made directly to the trustees of the insolvent estate |

What You'll Learn

Life insurance proceeds are not part of the estate

Life insurance proceeds are usually paid directly to the named beneficiaries and are not probate assets. This means that the proceeds do not go through the will and are not considered part of the estate. The only exception to this is when the insurance policy is payable to the estate, or when the named beneficiary dies before the insured person. In these cases, the life insurance funds will be considered estate assets and will be distributed according to the will or state laws.

It is important to note that the money paid out on a life insurance policy when the insured person dies is not the money of the insured person, but rather the money of the insurance company. The insurance company has a legal obligation to pay the named beneficiary, as specified in the policy. Therefore, the insured person cannot control who receives the proceeds through their will. The only way to change the beneficiary is by filling out and submitting a "change of beneficiary" form provided by the insurance company.

Keeping beneficiary designations up to date is crucial to ensuring that life insurance proceeds go to the intended beneficiaries. In some cases, individuals fail to change the beneficiary of their life insurance policies after a divorce, which can result in the ex-spouse still being named as the beneficiary. To avoid this, it is recommended to review and update estate plans and beneficiary designations after any major life changes, such as divorce or the death of a family member.

Additionally, it is important to be mindful of estate tax when dealing with life insurance proceeds. A substantial death benefit can increase the value of an estate to a level that triggers federal or state taxation, resulting in higher taxes for the beneficiaries. Consulting with a tax expert or an estate planning attorney can help individuals navigate the complexities of life insurance and estate planning.

Changing Life Insurance Beneficiary: A Letter's Power

You may want to see also

The estate is not required to pay the beneficiary's debts

However, there are a few exceptions to this. Firstly, if the beneficiary was a co-signer on a loan, they would be responsible for repaying that debt. Secondly, if the beneficiary is a surviving spouse in a community property state (such as Alaska, Arizona, California, Idaho, Louisiana, Nevada, New Mexico, Texas, Washington, or Wisconsin), they may be liable for at least a portion of the deceased's debt.

Additionally, while the beneficiary is not required to use the life insurance proceeds to pay off the estate's debts, they may choose to do so if they wish. This could be the case, for example, if the beneficiary wanted to pay off the credit cards of the deceased.

It is important to note that the laws and procedures surrounding estate planning, probate, and insolvency can vary from state to state, so it is always a good idea to consult with an attorney or financial professional to understand the specific rules and regulations that may apply in your situation.

Midland Life Insurance: Accelerated Benefits and Their Availability

You may want to see also

The beneficiary is not required to pay the estate's debts

If you are a beneficiary of a life insurance policy, you may be concerned about whether you are required to use the proceeds to pay off the debts of the estate. However, it is important to understand that life insurance proceeds are generally not considered part of the estate. They are typically paid directly to the named beneficiary and become their property. This means that the beneficiary is not obligated to use the proceeds to pay off any debts of the estate.

In most cases, life insurance proceeds bypass the estate and go directly to the named beneficiaries. This allows for a quick payout, usually within a month or so, and the death benefit is usually tax-free for the beneficiaries. However, if there are no named beneficiaries or if the named beneficiaries die before the insured person, the proceeds may become part of the estate assets. In such cases, the proceeds would be distributed according to the instructions in the will or per state laws.

It is worth noting that there are a few exceptions to this. If you were a co-signer on a loan, you may be responsible for repaying that debt. Additionally, if you are a surviving spouse in a community property state, you may be liable for at least a portion of your spouse's debt.

Furthermore, while the beneficiary is not required to pay the estate's debts, the amount of the life insurance may be included in the calculation of estate tax. This is known as the "Gross estate" and includes various assets that are not part of the "probate" estate. However, it is important to consult with an attorney to understand the specific laws and regulations that may apply in your situation.

Understanding Life Insurance: Choosing Your Beneficiaries

You may want to see also

The estate's creditors are not entitled to the insurance money

The estates creditors are not entitled to the insurance money. Life insurance proceeds are not part of the estate, and they go directly to the named beneficiary. The beneficiary can choose to pay off the deceased's credit cards, but they are not obligated to do so. The insurance money is not required to be used to pay the debts of the estate.

If the deceased owned the policy, the proceeds are considered part of the estate. In this case, the estate tax is prorated, and the insurance pays its portion of the tax bill. However, if the beneficiary owns the policy, the proceeds are not part of the estate, and the beneficiary receives the full amount.

In the case of a bankrupt estate, the insurance money is also not obligated to pay the creditors. For example, if the estate owes $100K and the life insurance payable to a named beneficiary outside of the estate is $10K, the estate's creditors are not entitled to the $10K insurance. The insurance money is protected from creditors, even if it goes to the estate.

It is important to note that laws vary from state to state, and it is crucial to review the specific situation with an attorney familiar with local laws.

Life Insurance Payouts: Are They Taxed in Minnesota?

You may want to see also

The insurance money is obligated to pay the creditors

When an estate is declared insolvent, it means that the total value of the estate's assets is less than the total debts and liabilities owed. In such cases, the executor must petition the court to declare the estate insolvent. While the beneficiaries and heirs are not responsible for paying off the estate's debts, they may not receive any gifts or assets from the estate. The probate court will oversee the process and decide on the distribution of funds to beneficiaries if the estate doesn't have enough money to pay them.

The insurance money, in this case, becomes a critical asset for the insolvent estate. If there are named beneficiaries on the insurance policy, the insurance money typically bypasses the estate and goes directly to them. However, if there are no named beneficiaries, or if the insured person owns the policy and names their estate as the beneficiary, the insurance proceeds become part of the estate assets.

In the case of an insolvent estate, the insurance money that becomes part of the estate assets is obligated to pay the creditors. The court will determine the order in which the estate's debts and liabilities are settled. This includes estate expenses such as legal fees, executor fees, court fees, and funeral expenses. The creditors with valid claims will be paid according to the priorities specified by state law.

It is important to note that the insurance money may not fully cover all the debts and liabilities of the estate. In such cases, the creditors who have proven their claims may still be prejudiced and not receive full repayment. The insurance money will be distributed as fairly as possible, but the insolvent estate's inability to fully repay its debts may remain.

To summarise, when an estate is insolvent, the insurance money that becomes part of the estate is used to pay off the creditors as per the court's determination. The beneficiaries of the insurance policy may receive the proceeds directly if they are named, but if the proceeds become part of the estate, they are obligated to be used for settling the estate's debts.

Physical Examinations: A Prerequisite for Life Insurance?

You may want to see also

Frequently asked questions

Life insurance proceeds are not part of your estate. They go directly to the beneficiary, and are their property. However, the amount of the life insurance is included in the estate for the purpose of calculating estate tax.

If the estate runs out of money before it pays all of its taxes and debts, then the executor must petition the court to declare the estate insolvent.

If there is no will, state laws dictate who receives any remaining assets.

The payment of the proceeds will be made to the trustees of the insolvent estate.