Whole life insurance is a comprehensive financial product that offers both a death benefit and an investment component. When considering the elements that make up whole life insurance, several key features come into play. One of the primary elements is the guaranteed death benefit, which provides a fixed amount of coverage to the policyholder's beneficiaries upon their passing. Additionally, whole life insurance includes an investment component, allowing policyholders to build cash value over time. This cash value can be borrowed against or withdrawn, providing financial flexibility. Another crucial element is the fixed premium, which remains consistent throughout the policy's duration, ensuring predictable costs for the policyholder. Understanding these elements is essential for individuals seeking to make informed decisions about their insurance coverage and financial planning.

| Characteristics | Values |

|---|---|

| Coverage Duration | Whole life insurance provides coverage for the entire lifetime of the insured individual. |

| Premium Structure | Premiums are typically level, meaning they remain the same throughout the policy term. |

| Death Benefit | A fixed death benefit is guaranteed, providing a lump sum payment to the beneficiary upon the insured's death. |

| Accumulates Cash Value | Over time, the policy builds cash value, which can be borrowed against or withdrawn. |

| Flexible Premiums | Premiums can be adjusted based on the insured's age and health, allowing for flexibility. |

| Long-Term Financial Planning | It offers a comprehensive financial planning tool with potential investment options. |

| Tax Advantages | Tax-deferred growth of cash value and potential tax benefits on death benefits. |

| Loan Features | Policyholders can borrow against the cash value without affecting the death benefit. |

| Dividend Options | Some policies offer the option to receive dividends, providing additional policy value. |

| Guaranteed Returns | Assured returns on the cash value accumulation, ensuring policy growth. |

What You'll Learn

- Definition: Whole life insurance is a permanent policy with a guaranteed death benefit and cash value accumulation

- Premiums: Premiums are fixed and remain the same throughout the policyholder's lifetime

- Death Benefit: The death benefit is a fixed amount paid to beneficiaries upon the insured's death

- Cash Value: Cash value builds up over time, allowing policyholders to borrow against it or withdraw funds

- Investments: Policyholders can invest a portion of the cash value in various investment options offered by the insurer

Definition: Whole life insurance is a permanent policy with a guaranteed death benefit and cash value accumulation

Whole life insurance is a type of permanent life insurance that offers a range of unique features and benefits. It is designed to provide coverage for the entire lifetime of the insured individual, hence the term "permanent." One of the key elements of whole life insurance is its guaranteed death benefit. This means that, regardless of the insured's age or health at the time of death, the insurance company will pay out a predetermined amount to the policy's beneficiaries. This guaranteed aspect provides financial security and peace of mind, knowing that your loved ones will receive a specified sum in the event of your passing.

In addition to the death benefit, whole life insurance also includes a component known as cash value. This is a significant feature that sets it apart from other types of insurance. Over time, a portion of the premiums paid by the policyholder is invested and grows tax-deferred within the policy. This accumulated cash value can be borrowed against or withdrawn, providing the policyholder with a source of funds that can be used for various purposes, such as funding education, starting a business, or covering unexpected expenses. The cash value grows alongside the policy, and it can be a valuable asset that the policyholder can access during their lifetime.

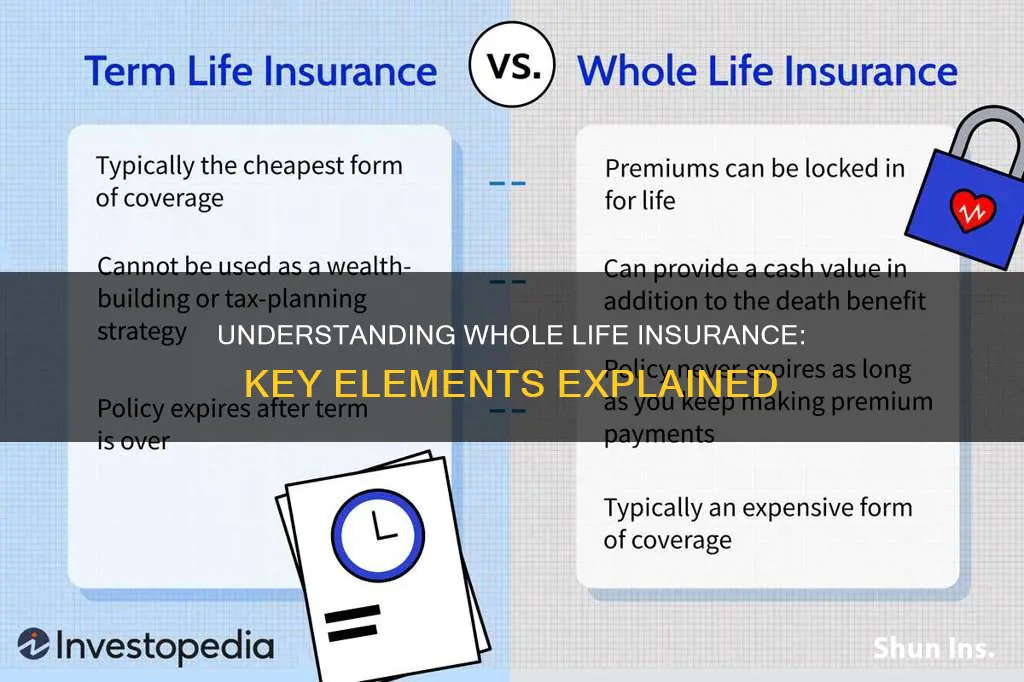

The permanent nature of whole life insurance is another crucial aspect. Unlike term life insurance, which provides coverage for a specified period, whole life insurance remains in force for as long as the policyholder makes the required premium payments. This longevity ensures that the insured individual is protected throughout their entire life, providing long-term financial security. Furthermore, the cash value accumulation within the policy allows for potential investment opportunities and the ability to build a substantial financial asset over time.

When considering whole life insurance, it is essential to understand the investment component. The cash value is typically invested in a diversified portfolio of assets managed by the insurance company. This investment strategy aims to generate returns that can outpace the interest rates paid on the cash value. As a result, the policyholder's money can grow significantly over the years, providing a substantial financial benefit. It is worth noting that the investment aspect of whole life insurance is carefully regulated, ensuring that the policyholder's funds are managed securely and in compliance with relevant financial regulations.

In summary, whole life insurance is a comprehensive and permanent solution that offers a guaranteed death benefit and the potential for significant cash value accumulation. The policy's longevity, combined with the ability to access cash value, provides individuals with a powerful tool for financial planning and security. Understanding these elements is crucial for anyone considering whole life insurance as a means to protect their loved ones and build a valuable financial asset.

Essential Life Insurance: Cash Surrender Value Explained

You may want to see also

Premiums: Premiums are fixed and remain the same throughout the policyholder's lifetime

Whole life insurance is a type of permanent life insurance that offers a range of unique features and benefits. One of the key elements of this insurance is the concept of fixed premiums. When you purchase a whole life insurance policy, you agree to pay a set premium amount regularly, typically on a monthly, quarterly, or annual basis. This premium is a crucial aspect of the policy and is designed to remain constant throughout your lifetime.

The fixed nature of the premium is a significant advantage for policyholders. Unlike some other insurance products, where premiums can vary based on various factors, whole life insurance provides stability and predictability. Policyholders can budget and plan their finances effectively knowing that their insurance premiums will not fluctuate. This predictability is especially beneficial for long-term financial planning, as it allows individuals to allocate their resources efficiently without the worry of unexpected premium increases.

The reason whole life insurance premiums remain fixed is that the policy provides coverage for the entire life of the insured individual. The insurance company calculates the premium based on various factors, including the insured's age, health, and the desired death benefit amount. Once the premium is set, it is locked in for the duration of the policy, ensuring that the policyholder's financial commitment remains consistent. This fixed premium structure is a defining characteristic that sets whole life insurance apart from other life insurance policies.

Having fixed premiums is advantageous as it provides financial security and peace of mind. Policyholders can rest assured that their insurance coverage will remain at the agreed-upon level without any surprises. Additionally, the fixed premium structure allows the insurance company to guarantee the death benefit to the policyholder or their beneficiaries, providing a sense of certainty and reliability. This feature is particularly valuable for those seeking long-term financial protection and stability.

In summary, the concept of fixed premiums is a fundamental aspect of whole life insurance. It ensures that policyholders can maintain consistent financial planning and budgeting, knowing their insurance costs will not vary. This stability is a key benefit of whole life insurance, making it an attractive option for individuals seeking reliable and predictable long-term financial protection. Understanding this element is essential for anyone considering this type of insurance policy.

Senior Life Insurance: Whole Life or Term?

You may want to see also

Death Benefit: The death benefit is a fixed amount paid to beneficiaries upon the insured's death

The death benefit is a fundamental component of whole life insurance, and it serves as a crucial financial safety net for the insured's beneficiaries. When an individual purchases a whole life insurance policy, they agree to pay a set premium over a specified period, typically until a certain age or for the duration of their life. In return, the insurance company promises to pay out a predetermined sum, known as the death benefit, to the designated beneficiaries upon the insured's death.

This benefit is a fixed amount, meaning it is agreed upon at the time of policy inception and remains unchanged throughout the policy's duration. The primary purpose of the death benefit is to provide financial security and support to the insured's loved ones in the event of their passing. It can be used to cover various expenses, such as funeral costs, outstanding debts, mortgage payments, or even to fund the education of dependent children.

Upon the insured's death, the beneficiaries must notify the insurance company to initiate the claims process. They will then provide the necessary documentation, including proof of death and identification, to the insurance provider. Once the claim is verified, the insurance company will promptly pay out the death benefit, ensuring that the beneficiaries receive the agreed-upon amount.

It is essential to understand that the death benefit is a critical aspect of whole life insurance as it provides long-term financial protection. Unlike term life insurance, which offers coverage for a specific period, whole life insurance provides permanent coverage for the insured's entire life. This means that the death benefit is guaranteed to be paid out, providing peace of mind and financial security for the insured's family.

In summary, the death benefit is a fixed amount that whole life insurance policies promise to pay out to beneficiaries upon the insured's death. It is a vital element of this type of insurance, offering financial protection and support to the insured's loved ones during challenging times. Understanding the death benefit and its implications is essential for anyone considering whole life insurance as a means of securing their family's future.

Understanding Supplemental Child Life Insurance: A Comprehensive Guide

You may want to see also

Cash Value: Cash value builds up over time, allowing policyholders to borrow against it or withdraw funds

Whole life insurance is a type of permanent life insurance that offers a range of features and benefits, one of which is the concept of cash value. This is a crucial aspect of the policy, providing policyholders with a financial asset that can be utilized in various ways.

Cash value is essentially the monetary benefit that accumulates within a whole life insurance policy over time. It is a result of the policy's investment component, where a portion of the premiums paid by the policyholder is allocated to an investment account. This investment strategy is carefully managed to ensure a steady growth of the cash value. As the policyholder makes regular payments, a small percentage of each premium goes towards building this cash reserve. The growth of this reserve is influenced by factors such as interest rates, investment performance, and the policy's duration.

Over the life of the policy, the cash value grows, and it can reach a significant amount, especially as the policy ages. This accumulation of cash value provides policyholders with a financial asset that they can access in several ways. One option is to borrow against the cash value, allowing policyholders to take out loans without the need for a separate credit check or collateral. These loans are typically interest-free, providing a convenient source of funds for various purposes. Additionally, policyholders can withdraw a portion of the cash value, providing access to their savings without the need for a loan. This flexibility is a significant advantage, especially for those who may require immediate funds for unexpected expenses or investments.

The ability to borrow against or withdraw funds from the cash value offers policyholders financial flexibility and security. It allows individuals to access their savings without the need for a separate loan, which can be particularly beneficial during financial emergencies or when making significant investments. Moreover, the cash value can also be used to pay for the policy's premiums in the future, ensuring that the coverage remains in place even if the policyholder faces financial challenges.

In summary, cash value is a fundamental aspect of whole life insurance, providing policyholders with a growing financial asset. It offers the advantage of borrowing and withdrawing funds, providing financial flexibility and security. This feature is particularly attractive to those seeking long-term financial planning and a reliable source of funds. Understanding the concept of cash value is essential for anyone considering whole life insurance, as it highlights the potential for long-term financial growth and accessibility.

Understanding Your Employer's Term Life Insurance Coverage Duration

You may want to see also

Investments: Policyholders can invest a portion of the cash value in various investment options offered by the insurer

Whole life insurance is a type of permanent life insurance that offers a range of features and benefits, one of which is the ability to invest a portion of the cash value. This investment aspect is a unique feature that sets whole life insurance apart from other insurance products. When you purchase a whole life policy, you pay a fixed premium over time, and a portion of this premium goes towards building cash value. This cash value can be invested in various options provided by the insurance company, allowing policyholders to potentially grow their money over time.

The investment options available within a whole life policy can vary depending on the insurer. Typically, policyholders can choose from a selection of investment accounts or funds, each with its own level of risk and potential return. These investment vehicles might include mutual funds, stocks, bonds, or even real estate investment trusts (REITs). By investing a portion of the cash value, policyholders can take advantage of the power of compounding, where their money can grow exponentially over the long term.

One of the key advantages of investing in whole life insurance is the potential for long-term wealth accumulation. The investment options offered by insurers often provide a diversified portfolio, which can help mitigate risk. This diversification can include a mix of growth-oriented assets and more conservative investments, ensuring a balanced approach to growing the policy's cash value. As the policyholder, you have the flexibility to adjust your investment strategy over time, aligning it with your financial goals and risk tolerance.

When considering investments within a whole life policy, it's essential to understand the associated risks. While investing can offer the potential for higher returns, it also comes with the risk of loss. Policyholders should carefully review the investment options and associated fees to ensure they align with their financial objectives. Additionally, it's crucial to monitor the performance of these investments regularly and make adjustments as needed to stay on track.

In summary, investing a portion of the cash value in various investment options is a significant aspect of whole life insurance. It provides policyholders with the opportunity to grow their money and potentially achieve long-term financial goals. By carefully selecting and managing these investments, individuals can make the most of this feature, ensuring their whole life policy works as a powerful tool for building wealth and security.

Life Insurance for Students: Is Cash Value a Good Option?

You may want to see also

Frequently asked questions

Whole life insurance is a type of permanent life insurance that provides coverage for the entire lifetime of the insured individual. It offers a combination of death benefit, savings component, and investment features, making it a comprehensive financial tool.

The savings aspect of whole life insurance is designed to accumulate cash value over time. A portion of the premium payments goes into an investment account, allowing the policyholder to build a reserve that can be borrowed against or withdrawn, providing financial flexibility.

The investment component of whole life insurance allows the policyholder to benefit from potential earnings on their premiums. These earnings can contribute to the cash value and may also be used to pay for future premiums, ensuring the policy remains in force.

Yes, policyholders can typically access the cash value built up in their whole life insurance policy. This can be done through policy loans or by taking out withdrawals, providing a source of funds that can be used for various financial needs.

The death benefit is a guaranteed amount that is paid out to the policyholder's beneficiaries upon the insured individual's passing. This financial payout provides financial security to the loved ones of the insured, ensuring they receive the intended compensation.