Supplemental child life insurance is an additional layer of financial protection designed to safeguard the well-being of children in the event of unforeseen circumstances. It serves as a safety net, providing financial support to families who have already purchased a basic life insurance policy for their children. This type of insurance is particularly important for families with young children, as it offers reassurance and financial security during challenging times, ensuring that the child's future needs are met, even if the primary breadwinner is no longer around. It complements the existing coverage, offering an extra layer of protection tailored to the specific needs of children, often including benefits for education, healthcare, and other essential expenses.

Characteristics of Supplemental Child Life Insurance

| Characteristics | Values |

|---|---|

| Definition | Supplemental child life insurance is an additional insurance policy designed to provide financial protection for children in the event of their death or permanent disability. It is often offered as a rider or add-on to an existing life insurance policy. |

| Purpose | To ensure financial security for the child's future, covering expenses like education, healthcare, and living costs. |

| Eligibility | Typically available to parents or guardians of children, with the child being the primary beneficiary. |

| Benefits | Provides a lump sum payment or regular income in case of the child's passing or disability. |

| Coverage Amount | Varies based on the policy, often ranging from a few thousand to several hundred thousand dollars. |

| Term | Can be term life insurance (specific period) or permanent (lasting for the child's entire life). |

| Riders/Add-ons | Often available as a rider to an existing policy, allowing customization and additional coverage options. |

| Cost | Generally, more affordable than a standalone policy, with rates depending on the child's age, health, and the chosen coverage amount. |

| Tax Implications | Premiums may be tax-deductible, and benefits received are typically tax-free. |

| Requirements | Medical exams and health history assessments might be necessary for the child and/or parents. |

| Provider | Offered by various insurance companies, often as part of a comprehensive life insurance package. |

| Advantages | Provides specialized coverage for children, ensuring their well-being and future financial stability. |

| Disadvantages | May be limited in coverage compared to a full-term policy, and costs can vary widely. |

| Alternatives | Parents can consider other options like term life insurance, whole life insurance, or savings plans for their children's future. |

What You'll Learn

- Definition: Supplemental child life insurance is an additional policy that provides extra coverage for children

- Benefits: It offers financial protection for children's future needs, such as education and healthcare

- Features: This insurance typically has no medical exams and offers guaranteed acceptance

- Eligibility: It is available for children of all ages, often with no health restrictions

- Comparison: Compare with regular life insurance to understand the extra coverage and benefits

Definition: Supplemental child life insurance is an additional policy that provides extra coverage for children

Supplemental child life insurance is an additional layer of financial protection designed specifically for children. It is an extra policy that goes beyond the standard life insurance coverage typically provided by a parent's policy. The primary purpose of this supplemental insurance is to ensure that children are adequately protected and their future needs are met in the event of the parent's untimely passing. This type of insurance is particularly important for families with young children, as it provides an additional safety net to cover various expenses that may arise when a parent is no longer around.

This insurance policy is tailored to cater to the unique needs of children, offering a range of benefits that are specifically designed to support their well-being. It typically includes coverage for educational expenses, such as tuition fees, books, and other educational resources, ensuring that a child's education remains uninterrupted even in the absence of a parent. Additionally, it may provide financial assistance for other essential needs, such as healthcare, extracurricular activities, and even future marriage or home-buying expenses. The goal is to provide a comprehensive safety net that ensures the child's long-term stability and security.

The supplemental nature of this insurance lies in its ability to complement and enhance the existing life insurance policy held by the parent. It is not a replacement but rather an additional layer of protection. When a parent purchases life insurance, they typically select a policy that suits their own needs and financial situation. Supplemental child life insurance, however, is a separate policy that focuses solely on the child's future, ensuring that their best interests are protected. This additional coverage can be particularly valuable for families with multiple children, as it provides increased security for each child.

In summary, supplemental child life insurance is a specialized insurance policy that offers extra financial protection for children. It is designed to complement the parent's existing life insurance, providing additional benefits tailored to the child's needs. This insurance ensures that children have the necessary resources to lead stable and secure lives, even when faced with the loss of a parent. By understanding the definition and purpose of supplemental child life insurance, parents can make informed decisions to safeguard their children's future.

Life Insurance and Skin Cancer: What's Covered?

You may want to see also

Benefits: It offers financial protection for children's future needs, such as education and healthcare

Supplemental Child Life Insurance is a financial product designed to provide additional coverage and support for children's long-term needs. It is an extension of the basic life insurance policy, tailored specifically for minors. This type of insurance offers a safety net for parents and guardians, ensuring that their children's future is financially secure.

One of the primary benefits of supplemental child life insurance is the financial protection it provides for a child's future. As children grow, they encounter various expenses that can be substantial. Education is a significant aspect, with the cost of tuition, books, and other educational resources often being a major financial burden. Supplemental insurance can help cover these expenses, ensuring that a child's educational journey is not hindered by financial constraints. Moreover, healthcare costs can be unpredictable and often rise over time. From routine check-ups to unexpected illnesses or accidents, medical expenses can accumulate quickly. This insurance policy can provide a financial cushion, allowing parents to access quality healthcare for their children without worrying about the financial impact.

The coverage offered by supplemental child life insurance is typically designed to adapt to the changing needs of the child. As the child matures, the insurance benefits can be adjusted to accommodate different stages of life. For instance, the policy might provide coverage for education expenses during the child's school years and later transition to covering healthcare costs as the individual enters adulthood. This flexibility ensures that the insurance remains relevant and beneficial throughout the child's life.

Additionally, this type of insurance can provide peace of mind for parents. Knowing that their child's future is financially protected can reduce stress and anxiety associated with potential financial burdens. It allows parents to focus on their children's well-being and development, knowing that they have taken proactive steps to secure their financial future.

In summary, supplemental child life insurance is a valuable tool for parents who want to ensure their children's financial security. It provides a comprehensive approach to covering future expenses, including education and healthcare, offering a sense of reassurance and stability for the child's well-being.

Life Insurance Payouts for Suicide: What You Need to Know

You may want to see also

Features: This insurance typically has no medical exams and offers guaranteed acceptance

Supplemental child life insurance is a type of insurance policy designed to provide additional financial protection for children, often as a supplement to their primary life insurance. One of its key features is the absence of medical exams, making it accessible and convenient for parents. This feature is particularly appealing as it eliminates the need for extensive medical assessments, which can be a barrier for some individuals. By removing this requirement, the insurance company can offer coverage without delving into the child's medical history or current health status, making it easier for parents to secure insurance for their children.

The guaranteed acceptance aspect is another significant advantage. With this feature, parents can be confident that their application for supplemental child life insurance will be approved, regardless of the child's health or pre-existing conditions. This is especially beneficial for families with a history of genetic disorders or chronic illnesses, as it ensures that their children can be protected without the fear of rejection. The guaranteed acceptance clause provides peace of mind, knowing that the insurance will be in place when it is needed most.

This type of insurance is often tailored to meet the unique needs of children. It typically offers higher coverage amounts relative to the child's age, ensuring that the financial protection is substantial during the early years when the risk of critical illnesses or accidents is higher. The policy may also include various riders or add-ons, such as accidental death coverage or critical illness benefits, allowing parents to customize the insurance to fit their specific requirements.

The no-medical-exam requirement streamlines the application process, making it quick and efficient. Parents can complete the application in a short time, providing basic personal and child-related information, and receive a swift decision on their application. This efficiency is particularly valuable for parents who want to secure insurance coverage promptly without the hassle of medical exams.

In summary, supplemental child life insurance with no medical exams and guaranteed acceptance is a valuable tool for parents. It provides an accessible and efficient way to secure financial protection for their children, ensuring that they are covered without the typical medical assessment process. This type of insurance offers peace of mind, allowing parents to focus on their children's well-being while having the reassurance of comprehensive coverage.

Life Insurance Interest: Myth or Reality?

You may want to see also

Eligibility: It is available for children of all ages, often with no health restrictions

Supplemental Child Life Insurance is a type of insurance policy designed to provide additional financial protection for children. It is an extension of the basic life insurance coverage that parents or guardians typically purchase for their children. This type of insurance is particularly beneficial as it offers a safety net for the child's future, ensuring that they are financially secure in the event of the parent's or guardian's untimely demise.

One of the key advantages of supplemental child life insurance is its eligibility criteria. Unlike some other insurance products, this policy is available for children of all ages, which means it can be purchased from birth until adulthood. This broad eligibility range is a significant benefit, as it allows parents to secure their child's future at any stage of their life. Moreover, this insurance often comes with no health restrictions, making it accessible to children with pre-existing conditions or those who are considered high-risk by other insurance providers. This inclusivity ensures that all children, regardless of their health status, can have a financial safety net in place.

The lack of health restrictions is a game-changer for parents, especially those with children who have medical issues or chronic illnesses. It means that the insurance company will not deny coverage or impose higher premiums based on the child's health. This aspect provides peace of mind, knowing that the child's future is protected, even if they have a condition that might typically be a concern for insurance providers.

When considering supplemental child life insurance, it is essential to understand the various coverage options available. Policies can vary, offering different benefits such as a lump sum payment, periodic income, or both. The choice of coverage depends on the family's specific needs and financial goals. For instance, a lump sum payment might be suitable for covering immediate expenses like education or medical bills, while periodic income could provide a steady financial stream for the child's long-term needs.

In summary, supplemental child life insurance is a valuable tool for parents to ensure their children's financial security. Its eligibility for all ages and lack of health restrictions make it an accessible and inclusive option. By providing various coverage choices, this insurance empowers parents to tailor a plan that best suits their family's requirements, offering a comprehensive safety net for their children's future.

Term Life Insurance: Fixed or Variable Expenses?

You may want to see also

Comparison: Compare with regular life insurance to understand the extra coverage and benefits

Supplemental child life insurance is an additional layer of financial protection designed specifically for children. It provides extra coverage beyond what is typically included in a standard life insurance policy, offering parents and guardians peace of mind and financial security for their children's future. This type of insurance is particularly valuable as it can help cover various expenses that may arise during a child's life, such as education costs, medical bills, or other unforeseen financial obligations.

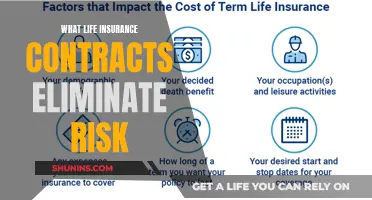

When comparing supplemental child life insurance with regular life insurance, the key difference lies in the scope of coverage and the specific needs it addresses. Regular life insurance is a broad financial tool that provides a death benefit to the policyholder's beneficiaries upon their passing. It is designed to replace income, cover final expenses, and provide financial security for loved ones. However, it may not fully account for the unique and evolving needs of a child as they grow and face different challenges.

Supplemental child life insurance, on the other hand, is tailored to address these specific needs. It often includes additional benefits such as education coverage, which can help pay for college or university tuition, room and board, and other educational expenses. This is particularly important as the cost of education continues to rise, and having dedicated coverage can ensure that a child's educational goals are financially supported. Additionally, supplemental policies may offer enhanced medical coverage, which can be crucial for covering unexpected medical expenses, especially during childhood, when health issues may arise.

Another advantage of supplemental child life insurance is the flexibility it provides. Parents can often customize the policy to fit their family's unique circumstances. This includes choosing the coverage amount, which can be adjusted as the child grows and their needs change. The policy may also offer various riders or add-ons, allowing for further customization and ensuring that the insurance remains relevant and beneficial throughout the child's life.

In summary, supplemental child life insurance offers an extra layer of financial protection, providing benefits that go beyond what regular life insurance typically covers. It is designed to address the specific and evolving needs of children, ensuring they have the necessary financial support for education, medical expenses, and other potential financial obligations. By comparing it with regular life insurance, parents can make an informed decision to safeguard their children's future and provide them with a comprehensive financial safety net.

Life Insurance Test: Is It Really That Hard?

You may want to see also

Frequently asked questions

Supplemental child life insurance is an additional layer of coverage that provides financial protection for children in the event of their untimely death. It is designed to complement the existing life insurance policy held by the parents or guardians, ensuring that the family has sufficient funds to cover expenses and maintain their standard of living.

While a standard life insurance policy typically covers the entire family, supplemental child life insurance specifically focuses on the financial security of the child. It often offers higher coverage amounts per child and can be tailored to the family's needs, providing an extra safety net for the child's future.

This insurance is generally available for children of all ages, from infancy to young adulthood. It can be purchased for newborns, toddlers, teenagers, and even young adults who are dependent on their parents or guardians. The eligibility criteria may vary depending on the insurance provider and the specific policy terms.

The primary benefit is the peace of mind it provides to parents, knowing that their child is financially protected. In the event of the child's death, the insurance payout can help cover various expenses, such as education fees, medical bills, funeral costs, and even provide a financial cushion for the remaining family members.

Yes, many supplemental child life insurance policies offer flexibility. They can be converted to a different type of insurance policy as the child grows older, such as converting to a term life policy for the parent or guardian. Some policies also allow for adjustments in coverage amounts or policy terms to accommodate changing family circumstances.