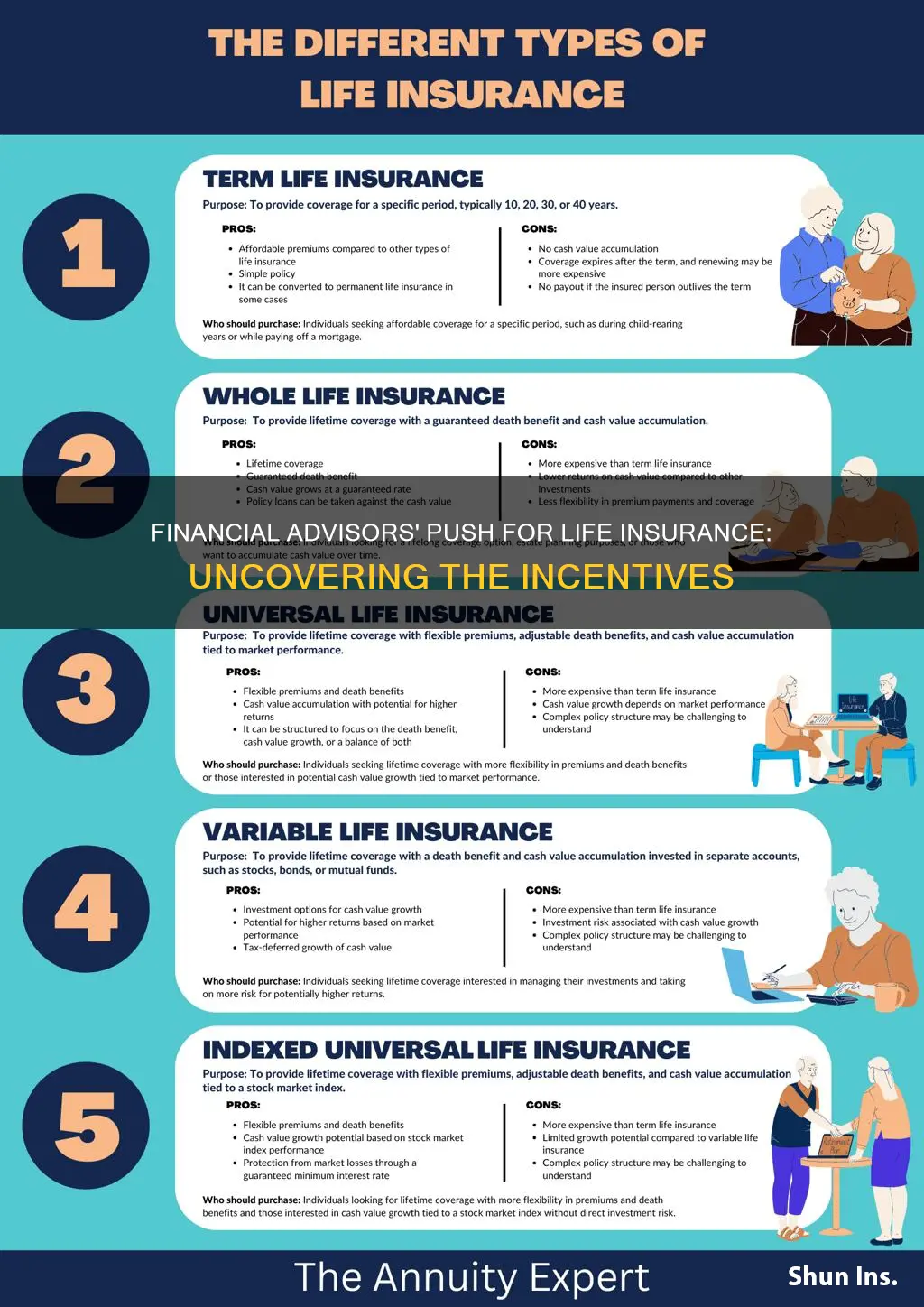

Financial advisors often recommend life insurance as a crucial component of a comprehensive financial plan. This is because life insurance provides financial security and peace of mind for individuals and their families. It can help cover expenses such as mortgage payments, education costs, and daily living expenses if the primary breadwinner passes away. Additionally, life insurance can be a valuable tool for wealth transfer, estate planning, and even as a source of investment. Understanding the various types of life insurance, such as term life, whole life, and universal life, and their respective benefits, is essential for making informed decisions. This knowledge empowers individuals to choose the right coverage that aligns with their financial goals and ensures the well-being of their loved ones.

What You'll Learn

- Risk Management: Life insurance provides financial protection against unforeseen events, ensuring clients' families are secure

- Wealth Transfer: It facilitates the transfer of wealth to beneficiaries, avoiding estate taxes and legal complexities

- Income Generation: Policies can generate regular income through dividends or loan payments, offering financial stability

- Debt Reduction: Life insurance can help pay off debts, preventing financial strain on loved ones

- Long-Term Savings: Term life insurance can act as a long-term savings tool, building value over time

Risk Management: Life insurance provides financial protection against unforeseen events, ensuring clients' families are secure

Life insurance is a powerful tool that financial advisors often recommend to their clients for a very specific and crucial reason: risk management. It serves as a financial safety net, providing protection and peace of mind in the face of life's unpredictable events. When an individual purchases life insurance, they are essentially entering into a contract with an insurance company, agreeing to pay regular premiums in exchange for a financial benefit if a specified event occurs. This event is typically the death of the insured individual. The primary purpose of this arrangement is to manage risk and ensure financial security for the client's loved ones.

In the context of risk management, life insurance acts as a safeguard against the financial impact of premature death. It provides a financial cushion to cover various expenses that a family might incur when a primary earner passes away. These expenses can include mortgage payments, outstanding debts, funeral costs, and the day-to-day living expenses of the family. Without life insurance, the financial burden of these obligations could fall solely on the surviving family members, potentially leading to financial strain and a loss of quality of life.

The beauty of life insurance in risk management lies in its ability to provide financial stability and continuity during challenging times. It ensures that the family's standard of living remains intact, allowing them to maintain their lifestyle, meet their financial commitments, and even plan for the future. For instance, the proceeds from a life insurance policy can be used to pay off a mortgage, ensuring that the family's home remains in their possession, or it can be used to fund a child's education, providing a secure future for the next generation.

Moreover, life insurance offers a sense of security and reassurance. It empowers individuals to take control of their financial future and that of their loved ones. By having a life insurance policy in place, clients can rest assured that their families will be financially protected, even if they are no longer around. This peace of mind is invaluable, allowing individuals to focus on their current responsibilities and make the most of their time with their loved ones.

In summary, life insurance is a critical component of risk management strategies recommended by financial advisors. It provides a financial safety net, ensuring that families are protected from the financial consequences of unforeseen events. By offering this protection, life insurance enables individuals to manage their risks effectively, secure their loved ones' futures, and provide a sense of financial security that is often invaluable in today's uncertain world.

Life Insurance: Bequests and Your Legacy

You may want to see also

Wealth Transfer: It facilitates the transfer of wealth to beneficiaries, avoiding estate taxes and legal complexities

Wealth transfer is a critical aspect of financial planning, especially for those with substantial assets. It involves the strategic distribution of wealth to designated beneficiaries, ensuring that assets are passed on according to the individual's wishes while also minimizing potential tax burdens and legal complications. This process is often facilitated by life insurance, which plays a pivotal role in wealth transfer strategies.

Financial advisors often recommend life insurance as a powerful tool for wealth transfer due to its ability to provide a tax-efficient means of passing on assets. When an individual purchases a life insurance policy, they essentially make a pre-arranged payment (premium) in exchange for a death benefit that will be paid out to the designated beneficiaries upon their passing. This death benefit can be structured to bypass the estate, thus avoiding the potential estate tax that would otherwise be levied on the value of the estate. Estate taxes can be substantial, and by utilizing life insurance, individuals can ensure that a larger portion of their wealth goes directly to their intended heirs, rather than being consumed by tax liabilities.

The process of wealth transfer through life insurance is relatively straightforward. The insured individual names the beneficiaries and specifies the amount of the death benefit. Upon the insured's death, the insurance company pays out the death benefit to the beneficiaries, who can then use this funds for their intended purposes, such as continuing the family business, funding education, or supporting charitable causes. This method of wealth transfer is often more efficient and less complicated than going through the legal process of estate administration, which can be time-consuming and costly.

Moreover, life insurance provides a level of flexibility in wealth transfer. The policyholder can adjust the death benefit amount and beneficiaries as their circumstances change, ensuring that the wealth transfer strategy remains relevant and effective over time. This adaptability is particularly important for individuals with complex family structures or those who wish to support multiple generations or charitable organizations.

In summary, wealth transfer through life insurance is a strategic approach to ensure that assets are passed on efficiently and according to the individual's wishes. It provides a means to avoid estate taxes, streamline the distribution of wealth, and offer flexibility in beneficiary selection. By incorporating life insurance into their financial plans, individuals can effectively facilitate the transfer of their hard-earned wealth to their chosen beneficiaries, while also providing financial security for their loved ones.

Canceling Veterans Group Life Insurance: A Step-by-Step Guide

You may want to see also

Income Generation: Policies can generate regular income through dividends or loan payments, offering financial stability

The concept of life insurance as a tool for income generation is a powerful strategy often overlooked by many. Financial advisors often emphasize this aspect when promoting life insurance policies, as it can provide a steady stream of financial support for individuals and their families. One of the primary reasons for this emphasis is the ability of life insurance policies to offer regular income through various mechanisms.

Firstly, term life insurance, a popular choice for many, can provide a fixed income during the policy term. This type of policy offers a death benefit, which is a lump sum paid to beneficiaries upon the insured individual's passing. However, it can also be structured to generate income through dividends. Dividends are essentially a portion of the policy's profits, which can be paid out regularly, providing a consistent financial stream. This is particularly beneficial for those seeking long-term financial security, as it ensures a reliable source of income, even if the primary earner is no longer present.

Secondly, whole life insurance policies offer a more permanent solution for income generation. These policies accumulate cash value over time, which can be borrowed against or withdrawn as needed. This feature allows policyholders to access funds without disrupting the policy's coverage. By taking out a loan against the policy's cash value, individuals can receive regular payments, providing a steady income stream. This is especially valuable for those who want to ensure financial stability for their families, as it offers a consistent source of funds that can be used for various purposes, such as education expenses or mortgage payments.

The income generation aspect of life insurance is a critical factor in its appeal to financial advisors. It provides a sense of financial security and stability, which is often a primary goal for individuals and their families. By offering regular income through dividends or loan payments, life insurance policies can help individuals build a robust financial foundation, ensuring that their loved ones are taken care of, even in their absence. This is a powerful incentive for many to consider life insurance as an essential component of their overall financial plan.

In summary, financial advisors often highlight the income generation potential of life insurance policies as a compelling reason for individuals to consider this type of coverage. Whether through the regular distribution of dividends or the ability to borrow against the policy's cash value, life insurance can provide a consistent and reliable source of income, offering financial stability and peace of mind. This aspect of life insurance is a key driver in its promotion, especially for those seeking to secure their family's financial future.

YNAB Guide: Budgeting Cash Value Life Insurance

You may want to see also

Debt Reduction: Life insurance can help pay off debts, preventing financial strain on loved ones

Life insurance is often recommended by financial advisors as a strategic tool to manage and reduce debt, offering a safety net for individuals and their families. When an individual passes away, the life insurance policy's death benefit is paid out to the designated beneficiaries, which can be a significant financial resource. This payout can be utilized to settle any outstanding debts, such as mortgages, loans, or credit card balances, ensuring that the family is not left with a financial burden. By incorporating life insurance into a debt management strategy, individuals can protect their loved ones from potential financial strain and provide a sense of security during challenging times.

The process typically involves reviewing an individual's existing debts and creating a plan to address them. For instance, if someone has a substantial mortgage, a life insurance policy can be structured to cover the remaining balance upon their death, preventing the family from having to sell the property to pay off the debt. Similarly, for those with personal loans or credit card debt, the insurance proceeds can be directed towards these liabilities, ensuring a swift resolution and reducing the risk of default. This approach not only helps in debt reduction but also minimizes the potential impact on the individual's credit score, which could otherwise be affected by the inability to make payments.

Financial advisors often emphasize the importance of life insurance in debt reduction because it provides a proactive solution. Instead of waiting for unforeseen circumstances to arise, individuals can take control of their financial future by incorporating insurance into their overall financial plan. This strategy allows for better debt management, ensuring that the focus remains on building wealth and securing the family's financial well-being. Moreover, the peace of mind that comes with knowing one's family is protected can significantly reduce stress and improve overall financial health.

In summary, life insurance serves as a powerful tool for debt reduction and financial planning. By utilizing the death benefit to settle debts, individuals can safeguard their loved ones from financial hardship and maintain a stable financial foundation. Financial advisors recommend this approach as it offers a practical and proactive method to manage debt, ensuring a more secure and stress-free future for families. Understanding the role of life insurance in debt management is crucial for anyone seeking to protect their loved ones and maintain financial stability.

Life Insurance Value: Does Term Insurance Decrease Over Time?

You may want to see also

Long-Term Savings: Term life insurance can act as a long-term savings tool, building value over time

Term life insurance is a powerful financial tool that can serve as a long-term savings strategy for individuals and families. While its primary function is to provide financial protection and peace of mind in the event of a loved one's passing, it also offers a unique opportunity to build wealth over time. This is particularly appealing to financial advisors who aim to help clients secure their financial future.

When considering long-term savings, term life insurance can be a strategic choice for several reasons. Firstly, it provides a guaranteed death benefit, which means the insurance company will pay out a specified amount if the insured individual passes away during the term of the policy. This guaranteed payout can be a valuable asset, especially for those with young families or dependents who rely on a steady income. By utilizing the death benefit, individuals can ensure that their loved ones are financially secure, even in their absence.

The long-term savings aspect comes into play as term life insurance accumulates cash value over time. Unlike permanent life insurance policies, term life insurance policies do not have an investment component, but they still build value through the premiums paid. These premiums are invested by the insurance company, and over the duration of the policy, the cash value grows. This growing cash value can be borrowed against or withdrawn, providing a source of funds that can be utilized for various financial goals. For instance, individuals can access this cash value to fund education expenses, start a business, or even invest in other investment vehicles to further grow their wealth.

Additionally, term life insurance offers flexibility in terms of policy duration. Advisors can tailor the term length to align with the client's specific needs and financial goals. For long-term savings, longer-term policies are often recommended, as they provide more time for the cash value to accumulate. This flexibility allows individuals to choose a policy that suits their current financial situation and future plans, ensuring that the insurance remains a valuable long-term asset.

In summary, term life insurance is a versatile financial product that can contribute to long-term savings goals. Its guaranteed death benefit provides financial security, while the accumulation of cash value over time offers a means to build wealth. Financial advisors can guide clients in utilizing term life insurance as a strategic savings tool, helping them secure their financial future and achieve their long-term objectives. This approach not only ensures financial protection but also empowers individuals to take control of their financial destiny.

Excess Interest Life Insurance: Taxable or Not?

You may want to see also

Frequently asked questions

Life insurance is a powerful tool that can provide financial security and peace of mind for individuals and their families. Financial advisors recommend it because it offers a way to protect loved ones from the financial impact of an untimely death. The proceeds from a life insurance policy can be used to cover essential expenses, such as mortgage payments, living costs, and education fees, ensuring that the family's financial goals and obligations are met even if the primary breadwinner is no longer around.

Life insurance is a long-term financial strategy that can have multiple benefits. For advisors, it provides an opportunity to build a strong relationship with clients by offering a comprehensive solution to their financial needs. Over time, the policy can accumulate cash value, which can be borrowed against or used to pay future premiums, providing a source of emergency funds. Additionally, life insurance can be a valuable asset in estate planning, helping to minimize taxes and ensure a smooth transfer of wealth to beneficiaries.

While life insurance is a valuable tool, it may not be suitable for everyone. Financial advisors should assess their clients' unique circumstances and financial goals before recommending any product. Some individuals might prefer alternative risk management strategies, such as building an emergency fund, investing in assets that can grow over time, or utilizing other insurance products like disability insurance. It's essential to tailor the financial plan to the client's specific needs, ensuring that life insurance is a well-informed decision and not a one-size-fits-all solution.