Life insurance is a valuable financial tool that provides financial security for loved ones after an individual's passing. Permanent life insurance policies, such as whole life and universal life insurance, offer an additional benefit: the ability to accrue cash value over time. This cash value component, also known as a living benefit, grows through interest or investment gains and provides a source of funds that the policyholder can borrow against, withdraw, or use for premium payments. Understanding how cash value accumulates and its potential advantages and disadvantages is essential for individuals considering permanent life insurance.

| Characteristics | Values |

|---|---|

| Type of insurance | Permanent life insurance, including whole life insurance and universal life insurance |

| Interest accrual | Yes, the cash value component typically earns interest or other investment gains |

| Tax implications | Cash value grows tax-deferred; withdrawals may be taxed as income |

| Accessing cash value | Policy loan, withdrawal, or surrender of the policy |

| Premium payments | A portion of premium payments goes towards the policy's cash value |

| Death benefit | Beneficiaries receive a death benefit, which may be reduced by any outstanding loans |

| Dividends | Dividends can be used to increase cash value, reduce premiums, or be taken as cash |

| Risk | Whole life policies are lower risk; variable life policies are higher risk |

What You'll Learn

Whole life insurance accrues interest at a fixed rate

Whole life insurance is a type of permanent life insurance that covers the insured's entire life, with fixed premiums and a guaranteed death benefit. It is more expensive than term life insurance but offers a range of benefits, including lifelong coverage, guaranteed death benefit amounts, and the ability to accrue interest at a fixed rate.

One of the distinctive features of whole life insurance is its cash value component, which grows over time and can be borrowed against or withdrawn. This cash value grows tax-deferred, providing a potential source of funds for emergencies or retirement. The cash value of a whole life policy typically earns a fixed rate of interest, which means that the rate of return on the policy is consistent and predictable.

The cash value of whole life insurance policies accumulates over time as a portion of the premium payments is set aside in an interest-bearing account. This account gradually builds up value, and policyholders can borrow against or withdraw from this cash value. The interest earned on the cash value is usually at a low, fixed rate, which means that while the money will grow steadily, it may not accumulate as quickly as with other investment options.

Whole life insurance policies offer guaranteed returns and low risk, making them a conservative investment choice. The fixed interest rate ensures that policyholders know exactly what rate of return to expect and can plan their finances accordingly. This stability and guaranteed growth make whole life insurance attractive to risk-averse individuals or those seeking long-term, safe investments.

Whole life insurance policies also offer flexibility in terms of premium payments and coverage. There are several types of whole life insurance policies, including traditional, participating, simplified, and guaranteed whole life insurance. Each type caters to different financial needs and preferences, offering options for individuals with varying risk tolerances and health considerations.

In summary, whole life insurance accrues interest at a fixed rate, providing policyholders with stable and predictable returns. This type of insurance offers lifelong coverage, guaranteed death benefits, and the ability to build cash value over time, making it a popular choice for individuals seeking long-term financial security.

Hashimoto's Thyroiditis: Life Insurance Considerations and Impacts

You may want to see also

Universal life insurance accrues interest based on market performance

Universal life insurance is a type of permanent life insurance that offers lifelong coverage and a death benefit, as long as you continue to pay your premiums. It is distinguished by its flexibility, allowing you to adjust your premium payments and, in some cases, your death benefit. This adaptability means that universal life insurance can align with your financial goals and changing needs over time.

One of the key features of universal life insurance is its ability to accrue interest. When you pay your premiums, a portion goes towards the cost of insurance, and the rest contributes to the policy's cash value. This cash value component functions similarly to a savings account, accumulating interest over time. The interest rate on this cash value is set by the insurer and can change frequently. However, there is usually a minimum interest rate guaranteed by the insurer, ensuring that your cash value grows.

The cash value in a universal life insurance policy can be accessed in a few ways. You can take out a loan against the policy's cash value, with the loan amount accruing interest until it is repaid in full. Alternatively, you can make direct withdrawals from the cash value. It is important to note that accessing the cash value may have consequences. Withdrawals will permanently reduce both the cash value and the death benefit, and if the cash value falls too low, it could lead to higher premiums or even cause the policy to lapse.

Universal life insurance offers a balance between permanent coverage and financial flexibility. By accruing interest, the cash value in these policies can grow over time, providing a valuable financial resource for the policyholder. However, it is essential to actively manage the policy and carefully consider the potential long-term implications of accessing the cash value.

Group Life Insurance: Covering Your Immediate Family?

You may want to see also

Cash value can be used to pay premiums

Cash value life insurance policies allow you to use the cash value to pay premiums. This is a useful feature if you're struggling to make payments, as it can provide some relief and help you keep the life insurance in force.

When you make a premium payment for cash value life insurance, the payment is split into three categories: the policy's cash value, the insurer's cost of providing the death benefit, and the insurance company's fees and charges. Only a portion of what you pay goes into the cash value, and it can take several years for this cash value to build up.

If you build up enough money in your cash value account, you can use it to cover premium payments. Speak to your insurance agent to find out the specific rules that apply to your policy.

Variable and universal life insurance policies are often favoured for this strategy, as they allow you to use the policy's cash value to pay premiums. This approach will only work in the short term if you start when the cash value is small or if interest rates are low. You'll need to carefully monitor the cash value to make sure it doesn't drop too far, otherwise, you may lose your coverage.

Whole life insurance policies typically don't let you pay premiums using the policy's cash value, except if you convert to a paid-up policy. Not all insurers offer this option, but with a paid-up life insurance policy, the cash value is large enough that you can stop paying premiums out of pocket. However, the downside is that each premium payment is deducted from the policy's death benefit, and less cash value is available for other purposes, such as a policy loan.

It's important to note that cash value life insurance policies are generally more expensive than term life insurance policies because of the cash value element.

Life Insurance in Europe: What You Need to Know

You may want to see also

Cash value can be withdrawn or borrowed against

Cash value life insurance policies, such as whole life and universal life insurance, offer a cash value component that can be withdrawn or borrowed against. This feature provides a financial safety net for the policyholder during their lifetime, in addition to the death benefit for loved ones. Understanding the options, benefits, and drawbacks can help in making informed decisions about withdrawing or borrowing from the cash value.

Withdrawing Cash Value

Policyholders can withdraw a portion of the cash value, usually up to the amount of premiums paid, without incurring income taxes. However, withdrawals above the cost basis may be taxable as ordinary income. Withdrawals will reduce the death benefit, and this reduction may be greater than the amount withdrawn, depending on the policy's terms. It is important to carefully consider the impact on the death benefit before making any withdrawals.

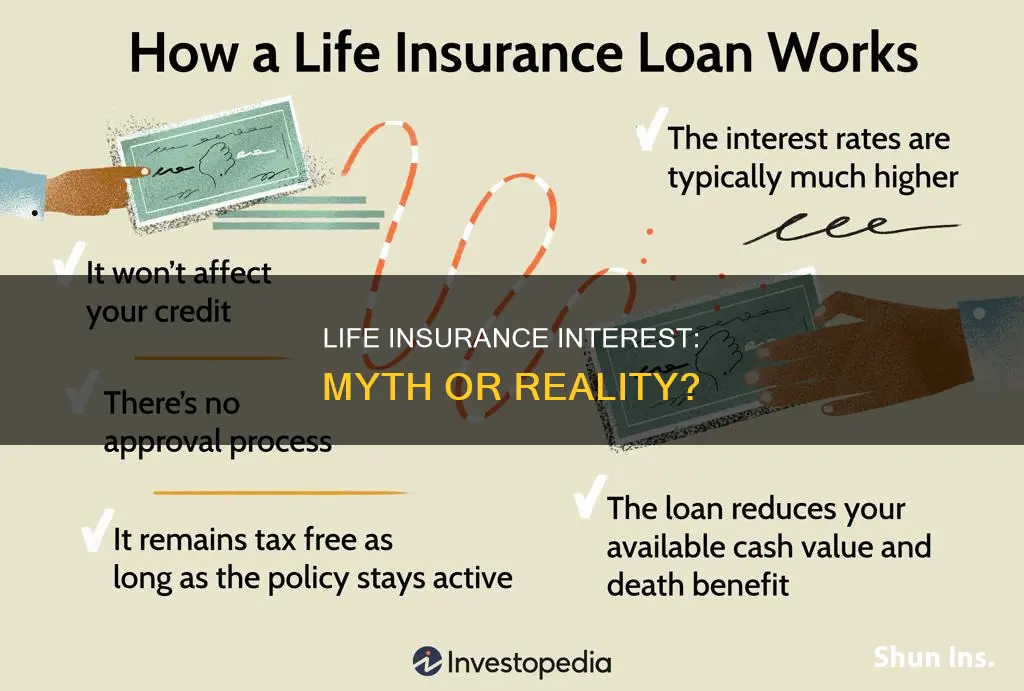

Borrowing Against Cash Value

Policyholders can borrow money from the cash value of their life insurance policy. This option provides a fast and easy way to access funds for various purposes, such as supplemental retirement income or large purchases. Borrowing against the cash value does not require a loan application or credit check, and the credit rating remains unaffected. Additionally, there is no obligation to repay the loan; however, if the loan is not repaid, the outstanding balance, including interest, will be deducted from the death benefit paid to beneficiaries. It is important to note that borrowing too much against the cash value may cause the policy to lapse.

Surrendering the Policy for Cash

Policyholders can choose to surrender their life insurance policy entirely and receive the full cash value, minus any surrender charges. However, this option comes with several drawbacks. Surrendering the policy results in the loss of life insurance coverage, and there may be significant surrender fees. Additionally, taxes may be owed on any gains earned on the cash value portion of the policy.

Weighing the Options

When considering withdrawing or borrowing from the cash value of a life insurance policy, it is essential to weigh the benefits and drawbacks of each option. Withdrawing cash may offer a tax-free source of funds, up to the amount of premiums paid, but it reduces the death benefit. Borrowing against the cash value provides access to funds without the need for a loan application or credit check, and the loan does not have to be repaid. However, if the loan is not repaid, the death benefit will be reduced, and there may be interest charges on the outstanding balance. Surrendering the policy provides access to the full cash value but results in the loss of coverage and may incur surrender charges and taxes. It is recommended to consult a financial advisor or insurance agent to make an informed decision that aligns with individual needs and goals.

FAFSA and Cash Value Life Insurance: What You Need to Know

You may want to see also

Cash value is separate from the death benefit

Cash value life insurance is a permanent life insurance policy that provides a death benefit and allows the policyholder to accrue savings within the policy. This cash value component typically earns interest or investment gains and grows tax-deferred. However, it is important to note that the cash value is separate from the death benefit. Here's what you need to know about this distinction:

Understanding Cash Value

The cash value of a life insurance policy is the savings component that the policyholder can access during their lifetime. It is funded by a portion of the insurance premiums paid by the policyholder. The cash value grows over time and can be borrowed against, withdrawn, or used to pay premiums. It provides a source of funds for emergencies, retirement, or other financial needs. The growth of the cash value depends on the type of policy, with some policies offering fixed rates and others depending on current interest rates or investment performance.

Understanding Death Benefit

The death benefit, on the other hand, is the amount of money that the insurance company pays to the beneficiaries upon the death of the insured. It is a tax-free payout to the policyholder's family or other designated beneficiaries. The death benefit amount is established when the policy is issued and remains the same or increases depending on the type of policy. The insurance company agrees to pay this benefit as long as the policy is in force and premiums are paid. The beneficiaries can use the death benefit funds however they wish, and it is typically paid as a lump sum.

Impact of Cash Value on Death Benefit

It is important to understand that the cash value and death benefit are interconnected. If the policyholder takes out cash value from the policy, it reduces the future death benefit for the beneficiaries. Additionally, any remaining cash value in the policy after the death of the insured is forfeited back to the insurance company, and the beneficiaries receive only the death benefit. However, some policies offer a rider that adds the cash value to the death benefit, creating a larger payout, but these policies tend to have higher premiums.

Considerations for Policyholders

When considering a cash value life insurance policy, it is essential to weigh the pros and cons. Cash value life insurance is typically more expensive than term life insurance, and building cash value takes time. Policyholders should also be aware that their beneficiaries will not receive the cash value unless they purchase a specific rider. Therefore, if the main goal is to provide financial security for beneficiaries after death, maximizing the death benefit may be a higher priority. On the other hand, if the policyholder is looking for an investment for their own needs, cash value may be more important. Ultimately, it is crucial to consult a financial advisor to understand how a cash value life insurance policy fits into their financial and estate plans.

Freedom Life Insurance: Does It Exist?

You may want to see also

Frequently asked questions

Cash value life insurance is a type of permanent life insurance that includes a cash component in addition to a death benefit. This cash value grows over time and can be borrowed against, withdrawn, or used to pay premiums.

With cash value life insurance, a portion of every premium payment goes towards a savings feature that collects interest over time. This cash value can be used to make premium payments, take out loans, or withdraw cash.

Whole life insurance and universal life insurance are the most common types of policies that accrue cash value. However, there are also other types of permanent life insurance policies that may include a cash value component.

Yes, there are several ways to access the cash value of your life insurance policy while you're still alive, including borrowing against the policy, withdrawing cash, or surrendering the policy for its cash value. However, doing so may result in changes to your death benefit or the termination of your coverage.