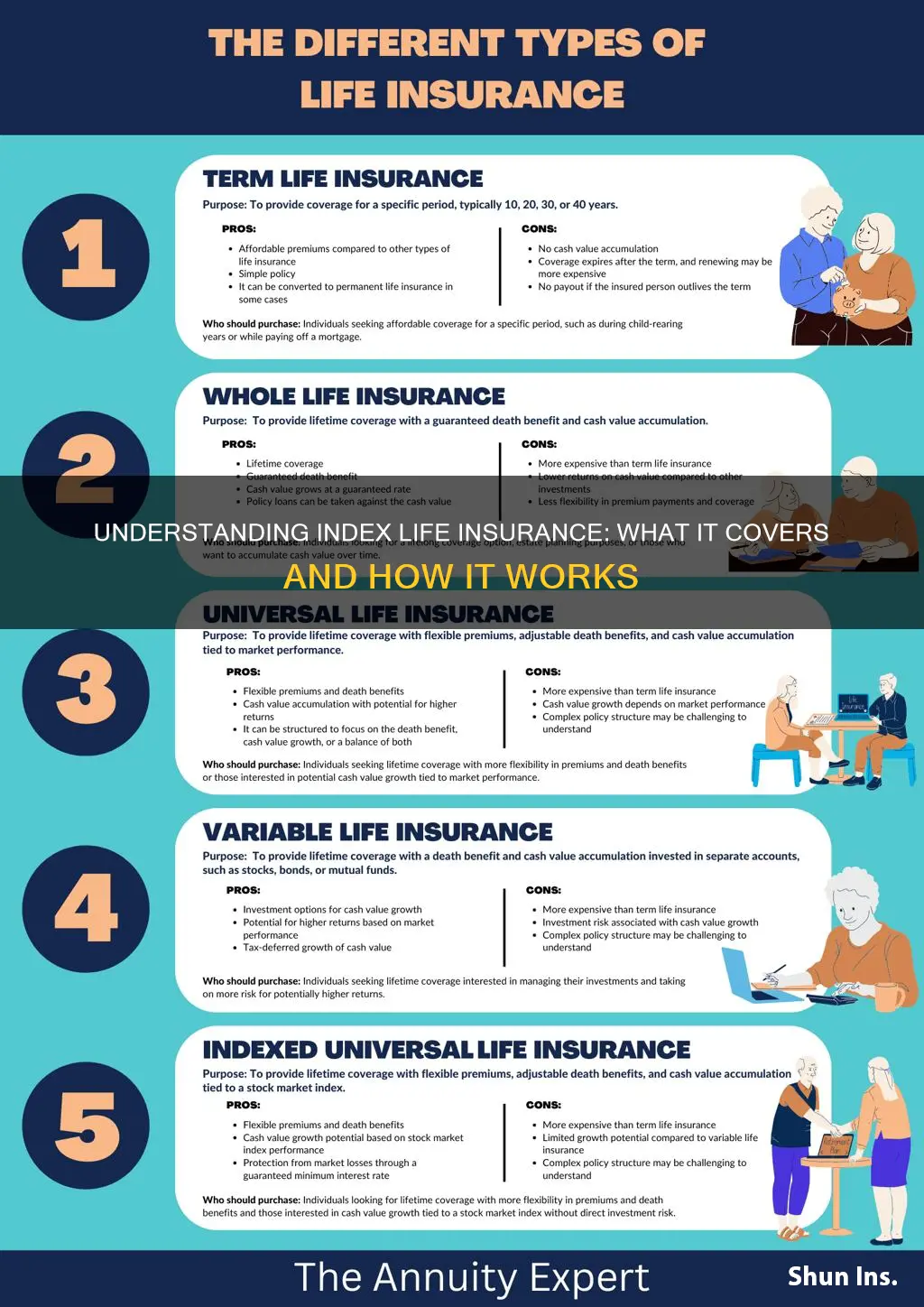

Index life insurance is a unique type of policy that offers a way to protect your loved ones and secure your financial future. Unlike traditional life insurance, which provides a fixed death benefit, index life insurance is designed to grow in value based on the performance of a specific index, such as the S&P 500. This means that as the index increases, your policy's cash value and death benefit can also increase, providing potential for higher returns over time. Understanding how index life insurance works and its benefits can help you make an informed decision about your insurance needs and ensure that your loved ones are protected in the event of your passing.

What You'll Learn

- Coverage Amount: The insured's death benefit, or payout, is determined by the policy's coverage amount

- Term Length: Policies can be for a specific period (e.g., 10, 20 years) or permanent

- Premiums: Regular payments made by the insured to maintain coverage

- Beneficiaries:指定された人々が保険金を受け取る。

- Exclusions: Specific events or conditions that are not covered by the policy

Coverage Amount: The insured's death benefit, or payout, is determined by the policy's coverage amount

The coverage amount is a critical aspect of index life insurance, as it directly determines the financial benefit that the insured's beneficiaries will receive in the event of their passing. This amount is the core of the insurance policy and is what provides financial security to the policyholder's loved ones. When purchasing an index life insurance policy, the insured has the option to choose the coverage amount, which is essentially the face value or the death benefit that will be paid out upon their death.

This policy's coverage amount is a promise made by the insurance company to the insured, ensuring that a specific financial sum will be provided to the designated beneficiaries. It is a fixed amount agreed upon at the time of policy inception and remains constant throughout the policy's duration. The insured has the freedom to select the coverage amount based on their financial goals and the level of protection they wish to provide for their family.

The determination of the coverage amount involves considering various factors. Firstly, the insured's age plays a significant role, as younger individuals may opt for higher coverage amounts due to their longer life expectancy and the potential for a longer-term financial commitment. Additionally, the insured's health and lifestyle choices are crucial. A healthy individual with no significant medical history may be offered a higher coverage amount compared to someone with pre-existing conditions or unhealthy habits.

Another factor influencing the coverage amount is the insured's financial obligations and goals. For instance, a policyholder with a large family and significant financial responsibilities, such as mortgage payments or children's education costs, might choose a higher coverage amount to ensure their family's financial stability in the event of their untimely demise. On the other hand, a young professional with fewer financial commitments may opt for a lower coverage amount, focusing more on the policy's investment component.

It is essential for insured individuals to carefully evaluate their circumstances and consult with insurance professionals to determine an appropriate coverage amount. This decision should be based on a comprehensive understanding of one's financial needs, health status, and life goals. By selecting the right coverage amount, the insured can ensure that their loved ones are adequately protected, and the insurance policy becomes a valuable tool for achieving their financial objectives.

Suicide and Life Insurance: Are Benefits Paid Out?

You may want to see also

Term Length: Policies can be for a specific period (e.g., 10, 20 years) or permanent

When considering index life insurance, one of the key factors to understand is the term length of the policy. This term length refers to the duration for which the insurance coverage is in effect. It is a crucial aspect to consider as it determines how long the policy will provide financial protection and benefits to the insured individual or their beneficiaries.

Index life insurance policies offer two primary term lengths: specific period and permanent. The specific period term, as the name suggests, is designed to cover a predetermined time frame. For instance, you can choose a 10-year term, 20-year term, or any other specific duration that aligns with your financial goals and needs. This type of term length is ideal for those who want coverage for a particular period, such as until a child's education is funded or a mortgage is paid off. It provides a clear end date, making it easier to plan and manage finances accordingly.

On the other hand, permanent term life insurance offers coverage for the entire lifetime of the insured individual. This means that the policy remains in force as long as the premiums are paid, providing long-term financial security. Permanent policies typically have higher premiums compared to specific period policies but offer the advantage of lifelong coverage. This type of term length is suitable for individuals who want to ensure their loved ones are protected for the long term, especially if they have significant financial obligations or dependants who rely on the insured person's income.

The choice between specific period and permanent term lengths depends on various factors, including personal financial goals, risk tolerance, and the level of coverage required. Younger individuals with long-term financial commitments might prefer specific period policies, as they can lock in coverage for a defined period without the long-term financial burden. In contrast, older individuals or those with long-term financial obligations may opt for permanent policies to ensure continuous protection.

It is essential to carefully evaluate your financial situation, future plans, and the level of risk you are willing to take when deciding on the term length. Consulting with a financial advisor or insurance professional can provide valuable guidance in making this decision, ensuring that your index life insurance policy aligns with your specific needs and objectives.

Life Insurance and VA Benefits: What's the Connection?

You may want to see also

Premiums: Regular payments made by the insured to maintain coverage

When it comes to index life insurance, understanding the concept of premiums is crucial for insured individuals. Premiums are regular payments made by the insured party to maintain their coverage under the policy. These payments are essential to ensure that the insurance company can fulfill its obligations in the event of the insured's death.

The amount of premium an insured person pays can vary depending on several factors. Firstly, the insurance company considers the insured's age, health, and lifestyle. Younger individuals often pay lower premiums as they are considered less risky. Additionally, the policy's coverage amount and the term length influence premium costs. Longer coverage periods typically result in higher premiums.

Insured individuals typically pay premiums on a regular basis, such as monthly, quarterly, or annually. These payments are usually made directly to the insurance company or through an authorized agent. It is important to note that the frequency and amount of premium payments can be customized to suit the insured's financial situation and preferences.

One advantage of index life insurance is that premiums can be adjusted based on the performance of a specific index, such as the S&P 500. This means that the insured's premium payments can vary, increasing or decreasing in line with the index's performance. This feature provides a level of flexibility and potential cost savings for the insured.

In summary, premiums are a fundamental aspect of index life insurance, representing the regular financial commitment made by the insured to maintain their coverage. Understanding how premiums are calculated and the factors that influence them is essential for making informed decisions regarding insurance policies. By grasping these concepts, insured individuals can better manage their financial obligations and ensure they have adequate protection.

Brain Cancer: Life Insurance Options and Availability

You may want to see also

Beneficiaries:指定された人々が保険金を受け取る。

When it comes to index life insurance, the concept of beneficiaries is crucial. Beneficiaries are the individuals or entities who are designated to receive the insurance proceeds in the event of the insured's death. This is a fundamental aspect of insurance, ensuring that the financial protection intended for the insured's loved ones is provided to the right people.

In the context of index life insurance, the insured has the flexibility to choose who will benefit from the policy. This choice is typically made during the application process or through subsequent adjustments. The insured can select primary beneficiaries, who will receive the majority of the proceeds, and contingent beneficiaries, who will step in if the primary beneficiaries are no longer eligible or have passed away. This flexibility allows for a tailored approach to insurance, ensuring that the financial support goes to those who need it most.

Designating beneficiaries is a critical step in the insurance process. It involves providing the insurance company with the names, addresses, and relationships of the chosen individuals. This information is essential for the company to verify the beneficiaries' eligibility and to ensure a smooth distribution of the insurance money. It is advisable to regularly review and update the beneficiary list to reflect any changes in personal relationships or circumstances.

The role of beneficiaries is not limited to receiving the insurance payout. They also have the responsibility to provide the insurance company with any necessary documentation and information to facilitate the claims process. This may include death certificates, proof of the insured's passing, and any other relevant paperwork. By fulfilling these obligations, beneficiaries ensure that the insurance benefits are distributed efficiently and according to the terms of the policy.

In summary, beneficiaries play a vital role in index life insurance. They are the designated recipients of the insurance proceeds, ensuring that the financial protection intended for the insured's beneficiaries is provided. By carefully selecting and managing beneficiaries, individuals can ensure that their loved ones are cared for and that the insurance policy fulfills its purpose. It is a crucial aspect of insurance planning that should not be overlooked.

Life Insurance Cash Value: An IRA Alternative?

You may want to see also

Exclusions: Specific events or conditions that are not covered by the policy

When considering an index life insurance policy, it's crucial to understand the specific events and conditions that are not covered by the policy. These exclusions are designed to protect the insurance company and ensure that the policy remains financially viable. Here are some key points to be aware of:

- Pre-existing Conditions: One of the most common exclusions is related to pre-existing medical conditions. If you have a significant health issue or a chronic disease at the time of taking out the policy, it may not be covered. For example, if you have a history of heart disease, diabetes, or cancer, the insurance company might exclude coverage for any related complications or treatments. It's essential to disclose your full medical history accurately during the application process to avoid potential issues in the future.

- Suicide and Self-Inflicted Injuries: Many life insurance policies, including index-linked ones, typically exclude coverage for death caused by suicide or self-inflicted injuries within a specified period after taking out the policy. This exclusion is in place to prevent fraud and ensure that the insurance company is not exposed to excessive risk. The waiting period can vary, often ranging from one to two years, during which the policyholder must demonstrate their commitment to the insurance by remaining in good health.

- Criminal Acts: Acts of war, rebellion, or civil unrest are often excluded from coverage. If you are involved in any illegal activities or criminal behavior, the insurance company may deny any claims related to those events. Additionally, intentional self-harm or illegal drug use can also lead to exclusions.

- Extreme Sports and High-Risk Activities: Engaging in extreme sports or high-risk activities can result in policy exclusions. These may include skydiving, scuba diving, rock climbing, racing cars, or any other activity deemed dangerous by the insurance provider. Such exclusions aim to protect the insurance company from the increased risk associated with these pursuits.

- Alcohol and Drug-Related Incidents: Excessive alcohol consumption or drug abuse can lead to policy exclusions. If your death or disability is directly linked to these substances, the insurance company may deny any claims. It's important to maintain a healthy lifestyle and adhere to the policy's terms to ensure coverage.

Understanding these exclusions is vital for making informed decisions about your insurance coverage. It's always advisable to carefully review the policy documents and seek professional advice if needed. By being aware of these specific events and conditions, you can better manage your expectations and choose the appropriate index life insurance policy that suits your requirements.

Life Insurance Coverage: Northwestern Mutual's Reach

You may want to see also

Frequently asked questions

Index Life Insurance is a type of term life insurance that is designed to provide coverage based on the performance of a specific market index, such as the S&P 500. The policy's death benefit is linked to the index, and it increases or decreases based on the index's performance over a specified period. This type of insurance offers a way to potentially increase the death benefit without the need for frequent policy adjustments.

The insured amount, or the death benefit, of an Index Life Insurance policy is directly tied to the performance of the chosen market index. If the index value increases, the death benefit will also increase, providing a higher payout to the policyholder's beneficiaries. Conversely, if the index value decreases, the death benefit may decrease accordingly. This feature allows the policy to adapt to market conditions and potentially offer a more substantial financial safety net.

While Index Life Insurance can be a valuable financial tool, it also carries certain risks. One significant risk is the potential for the death benefit to decrease if the market index underperforms. Additionally, the policy may have limitations or restrictions on policy modifications, which could impact the insured's ability to adjust coverage as needed. It is essential to carefully review the policy terms and understand the potential risks before purchasing this type of insurance.