Yes, you can cancel your life insurance contract at any time, but there may be financial repercussions for doing so. The process for cancelling a life insurance policy depends on the type of policy you have and how long you've had it. Term life insurance policies can be cancelled by simply stopping premium payments, whereas cancelling whole life insurance policies may require a conversation with your insurance company and could result in surrender fees or other financial penalties. It's important to review the terms and conditions of your policy before making any decisions, as cancelling your policy may leave your loved ones unprotected and could result in higher premiums if you decide to take out a new policy in the future.

| Characteristics | Values |

|---|---|

| Can I cancel my life insurance contract at any time? | Yes |

| Are there any time restrictions? | Yes, there is a "free look" period, which typically lasts 10-30 days, during which you can cancel without any financial penalty. |

| What happens if I cancel during the "free look" period? | You will get a full refund of any premiums paid. |

| What happens if I cancel after the "free look" period? | You may be charged a surrender fee and will only get a partial refund. |

| What is the process of cancelling term life insurance? | Contact your insurance provider, stop making payments, or submit a written notice. |

| What is the process of cancelling whole life insurance? | Contact your insurance provider, submit a written notice, or sell your policy. |

What You'll Learn

Cancelling term life insurance

Stop Premium Payments

One of the most effective ways to cancel your term life insurance is to stop making premium payments. Contact your insurance company to end any automatic payments you have set up. By stopping premium payments, you will trigger a grace period, usually lasting 30 days, during which you can make up missed payments and keep your policy active if you change your mind. If you don't make any payments during the grace period, your insurance coverage will end.

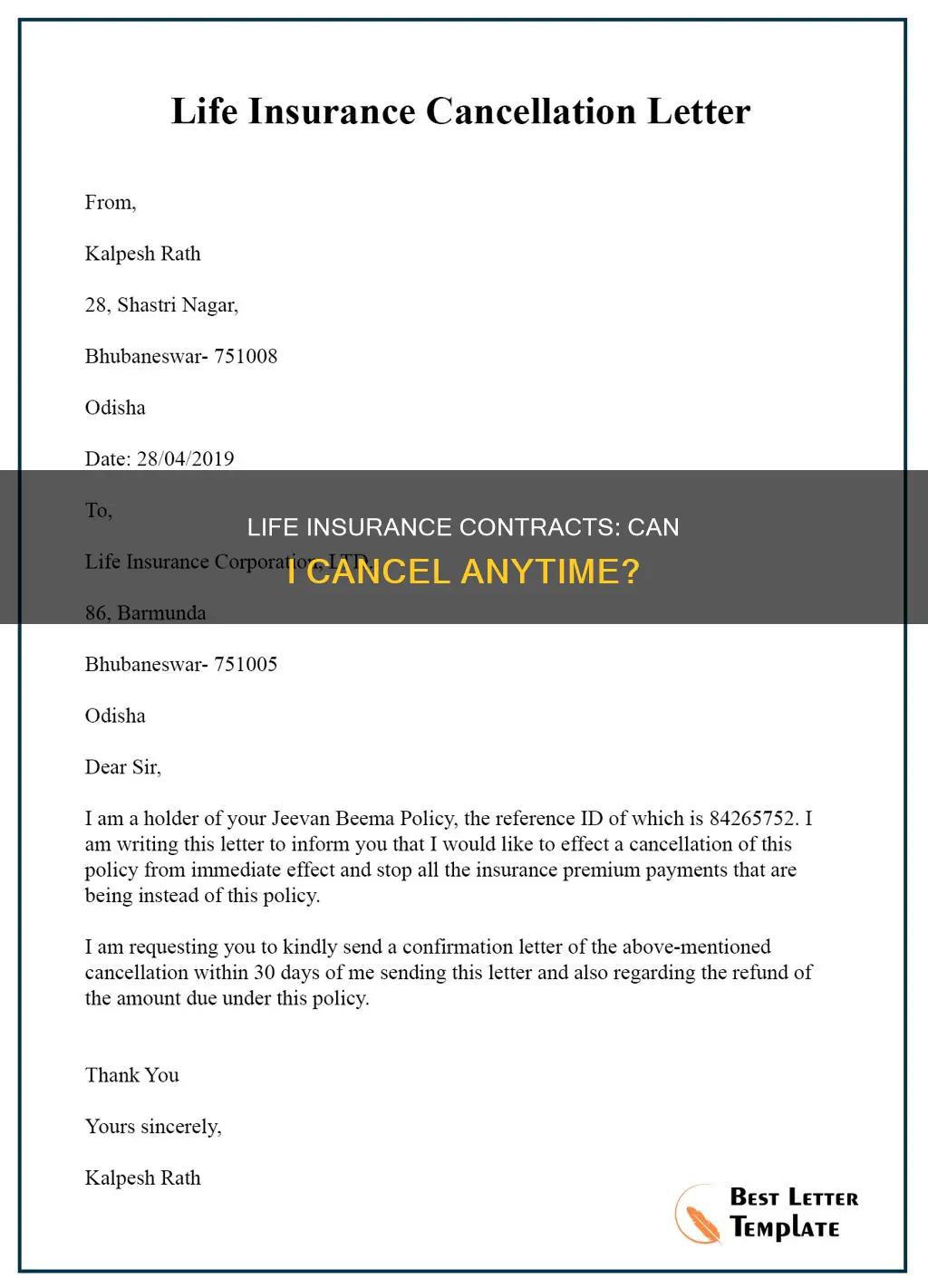

Provide Written Notice

If you prefer a more formal approach, you can submit a written notice to your insurance provider informing them of your decision to cancel the policy. This step is optional but can provide peace of mind to many individuals. You can find sample insurance cancellation letters on various websites. Some insurance providers also offer the option to submit your notice online.

Contact Your Insurance Provider

Calling your insurance provider is another way to initiate the cancellation process. Have your policy number ready, as this will help the agent pull up your policy and guide you through the necessary steps. Most insurers can cancel your policy over the phone or at least start the cancellation process.

It is important to note that cancelling a term life insurance policy is generally a simple process. However, if you are considering cancelling a whole life insurance policy, the process may be more complex due to the involvement of cash value components and potential financial penalties.

Getting Life Insurance on Someone Else: What You Need to Know

You may want to see also

Cancelling whole life insurance

Understanding Whole Life Insurance

Whole life insurance is a type of permanent life insurance that combines life insurance with an investment component. It provides lifelong coverage, typically with a maximum coverage age ranging from 95 to 121. Whole life insurance policies also include a cash value component, which grows over time and can be borrowed against or withdrawn.

Steps to Cancel Whole Life Insurance

The process of cancelling whole life insurance can be more complex than cancelling a term life insurance policy due to the additional elements involved. Here are the steps you can take:

- Review Your Policy: Understand the terms and conditions of your whole life insurance policy, including any applicable surrender or cancellation fees.

- Contact Your Insurance Company: Get in touch with your insurance provider to discuss your intention to cancel the policy. They will guide you through their specific requirements and procedures.

- Evaluate the Financial Implications: Whole life insurance policies have cash value, and cancelling the policy may result in a payout based on the cash surrender value. However, there may be surrender charges, especially in the early years of the policy, which can reduce the amount you receive.

- Consider Alternatives: Before cancelling, explore alternative options such as reducing your coverage amount, withdrawing or borrowing from the cash value, or requesting a new medical exam to qualify for lower premiums.

- Complete the Necessary Paperwork: Your insurance company will likely require you to fill out surrender or cancellation forms to finalize the process. Provide any supporting documentation as needed.

- Understand the Impact on Beneficiaries: Carefully consider the impact of cancelling the policy on your beneficiaries. Ensure that your spouse, children, or other dependents will not be negatively affected by the loss of coverage.

- Explore Other Options: If you still want or need life insurance coverage, consider shopping for a new policy with more competitive rates or exploring alternative types of life insurance, such as term life insurance.

Key Considerations

- Timing: The timing of your cancellation can impact the financial implications. Cancelling during the "free look" period, typically within the first 30 days of purchasing the policy, allows you to receive a full refund of any premiums paid without penalties.

- Surrender Fees: Whole life insurance policies may have surrender fees, especially in the early years. These fees can reduce the cash value you receive upon cancellation.

- Outstanding Loans: If you have borrowed against the policy's cash value, the surrender value will be reduced by the outstanding loan balance (unpaid loan plus accrued interest).

- Tax Implications: Cancelling a whole life insurance policy may have tax implications. Consult a financial advisor or tax professional to understand the potential tax consequences.

Life Insurance: Is Nationwide a Good Option?

You may want to see also

Surrendering a permanent life insurance policy

Understanding the Surrender Process

Before initiating the surrender process, it's advisable to review your policy documents thoroughly. Look for information regarding cash surrender value, surrender charges, and other relevant terms. Once you're familiar with the policy details, contact your insurance provider to express your intention to surrender the policy. They will guide you through their specific process for surrendering the policy and paying out the cash surrender value.

Filling Out the Necessary Paperwork

Your insurance company will likely provide you with the required forms, such as a policy termination form or a surrender request form. Make sure to complete these forms accurately and provide all the requested information and documentation. This step is crucial for a smooth surrender process.

Receiving the Cash Surrender Value

After submitting the necessary paperwork, your insurance provider will process your surrender request. They will calculate the cash surrender value based on the policy's terms, taking into account factors such as the policy's duration, growth, assets, and any applicable surrender charges. The insurer will then pay you the determined amount, usually via check or direct deposit.

Consulting with Experts

It is highly recommended to consult with a tax expert and a financial advisor before or after surrendering your policy. A tax expert can help you navigate any tax implications resulting from the surrender. On the other hand, a financial advisor can provide guidance on saving or investing the funds you receive.

Weighing the Pros and Cons

Exploring Alternatives

Before surrendering your policy, consider alternative options that can help you access your cash value while maintaining your coverage. These alternatives include borrowing against your cash value, withdrawing from your cash value, or using your cash value to pay premiums. These options may provide more flexibility and allow you to retain the benefits of your permanent life insurance policy.

Life Insurance and Welfare: What's the Connection?

You may want to see also

Cancelling during the free look period

The free look period is a window of time, typically lasting 10 to 30 days, during which you can cancel your life insurance policy without incurring any financial penalties. This period begins when your policy goes into effect, and it allows you to reconsider your decision and get a full refund of any premiums paid. It's important to note that the duration of the free look period can vary depending on your state and insurance provider, so it's a good idea to check with your insurer about their specific policy.

During the free look period, you have the right to cancel your policy for any reason. This could be due to a change of mind, finding a better policy, or simply not needing the coverage anymore. To initiate the cancellation, you can contact your insurance agent or company and request to terminate the policy. Some insurers may also offer an online cancellation form on their website.

It's important to act promptly during the free look period if you decide to cancel your policy. Once this period ends, cancelling your policy may involve more steps and could result in surrender fees or other financial implications, especially for whole life insurance policies.

By cancelling during the free look period, you can take advantage of the flexibility it offers and make adjustments to your coverage without any financial penalties. This period provides an opportunity to review your policy details and ensure it aligns with your needs and financial situation.

Life Insurance and Subrogation: What's the Verdict?

You may want to see also

Cancelling after the surrender period

Cancelling a whole life insurance policy after the surrender period is a little more complicated than doing so during the surrender period. The surrender period is the amount of time you must wait to withdraw your policy's cash value without fees or penalties. How long this lasts depends on your insurer. If you cancel your whole life policy after the surrender period, you won't have to pay surrender fees, and you'll receive your remaining cash value.

- Surrender or cash out your policy: If you withdraw the cash value of your whole life policy during the surrender period, you may have to pay steep surrender fees or not receive any cash value. If you take out your cash value after the surrender period, you will likely still have to pay a surrender fee, but you will receive some of your funds. Your policy will be terminated once you take out your cash value.

- Sell your insurance policy: An insurance policy is an asset, so you can sell it off like other assets. If the life insurance policy cancellation rules are too complex, you can sell it or undergo a tax-free exchange. Contact a reputable broker to help you with this process. Once you sell your policy, the third party will receive the death benefit upon your passing. While selling is straightforward, a tax-free exchange or 1035 exchange lets you trade your life insurance for another product of similar value without any tax implications.

- Choose a reduced paid-up option: Some insurers allow you to stop payments and keep the policy in exchange for a lower death benefit. This will depend on the premiums you've paid. Contact your insurer to ask if they offer this option.

- Understand the financial implications: When you cancel a whole life insurance policy, you will likely receive the cash value minus any surrender charges, withdrawals, and fees associated with managing your policy. Thus, you probably won't receive the full cash value you've accumulated. Additionally, you might get taxed if your cash surrender amount exceeds what you've paid into your cash value. Contact a tax professional or your agent to see what surrender charges you might face.

Whole Life Insurance: Taking Dividends, Good or Bad?

You may want to see also

Frequently asked questions

Yes, you can cancel your life insurance policy at any time, but there may be financial repercussions. Cancelling during the "free look" period, which is usually 10-30 days, will allow you to get a full refund. Cancelling after this period may result in surrender fees and other charges.

Cancelling a term life insurance policy is straightforward. You can simply stop paying your premiums and notify your insurer by phone or in writing.

Cancelling a whole life insurance policy is more complex due to the cash value component. You will need to contact your insurer and may have to pay surrender fees and other charges.

If you are struggling with premium payments, you could consider the following options:

- Lowering your coverage amount

- Borrowing from your policy

- Requesting a new medical exam

- Shopping for a new policy