Variable life insurance is a type of permanent life insurance policy that includes an investment component. It offers lifelong coverage and a death benefit, with the added flexibility of adjustable premiums and a cash value growth component. This cash value can be invested in various securities, such as stocks, bonds, and

| Characteristics | Values |

|---|---|

| Type | Permanent life insurance policy with an investment component |

| Coverage | Lifelong |

| Payout | Death benefit |

| Cash value | Invested in securities such as stocks, bonds, and mutual funds |

| Flexibility | Flexible premiums and death benefit |

| Complexity | More complex than other forms of life insurance |

| Risk | More volatile and risky than standard life insurance policies |

| Tax advantages | Yes |

| Investment growth potential | Yes |

What You'll Learn

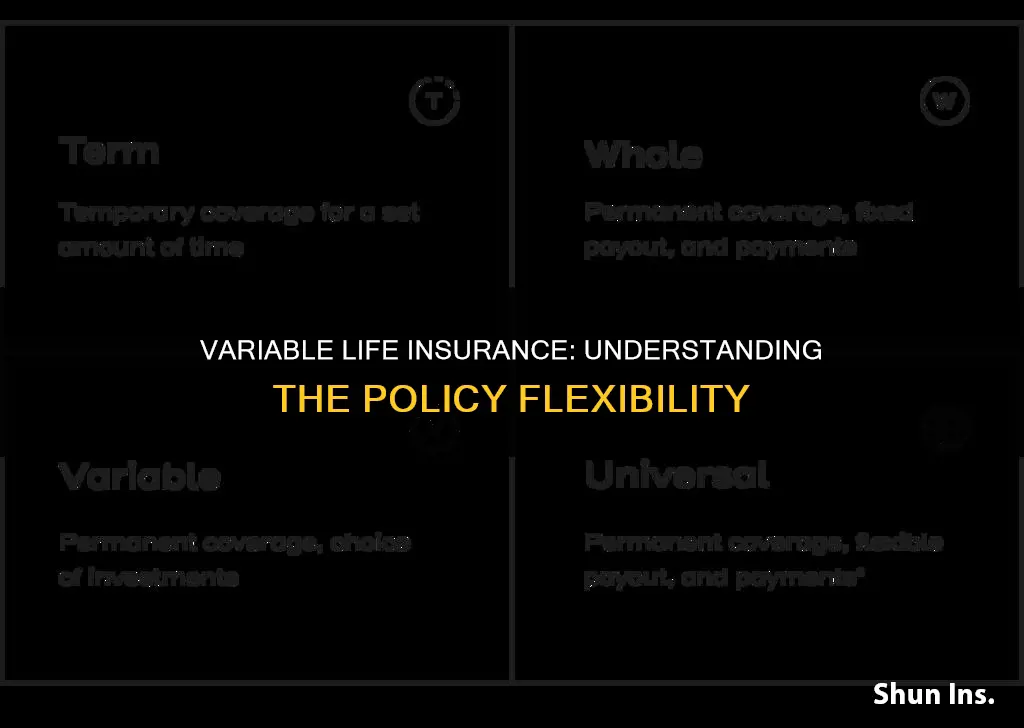

Variable life insurance is permanent coverage

Variable life insurance is a permanent life insurance policy that offers coverage for the entirety of the policyholder's life. This means that, unlike term life insurance, variable life insurance does not expire after a certain number of years and will pay out a death benefit to beneficiaries when the policyholder dies.

Variable life insurance is unique in that it features a death benefit and a cash value growth component. The cash value component allows policyholders to invest in various securities, such as stocks, bonds, and mutual funds. This provides more upside potential but also introduces more risk. The cash value of a variable life insurance policy can be invested in asset options, mainly mutual funds, and it may rise or fall in value. This means that these policies carry more risk compared to other life insurance policies.

Variable life insurance policies offer flexible premium payments. Policyholders can pay lower premiums in exchange for a lower death benefit or increase their death benefit by paying higher premiums. Once the cash value of a policy has grown enough, the cash can be borrowed from, withdrawn, used to pay premiums, or used to increase the death benefit.

Variable life insurance is a more complex policy type than other forms of life insurance due to the extra choice and flexibility it offers. Policyholders must monitor and manage their investments and determine how they want to pay premiums. This can require additional time and may lead to stress if the policyholder becomes overwhelmed by investment selection and management.

Gerber Life Insurance: Doubling Benefits for Parents

You may want to see also

It has flexible premiums

Variable life insurance offers flexible premium payments. This means that you can adjust your premiums in several ways. For example, if you want lower premiums, you can pay less in exchange for a lower death benefit. On the other hand, if you want to increase your death benefit, you can pay higher premiums.

Another way to adjust your premiums is through the cash value component of variable life insurance. Once your cash value grows enough, you can use it to pay some or all of your premiums. If your investments continue to perform well, you could potentially earn sufficient returns to pay premiums with your cash value indefinitely.

Additionally, you have the option to overpay your premiums to put more into your cash value. This could help you invest more funds early on, taking advantage of compounding returns and faster potential growth if your investments do well.

Variable life insurance also allows you to pay more of your premiums upfront, pay premiums from the policy's cash value, or pay a monthly minimum premium without building cash value. The monthly minimum payment keeps the policy active and the death benefit in place, with anything beyond the minimum going towards the cash value.

The flexibility in premium payments that variable life insurance offers can be beneficial for those who want to manage their premiums according to their financial situation and goals.

Life Insurance Advisors: Your Guide to Financial Security

You may want to see also

It offers a death benefit

Variable life insurance is a type of permanent life insurance policy that offers a death benefit. This means that, unlike term life insurance, which only provides coverage for a set number of years, variable life insurance provides coverage until the policyholder's death. The death benefit is a guaranteed payout to the policyholder's beneficiaries upon their death.

The death benefit payout is typically structured in one of two ways. The first is a level death benefit, which equals the face value of the policy when purchased. The second option is to choose the face amount plus the cash value of the policy as the death benefit. This option usually comes at a higher cost.

Variable life insurance policies also offer flexible death benefits, allowing policyholders to increase or reduce the benefit amount as their circumstances change. For example, if the policyholder has another child, they may want to increase their death benefit to protect their growing family. Similarly, if their child graduates college and becomes financially independent, they may choose to reduce their coverage.

The death benefit can be paid out as a lump sum or an annuity with various payout methods. Beneficiaries can use the death benefit to replace the policyholder's income, pay down debts, cover final expenses, and save for the future.

In addition to the death benefit, variable life insurance policies also offer a cash value component. This means that part of each premium payment goes into a cash value account that grows over time. Policyholders can then borrow from this cash value, withdraw from it, use it to pay premiums, or increase their death benefit. The cash value can also be invested in various securities, such as stocks, bonds, and mutual funds, providing the potential for greater returns but also carrying more risk.

Overall, the death benefit offered by variable life insurance policies provides financial protection and peace of mind for the policyholder's loved ones, ensuring that they will receive financial support in the event of the policyholder's death.

Lightning McQueen's Life Insurance: What's the Deal?

You may want to see also

It has a cash value growth component

Variable life insurance is a type of permanent life insurance policy that features a death benefit and a cash value growth component. The cash value component of variable life insurance is what sets it apart from other types of life insurance policies. This component allows you to invest in various securities, such as stocks, bonds, and mutual funds, providing more upside potential but also more risk.

The cash value growth component of variable life insurance offers several benefits. Firstly, it provides coverage for your whole life. Variable life insurance is a permanent policy, which means that once you buy the policy, it will never expire as long as you remain current on premium payments. This provides added peace of mind, knowing that your loved ones will receive financial support no matter when you pass away.

Secondly, the cash value growth component offers investment growth potential. You have the ability to select individual investments, which provides additional tax-deferred growth potential that is not available on policies with fixed interest rates, like whole life insurance. Choosing good investments can potentially help you accumulate more cash value over time.

Another advantage of the cash value growth component is flexible premiums. Variable life insurance allows you to adjust your premiums in several ways. You can choose to pay lower premiums in exchange for a lower death benefit or increase your death benefit by paying higher premiums. Once you have accumulated enough cash value, you can use it to pay some or all of your premiums. If your investments perform well, you may even be able to earn enough returns to pay premiums with your cash value indefinitely. Additionally, you have the option to overpay premiums to put more money into your cash value, allowing you to take advantage of compounding returns and faster potential growth.

However, it's important to consider the downsides of the cash value growth component. Variable life insurance is a more complex policy compared to other forms of life insurance. It requires you to monitor and manage your investments and determine how you want to pay premiums, which can be time-consuming and stressful if you become overwhelmed by investment selection and management.

Another potential drawback is the risk of your cash value decreasing. While the ability to invest in various securities offers more growth potential, it also comes with more risk. If your investments underperform, your cash value can decrease, leaving you with less wealth to tap into. Significant underperformance could even result in a smaller death benefit.

Life Insurance: Kids' Money After Aging Out

You may want to see also

It is a more complex policy

Variable life insurance is a more complex policy type than other forms of life insurance. This is due to the extra choice and flexibility it offers. For example, you must monitor and manage your investments and determine how you want to pay premiums. This can require additional time and may lead to stress if you become overwhelmed by investment selection and management.

Variable life insurance is a permanent life insurance policy with an investment component. The policy has a cash-value account with money that is invested, typically in mutual funds. The cash value component of variable life insurance is invested in assets like mutual funds, stocks, bonds, and other securities. This means that the value of the policy may rise or fall, so these policies carry more risk compared to other life insurance policies.

Variable life insurance offers flexible premium payments. You can pay more of your premiums upfront, pay premiums from the policy's cash value, or pay a monthly minimum premium without building cash value. Paying the minimum keeps the policy from lapsing and the death benefit in place. Anything beyond the minimum goes toward the cash value.

Variable life insurance also allows you to customize a policy to fit your financial needs. If you want a wider range of investment options, variable life insurance might be the right choice. You can choose how to invest the cash value from a menu of investment options.

Life Insurance for Retired Postal Workers: What's the Deal?

You may want to see also

Frequently asked questions

Variable life insurance is a permanent life insurance policy with an investment component. It has a cash-value account that is typically invested in mutual funds. It is intended to meet insurance needs, investment goals, and tax planning objectives.

Variable life insurance works similarly to other life insurance policies, where you pay a premium and your beneficiaries receive a benefit upon your death. However, it also includes a cash value component that can be invested in various securities, such as stocks, bonds, and mutual funds. The value of your account depends on the premiums paid, investment performance, and associated fees.

Variable life insurance offers several benefits, including lifelong coverage, investment growth potential, and flexible premiums. It provides the opportunity for tax-advantaged wealth accumulation and allows you to customize your policy to fit your financial needs.