Level benefit term life insurance, also known as level term life insurance, is a type of life insurance policy that offers a fixed death benefit for the entire term of the policy. This means that the policyholder's beneficiaries will receive the same payout, regardless of when the policyholder dies during the policy term. The term of these policies typically ranges from 10 to 30 years, and the policyholder pays the same premium each year. Level term life insurance is a common form of life insurance due to its stable coverage options and straightforward structure. It is also generally more affordable than other types of life insurance as it does not build cash value over time.

| Characteristics | Values |

|---|---|

| Type of policy | Term life insurance |

| Death benefit | Level throughout the term |

| Premium | Level throughout the term |

| Term length | 10, 15, 20 or 30 years |

| Simplicity | Easy to understand and maintain |

| Cost | Lower premiums compared to other types of policies |

| Predictability | Beneficiaries can make plans with a single dollar amount in mind |

| Budgeting | Easy to budget as premium stays the same |

| Health | Locked-in rate based on current health |

| Age | Locked-in rate based on current age |

What You'll Learn

- Level term life insurance offers a level death benefit for the entire term of the policy

- It is the most common and basic form of term life insurance

- It is a straightforward and cost-effective option

- The premium and death benefit remain the same throughout the policy

- It is a good option for young and healthy people

Level term life insurance offers a level death benefit for the entire term of the policy

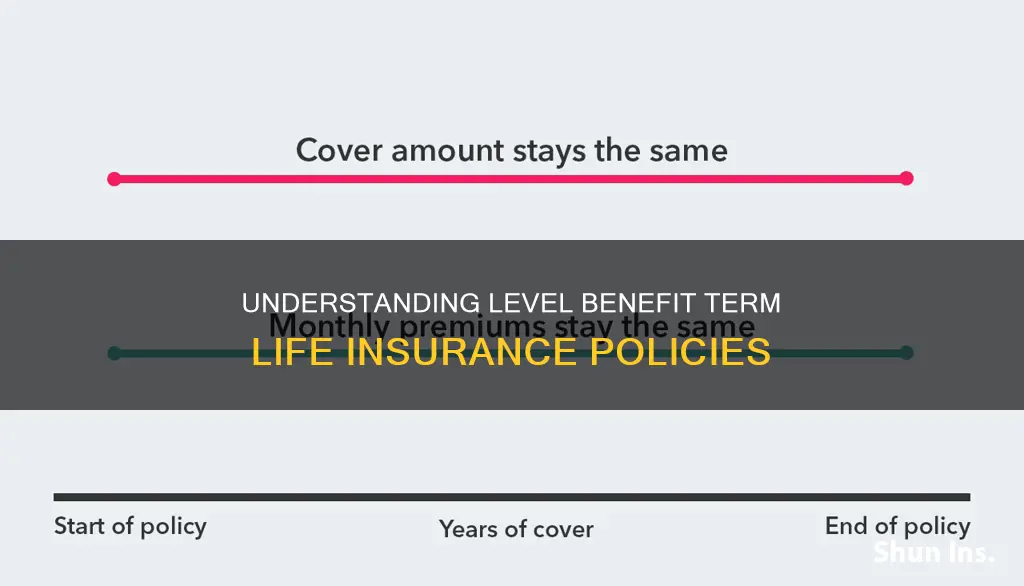

Level term life insurance is a type of life insurance policy that offers a level death benefit for the entire term of the policy. This means that the payout to your beneficiaries remains the same, regardless of when you die during the policy term. For example, if you have a 20-year policy, your beneficiaries will receive the same amount whether you pass away in the third year or the last year of the policy. This feature provides stability and predictability, making it easier for your loved ones to make long-term financial plans.

The level death benefit is a defining characteristic of level term life insurance, and it is often paired with a level premium. This means that not only is the payout amount fixed, but the premiums you pay will also remain unchanged throughout the policy term. This consistency in both the death benefit and premium makes level term life insurance a popular choice for individuals seeking straightforward and cost-effective life insurance options.

The term length of level term life insurance policies typically ranges from 10 to 30 years, and you can choose a duration that suits your needs. During this time, you are guaranteed a fixed death benefit and premium, which simplifies the management of your policy. This stability allows you to make informed financial decisions and budget effectively, knowing exactly how much coverage you have and what your ongoing costs will be.

Level term life insurance is particularly advantageous for young and healthy individuals as it allows them to lock in affordable rates for an extended period. The predictability and consistency of level term life insurance provide peace of mind, ensuring that your loved ones will receive a predetermined payout should the unexpected occur during the policy term.

Compared to other types of life insurance, level term life insurance is generally more affordable. This affordability, combined with its simplicity and stability, makes it a common choice for individuals seeking temporary life insurance coverage. However, it's important to note that level term life insurance does not offer cash value, and premiums are tied to your health, which can be a drawback for some individuals.

Life Insurance and THC: What You Need to Know

You may want to see also

It is the most common and basic form of term life insurance

Level term life insurance is the most common and basic form of term life insurance. It is a straightforward and cost-effective option, with a simplistic structure. The premium and death benefit remain the same throughout the term of the policy, which usually ranges from 10 to 30 years. This means that beneficiaries will receive the same payout, regardless of when the policyholder dies.

The level term is a good option for those seeking temporary life insurance. It is often the most inexpensive form of life insurance, and the premiums do not increase over time. The death benefit also remains consistent. Its simple structure makes it easier to manage than other types of life insurance policies.

When taking out a level term life insurance policy, the policyholder selects the coverage amount and the term length. They then choose the frequency of their premium payments, typically monthly or annually. If the policyholder passes away while the policy is in force, their beneficiaries will usually receive a tax-free death benefit.

The application process for level term life insurance is generally straightforward. It involves filling out a form with general personal information and a detailed questionnaire about medical history. Depending on the policy, a medical examination may be required. Once the application is processed and accepted, the policyholder signs the relevant paperwork and begins paying their premiums.

Maintaining a level term life insurance policy is simple and requires little to no maintenance. Policyholders simply need to ensure they keep up with their premium payments. However, it is worth periodically assessing the level of coverage to determine if it still meets the policyholder's needs.

At the end of the term, the policy will expire, and the policyholder will have several options. They may be able to convert to a whole life policy, which is more expensive but lasts for the duration of the policyholder's life. Alternatively, they can start a new level term life insurance policy, which will require going through the application process again.

Dementia and Life Insurance: What Are Your Options?

You may want to see also

It is a straightforward and cost-effective option

Level benefit term life insurance is a straightforward and cost-effective option for those seeking life insurance. The structure is simple: the premium and death benefit remain the same throughout the policy term. This means that, unlike other policies, there are no surprises, and you can plan and budget with ease.

The death benefit remains "level" or unchanged, so your beneficiaries will receive the same payout whether you die in the first or last year of your policy. This is a common type of coverage because it is easy to understand and maintain. Once approved, you simply pay your premiums and receive your coverage. The death benefit is guaranteed, and you don't have to worry about premiums increasing over time.

The premiums for level term life insurance are generally lower than for whole life coverage. The rates depend on several factors, including age, health status, and the insurance company, but it is usually possible to find affordable coverage. For example, a 35-year-old in good health may secure a 20-year policy with a $250,000 death benefit for less than $20 per month.

The application process is also typically straightforward. You fill out a form with personal information and details about your health and lifestyle, and you may need to take a quick medical exam, depending on the policy. Once accepted, you sign the paperwork and start paying your premiums.

Level term life insurance is a good option for those seeking a simple, affordable, and reliable life insurance policy. It provides peace of mind without breaking the bank.

Faking Death: Insurance Fraud and its Complexities

You may want to see also

The premium and death benefit remain the same throughout the policy

Level benefit term life insurance, also known as level term life insurance, is a type of life insurance policy where the premium and death benefit remain the same throughout the policy term. This means that the policyholder pays the same premium amount each year, and the death benefit payout remains unchanged regardless of when the insured person dies. Level term life insurance policies typically last for a specified term, usually ranging from 10 to 30 years.

One of the key advantages of level term life insurance is its predictability. Both the premium and death benefit stay level, allowing the policyholder to make long-term plans and budgets with a single dollar amount in mind. This stability also makes it easier to manage the policy, as there are no surprises or fluctuations in costs.

The consistent premium and death benefit of level term life insurance also enable effective budgeting. Policyholders know exactly how much they need to pay each year, and this amount remains the same throughout the policy term. This predictability can be especially beneficial for long-term financial planning.

Additionally, level term life insurance can be a cost-effective option, especially for young and healthy individuals. By locking in a rate and coverage amount based on their current health, individuals can obtain affordable life insurance coverage for an extended period. This is in contrast to annual renewable term life insurance, where rates increase as the insured person ages.

However, it is important to note that the premiums for level term life insurance are linked to the policyholder's health. While it is possible to get a rate reconsideration if health improves, the initial rate is based on the individual's current health status.

Get Licensed: Health and Life Insurance Basics

You may want to see also

It is a good option for young and healthy people

Level benefit term life insurance is a good option for young and healthy people for several reasons. Firstly, it offers a set premium and death benefit that remains unchanged throughout the policy term, typically ranging from 10 to 30 years. This means that young people can lock in affordable rates for an extended period, providing financial protection for their loved ones in the event of their sudden death. The predictability of level term life insurance allows for long-term planning and budgeting, as the beneficiaries will receive the same payout regardless of when the policyholder dies.

Another advantage is its simplicity and ease of management. Level term life insurance has a straightforward structure, making it easier to understand and maintain compared to other types of policies. The premium and death benefit amounts remain consistent, eliminating the worry of changing premiums or benefits over time. This stability also aids in planning and budgeting, as the policyholder knows exactly how much they need to pay and how much their beneficiaries will receive.

Additionally, level term life insurance is often the most inexpensive form of life insurance for young and healthy individuals. The premiums are generally lower than those of whole life policies, and the coverage can be locked in for up to 30 years. This affordability is particularly beneficial for young people who may be starting their careers and have limited financial resources.

Furthermore, level term life insurance provides flexibility. Policyholders can choose their coverage amount and policy length, ensuring that they are not locked into a lifelong contract. It also offers the option to convert the term policy into a permanent one, such as whole life insurance, without requiring additional medical exams or updates to medical information. This flexibility allows young people to adjust their coverage as their needs change over time.

Cigna's Individual Life Insurance: What You Need to Know

You may want to see also

Frequently asked questions

Level benefit term life insurance, also known as level term life insurance, is a type of life insurance where the premium and death benefit remain the same for the duration of the policy. This means that the payout to your beneficiaries will not change, providing stability and making it easier to plan and budget.

Unlike level term life insurance, decreasing term life insurance has a payout that decreases over time. This type of policy is designed for those who may need less coverage as time goes on, such as those gradually paying off large debts.

Level benefit term life insurance is typically the most inexpensive form of life insurance and offers stable coverage. It is simple to understand and maintain, with consistent premiums and death benefits. It also allows you to lock in a rate based on your current health, which can be advantageous if you are young and healthy.

One drawback is that premiums are linked to your health, so if your health improves, you may end up paying a higher rate for the entire policy. Additionally, level term life insurance policies do not build cash value, and you will not get your premiums refunded if you outlive the policy.