Many people rely on their cell phones for essential communication and daily tasks, making it crucial to understand the insurance coverage available for these devices. Allstate, a well-known insurance provider, offers various protection plans for personal belongings, including cell phones. This introduction aims to explore whether Allstate's insurance policies cover cell phones and what specific coverage options are available to consumers.

What You'll Learn

- Coverage Options: Allstate offers various insurance plans for cell phones, including theft, damage, and accidental coverage

- Policy Details: Review specific policy terms to understand what is covered and any exclusions

- Claims Process: Learn how to file a claim for cell phone damage or loss

- Pricing Factors: Insurance costs depend on phone value, usage, and coverage level

- Customer Reviews: Check Allstate's customer feedback for insights into their cell phone insurance service

Coverage Options: Allstate offers various insurance plans for cell phones, including theft, damage, and accidental coverage

Allstate, a well-known insurance provider, offers comprehensive coverage options for cell phones, ensuring that your device is protected against various risks. With their specialized plans, Allstate aims to provide peace of mind to customers who want to safeguard their mobile devices. Here's an overview of the coverage options they provide:

Theft Coverage: Allstate understands that cell phones can be attractive targets for thieves. Their theft coverage is designed to protect your device in case it goes missing. If your phone is stolen, Allstate will provide financial assistance to help you replace it. This coverage is particularly useful for those who frequently travel or live in areas with higher crime rates. By opting for this plan, you can have the assurance that your investment in the latest smartphone technology is protected.

Damage Protection: Accidental damage is a common concern for cell phone owners. Allstate's damage protection plan covers a wide range of accidental incidents. This includes protection against drops, spills, liquid damage, and even screen cracks. When you enroll in this coverage, you gain access to professional repair services, ensuring that your phone is restored to its proper functioning state. Allstate's network of authorized repair shops guarantees that your device will be handled with care and expertise.

Accidental Coverage: In addition to damage protection, Allstate also offers accidental coverage, which provides financial reimbursement for specific accidental incidents. This plan covers situations like broken buttons, malfunctioning parts, or even accidental damage to the phone's housing. With this coverage, you can avoid the financial burden of repairing or replacing your device due to accidental misuse. Allstate's accidental coverage is an excellent choice for individuals who want comprehensive protection for their cell phones.

Allstate's insurance plans for cell phones are tailored to meet different customer needs. Whether you're a frequent traveler, a tech enthusiast, or simply someone who wants peace of mind, Allstate's coverage options provide a safety net for your valuable devices. By choosing Allstate, you can focus on staying connected and productive without worrying about potential losses or damages. Remember, with Allstate's specialized insurance plans, you can customize your coverage to fit your unique requirements.

**Credit Conundrum: Unraveling the Connection Between Insurance Bills and Credit Building**

You may want to see also

Policy Details: Review specific policy terms to understand what is covered and any exclusions

When considering Allstate's coverage for your cell phone, it's crucial to delve into the specifics of their policy to ensure you fully understand what is covered and any potential limitations. Here's a breakdown of what you need to know:

Coverage: Allstate's cell phone insurance typically offers protection against various risks. This may include damage caused by accidental drops, spills, or mechanical failures. Some policies might also cover theft or loss, providing financial reimbursement or a replacement device. It's important to note that coverage details can vary depending on the specific plan and region.

Exclusions: As with any insurance policy, there are certain situations that may not be covered. Common exclusions include:

- Normal wear and tear: Insurance may not cover issues that arise due to regular use and aging.

- Intentional damage: Deliberate damage caused by the policyholder or others is usually not covered.

- Water damage: Spills or immersion in water might be excluded unless specifically mentioned in the policy.

- Pre-existing conditions: Damage that existed before the policy purchase may not be covered.

- Misuse or abuse: Insurance may not cover damage resulting from misuse, such as using the phone in extreme conditions or for commercial purposes.

Policy Terms and Conditions: Reviewing the fine print is essential. Policies often have specific terms regarding coverage limits, deductibles, and claim processes. For instance, there may be a maximum payout for a single claim or a yearly limit on coverage. Understanding these terms ensures you know your rights and responsibilities as a policyholder.

Additional Benefits: Some Allstate policies might offer extra benefits like extended warranty coverage or access to repair services. These add-ons can provide further protection and convenience. However, they may come at an additional cost, so it's worth evaluating whether these extras align with your needs and budget.

By carefully examining the policy details, you can make an informed decision about Allstate's cell phone insurance. Understanding the coverage, exclusions, and terms will help you determine if it's the right choice for your specific situation. Remember, insurance policies can be complex, so don't hesitate to ask questions or seek clarification from Allstate representatives if needed.

Navigating the Road to Recovery: Understanding Insurance Billing for Windshield Repairs

You may want to see also

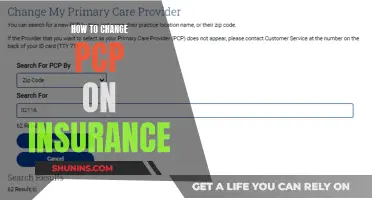

Claims Process: Learn how to file a claim for cell phone damage or loss

To file a claim for cell phone damage or loss, you'll need to follow a structured process to ensure a smooth and efficient resolution. Here's a step-by-step guide on how to navigate the claims process with Allstate:

- Document the Damage: The first step is to thoroughly examine your device and document the damage. Take clear photos or videos of the phone, showing the extent of the damage. If possible, also capture any relevant details, such as the model and serial number of the device. This documentation will be crucial when filing the claim.

- Contact Allstate: Reach out to Allstate's customer service team as soon as possible. You can typically do this by phone or through their online portal. Inform them about the incident and provide them with the necessary details, including your policy number, personal information, and the date of the incident. Be prepared to explain the situation and answer any questions they may have.

- Provide Proof of Ownership: Allstate will need to verify your ownership of the device. Gather any relevant documents, such as purchase receipts, invoices, or warranty information. These documents will help establish your claim and ensure that the insurance coverage applies.

- Follow the Claims Representative's Instructions: Once your claim is filed, a claims representative will guide you through the next steps. They may request additional information or evidence to support your claim. It's essential to cooperate and provide any necessary documentation promptly. The representative will assess the damage and determine the coverage options available to you.

- Choose a Repair or Replacement Option: Depending on the severity of the damage and the terms of your policy, Allstate may offer you two main options: repair or replacement. If the repair is feasible and cost-effective, Allstate will arrange for the necessary repairs. Otherwise, they may provide a new device, ensuring that it meets the coverage criteria.

- Understand the Coverage and Costs: Before finalizing the claim, review the coverage details and any associated costs. Allstate should provide a clear breakdown of the expenses covered and any deductibles or co-pays you may be responsible for. This transparency ensures that you understand your financial obligations.

Remember, the key to a successful claim is prompt action and clear communication. By following these steps, you can efficiently navigate the process and potentially recover from cell phone damage or loss with Allstate's insurance coverage.

The Intricacies of Jettison in Insurance: Understanding the Concept and Its Implications

You may want to see also

Pricing Factors: Insurance costs depend on phone value, usage, and coverage level

When it comes to insuring your cell phone, Allstate offers a range of coverage options tailored to your device's value, usage patterns, and specific needs. The cost of insuring your phone can vary significantly based on several key factors.

Phone Value: The price of your insurance policy will be directly influenced by the value of your phone. More expensive devices naturally incur higher insurance premiums. Allstate's pricing structure reflects the potential cost of replacing or repairing a high-end smartphone, which might be significantly more expensive than a budget-friendly model. For instance, insuring a flagship iPhone or a high-end Android device will likely be more costly than insuring a basic smartphone.

Usage and Risk Factors: Allstate considers your phone usage habits and the associated risks. Frequent use, especially in high-risk environments like crowded places or areas with a high crime rate, can lead to higher insurance premiums. Additionally, if your phone is primarily used for work or business, the insurance company may offer specialized coverage with higher costs to account for the increased risk of loss or damage.

Coverage Level: The extent of coverage you choose will also impact the price. Allstate provides various coverage options, including standard, comprehensive, and custom plans. Standard coverage typically covers physical damage and theft, while comprehensive plans offer broader protection, including accidental damage, water damage, and loss. Custom plans allow you to select specific coverage options, which can be more cost-effective if you only need certain types of protection. The more comprehensive the coverage, the higher the insurance premium will be.

Additional Factors: Other factors that can influence pricing include your location, the age of your phone, and any existing insurance policies. Allstate may also consider your credit history and payment behavior when determining your insurance rates. It's essential to provide accurate information during the application process to ensure you receive the most suitable and cost-effective coverage.

Understanding these pricing factors can help you make informed decisions when choosing an insurance plan for your cell phone. Allstate's policies are designed to provide peace of mind, ensuring your device is protected against various risks while offering flexibility in coverage and pricing to suit your individual needs.

Name Change: Navigating the Process with PEHP Insurance

You may want to see also

Customer Reviews: Check Allstate's customer feedback for insights into their cell phone insurance service

Allstate's cell phone insurance service has garnered a range of customer reviews, offering valuable insights into the company's offerings. Here's a breakdown of what customers have to say:

Positive Feedback:

Many customers praise Allstate's cell phone insurance for its comprehensive coverage options. Reviewers appreciate the ability to customize their plans, ensuring they get protection tailored to their specific needs. The company's breakdown of coverage types, such as damage, theft, and accidental coverage, is often highlighted as helpful in understanding their protection.

The ease of filing claims is a recurring theme in positive reviews. Customers appreciate the streamlined process, including the availability of online claim submissions and the efficiency of the claims adjuster's response.

Areas for Improvement:

Some customers express frustration with the cost of the insurance. They feel that the premiums are relatively high compared to other providers, despite the comprehensive coverage.

Another common complaint revolves around the perceived lack of transparency in pricing. Customers mention that the initial quotes they receive online may not accurately reflect the final cost, leading to unexpected expenses.

Overall Satisfaction:

Despite the criticisms, many customers remain satisfied with Allstate's cell phone insurance. They appreciate the peace of mind that comes with knowing their device is protected.

Tips for Prospective Customers:

- Carefully review the coverage options and compare them to your specific needs.

- Be aware of potential hidden costs and seek clarification on pricing before committing.

- Utilize the online resources and customer support to understand the claims process thoroughly.

By considering both positive and negative feedback, you can make an informed decision about Allstate's cell phone insurance service.

Understanding the Insured's Road to Restoration: A Guide to Insurance Restoration

You may want to see also

Frequently asked questions

Yes, Allstate provides insurance for cell phones through its Allstate Mobile Protection plan. This plan covers damage, theft, and accidental loss of your mobile device.

To file a claim, you can contact Allstate's customer service and provide details about the incident. They will guide you through the process, which may involve submitting proof of purchase, device details, and any relevant documentation. Allstate aims to make the claim process straightforward and efficient.

Like any insurance policy, there are certain limitations and exclusions. For instance, the plan might not cover damage caused by misuse, intentional acts, or natural disasters. It's essential to review the policy terms and conditions to understand what is covered and any specific requirements or restrictions.