Child life insurance is a crucial aspect of financial planning that often goes overlooked. It provides a safety net for your family in the event of the unexpected passing of a child. This type of insurance offers financial security, ensuring that your loved ones are cared for and their future needs are met. With various coverage options available, it can help cover expenses such as funeral costs, ongoing living expenses, education, and other financial obligations. Understanding the benefits and considerations of child life insurance is essential for parents and guardians to make informed decisions and provide long-term protection for their children.

What You'll Learn

- Financial Security: Protects family's financial future in case of the child's untimely death

- Peace of Mind: Provides reassurance for parents, knowing their child is protected

- Long-Term Benefits: Offers lifelong coverage, ensuring financial stability for the child's future

- Customizable Plans: Tailored policies can meet specific family needs and budgets

- Early Planning: Starting early ensures the child is covered from birth

Financial Security: Protects family's financial future in case of the child's untimely death

Child life insurance is a crucial aspect of financial planning that often gets overlooked, yet it plays a vital role in ensuring the long-term financial security of a family. This type of insurance is specifically designed to provide financial protection for children, offering a safety net in the event of their untimely death. By taking out a child life insurance policy, parents can secure their family's future and ease the financial burden that often accompanies the loss of a child.

The primary purpose of this insurance is to provide financial stability during challenging times. When a child passes away, the surviving family members are already emotionally devastated, and the last thing they need to worry about is the financial implications. Child life insurance steps in to cover various expenses, including funeral costs, outstanding debts, and even ongoing living expenses for the remaining family members. It ensures that the family can maintain their standard of living and have the necessary financial resources to cope with the sudden change.

One of the key advantages of child life insurance is its ability to provide a lump sum payment, which can be a significant financial cushion. This lump sum can be used to cover immediate expenses and also as a long-term investment for the family's future. For instance, it can be utilized to pay for a child's education, secure a home, or even start a business, ensuring that the family's financial goals are met despite the tragic loss. Moreover, the insurance policy can be tailored to the family's specific needs, allowing them to choose the coverage amount and term that best suits their requirements.

In addition to financial security, child life insurance also offers peace of mind. Knowing that your family is protected in the event of an unforeseen tragedy can significantly reduce stress and anxiety. It allows parents to focus on grieving and supporting each other during this difficult period without constantly worrying about financial matters. This type of insurance is a proactive approach to safeguarding your loved ones' future, ensuring that they are taken care of even when you're not around.

When considering child life insurance, it is essential to research and choose a reputable insurance provider. Parents should compare different policies, understanding the terms, conditions, and benefits offered. They should also assess their family's unique needs and select a coverage option that aligns with their financial goals. By doing so, they can ensure that their child's life insurance policy is a valuable asset, providing the necessary financial security and peace of mind.

Expunged Records: Life Insurance and Convictions

You may want to see also

Peace of Mind: Provides reassurance for parents, knowing their child is protected

Child life insurance is a crucial aspect of financial planning that offers parents a sense of security and peace of mind. The primary purpose of this insurance is to provide financial protection for a child in the event of the parent's untimely demise. It ensures that the child's future is safeguarded, allowing them to have a stable financial foundation during their formative years. This type of insurance is particularly important for families who want to ensure their children's well-being and education, even if they are no longer around.

When parents purchase child life insurance, they are taking a proactive approach to safeguarding their family's future. It provides a safety net, knowing that their child will have financial resources to fall back on if something happens to the primary caregiver. This reassurance is invaluable, as it allows parents to focus on their daily lives and responsibilities without constantly worrying about their child's financial future. The insurance policy can cover various expenses, including education fees, medical costs, and even daily living expenses, ensuring the child's needs are met.

The peace of mind that child life insurance offers is a powerful motivator for parents. It enables them to make decisions with their children's best interests at heart, knowing they have taken the necessary steps to protect them. For instance, parents can use the insurance proceeds to secure their child's education, providing them with the opportunity to pursue their dreams and goals. This financial security can also help alleviate the stress associated with the loss of a parent, allowing the child to grieve and heal in a more stable environment.

Furthermore, child life insurance can be tailored to suit the family's specific needs. Policies can be customized to include various benefits, such as coverage for specific ages, education expenses, or even a lump sum payment. This flexibility ensures that parents can choose the level of protection that aligns with their financial goals and their child's unique circumstances. By doing so, they can create a comprehensive plan that provides long-term security and peace of mind.

In summary, child life insurance is an essential tool for parents who want to ensure their children's well-being and future. It offers a sense of security, knowing that their child will be financially protected, even in the absence of one parent. With this insurance, parents can make decisions with confidence, knowing they have taken the necessary steps to provide for their children's needs. The peace of mind it offers is a valuable benefit, allowing families to focus on their present and future happiness.

Aegon Life Insurance: Is It Worth the Hype?

You may want to see also

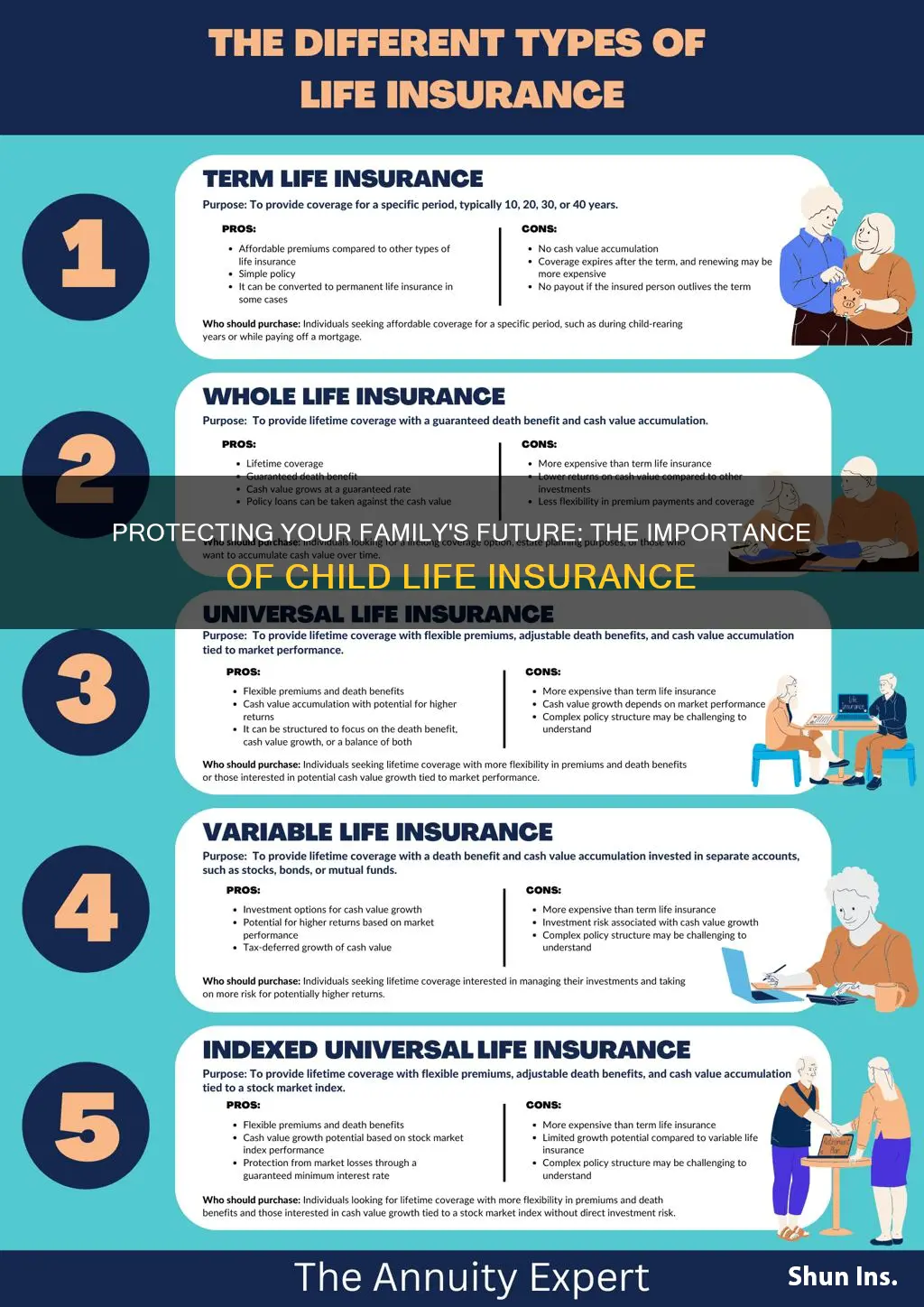

Long-Term Benefits: Offers lifelong coverage, ensuring financial stability for the child's future

Child life insurance is a powerful tool that provides a safety net for your child's future, offering long-term benefits that can be invaluable. This type of insurance is designed to provide financial security and peace of mind for parents, ensuring that their children are protected even in their absence. One of the most significant advantages is the lifelong coverage it offers. Unlike term life insurance, which provides coverage for a specific period, child life insurance is typically a permanent policy, remaining in force throughout the child's life. This means that as your child grows and their needs evolve, the insurance will continue to provide the necessary financial support.

The long-term nature of this insurance is crucial for several reasons. Firstly, it ensures that your child has a financial safety net during their formative years. As a child, they may not have the means to provide for themselves, and unexpected events can have a significant impact on their future. By having lifelong coverage, you are preparing for potential challenges that may arise, such as accidents, illnesses, or other unforeseen circumstances. This financial stability can help cover essential expenses, including education, healthcare, and even future career opportunities.

Moreover, child life insurance can provide a sense of security and stability for your child's future endeavors. As they grow older, they may face decisions about higher education, starting a career, or even starting a family. Having a financial safety net in place can reduce the stress and anxiety associated with these life milestones. It allows your child to focus on their goals and aspirations without constantly worrying about financial constraints. This peace of mind can be a significant benefit, enabling your child to make choices that align with their dreams and aspirations.

Additionally, the lifelong coverage aspect of child life insurance ensures that your child's financial needs are met as they transition into adulthood. As they leave the nest and start their independent lives, the insurance can provide a foundation for their financial stability. This is particularly important if your child has specific goals or aspirations that require financial support, such as starting a business or pursuing a passion. The long-term coverage ensures that they have the resources to turn their dreams into reality.

In summary, child life insurance offers a unique and valuable benefit: lifelong coverage. This ensures that your child's future is protected, providing financial stability and security. By investing in this type of insurance, you are taking a proactive approach to safeguarding your child's well-being and empowering them to build a bright and secure future. It is a thoughtful and responsible decision that can have a profound impact on your child's life.

Life Insurance: Gaining Value Through Protection

You may want to see also

Customizable Plans: Tailored policies can meet specific family needs and budgets

Child life insurance is a specialized form of coverage designed to protect the financial well-being of a family in the event of the untimely death of a child. It goes beyond traditional life insurance, offering a range of benefits tailored to the unique needs of families with children. One of the key advantages of child life insurance is its flexibility and customization.

Customizable plans are a cornerstone of child life insurance, allowing families to design policies that align perfectly with their specific circumstances and financial goals. These plans recognize that every family is unique, and their insurance needs can vary greatly. By offering customizable options, insurers empower parents to create a policy that provides the necessary financial security for their children's future. This level of customization ensures that the insurance plan is not a one-size-fits-all solution but rather a carefully crafted tool to address the family's unique challenges.

The flexibility of these plans allows parents to choose the coverage amount based on their child's needs and the family's financial situation. For instance, a family might opt for a higher coverage amount if they have multiple children or if the child has specific health conditions that require additional financial support. Conversely, a family with a more modest budget might select a lower coverage amount while still ensuring their child's future is protected. This adaptability is particularly important as it allows families to make informed decisions about their insurance without feeling pressured to overspend.

In addition to the coverage amount, customizable plans often include various riders and add-ons. These optional features can enhance the policy's benefits, such as providing additional coverage for education expenses, disability, or critical illnesses. For example, a family might choose an education rider to ensure their child's college fund is protected, even if the primary breadwinner passes away. Such customization ensures that the insurance policy evolves with the family's changing needs over time.

Furthermore, the ability to customize child life insurance policies can provide peace of mind to parents. Knowing that their child's future is financially secure, even in the face of unforeseen circumstances, can significantly reduce stress and anxiety. This aspect of insurance is particularly valuable, as it allows parents to focus on raising their children without constantly worrying about potential financial setbacks. Customizable plans, therefore, not only offer financial protection but also contribute to the overall well-being of the family.

Variable Life Insurance: Understanding the Policy Flexibility

You may want to see also

Early Planning: Starting early ensures the child is covered from birth

Starting the process of securing life insurance for your child early is a wise and proactive decision that can provide a sense of security and peace of mind for parents. By initiating this planning at the beginning of your child's life, you are taking a crucial step towards ensuring their future well-being. Here's why early planning is essential:

Newborn Coverage: When you welcome a new baby into the world, it is a life-changing event. However, it also marks the beginning of a journey that requires careful financial planning. Life insurance for children can be tailored to provide coverage from birth, ensuring that your little one is protected from the very start. This early coverage can be particularly beneficial if you have specific financial goals or want to secure a policy while rates are often more favorable for younger individuals.

Long-Term Benefits: Early planning allows you to take advantage of the long-term advantages of child life insurance. As your child grows, their needs and expenses will change. By starting early, you can lock in lower premiums and potentially secure a policy with a higher coverage amount. Over time, this can result in significant savings, ensuring that your child's insurance remains affordable and comprehensive throughout their childhood and beyond.

Financial Security: Life insurance provides a financial safety net for your family. In the event of an unforeseen tragedy, the policy's death benefit can help cover various expenses, such as funeral costs, outstanding debts, or even educational fees. Starting early ensures that your child's future is protected, and the financial burden on the surviving family members is minimized. This early planning can also help you build a substantial policy, providing a more substantial safety net for your child's future.

Peace of Mind: Perhaps the most valuable aspect of early planning is the peace of mind it offers. Knowing that your child is protected can reduce stress and anxiety, allowing you to focus on creating a loving and nurturing environment. Early planning ensures that you are prepared for any eventuality, giving you the freedom to make the most of your parenting journey without constant worry about your child's financial future.

In summary, starting the process of securing life insurance for your child early is a thoughtful and practical approach to their well-being. It provides coverage from birth, long-term benefits, financial security, and the invaluable gift of peace of mind. By taking this proactive step, you are investing in your child's future and ensuring they have the support they need as they grow and navigate life's challenges.

Whole Life Insurance: A Smart 401(k) Conversion Strategy?

You may want to see also

Frequently asked questions

Child life insurance is a type of insurance policy designed to provide financial protection for children. It offers coverage in the event of the child's death, ensuring that their family receives a financial benefit to help with expenses and provide for their future needs.

Families often consider child life insurance for several reasons. Firstly, it provides peace of mind, knowing that their children are protected financially in the worst-case scenario. It can also help cover funeral expenses, outstanding debts, and future education costs, ensuring the family's financial stability.

The primary benefit is the financial security it provides. The policy's death benefit can be used to cover various expenses, such as funeral costs, outstanding loans, and educational funds for siblings or other dependents. It ensures that the family can maintain their standard of living and have the necessary resources during a difficult time.

No, child life insurance is not exclusively for families with financial worries. It is a proactive measure that can benefit any family. While it can provide financial relief in challenging circumstances, it also offers long-term advantages, such as building a financial safety net for the child's future.

Absolutely! Child life insurance can be an essential component of a comprehensive financial strategy. It can complement other insurance policies, retirement plans, and savings accounts, creating a robust financial framework. By integrating child life insurance into a broader plan, families can ensure a more secure future for their children.