Life insurance is typically available for diabetics, but the options and costs vary depending on several factors. The type of diabetes, the severity of the condition, and how well it is managed all play a role in determining eligibility and pricing. While it is more challenging to obtain life insurance with Type 1 diabetes, those with Type 2 diabetes may have more options if their condition is well-controlled through lifestyle changes and healthy habits. The timing of the life insurance application is also crucial, as applying before developing diabetes or waiting until the condition is under control can result in more favourable rates and options.

| Characteristics | Values |

|---|---|

| Can you get life insurance if you have diabetes? | Yes, but it will likely be more expensive than for someone without diabetes. |

| What factors affect the cost of life insurance for diabetics? | Type of diabetes, how well the diabetes is managed, age, gender, occupation, other health conditions, lifestyle choices. |

| Is life insurance for Type 1 diabetes more expensive than for Type 2? | Yes, Type 1 diabetes is considered riskier and harder to control, so premiums are likely to be higher. |

| What types of life insurance are available for diabetics? | Term life, whole life, universal life, guaranteed issue life insurance. |

| Can you get specialised life insurance for diabetics? | John Hancock offers a program called Aspire, which is designed specifically for people with Type 1 and Type 2 diabetes. |

What You'll Learn

Life insurance for Type 1 and Type 2 diabetics

People with diabetes can generally get life insurance, possibly even at competitive rates. However, this depends on several factors, including the type of diabetes, how well it is being managed, and the insurance company's policies. Here is what you need to know about life insurance for Type 1 and Type 2 diabetics:

Type 1 Diabetics

People with Type 1 diabetes may face more challenges in finding life insurance as it is considered a higher risk by insurance companies. Type 1 diabetes is often viewed as less manageable, especially if insulin is required. The age of diagnosis also plays a role, as a later-in-life diagnosis is seen more favorably. Type 1 diabetics may be able to qualify for standard life insurance but may face higher costs compared to those with Type 2 diabetes.

Type 2 Diabetics

Type 2 diabetes is generally considered a lower risk by life insurance companies, especially if it can be managed with lifestyle changes or medication. Since Type 2 diabetes is often diagnosed in adulthood, individuals are more likely to be viewed favorably by insurance companies. If you are otherwise healthy and have no complications, Type 2 diabetes should not prevent you from getting a policy, but it will likely affect your risk rating and cost.

Gestational Diabetes

Pregnant women with gestational diabetes may want to wait until after giving birth to apply for life insurance, as they are likely to get lower premiums once the condition resolves. However, it is important to weigh the increased cost against the risks of childbirth. Pregnant women with gestational diabetes can also buy a life insurance policy and then shop around for better rates after giving birth.

Factors Affecting Life Insurance for Diabetics

When applying for life insurance with diabetes, insurance companies will consider various health factors, including current health, medical history, family history, and lifestyle. They will also look at how well the diabetes is controlled, the impact on the body, and the likelihood of developing other health conditions. The application process may include a medical exam, questionnaire, and requests for medical records.

Choosing the Right Policy

When choosing a life insurance policy, it is important to determine the type of policy (term, whole, guaranteed universal, or universal), the level of underwriting, and the amount of coverage needed. Term life insurance policies are generally the cheapest option, while whole life insurance policies are more expensive but offer lifelong coverage. Guaranteed universal life insurance policies are also an option, providing lifelong coverage at a lower cost but with limited coverage amounts.

No Medical Exam Policies

Individuals with diabetes can purchase term or whole life insurance without a medical exam, but these policies may be more expensive and have limits on coverage amounts. No medical exam policies may be a good option if you think you might have undiagnosed complications, as a paramedical exam for a fully underwritten policy could result in a denial of coverage. However, it is important to answer all questions honestly, as dishonesty could lead to coverage cancellation or a denied claim.

Guaranteed Acceptance Policies

If you are rejected for fully underwritten and no medical exam policies, guaranteed acceptance life insurance policies are an option, although they are more costly. These policies often have a maximum death benefit and come with a waiting period, where beneficiaries would receive only the premiums paid plus interest if the insured dies during this period.

Smoking's Impact: Higher Life Insurance Rates and Health Risks

You may want to see also

Getting life insurance before or after diabetes diagnosis

Getting life insurance before or after a diabetes diagnosis

If you already have a life insurance policy before you develop diabetes, your premiums will generally be cheaper than if you try to get life insurance after you've been diagnosed. However, it's important to be honest about your diabetes diagnosis when applying for life insurance, as hiding it could be considered insurance fraud and your policy could be nullified.

The timing of applying for life insurance with diabetes can impact which policies and rates you qualify for. Here are some things to consider:

Getting life insurance before a diabetes diagnosis

If you already have a life insurance policy in place before being diagnosed with diabetes, your premiums will generally be lower than if you were to get life insurance after the diagnosis. This is because life insurance rates are based on the risk to the insurer, and a diabetes diagnosis increases the risk of mortality.

Waiting for gestational diabetes to resolve

If you've developed gestational diabetes during pregnancy, it may be worth waiting until after your pregnancy to apply for life insurance. Gestational diabetes is often temporary, and if you're otherwise in good health, you may be able to get a more affordable quote once your gestational diabetes resolves.

Getting life insurance after a diabetes diagnosis

While it is still possible to get life insurance after being diagnosed with diabetes, you may face higher premiums or more limited coverage options. The cost and availability of life insurance after a diabetes diagnosis will depend on several factors:

- Type of diabetes: Type 1 diabetes is typically considered riskier by insurance companies than Type 2 diabetes, as it is harder to control and may require frequent blood sugar monitoring and insulin therapy. As a result, individuals with Type 1 diabetes may have more difficulty qualifying for life insurance and may face higher premiums.

- Management of diabetes: If your diabetes is well-controlled through lifestyle changes, diet, exercise, and stable blood glucose levels, you may be able to get more favourable rates from insurers. Demonstrating that you are in good health and managing your diabetes well can help you get lower rates.

- Other health conditions: Insurers will consider your overall health when determining your premiums. Additional medical conditions, such as high blood pressure, heart disease, or a history of cancer, can increase your premiums significantly.

- Age, gender, and lifestyle: These factors also play a role in determining your risk level and premiums. Older individuals, for example, may have more difficulty obtaining life insurance or may face higher premiums.

Life insurance options for diabetics

Individuals with diabetes may have several life insurance options available to them, depending on their specific circumstances:

- Term life insurance: This type of insurance is only active for a certain period, usually between 10 and 30 years. It is typically more affordable than permanent insurance since there is a chance you could outlive the policy term.

- Whole life insurance: This is a type of permanent life insurance that includes a death benefit and a cash value component that accumulates over time. Whole life insurance is usually more expensive than term life insurance but guarantees a death benefit payout as long as the policy terms are met.

- Universal life insurance: Another form of permanent life insurance, universal life insurance includes a death benefit and a cash value component that can be used to pay premiums or adjust the death benefit. There are several types of universal life insurance, including indexed, variable, and guaranteed universal life, each with different investment strategies.

- Guaranteed issue life insurance: This type of policy does not require a medical exam, making it an option for individuals with advanced or hard-to-manage diabetes. However, guaranteed issue policies tend to be more expensive and offer lower coverage amounts.

Life Insurance at 90: Is It Possible to Get Covered?

You may want to see also

Managing diabetes with diet, exercise, and medication

Yes, you can generally get life insurance with diabetes, possibly even at a competitive rate. However, different companies have different rules, and your policy and pricing options will depend on the type of diabetes you have, how long you've had it, and how well you're managing it.

For many people with diabetes, managing the symptoms often requires medication. However, nutrition and physical activity can play an important role in staying healthy with type 1 or type 2 diabetes. Both can help keep blood sugar within the target range or bring it back down if it spikes.

Diet

To manage diabetes with diet, it is recommended to:

- Limit starchy vegetables (potatoes, corn, carrots, green peas), fried foods, sweets, sugary drinks, and processed foods. These foods can quickly raise blood sugar levels.

- Consume heart-healthy fats (olive oil, nuts, seeds, salmon, avocado), whole foods (whole grains, fresh fruits and vegetables, legumes), non-starchy vegetables (broccoli, spinach, cucumbers), and protein-rich foods (black beans, poultry without skin, fish such as tuna and mackerel).

- Eat regular, balanced meals to avoid high or low blood sugar levels. Try to eat the same amount of carbs at each meal to keep sugar levels in your target range.

- Check out the Diabetes Plate Method, created by the American Heart Association, to help create well-portioned meals without any complicated calculations.

Exercise

To manage diabetes with exercise, it is recommended to:

- Add physical activity to your daily routine, such as aerobic exercise or strength training. Physical activity lowers blood sugar levels and blood pressure and helps with weight management.

- Start slowly and gradually increase the intensity of your workouts as you get more comfortable.

- Incorporate small amounts of physical activity into your day, such as taking the stairs instead of the elevator or parking farther away when running errands.

Medication

While diet and exercise are important, medication may still be necessary to manage diabetes effectively. It is crucial to consult your doctor before starting a new exercise routine or making significant changes to your diet. They can provide guidance and address any questions or concerns you may have.

Group Life Insurance: Contestability and You

You may want to see also

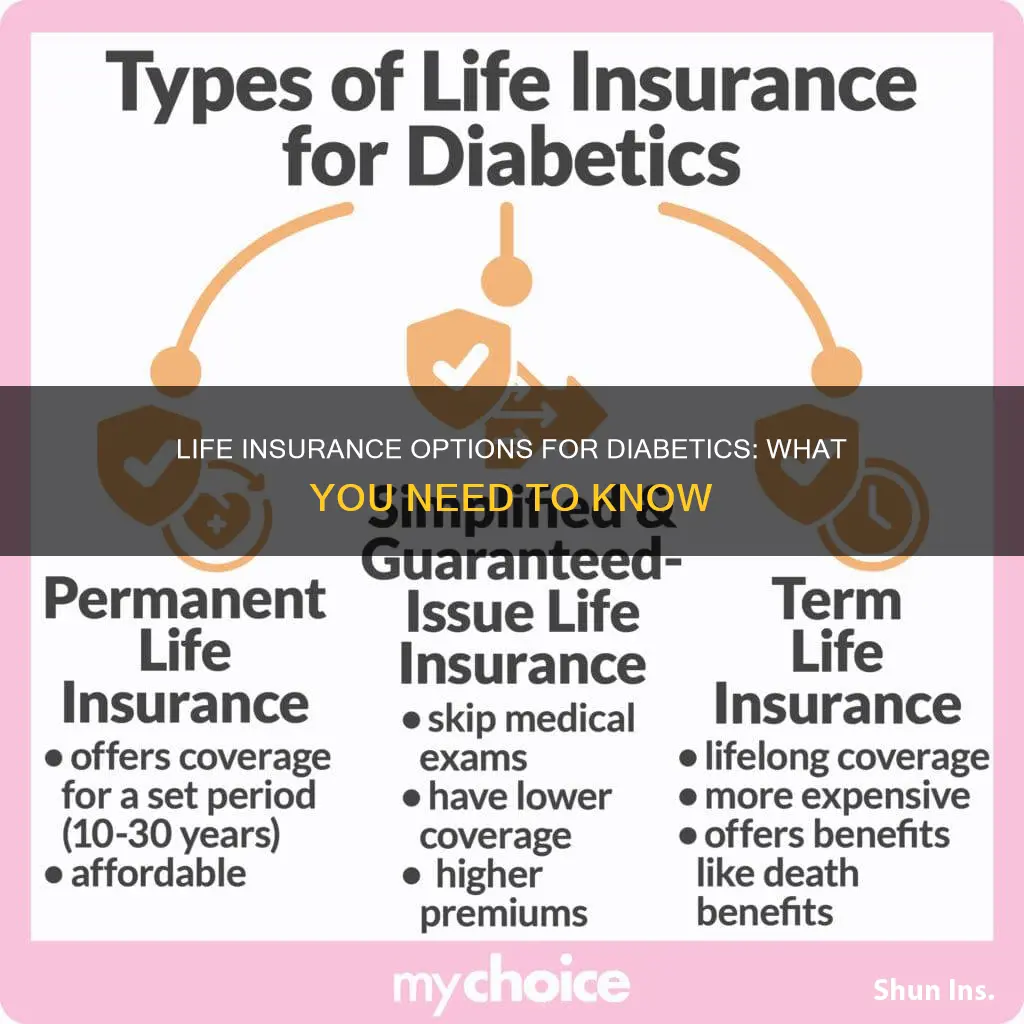

Life insurance policy types for diabetics

If you have diabetes, you can generally get life insurance, possibly even at a competitive rate. However, the type of policy you can get depends on several factors, including the type of diabetes you have, how long you've had it, and how well you're managing it. Here are some life insurance policy options for diabetics:

Term Life Insurance

Term life insurance is a type of policy that provides coverage for a specific term or set number of years. It is more affordable than permanent life insurance and can be a good option for diabetics who want coverage within a certain time frame. If you have well-managed diabetes and are relatively healthy, you may qualify for a traditional term life insurance policy.

Permanent Life Insurance

Permanent life insurance, such as whole life and universal life, provides coverage for the insured's entire life as long as the premiums are paid. These policies are more expensive than term life insurance but offer guaranteed coverage regardless of when the insured passes away. Diabetics with well-managed blood glucose and A1C levels may qualify for competitive rates on permanent life insurance policies.

Final Expense Life Insurance

Final expense life insurance, also known as burial insurance, is intended to help cover end-of-life costs such as medical bills and funeral expenses. This type of policy is typically purchased by individuals over 50, and the younger and healthier you are when you apply, the more affordable the options will be. Diabetics with well-managed diabetes may qualify for final expense life insurance.

Simplified Issue Life Insurance

If your medical exam results are limiting your standard life insurance options due to your diabetes, a simplified issue policy may be a good alternative. This type of policy does not require a medical exam and allows you to apply by completing a health survey and answering medical questions. Simplified issue policies may be a suitable option for diabetics who are in good overall health.

Guaranteed Issue Life Insurance

Guaranteed issue life insurance policies do not consider your health status and cannot be disqualified based on your medical condition. These policies are more expensive and offer lower coverage options, but they can be a viable choice for diabetics who are older, in poor health, or struggling to control their diabetes.

Lumico Life Insurance: AmBest's Top-Rated Coverage Options

You may want to see also

Factors affecting life insurance for diabetics

There are several factors that influence the availability and pricing of life insurance for diabetics. While it is generally possible to obtain life insurance with diabetes, the specific policy and pricing options depend on various factors. Here are the key factors that play a role:

Type of Diabetes

The type of diabetes, whether Type 1 or Type 2, is a significant factor. Individuals with Type 2 diabetes are generally considered more insurable than those with Type 1. Type 1 diabetes is viewed as a higher risk by insurance companies because it is harder to control and often requires insulin therapy and frequent blood sugar monitoring. As a result, Type 1 diabetics may face higher premiums or even disqualification from certain policies.

Management of Diabetes

The management and control of diabetes is crucial. Well-controlled diabetes that is managed through lifestyle changes, such as diet, exercise, and healthy habits, is viewed more favourably by insurers. Demonstrating good management over time can help diabetics obtain more favourable rates. This includes maintaining stable blood glucose and A1C levels as recommended by doctors.

Timing of Application

The timing of applying for life insurance can impact the available policies and rates. It is generally more affordable to obtain life insurance before developing diabetes or waiting until the condition is under control. For those with gestational diabetes, it is advisable to wait until it resolves, as it is often temporary, and getting insurance after resolution may result in lower prices.

Other Health Conditions

Insurers consider additional health conditions beyond diabetes. The presence of high blood pressure, heart conditions, cancer history, or other medical issues can significantly increase the cost of life insurance. The overall health profile of the applicant is taken into account.

Age, Gender, and Lifestyle

Basic factors such as age, gender, and lifestyle choices also influence life insurance rates. Life insurers consider age, driving record, criminal history, risky hobbies, and credit history when determining risk levels and pricing.

Policy Type

The type of life insurance policy also affects the availability and pricing. Traditional term or permanent life insurance policies may be available at competitive rates for diabetics with well-managed conditions. Simplified issue policies, which do not require a medical exam, may be an option for diabetics in good overall health. Guaranteed issue policies, which do not consider health conditions, are also available but tend to be more expensive with lower coverage options.

Suzy Orman's Take on Universal Life Insurance

You may want to see also

Frequently asked questions

Yes, people with diabetes can get life insurance. However, the cost of coverage is typically higher for diabetics than for those without the condition. The type of diabetes you have and how well you are managing it will also impact your policy and pricing options.

Diabetics are not usually limited to one policy type. Term life, whole life, and universal life insurance are all options for diabetics. Additionally, guaranteed issue life insurance, which does not require a medical exam, may be an option for those with advanced or hard-to-manage diabetes.

No, your existing life insurance policy cannot be canceled if you develop diabetes. Permanent policies like whole life and universal life will continue at the pre-diagnosis rate as long as premiums are paid on time. Term policies will also remain in effect during the policy term, with payments staying the same until the end of the term.

Several factors come into play when underwriting life insurance for diabetics. These include the type of diabetes (Type 1 or Type 2), how well the condition is managed, age, lifestyle, occupation, and other health conditions.

John Hancock offers a program called Aspire, which is specifically designed for individuals with Type 1 or Type 2 diabetes. This program offers perks like discounts on healthy foods and virtual meetings with diabetes experts.