Voluntary group life insurance is a type of life insurance policy that is offered to employees as part of their benefits package. It is a voluntary benefit, meaning that employees choose to participate in the program and pay for the insurance themselves, often through payroll deductions. This type of insurance provides financial protection for the employee's beneficiaries in the event of their death, offering a safety net for loved ones during difficult times. The policy is typically administered by the employer, who may negotiate favorable rates with an insurance company on behalf of the group, making it more affordable for employees compared to individual policies. Understanding the details of voluntary group life insurance is essential for employees to make informed decisions about their financial security and the well-being of their families.

What You'll Learn

- Definition: Voluntary group life insurance is a policy offered through an employer or association

- Benefits: It provides financial protection for members and their families

- Eligibility: Membership criteria vary, often based on employment or affiliation

- Cost: Premiums are typically shared by the group, making it affordable

- Flexibility: Policies can be customized to suit the group's needs

Definition: Voluntary group life insurance is a policy offered through an employer or association

Voluntary group life insurance is a type of life insurance policy that is offered as a benefit to employees or members of an organization. It is a voluntary arrangement, meaning individuals choose to participate and pay for the coverage. This insurance is typically provided through an employer or an association, such as a professional organization or a trade union. The key aspect is that it is not mandatory for employees or members to purchase this insurance, unlike some other benefits that might be required.

When an employer or association offers voluntary group life insurance, they often negotiate a group rate with an insurance company, which can result in lower premiums for the participants. This group approach allows for a more cost-effective way to obtain life insurance coverage compared to individual policies. The policy covers the lives of the enrolled individuals, providing financial protection to their beneficiaries in the event of the insured person's death.

In this type of insurance, the employer or association acts as the policyholder, and they manage the administration of the plan. Employees or members can typically choose the level of coverage they desire, often with the option to increase or decrease the amount based on their personal needs and preferences. This flexibility is a significant advantage, as it allows individuals to tailor the insurance to their specific circumstances.

Voluntary group life insurance policies usually have certain eligibility criteria, such as being employed or a member of the offering organization. The coverage amount and terms can vary depending on the employer or association's policies and the insurance provider's offerings. It is essential for individuals to understand the details of the plan, including any exclusions or limitations, before enrolling.

This form of insurance provides a convenient way for individuals to secure financial protection for their loved ones without the complexity and cost often associated with individual life insurance policies. It is a valuable benefit that can offer peace of mind and financial security, especially for those who may not have access to other life insurance options.

Sober but Denied: Life Insurance's Catch-22

You may want to see also

Benefits: It provides financial protection for members and their families

Voluntary group life insurance is a valuable benefit that offers financial security and peace of mind to individuals within a community or organization. This type of insurance is designed to provide financial protection for members and their loved ones in the event of the insured individual's untimely death. It is a voluntary arrangement, meaning individuals choose to participate and pay for the coverage, often through payroll deductions or other convenient methods.

One of the primary benefits of voluntary group life insurance is the financial safeguard it offers to the policyholder's family. In the unfortunate event of a member's passing, the insurance company pays out a death benefit, which can provide a crucial financial cushion for the family. This benefit can help cover various expenses, such as funeral costs, outstanding debts, mortgage payments, or daily living expenses, ensuring that the family's financial stability is maintained during a challenging time. The death benefit can be a significant source of support, especially for those who rely on the income of the deceased family member.

Moreover, voluntary group life insurance often provides coverage for a specific period, such as one year or five years, which is typically aligned with the duration of employment or membership. This feature ensures that the insurance remains relevant and beneficial as individuals progress through different life stages. For instance, a young professional might opt for a higher coverage amount to secure their family's future, while a retiree might choose a lower amount to avoid over-insurance. The flexibility in coverage options allows individuals to tailor the insurance to their specific needs and financial circumstances.

In addition to the financial protection, voluntary group life insurance can also offer other advantages. Many policies provide access to additional benefits, such as critical illness coverage, disability insurance, or accidental death benefits. These supplementary features can further enhance the overall protection and support for members and their families. For example, critical illness coverage can help with medical expenses and income replacement if the insured individual is diagnosed with a serious illness, while disability insurance can provide income protection if the individual becomes unable to work due to injury or illness.

By offering voluntary group life insurance, organizations demonstrate their commitment to the well-being of their members. It not only provides financial security but also fosters a sense of community and support. Members can feel reassured that their families will be taken care of, even in the worst-case scenario, allowing them to focus on their work, personal growth, and overall happiness. This type of insurance is a valuable tool for both individuals and the organizations that offer it, creating a supportive environment and ensuring financial stability for those who matter most.

Transferring Life Insurance: A Comprehensive Guide to Policy Assignment

You may want to see also

Eligibility: Membership criteria vary, often based on employment or affiliation

Voluntary group life insurance is a type of life insurance policy that is offered as an optional benefit to employees within a specific group or organization. This insurance is typically provided by employers as a way to offer additional financial protection to their workforce. The key aspect of this insurance is that it is voluntary, meaning employees can choose whether or not to participate, unlike mandatory coverage.

Eligibility for voluntary group life insurance is often tied to employment status and affiliation with the offering organization. Here are some common membership criteria:

- Employment Status: Most voluntary group life insurance plans are available exclusively to active employees of the company. This ensures that the insurance is relevant to the workforce and provides coverage during their employment period.

- Length of Employment: Some plans may have a minimum tenure requirement. For instance, an employee might need to have been with the company for a specific number of years before becoming eligible for the insurance. This could be a way to ensure the organization's commitment to the employee's long-term career.

- Affiliation and Membership: Certain groups or associations may offer voluntary life insurance to their members. For example, professional associations, trade unions, or alumni networks might provide this benefit to their affiliated members. This type of insurance can be a valuable addition to the benefits package for these specific groups.

- Age and Health Considerations: While not always a primary factor, age and health status can influence eligibility. Younger and healthier individuals may be offered more competitive rates, while older or those with pre-existing health conditions might have different terms and premiums.

It is important to note that the specific eligibility criteria can vary widely depending on the insurance provider and the organization offering the plan. Some companies might offer a range of coverage options, allowing employees to choose the level of protection that suits their needs. This flexibility is a significant advantage of voluntary group life insurance, as it caters to individual preferences and financial situations.

When considering voluntary group life insurance, employees should carefully review the terms and conditions, including any waiting periods, exclusions, and coverage limits. Understanding the eligibility requirements and the overall benefits package can help individuals make informed decisions about their insurance coverage.

Canceling HSBC Life Insurance: A Step-by-Step Guide

You may want to see also

Cost: Premiums are typically shared by the group, making it affordable

Voluntary group life insurance is a type of life insurance policy that is offered as part of an employee benefit package. It is a voluntary benefit, meaning that employees have the option to enroll in the policy and choose the level of coverage that suits their needs. One of the key advantages of this type of insurance is its cost-effectiveness.

The cost of voluntary group life insurance is typically shared by the employer and the employees. This shared responsibility makes it an affordable option for individuals who may not otherwise be able to afford individual life insurance. By pooling the risk and costs among a group, the financial burden is significantly reduced for each member.

When an employee joins a group life insurance plan, they contribute a portion of the premium, often deducted from their paycheck. The employer then matches this contribution, sometimes even providing additional funding. This shared premium structure ensures that the cost is distributed fairly and allows for a more accessible insurance option.

The affordability of voluntary group life insurance is particularly beneficial for employees who might not qualify for or cannot afford higher coverage amounts through individual policies. It provides a safety net for individuals and their families, offering financial protection in the event of death. With the shared cost structure, employees can access a valuable benefit without incurring substantial financial strain.

In summary, the cost-sharing aspect of voluntary group life insurance makes it an attractive and accessible option for employees. By combining employer and employee contributions, this type of insurance ensures that individuals can obtain the necessary coverage at a reasonable cost, providing peace of mind and financial security.

Should Employees Decline Life Insurance Over $50k?

You may want to see also

Flexibility: Policies can be customized to suit the group's needs

Voluntary group life insurance offers a flexible and tailored approach to providing life coverage for employees within a company or organization. This type of insurance is designed to be adaptable, allowing businesses to customize the policy to meet the specific needs of their workforce. By offering voluntary group life insurance, employers can demonstrate their commitment to employee well-being and provide a valuable benefit that can be tailored to the unique circumstances of the group.

The flexibility of voluntary group life insurance policies is a key advantage. Employers can choose the level of coverage that best suits their employees' requirements. This customization ensures that the insurance plan aligns with the financial situation and risk tolerance of the group. For instance, a company might offer a basic level of coverage as a standard benefit, while also providing an option for higher coverage amounts for those who wish to purchase more extensive protection. This approach allows employees to select a policy that fits their personal preferences and financial capabilities.

Furthermore, voluntary group life insurance policies can be adjusted over time to accommodate changing circumstances. As employees progress in their careers, their financial needs and risk profiles may evolve. The flexibility of this insurance allows for adjustments to the policy, ensuring that the coverage remains relevant and valuable throughout an employee's tenure. For example, a company might offer an initial policy with a set term, and then provide the option to increase or decrease coverage as employees reach different life stages, such as starting a family or purchasing a home.

Customization also extends to the payment options. Employers can decide how the premiums will be collected, whether through payroll deductions or other convenient methods. This flexibility ensures that the cost of the insurance is manageable for employees and aligns with their income streams. Additionally, the policy can be structured to include various riders or add-ons, such as accidental death coverage or critical illness insurance, allowing employees to enhance their protection according to their specific needs.

In summary, voluntary group life insurance provides a flexible and personalized solution for employers to support their employees' financial security. By customizing policies, businesses can offer a valuable benefit that is tailored to the unique needs of their workforce, ensuring that employees receive appropriate coverage while also maintaining control over their insurance choices. This flexibility is a significant advantage, allowing both employers and employees to benefit from a well-designed and adaptable insurance program.

Life Insurance Agents: Essential or Unnecessary?

You may want to see also

Frequently asked questions

Voluntary group life insurance is a type of life insurance policy offered as a voluntary benefit to employees by their employer. It is typically part of an employee's benefits package and allows them to purchase a life insurance policy at a group rate, often with lower premiums compared to individual policies. This insurance provides financial protection to the employee's beneficiaries in the event of their death.

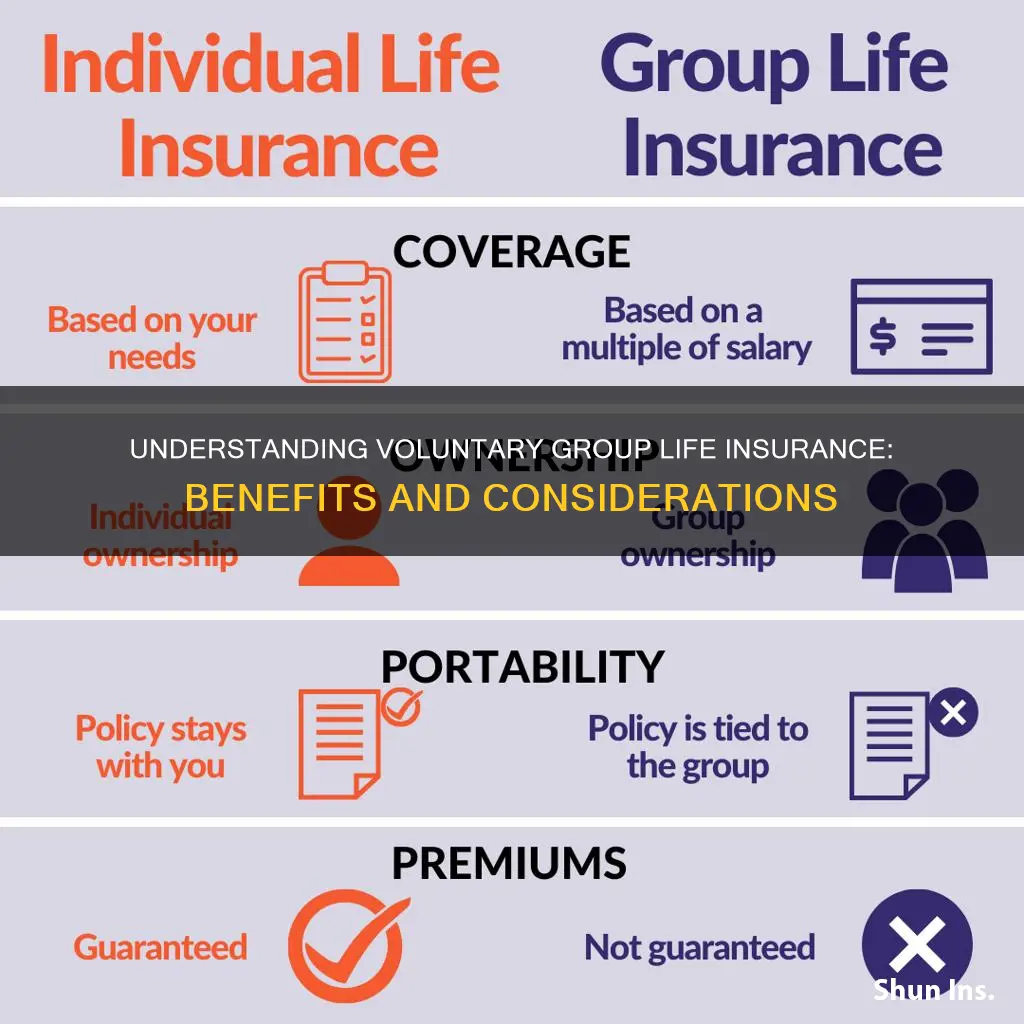

The key difference lies in the cost and convenience. Voluntary group life insurance is usually more affordable because the employer covers a portion of the premium, and the group rate is negotiated with an insurance company. This makes it accessible to a larger number of employees. Individual life insurance, on the other hand, is purchased independently and may have higher premiums, especially for those with pre-existing health conditions or specific coverage needs.

Eligibility criteria can vary depending on the employer's policies and the insurance provider's guidelines. Generally, all active employees are eligible to participate in the voluntary group life insurance plan. Some employers may also offer it to retired employees or dependents. It is a voluntary benefit, so employees choose whether to enroll or not, and they can select the coverage amount that suits their needs and budget.