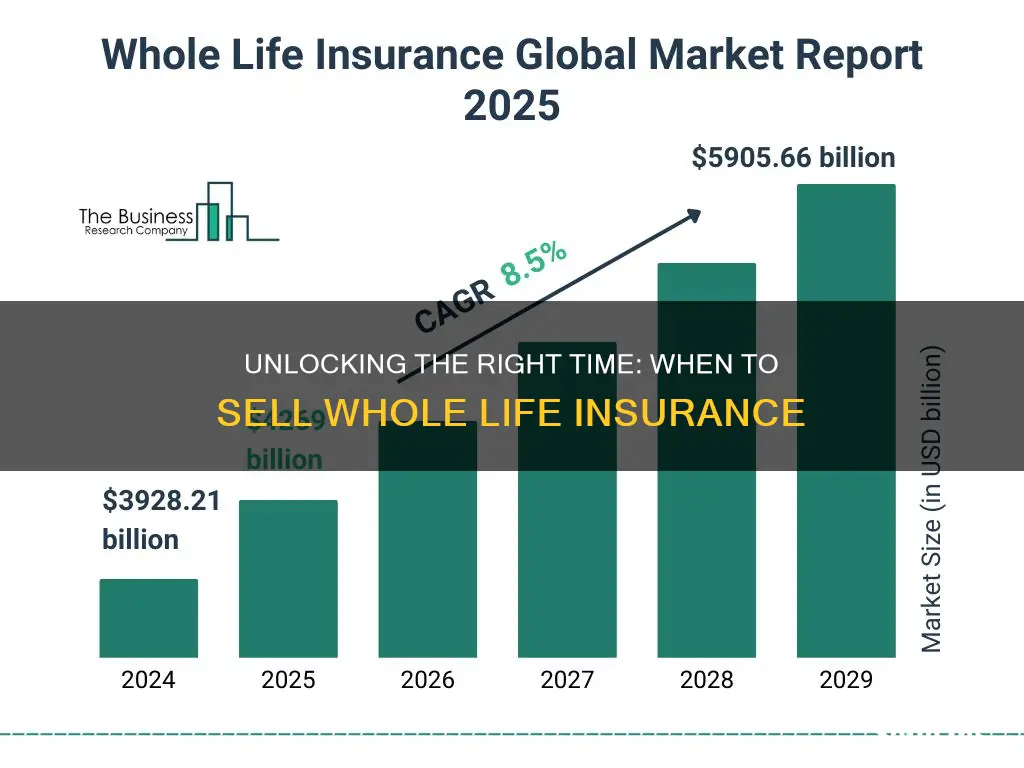

When considering when to sell whole life insurance, it's important to understand the unique features and benefits of this type of policy. Whole life insurance provides lifelong coverage and a guaranteed death benefit, making it a valuable asset for many individuals. However, the decision to sell whole life insurance should be made carefully, as it can be a significant financial move. Factors to consider include the policyholder's financial goals, the current market value of the policy, and the potential tax implications of selling the policy. This paragraph aims to provide an overview of the key considerations for those thinking about selling their whole life insurance.

What You'll Learn

- Cost-Effectiveness: When premiums are affordable and provide long-term financial security

- Financial Goals: Selling when your financial objectives are met and insurance is no longer needed

- Health Changes: Selling if health improves, making whole life less beneficial

- Alternative Investments: When other investments offer higher returns, making whole life less attractive

- Retirement Planning: Selling when retirement funds are sufficient, and whole life is no longer essential

Cost-Effectiveness: When premiums are affordable and provide long-term financial security

When considering the timing of selling whole life insurance, cost-effectiveness is a crucial factor to evaluate. Whole life insurance offers a unique advantage in this regard, as it provides long-term financial security at a potentially lower cost compared to other insurance types. The cost-effectiveness of whole life insurance is particularly notable when premiums are affordable and offer a sense of financial stability.

One key aspect is the initial premium payment. With whole life insurance, you typically pay a single premium or a series of regular payments. These premiums are calculated based on various factors, including your age, health, and the desired death benefit. When you purchase whole life insurance at a younger age, the premiums are generally lower due to the extended coverage period. As you age, the premiums may increase, but the coverage remains in place for the entire lifetime, ensuring long-term financial protection.

The affordability of premiums is essential for individuals and families who want to secure their financial future without incurring excessive expenses. Whole life insurance provides a sense of security, knowing that your loved ones will receive a guaranteed death benefit, regardless of market fluctuations or economic downturns. This long-term financial security can be particularly valuable for those with financial goals, such as saving for children's education or retirement planning.

Additionally, the cost-effectiveness of whole life insurance becomes more apparent when considering the investment component. Many whole life insurance policies include an investment account, allowing policyholders to grow their money over time. This feature enables individuals to potentially earn higher returns compared to traditional savings accounts, providing an extra layer of financial security. The investment growth can be used to increase the death benefit or even provide additional cash value, further enhancing the policy's value.

In summary, the timing of selling whole life insurance should consider the cost-effectiveness and long-term financial security it offers. Affordable premiums, especially when purchased at a younger age, provide a solid foundation for financial planning. The combination of guaranteed death benefits and potential investment growth makes whole life insurance a valuable tool for individuals seeking to secure their financial future without compromising on cost. It is a strategic decision that can offer peace of mind and financial stability for generations to come.

Life Insurance Medical Exam: Blood or Urine Test?

You may want to see also

Financial Goals: Selling when your financial objectives are met and insurance is no longer needed

When you've achieved your financial goals and no longer require the coverage provided by whole life insurance, it's a strategic move to consider selling the policy. This decision is particularly relevant if you've accumulated sufficient savings, assets, or other financial instruments to meet your objectives without relying on the insurance's death benefit. Selling your whole life insurance policy can be a wise financial move, allowing you to access the cash value built up over the years, which can then be utilized to further your financial goals.

The process of selling a whole life insurance policy typically involves surrendering the policy to the insurance company. This surrender option allows you to receive a lump sum payment, known as the cash surrender value, which is the accumulated value of the policy minus any outstanding loans or interest. This amount can be a valuable resource, providing financial flexibility and enabling you to make strategic decisions about your money. For instance, you might choose to invest the proceeds in other assets, pay off debts, or contribute to retirement accounts, ensuring that your financial objectives are met without the ongoing need for the insurance coverage.

It's important to carefully consider the timing of selling your policy. If you've recently made significant financial progress, such as paying off a mortgage or achieving a substantial savings target, it may be an opportune moment to review your insurance needs. Additionally, life events like getting married, having children, or purchasing a home might prompt a reevaluation of your insurance strategy. During these times, you may find that your insurance needs have changed, and selling the policy can be a way to adapt to your evolving financial situation.

When deciding to sell, it's advisable to consult with a financial advisor or insurance specialist. They can provide valuable insights into the potential benefits and risks associated with selling your policy. These professionals can help you navigate the process, ensuring that you understand the financial implications and make informed decisions. They may also offer alternative strategies to meet your financial goals, such as adjusting your investment portfolio or exploring other insurance products that better align with your current needs.

In summary, selling your whole life insurance policy when your financial objectives are met can be a strategic financial move. It allows you to access the cash value, providing financial flexibility and enabling you to make informed decisions about your money. By carefully considering your financial situation and seeking professional advice, you can determine the optimal time to sell and ensure that your financial goals remain on track.

Calculating Life Insurance: A Child's Age Matters

You may want to see also

Health Changes: Selling if health improves, making whole life less beneficial

When considering the timing of selling your whole life insurance policy, it's crucial to evaluate how your health has evolved. If your health has significantly improved, this could render the long-term benefits of whole life insurance less appealing. Here's a detailed guide on why and how to approach this decision:

Understanding the Impact of Health Improvements:

When you initially purchased whole life insurance, your health status was a critical factor in determining the policy's terms and rates. Over time, if your health has improved, you may have experienced a reduction in health risks, such as lower blood pressure, improved cholesterol levels, or successful management of chronic conditions. This improved health can make you a more attractive candidate for other insurance products or even healthier lifestyle choices. As a result, the long-term investment in whole life insurance might no longer align with your current needs and goals.

Reassessing the Value of Whole Life Insurance:

Whole life insurance is designed to provide lifelong coverage, offering a fixed death benefit and a cash value component that grows over time. However, with improved health, you may find that the premiums for this policy are no longer justifiable. The improved health status could lead to lower insurance rates from other providers, making it more cost-effective to switch to a different policy. Additionally, if your health has improved significantly, you might consider the potential savings from reduced premiums in other areas of your life, such as health and life insurance premiums, or even investing in other financial instruments.

Exploring Alternative Options:

If you decide to sell your whole life insurance policy due to improved health, there are several alternatives to consider:

- Term Life Insurance: This type of policy provides coverage for a specified term, typically 10, 20, or 30 years. It can be more affordable than whole life, especially if your health has improved, as it focuses on providing coverage for a defined period rather than lifelong benefits.

- Health and Life Insurance: With improved health, you may qualify for more competitive rates on standard health and life insurance policies, offering better coverage options.

- Investment Opportunities: Improved health could provide the financial freedom to explore other investment avenues, such as stocks, bonds, or retirement plans, which may offer higher returns over time.

Consulting a Financial Advisor:

Making a decision to sell your whole life insurance policy is a significant financial move. It's essential to consult with a financial advisor who can provide personalized advice based on your unique circumstances. They can help you understand the tax implications, potential penalties, and the overall impact of selling the policy. Additionally, they can assist in exploring alternative financial strategies that align with your improved health and long-term goals.

In summary, improved health can significantly influence the decision to sell your whole life insurance policy. By reassessing the value of the policy, exploring alternative insurance options, and seeking professional advice, you can make an informed choice that best suits your current financial and health situation.

How to Add a Person to Your Life Insurance Policy

You may want to see also

Alternative Investments: When other investments offer higher returns, making whole life less attractive

When considering whether to sell your whole life insurance policy, it's important to evaluate the performance of your investment component. One key factor to consider is the availability of alternative investments that offer higher returns, potentially making whole life insurance less attractive. Here's an analysis of this scenario:

In the financial market, investors are constantly seeking opportunities to grow their wealth. When other investment options provide more favorable returns, it can prompt policyholders to reevaluate their insurance choices. For instance, if you've invested in a whole life insurance policy with an investment component, you might find that the market offers more lucrative opportunities elsewhere. High-yield savings accounts, stocks, bonds, or even real estate investments could potentially yield higher returns than the investment portion of your whole life policy. This is especially true if the market is experiencing a bull run, and various asset classes are outperforming the expected growth of your insurance investment.

The decision to sell whole life insurance in this context should be based on a thorough comparison of returns. You'll want to assess the historical and projected performance of your insurance policy's investment component against the potential gains from alternative investments. If the market is consistently delivering higher returns, it might be wise to consider selling and reinvesting the proceeds in more lucrative options. This strategy can be particularly appealing if you're seeking to maximize your long-term wealth accumulation.

However, it's crucial to approach this decision with caution. Selling whole life insurance should not be impulsive but rather a well-informed choice. Consider the fees and penalties associated with selling the policy, as these can impact your overall returns. Additionally, evaluate the tax implications of selling the policy, as tax laws may affect your decision. It's advisable to consult a financial advisor who can provide personalized guidance based on your specific circumstances.

In summary, when alternative investments offer higher returns, it can prompt a reevaluation of the attractiveness of whole life insurance. Policyholders should carefully compare the investment performance of their whole life policy against market alternatives, ensuring they make an informed decision that aligns with their financial goals and considers the associated costs and tax implications. This approach allows for a strategic adjustment of one's investment portfolio to optimize wealth growth.

Mortgage Life Insurance: Worth the Cost?

You may want to see also

Retirement Planning: Selling when retirement funds are sufficient, and whole life is no longer essential

When it comes to retirement planning, one of the key decisions you'll need to make is whether to continue paying into your whole life insurance policy or to sell it. Whole life insurance is a long-term financial commitment, and there may come a time when you no longer need the coverage or the financial benefits it provides. Here's a guide to help you determine when to sell your whole life insurance policy and focus on other retirement funds.

Assess Your Retirement Needs: Before making any decisions, it's crucial to evaluate your retirement goals and financial situation. Calculate your expected retirement expenses and determine how much income you will need to maintain your desired standard of living. Consider factors such as healthcare costs, travel plans, and any specific retirement goals you have set. This assessment will help you understand the role that your whole life insurance policy plays in your overall retirement strategy.

Evaluate the Policy's Value: Whole life insurance policies accumulate cash value over time, which can be borrowed against or withdrawn. Assess the current value of your policy, including any dividends or interest earned. If the cash value is substantial and exceeds your retirement needs, it might be worth considering selling the policy. However, be cautious and seek professional advice to ensure you understand the tax implications and potential penalties associated with policy surrender.

Consider Alternative Investments: If you've determined that your retirement funds are sufficient and you no longer require the coverage, it's essential to explore alternative investment options. Consider diversifying your retirement portfolio by investing in other vehicles such as stocks, bonds, mutual funds, or retirement accounts like a 401(k) or IRA. These alternatives can provide higher returns and more flexibility to adapt to changing financial circumstances.

Review Regularly: Retirement planning is an ongoing process, and your financial situation will likely evolve over time. Regularly review your retirement funds and insurance policies to ensure they remain aligned with your goals. As you approach retirement age, you may find that your whole life insurance policy is no longer necessary, and selling it can provide a significant financial boost to support your retirement lifestyle.

Remember, selling a whole life insurance policy should be a well-informed decision, and it's advisable to consult with a financial advisor who can provide personalized guidance based on your unique circumstances. By carefully assessing your retirement needs and exploring alternative investment options, you can make the right choice to secure your financial future during retirement.

Gerber Life Insurance: College Funding Option?

You may want to see also

Frequently asked questions

Whole life insurance is a long-term financial commitment, and the decision to sell it should be made when you no longer need the coverage or when the policy has reached a certain maturity. Typically, this is after the children have grown up and are financially independent, or when you've achieved your financial goals and no longer require the insurance benefits.

Before making a decision, evaluate your current financial situation and goals. Consider the policy's cash value, which can be borrowed against or withdrawn. Assess if you have other financial resources or investments that can provide similar benefits. Additionally, review the policy's terms and conditions, including any surrender charges or penalties, to understand the potential costs of selling early.

Selling a whole life insurance policy may have tax consequences. If you take a lump sum payment from the policy's cash value, it may be subject to income tax. However, if you choose to surrender the policy for its cash value, you might be able to avoid taxes on the full amount. It's essential to consult with a tax advisor to understand the specific tax implications based on your circumstances.

Yes, you can typically access the cash value of your whole life insurance policy even if you decide to sell it. The cash value accumulates over time and can be borrowed against or withdrawn. This feature allows policyholders to utilize the funds for various purposes, such as financing major purchases, starting a business, or investing in other opportunities. However, it's crucial to consider the potential impact on the policy's coverage and long-term value.